The global Synthetic Fuels Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Gas to Liquid Fuel (GTL), Methanol to Liquid (MTL), Power to Liquid Fuel (PTL), Others), By Application (Gasoline, Diesel, Kerosene), By End-User (Transportation, Industrial, Chemical & Others).

Synthetic fuels, produced from non-petroleum sources through chemical processes such as Fischer-Tropsch synthesis or biomass conversion, to gain traction as alternatives to conventional fossil fuels in 2024. These fuels, which include synthetic gasoline, diesel, and jet fuel, offer advantages such as reduced greenhouse gas emissions, energy security, and compatibility with existing infrastructure. In sectors such as transportation, aviation, and marine shipping, synthetic fuels serve as drop-in replacements for petroleum-based fuels, offering a pathway to decarbonize the energy sector and mitigate climate change. Additionally, synthetic fuels can be produced from a variety of feedstocks, including biomass, municipal waste, and renewable electricity, providing flexibility and resilience to energy supply chains. With increasing regulatory pressures to reduce carbon emissions and transition to renewable energy sources, the market for synthetic fuels is poised for growth, driven by advancements in technology, scalability, and cost competitiveness.

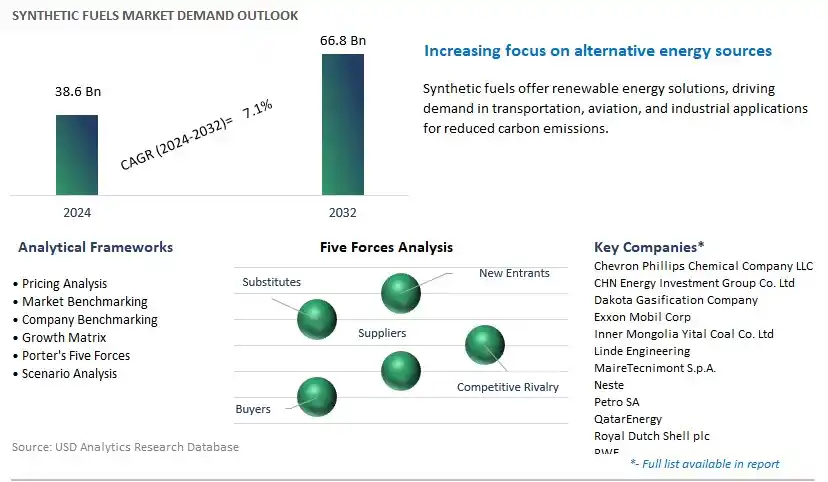

The market report analyses the leading companies in the industry including Chevron Phillips Chemical Company LLC, CHN Energy Investment Group Co. Ltd, Dakota Gasification Company, Exxon Mobil Corp, Inner Mongolia Yital Coal Co. Ltd, Linde Engineering, MaireTecnimont S.p.A., Neste, Petro SA, QatarEnergy, Royal Dutch Shell plc, RWE, Sasol Ltd, Sunfire GmbH, Synthesis Energy Systems Inc, TOPSOE, TotalEnergies SE, and others.

A significant trend in the synthetic fuels market is the global transition towards low-carbon and renewable energy sources. With increasing concerns about climate change, air pollution, and energy security, there is a growing emphasis on reducing greenhouse gas emissions and dependency on fossil fuels. Synthetic fuels, produced from renewable feedstocks such as biomass, waste, and carbon dioxide captured from industrial emissions, offer a promising solution to decarbonize transportation, heating, and industrial sectors. Governments, industries, and consumers are increasingly investing in synthetic fuel technologies such as biomass-to-liquid (BTL), gas-to-liquid (GTL), and power-to-gas (PtG) to produce clean and sustainable alternatives to conventional petroleum-based fuels. As renewable energy technologies mature and regulatory frameworks incentivize the adoption of synthetic fuels, the market is witnessing a shift towards sustainable energy sources and the widespread adoption of synthetic fuels as a key component of the future energy mix.

The primary driver for the synthetic fuels market is energy security and the diversification of fuel supply to reduce reliance on imported oil and volatile fuel markets. Synthetic fuels offer a reliable and domestic source of energy that can be produced from a variety of feedstocks, including biomass, coal, natural gas, and renewable electricity. This diversification of fuel sources enhances energy resilience and mitigates geopolitical risks associated with dependence on oil-producing regions. Additionally, synthetic fuels can be produced locally, reducing transportation costs and increasing energy independence for countries with limited access to conventional fossil fuels. As energy security becomes a priority for governments and industries, investments in synthetic fuel production facilities and infrastructure are expected to increase, driving market growth and stimulating innovation in synthetic fuel technologies.

A significant opportunity for the synthetic fuels market lies in the integration with carbon capture and utilization (CCU) technologies to reduce greenhouse gas emissions and mitigate climate change. Synthetic fuels produced from carbon dioxide captured from industrial processes, power plants, and atmospheric sources offer a carbon-neutral or even carbon-negative alternative to conventional fossil fuels. By capturing and utilizing CO2 emissions to produce synthetic fuels, industries can decarbonize their operations and contribute to global efforts to achieve net-zero emissions targets. Additionally, synthetic fuels can serve as a valuable energy storage medium for renewable electricity generated from intermittent sources such as wind and solar power. By leveraging CCU technologies and renewable energy sources, synthetic fuel producers can enhance the sustainability and environmental performance of their products, meet regulatory requirements for emissions reduction, and capitalize on the growing demand for low-carbon energy solutions in a carbon-constrained world.

Within the synthetic fuels market, the Gas to Liquid Fuel (GTL) segment is the largest and most dominant player. This leadership position can be attributed to GTL technology enables the conversion of natural gas into high-quality liquid fuels such as diesel, naphtha, and waxes through a series of chemical processes. This process provides a viable solution for monetizing stranded natural gas reserves and offers a cleaner alternative to conventional crude oil-based fuels, contributing to energy security and environmental sustainability. Moreover, GTL fuels exhibit superior properties in terms of low sulfur content, high cetane numbers, and excellent combustion characteristics, making them highly desirable for various applications in transportation, industrial, and power generation sectors. Additionally, ongoing advancements in GTL technology, coupled with favorable government policies promoting energy diversification and emission reduction, further bolster the market growth of GTL fuels. With their proven performance, versatility, and environmental benefits, the GTL segment is poised to maintain its leadership position in the synthetic fuels market.

Among the various applications in the synthetic fuels market, the diesel segment is the fastest-growing segment. In particular, diesel remains a primary fuel source for transportation, particularly in heavy-duty vehicles, commercial fleets, and off-road machinery, where its high energy density and efficiency are highly valued. With increasing global focus on reducing greenhouse gas emissions and improving air quality, there is a growing demand for cleaner-burning diesel alternatives that can mitigate environmental impact. Synthetic diesel fuels, derived from sources such as natural gas, coal, or biomass through processes like Fischer-Tropsch synthesis, offer significant emissions reductions compared to conventional diesel, making them increasingly attractive to fleet operators and governments seeking to meet stringent emission regulations. Moreover, the versatility of synthetic diesel extends beyond transportation to include applications in stationary power generation and industrial processes, further driving market growth. Additionally, ongoing technological advancements and investments in synthetic fuel production infrastructure contribute to the rapid expansion of the diesel segment in the synthetic fuels market. With its pivotal role in addressing both energy security and environmental sustainability concerns, the diesel segment is poised to continue its robust growth trajectory in the synthetic fuels market.

Within the synthetic fuels market, the transportation sector is the largest and most dominant end-user segment. This leadership position can be attributed to transportation remains one of the largest consumers of fossil fuels globally, with a significant portion of energy demand attributed to road, aviation, maritime, and rail transportation. Synthetic fuels offer a promising alternative to conventional petroleum-based fuels, providing compatibility with existing infrastructure and vehicles while offering potential emissions reductions and energy security benefits. Moreover, the transportation sector is under increasing pressure to reduce its carbon footprint and comply with stringent emissions regulations, driving the demand for cleaner-burning fuels derived from renewable or low-carbon sources. Synthetic fuels, including synthetic diesel, gasoline, and aviation fuels, present viable solutions to address these challenges, further fuelling their adoption in the transportation sector. Additionally, ongoing investments in synthetic fuel production technologies and government initiatives supporting fuel diversification contribute to the dominance of the transportation sector in the synthetic fuels market. With the transportation sector's pivotal role in energy consumption and emissions mitigation, it is poised to maintain its leading position in driving the adoption of synthetic fuels globally.

By Type

Gas to Liquid Fuel (GTL)

Methanol to Liquid (MTL)

Power to Liquid Fuel (PTL)

Others

By Application

Gasoline

Diesel

Kerosene

By End-User

Transportation

Industrial

Chemical & Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Chevron Phillips Chemical Company LLC

CHN Energy Investment Group Co. Ltd

Dakota Gasification Company

Exxon Mobil Corp

Inner Mongolia Yital Coal Co. Ltd

Linde Engineering

MaireTecnimont S.p.A.

Neste

Petro SA

QatarEnergy

Royal Dutch Shell plc

RWE

Sasol Ltd

Sunfire GmbH

Synthesis Energy Systems Inc

TOPSOE

TotalEnergies SE

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Synthetic Fuels Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Synthetic Fuels Market Size Outlook, $ Million, 2021 to 2032

3.2 Synthetic Fuels Market Outlook by Type, $ Million, 2021 to 2032

3.3 Synthetic Fuels Market Outlook by Product, $ Million, 2021 to 2032

3.4 Synthetic Fuels Market Outlook by Application, $ Million, 2021 to 2032

3.5 Synthetic Fuels Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Synthetic Fuels Industry

4.2 Key Market Trends in Synthetic Fuels Industry

4.3 Potential Opportunities in Synthetic Fuels Industry

4.4 Key Challenges in Synthetic Fuels Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Synthetic Fuels Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Synthetic Fuels Market Outlook by Segments

7.1 Synthetic Fuels Market Outlook by Segments, $ Million, 2021- 2032

By Type

Gas to Liquid Fuel (GTL)

Methanol to Liquid (MTL)

Power to Liquid Fuel (PTL)

Others

By Application

Gasoline

Diesel

Kerosene

By End-User

Transportation

Industrial

Chemical & Others

8 North America Synthetic Fuels Market Analysis and Outlook To 2032

8.1 Introduction to North America Synthetic Fuels Markets in 2024

8.2 North America Synthetic Fuels Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Synthetic Fuels Market size Outlook by Segments, 2021-2032

By Type

Gas to Liquid Fuel (GTL)

Methanol to Liquid (MTL)

Power to Liquid Fuel (PTL)

Others

By Application

Gasoline

Diesel

Kerosene

By End-User

Transportation

Industrial

Chemical & Others

9 Europe Synthetic Fuels Market Analysis and Outlook To 2032

9.1 Introduction to Europe Synthetic Fuels Markets in 2024

9.2 Europe Synthetic Fuels Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Synthetic Fuels Market Size Outlook by Segments, 2021-2032

By Type

Gas to Liquid Fuel (GTL)

Methanol to Liquid (MTL)

Power to Liquid Fuel (PTL)

Others

By Application

Gasoline

Diesel

Kerosene

By End-User

Transportation

Industrial

Chemical & Others

10 Asia Pacific Synthetic Fuels Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Synthetic Fuels Markets in 2024

10.2 Asia Pacific Synthetic Fuels Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Synthetic Fuels Market size Outlook by Segments, 2021-2032

By Type

Gas to Liquid Fuel (GTL)

Methanol to Liquid (MTL)

Power to Liquid Fuel (PTL)

Others

By Application

Gasoline

Diesel

Kerosene

By End-User

Transportation

Industrial

Chemical & Others

11 South America Synthetic Fuels Market Analysis and Outlook To 2032

11.1 Introduction to South America Synthetic Fuels Markets in 2024

11.2 South America Synthetic Fuels Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Synthetic Fuels Market size Outlook by Segments, 2021-2032

By Type

Gas to Liquid Fuel (GTL)

Methanol to Liquid (MTL)

Power to Liquid Fuel (PTL)

Others

By Application

Gasoline

Diesel

Kerosene

By End-User

Transportation

Industrial

Chemical & Others

12 Middle East and Africa Synthetic Fuels Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Synthetic Fuels Markets in 2024

12.2 Middle East and Africa Synthetic Fuels Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Synthetic Fuels Market size Outlook by Segments, 2021-2032

By Type

Gas to Liquid Fuel (GTL)

Methanol to Liquid (MTL)

Power to Liquid Fuel (PTL)

Others

By Application

Gasoline

Diesel

Kerosene

By End-User

Transportation

Industrial

Chemical & Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Chevron Phillips Chemical Company LLC

CHN Energy Investment Group Co. Ltd

Dakota Gasification Company

Exxon Mobil Corp

Inner Mongolia Yital Coal Co. Ltd

Linde Engineering

MaireTecnimont S.p.A.

Neste

Petro SA

QatarEnergy

Royal Dutch Shell plc

RWE

Sasol Ltd

Sunfire GmbH

Synthesis Energy Systems Inc

TOPSOE

TotalEnergies SE

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Gas to Liquid Fuel (GTL)

Methanol to Liquid (MTL)

Power to Liquid Fuel (PTL)

Others

By Application

Gasoline

Diesel

Kerosene

By End-User

Transportation

Industrial

Chemical & Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Synthetic Fuels Market Size is valued at $38.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.1% to reach $66.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Chevron Phillips Chemical Company LLC, CHN Energy Investment Group Co. Ltd, Dakota Gasification Company, Exxon Mobil Corp, Inner Mongolia Yital Coal Co. Ltd, Linde Engineering, MaireTecnimont S.p.A., Neste, Petro SA, QatarEnergy, Royal Dutch Shell plc, RWE, Sasol Ltd, Sunfire GmbH, Synthesis Energy Systems Inc, TOPSOE, TotalEnergies SE

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume