The global Synthetic Paper Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (BOPP, HDPE, PET, Others), By Application (Hand Tags, Medical Tags, Packaging, Documents).

Synthetic paper, a durable and versatile alternative to traditional paper made from wood pulp, s to gain popularity across various industries in 2024. Composed of synthetic materials such as polyester or polypropylene, synthetic paper offers advantages such as water resistance, tear resistance, and chemical resistance, making it suitable for a wide range of applications. In printing and packaging, synthetic paper is used for labels, tags, maps, menus, and outdoor signage, where durability and weather resistance are essential. Further, in industries such as manufacturing, healthcare, and logistics, synthetic paper finds applications in manuals, charts, identification cards, and durable product labels. With ongoing advancements in material science and printing technologies, synthetic paper s to evolve, offering enhanced printability, recyclability, and sustainability compared to traditional paper products.

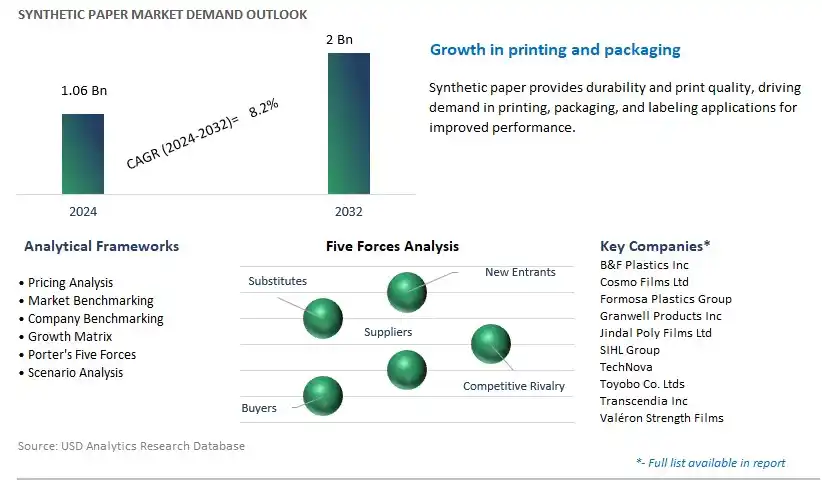

The market report analyses the leading companies in the industry including B&F Plastics Inc, Cosmo Films Ltd, Formosa Plastics Group, Granwell Products Inc, Jindal Poly Films Ltd, SIHL Group, TechNova, Toyobo Co. Ltds, Transcendia Inc, Valéron Strength Films, and others.

A significant trend in the synthetic paper market is the increasing demand for sustainable packaging solutions across various industries. With growing concerns about plastic pollution and environmental sustainability, there is a shift towards the adoption of synthetic paper as an eco-friendly alternative to traditional paper and plastic-based packaging materials. Synthetic paper, made from polymer resins such as polypropylene (PP) or polyethylene (PE), offers several advantages including water resistance, tear resistance, durability, and recyclability. As companies strive to reduce their carbon footprint and meet consumer preferences for environmentally responsible products, the demand for synthetic paper for applications such as labels, tags, posters, and packaging is on the rise. Additionally, advancements in printing technologies enable high-quality graphics and customization options on synthetic paper, further driving its adoption in packaging and labeling applications. As sustainability becomes a key driver of purchasing decisions, the synthetic paper market is expected to continue growing to meet the demand for sustainable packaging solutions.

The primary driver for the synthetic paper market is the growth in packaging and labeling industries worldwide, which rely on synthetic paper for a wide range of applications such as food packaging, beverage labels, pharmaceutical packaging, and retail signage. As consumer preferences evolve and e-commerce sales continue to rise, there is an increasing demand for durable and attractive packaging materials that protect products during shipping, storage, and display. Synthetic paper offers superior moisture resistance, tear resistance, and printability compared to traditional paper, making it an ideal choice for applications where durability and visual appeal are critical. Additionally, stringent regulations regarding food safety, product labeling, and counterfeit prevention drive the adoption of synthetic paper for applications such as food labels, tamper-evident seals, and security tags. As industries invest in innovative packaging and labeling solutions to enhance brand recognition, product differentiation, and consumer engagement, the demand for synthetic paper is expected to grow, supported by the expanding packaging and labeling markets globally.

A significant opportunity for the synthetic paper market lies in the expansion into specialty applications and emerging markets with unmet needs. While packaging and labeling remain the largest end-user segments for synthetic paper, there are opportunities to diversify into niche applications such as outdoor signage, maps, banners, and medical charts, where synthetic paper offers durability, weather resistance, and longevity. Additionally, there is potential to penetrate emerging markets in regions such as Asia-Pacific, Latin America, and Africa, where rapid urbanization, infrastructure development, and growing disposable incomes drive demand for high-quality printing materials and packaging solutions. By leveraging advancements in polymer technology and collaborating with end-users to identify specific application requirements, synthetic paper manufacturers can develop customized solutions tailored to niche markets and geographic regions, expanding their customer base and revenue streams. Furthermore, the adoption of digital printing technologies and smart packaging solutions presents opportunities to innovate and differentiate synthetic paper products, offering added functionalities such as QR codes, RFID tags, and temperature-sensitive inks, which enhance product traceability, security, and interactivity. By seizing these opportunities for market expansion and product innovation, synthetic paper manufacturers can position themselves for long-term growth and competitiveness in the global marketplace.

Among the various products in the synthetic paper market, the BOPP (Biaxially Oriented Polypropylene) segment is the largest and most dominant player. This leadership position can be attributed to BOPP synthetic paper offers a unique combination of properties, including high tensile strength, tear resistance, water resistance, and printability, making it suitable for a wide range of applications such as labels, packaging, printing, and outdoor signage. The versatility of BOPP synthetic paper, coupled with its cost-effectiveness compared to other synthetic paper options like HDPE and PET, drives its widespread adoption across industries. Moreover, the growing demand for sustainable packaging solutions, coupled with increasing environmental concerns regarding traditional paper production, further boosts the market demand for BOPP synthetic paper, which is recyclable and offers reduced environmental impact. Additionally, advancements in BOPP manufacturing technologies, such as improved surface treatments and coatings, enhance its printability and performance characteristics, further solidifying its position as the largest segment in the synthetic paper market. With its versatility, performance advantages, and sustainability benefits, the BOPP segment is poised to maintain its leadership and drive continued growth in the synthetic paper market.

Among the diverse applications in the synthetic paper market, the Packaging segment is the fastest-growing segment. In particular, the packaging industry is experiencing significant expansion driven by e-commerce, consumer goods, and food and beverage sectors, increasing the demand for durable, moisture-resistant, and printable packaging materials. Synthetic paper offers numerous advantages over traditional paper-based packaging, including tear resistance, water resistance, and compatibility with various printing techniques such as offset, flexography, and digital printing. Moreover, synthetic paper's versatility allows for the production of a wide range of packaging formats, including labels, pouches, bags, and wraps, catering to the diverse needs of manufacturers and consumers alike. Additionally, the shift towards sustainable packaging solutions to reduce plastic usage and environmental impact further drives the adoption of recyclable and eco-friendly synthetic paper for packaging applications. With the growing emphasis on convenience, durability, and sustainability in packaging, the Packaging segment is poised to maintain its rapid growth trajectory in the synthetic paper market.

By Product

BOPP

HDPE

PET

Others

By Application

Label

-Hand Tags

-Medical Tags

Non-Label

-Packaging

-DocumentsCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

B&F Plastics Inc

Cosmo Films Ltd

Formosa Plastics Group

Granwell Products Inc

Jindal Poly Films Ltd

SIHL Group

TechNova

Toyobo Co. Ltds

Transcendia Inc

Valéron Strength Films

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Synthetic Paper Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Synthetic Paper Market Size Outlook, $ Million, 2021 to 2032

3.2 Synthetic Paper Market Outlook by Type, $ Million, 2021 to 2032

3.3 Synthetic Paper Market Outlook by Product, $ Million, 2021 to 2032

3.4 Synthetic Paper Market Outlook by Application, $ Million, 2021 to 2032

3.5 Synthetic Paper Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Synthetic Paper Industry

4.2 Key Market Trends in Synthetic Paper Industry

4.3 Potential Opportunities in Synthetic Paper Industry

4.4 Key Challenges in Synthetic Paper Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Synthetic Paper Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Synthetic Paper Market Outlook by Segments

7.1 Synthetic Paper Market Outlook by Segments, $ Million, 2021- 2032

By Product

BOPP

HDPE

PET

Others

By Application

Label

-Hand Tags

-Medical Tags

Non-Label

-Packaging

-Documents

8 North America Synthetic Paper Market Analysis and Outlook To 2032

8.1 Introduction to North America Synthetic Paper Markets in 2024

8.2 North America Synthetic Paper Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Synthetic Paper Market size Outlook by Segments, 2021-2032

By Product

BOPP

HDPE

PET

Others

By Application

Label

-Hand Tags

-Medical Tags

Non-Label

-Packaging

-Documents

9 Europe Synthetic Paper Market Analysis and Outlook To 2032

9.1 Introduction to Europe Synthetic Paper Markets in 2024

9.2 Europe Synthetic Paper Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Synthetic Paper Market Size Outlook by Segments, 2021-2032

By Product

BOPP

HDPE

PET

Others

By Application

Label

-Hand Tags

-Medical Tags

Non-Label

-Packaging

-Documents

10 Asia Pacific Synthetic Paper Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Synthetic Paper Markets in 2024

10.2 Asia Pacific Synthetic Paper Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Synthetic Paper Market size Outlook by Segments, 2021-2032

By Product

BOPP

HDPE

PET

Others

By Application

Label

-Hand Tags

-Medical Tags

Non-Label

-Packaging

-Documents

11 South America Synthetic Paper Market Analysis and Outlook To 2032

11.1 Introduction to South America Synthetic Paper Markets in 2024

11.2 South America Synthetic Paper Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Synthetic Paper Market size Outlook by Segments, 2021-2032

By Product

BOPP

HDPE

PET

Others

By Application

Label

-Hand Tags

-Medical Tags

Non-Label

-Packaging

-Documents

12 Middle East and Africa Synthetic Paper Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Synthetic Paper Markets in 2024

12.2 Middle East and Africa Synthetic Paper Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Synthetic Paper Market size Outlook by Segments, 2021-2032

By Product

BOPP

HDPE

PET

Others

By Application

Label

-Hand Tags

-Medical Tags

Non-Label

-Packaging

-Documents

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

B&F Plastics Inc

Cosmo Films Ltd

Formosa Plastics Group

Granwell Products Inc

Jindal Poly Films Ltd

SIHL Group

TechNova

Toyobo Co. Ltds

Transcendia Inc

Valéron Strength Films

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

BOPP

HDPE

PET

Others

By Application

Label

-Hand Tags

-Medical Tags

Non-Label

-Packaging

-Documents

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Synthetic Paper Market Size is valued at $1.06 Billion in 2024 and is forecast to register a growth rate (CAGR) of 8.2% to reach $2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

B&F Plastics Inc, Cosmo Films Ltd, Formosa Plastics Group, Granwell Products Inc, Jindal Poly Films Ltd, SIHL Group, TechNova, Toyobo Co. Ltds, Transcendia Inc, Valéron Strength Films

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume