The global Synthetic Latex Polymers Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Styrene Acrylics, Acrylics, Styrene Butadiene, Vinyl Acetate Ethylene, Polyvinyl Acetate, Vinyl Acetate Copolymer), By Application (Paints & Coatings, Adhesives & Sealants, Paper & Paperboard, Carpets, Nonwovens).

Synthetic latex polymers, versatile materials derived from emulsion polymerization of monomers such as styrene, butadiene, and acrylics, to find diverse applications in coatings, adhesives, textiles, and carpet backing in 2024. These latex polymers offer advantages such as water resistance, adhesion, and flexibility, making them ideal for formulations requiring durability and performance. In the coatings industry, synthetic latex polymers serve as binders for architectural paints, providing film formation, weather resistance, and color retention properties. Similarly, in adhesives and sealants, latex polymers offer bonding strength and flexibility, contributing to the performance of construction and industrial adhesive products. With increasing demand for eco-friendly and low-VOC (volatile organic compound) formulations, synthetic latex polymers are being developed with improved sustainability profiles, driving their adoption in green building materials and environmentally conscious consumer products.

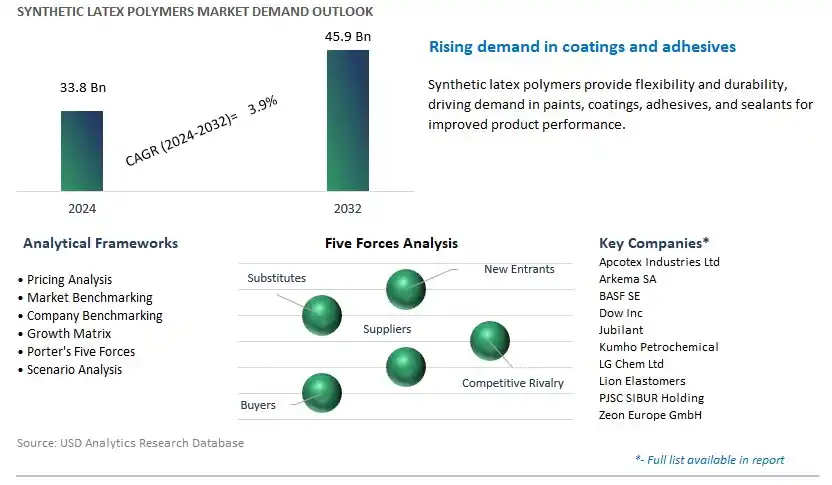

The market report analyses the leading companies in the industry including Apcotex Industries Ltd, Arkema SA, BASF SE, Dow Inc, Jubilant, Kumho Petrochemical, LG Chem Ltd, Lion Elastomers, PJSC SIBUR Holding, Zeon Europe GmbH, and others.

A significant trend in the synthetic latex polymers market is the increasing demand for eco-friendly and sustainable products across various industries. As environmental concerns mount and regulatory pressure to reduce carbon footprint intensifies, there is a shift towards the adoption of synthetic latex polymers derived from renewable and bio-based sources, as well as those with reduced environmental impact throughout their lifecycle. Manufacturers are focusing on developing latex polymers with improved biodegradability, recyclability, and lower emissions of volatile organic compounds (VOCs) during production and application processes. Additionally, there is a rising preference among consumers for products manufactured using sustainable materials, driving the demand for eco-friendly synthetic latex polymers in applications such as adhesives, coatings, paints, and sealants. As sustainability becomes a key criterion for product selection and brand loyalty, the market for synthetic latex polymers is expected to continue growing, driven by the shift towards environmentally responsible manufacturing practices and consumer preferences.

The primary driver for the synthetic latex polymers market is the growth in construction and infrastructure development activities worldwide, which rely on latex-based products for a wide range of applications such as architectural coatings, adhesives, sealants, and waterproofing membranes. As urbanization and population growth drive demand for housing, commercial buildings, and infrastructure projects, there is an increasing need for high-performance materials that offer durability, weather resistance, and versatility. Synthetic latex polymers provide excellent adhesion, flexibility, and water resistance properties, making them ideal for use in construction applications such as concrete admixtures, mortar modifiers, and polymer-modified overlays. Additionally, the demand for green buildings and sustainable construction practices further stimulates the adoption of synthetic latex polymers with low VOC emissions and eco-friendly characteristics. As governments invest in infrastructure development projects and construction activities rebound from economic downturns, the market for synthetic latex polymers is poised for sustained growth, driven by the construction industry's need for innovative and sustainable materials.

A significant opportunity for the synthetic latex polymers market lies in the development of specialized formulations tailored to specific application requirements and niche markets. With advancements in polymer chemistry and formulation techniques, manufacturers can create custom-designed latex polymers with enhanced performance characteristics such as improved adhesion, durability, chemical resistance, and fire retardancy. These specialized formulations can address the unique needs of industries such as automotive, textiles, healthcare, and electronics, where latex-based materials are used in applications ranging from automotive coatings and medical adhesives to textile finishes and electronic encapsulants. By collaborating with end-users and understanding their specific requirements, synthetic latex polymer producers can develop innovative solutions that offer value-added benefits and competitive advantages in niche markets. Additionally, there is an opportunity to expand into emerging applications such as 3D printing, wearable electronics, and biomedical devices, where latex polymers with tailored properties can enable new functionalities and performance capabilities. By capitalizing on these opportunities for product innovation and market diversification, synthetic latex polymer manufacturers can unlock new growth avenues and strengthen their competitive position in the global marketplace.

Among the various types of synthetic latex polymers, the Styrene Butadiene segment is the largest and most dominant player in the market. In particular, Styrene Butadiene latex polymers offer a versatile combination of properties, including excellent adhesion, durability, and water resistance, making them highly desirable for a wide range of applications across industries such as construction, adhesives, coatings, and paper processing. Moreover, the inherent cost-effectiveness of Styrene Butadiene polymers compared to certain other latex types further contributes to their widespread adoption by manufacturers seeking high-performance yet economical solutions. Additionally, the growing construction activities, particularly in emerging economies, drive the demand for Styrene Butadiene latex polymers in applications such as architectural coatings, sealants, and carpet backing, further solidifying their position as the largest segment in the synthetic latex polymers market. With their proven performance, versatility, and cost-effectiveness, the Styrene Butadiene segment is poised to maintain its dominance and drive continued growth in the synthetic latex polymers market.

Among the diverse applications in the synthetic latex polymers market, the Nonwovens segment is the fastest-growing segment. This accelerated growth can be attributed to nonwovens, which encompass a wide range of products such as wipes, medical textiles, filtration materials, and hygiene products, are witnessing increasing demand across various end-user industries, including healthcare, personal care, and automotive. Synthetic latex polymers play a crucial role in nonwoven manufacturing, serving as binders, coatings, and adhesives to enhance product performance, durability, and processability. Moreover, the growing awareness of hygiene and sanitation, coupled with the rising disposable income levels in emerging economies, is driving the demand for nonwoven products, thereby fuelling the market growth of synthetic latex polymers. Additionally, advancements in polymer technologies, such as the development of low-VOC (volatile organic compound) and eco-friendly formulations, cater to the sustainability preferences of consumers and regulatory requirements, further boosting the adoption of synthetic latex polymers in nonwoven applications. With the expanding nonwovens market and ongoing innovations in polymer formulations, the Nonwovens segment is poised to sustain its rapid growth trajectory in the synthetic latex polymers market.

By Type

Styrene Acrylics

Acrylics

Styrene Butadiene

Vinyl Acetate Ethylene

Polyvinyl Acetate

Vinyl Acetate Copolymer

By Application

Paints & Coatings

Adhesives & Sealants

Paper & Paperboard

Carpets

NonwovensCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Apcotex Industries Ltd

Arkema SA

BASF SE

Dow Inc

Jubilant

Kumho Petrochemical

LG Chem Ltd

Lion Elastomers

PJSC SIBUR Holding

Zeon Europe GmbH

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Synthetic Latex Polymers Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Synthetic Latex Polymers Market Size Outlook, $ Million, 2021 to 2032

3.2 Synthetic Latex Polymers Market Outlook by Type, $ Million, 2021 to 2032

3.3 Synthetic Latex Polymers Market Outlook by Product, $ Million, 2021 to 2032

3.4 Synthetic Latex Polymers Market Outlook by Application, $ Million, 2021 to 2032

3.5 Synthetic Latex Polymers Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Synthetic Latex Polymers Industry

4.2 Key Market Trends in Synthetic Latex Polymers Industry

4.3 Potential Opportunities in Synthetic Latex Polymers Industry

4.4 Key Challenges in Synthetic Latex Polymers Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Synthetic Latex Polymers Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Synthetic Latex Polymers Market Outlook by Segments

7.1 Synthetic Latex Polymers Market Outlook by Segments, $ Million, 2021- 2032

By Type

Styrene Acrylics

Acrylics

Styrene Butadiene

Vinyl Acetate Ethylene

Polyvinyl Acetate

Vinyl Acetate Copolymer

By Application

Paints & Coatings

Adhesives & Sealants

Paper & Paperboard

Carpets

Nonwovens

8 North America Synthetic Latex Polymers Market Analysis and Outlook To 2032

8.1 Introduction to North America Synthetic Latex Polymers Markets in 2024

8.2 North America Synthetic Latex Polymers Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Synthetic Latex Polymers Market size Outlook by Segments, 2021-2032

By Type

Styrene Acrylics

Acrylics

Styrene Butadiene

Vinyl Acetate Ethylene

Polyvinyl Acetate

Vinyl Acetate Copolymer

By Application

Paints & Coatings

Adhesives & Sealants

Paper & Paperboard

Carpets

Nonwovens

9 Europe Synthetic Latex Polymers Market Analysis and Outlook To 2032

9.1 Introduction to Europe Synthetic Latex Polymers Markets in 2024

9.2 Europe Synthetic Latex Polymers Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Synthetic Latex Polymers Market Size Outlook by Segments, 2021-2032

By Type

Styrene Acrylics

Acrylics

Styrene Butadiene

Vinyl Acetate Ethylene

Polyvinyl Acetate

Vinyl Acetate Copolymer

By Application

Paints & Coatings

Adhesives & Sealants

Paper & Paperboard

Carpets

Nonwovens

10 Asia Pacific Synthetic Latex Polymers Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Synthetic Latex Polymers Markets in 2024

10.2 Asia Pacific Synthetic Latex Polymers Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Synthetic Latex Polymers Market size Outlook by Segments, 2021-2032

By Type

Styrene Acrylics

Acrylics

Styrene Butadiene

Vinyl Acetate Ethylene

Polyvinyl Acetate

Vinyl Acetate Copolymer

By Application

Paints & Coatings

Adhesives & Sealants

Paper & Paperboard

Carpets

Nonwovens

11 South America Synthetic Latex Polymers Market Analysis and Outlook To 2032

11.1 Introduction to South America Synthetic Latex Polymers Markets in 2024

11.2 South America Synthetic Latex Polymers Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Synthetic Latex Polymers Market size Outlook by Segments, 2021-2032

By Type

Styrene Acrylics

Acrylics

Styrene Butadiene

Vinyl Acetate Ethylene

Polyvinyl Acetate

Vinyl Acetate Copolymer

By Application

Paints & Coatings

Adhesives & Sealants

Paper & Paperboard

Carpets

Nonwovens

12 Middle East and Africa Synthetic Latex Polymers Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Synthetic Latex Polymers Markets in 2024

12.2 Middle East and Africa Synthetic Latex Polymers Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Synthetic Latex Polymers Market size Outlook by Segments, 2021-2032

By Type

Styrene Acrylics

Acrylics

Styrene Butadiene

Vinyl Acetate Ethylene

Polyvinyl Acetate

Vinyl Acetate Copolymer

By Application

Paints & Coatings

Adhesives & Sealants

Paper & Paperboard

Carpets

Nonwovens

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Apcotex Industries Ltd

Arkema SA

BASF SE

Dow Inc

Jubilant

Kumho Petrochemical

LG Chem Ltd

Lion Elastomers

PJSC SIBUR Holding

Zeon Europe GmbH

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Styrene Acrylics

Acrylics

Styrene Butadiene

Vinyl Acetate Ethylene

Polyvinyl Acetate

Vinyl Acetate Copolymer

By Application

Paints & Coatings

Adhesives & Sealants

Paper & Paperboard

Carpets

Nonwovens

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Synthetic Latex Polymers Market Size is valued at $33.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.9% to reach $45.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Apcotex Industries Ltd, Arkema SA, BASF SE, Dow Inc, Jubilant, Kumho Petrochemical, LG Chem Ltd, Lion Elastomers, PJSC SIBUR Holding, Zeon Europe GmbH

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume