The global Syntactic Foam Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Metal, Polymer, Ceramic), By Application (Marine and Subsea, Automotive and Transportation, Aerospace and Defense, Others).

Syntactic foam, a lightweight and high-strength composite material, remains indispensable in aerospace, marine, and underwater applications in 2024. This engineered foam consists of hollow microspheres embedded in a matrix material such as epoxy or polyester resin. Syntactic foams offer exceptional buoyancy, thermal insulation, and compressive strength, making them ideal for applications such as deep-sea buoyancy modules, subsea insulation, and composite sandwich structures for marine vessels and aircraft. Additionally, syntactic foams are utilized in underwater vehicles, underwater acoustic arrays, and offshore drilling equipment, where lightweight materials with high strength and durability are required. With ongoing advancements in microsphere technology, resin formulations, and manufacturing processes, syntactic foam s to push the boundaries of material performance and enable innovative solutions for challenging marine and aerospace environments.

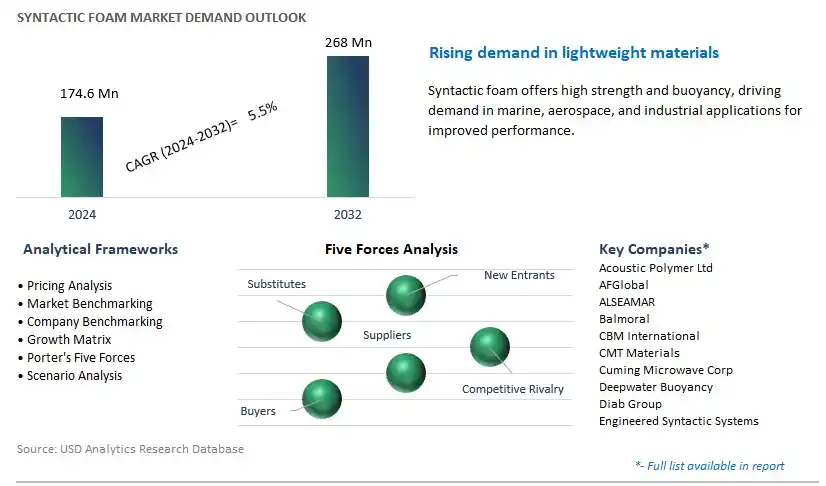

The market report analyses the leading companies in the industry including Acoustic Polymer Ltd, AFGlobal, ALSEAMAR, Balmoral, CBM International, CMT Materials, Cuming Microwave Corp, Deepwater Buoyancy, Diab Group, Engineered Syntactic Systems, and others.

A significant trend in the syntactic foam market is the increasing demand for lightweight and high-performance materials in marine and aerospace industries. Syntactic foams, composed of hollow glass or polymer microspheres dispersed in a matrix material, offer exceptional strength-to-weight ratios, buoyancy, and resistance to water ingress, making them ideal for use in marine buoyancy modules, subsea insulation, and aerospace components. With the aerospace sector focusing on fuel efficiency and emissions reduction, and the marine industry seeking to improve vessel performance and safety, there is a growing adoption of syntactic foams to replace traditional materials such as metals and solid plastics. Additionally, the expansion of offshore oil and gas exploration activities and the development of deep-sea mining projects further drive the demand for syntactic foams that can withstand harsh underwater environments and provide reliable buoyancy and thermal insulation properties. As industries prioritize lightweighting, durability, and corrosion resistance, the demand for syntactic foams is expected to continue growing.

The primary driver for the syntactic foam market is technological advancements in material science and manufacturing processes, which enable the development of syntactic foams with enhanced properties and performance characteristics. Researchers and manufacturers are continually innovating to optimize the composition, structure, and processing techniques of syntactic foams to meet the stringent requirements of diverse applications. Advances in microsphere technology, such as the development of high-strength and low-density microspheres, enable the production of syntactic foams with improved mechanical properties and buoyancy performance. Additionally, innovations in matrix materials, such as thermoset resins, thermoplastics, and syntactic foam syntactic foam coatings, enhance the durability, corrosion resistance, and environmental stability of syntactic foams for marine and aerospace applications. Furthermore, advancements in manufacturing processes such as injection molding, compression molding, and additive manufacturing facilitate the production of complex geometries and customized syntactic foam components tailored to specific design requirements. As material science continues to evolve and manufacturing capabilities advance, the versatility and applicability of syntactic foams in various industries and applications are expected to expand.

A significant opportunity for the syntactic foam market lies in expansion into emerging markets and applications with untapped growth potential. With the increasing demand for lightweight, durable, and corrosion-resistant materials in sectors such as renewable energy, transportation, defense, and underwater robotics, there are opportunities to introduce syntactic foams into new applications and industries. For example, syntactic foams can be used in renewable energy applications such as offshore wind turbines, wave energy converters, and marine hydrokinetic systems to provide buoyancy and structural support in harsh marine environments. Similarly, in the transportation sector, syntactic foams can be utilized in lightweight vehicle components, aerospace structures, and unmanned aerial vehicles (UAVs) to improve fuel efficiency, payload capacity, and performance. By leveraging the unique properties of syntactic foams and targeting emerging markets with tailored solutions, manufacturers can diversify their product portfolios, capture new market segments, and establish themselves as leaders in the rapidly evolving landscape of lightweight materials and advanced composites.

The Polymer segment is the largest segment in the Syntactic Foam Market. polymer-based syntactic foams offer a versatile range of properties, including lightweight, high strength-to-weight ratio, excellent buoyancy, and resistance to water absorption and corrosion. These properties make them highly suitable for a wide array of applications, such as marine, aerospace, automotive, and sports equipment. Additionally, advancements in polymer chemistry and manufacturing technologies have led to the development of tailored syntactic foam formulations that meet specific performance requirements of various industries. Furthermore, the increasing demand for lightweight materials to improve fuel efficiency and reduce emissions in automotive and aerospace applications has further boosted the adoption of polymer-based syntactic foams. Moreover, the growing focus on sustainable and environmentally friendly materials is driving the development of bio-based and recyclable polymer syntactic foams, further expanding the market potential. Over the forecast period, the Polymer segment's versatility, performance, and adaptability to diverse applications position it as the largest segment in the Syntactic Foam Market.

The marine and subsea segment stands out as the fastest-growing segment in the syntactic foam market. In particular, advancements in offshore exploration and production activities have increased the demand for syntactic foams in deep-water drilling applications. These materials offer buoyancy and structural support in underwater environments, making them indispensable for subsea equipment such as risers, buoys, and underwater vehicles. Moreover, the burgeoning marine renewable energy sector, including offshore wind farms and tidal energy projects, relies heavily on syntactic foams for buoyancy modules and mooring systems. Additionally, the increasing emphasis on lightweighting in marine structures to enhance fuel efficiency and reduce carbon emissions further fuels the demand for high-performance syntactic foams. With ongoing innovations in material science and manufacturing processes, the marine and subsea segment is poised to maintain its rapid growth trajectory in the foreseeable future.

By Product

Metal

Polymer

Ceramic

By Application

Marine and Subsea

Automotive and Transportation

Aerospace and Defense

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Acoustic Polymer Ltd

AFGlobal

ALSEAMAR

Balmoral

CBM International

CMT Materials

Cuming Microwave Corp

Deepwater Buoyancy

Diab Group

Engineered Syntactic Systems

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Syntactic Foam Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Syntactic Foam Market Size Outlook, $ Million, 2021 to 2032

3.2 Syntactic Foam Market Outlook by Type, $ Million, 2021 to 2032

3.3 Syntactic Foam Market Outlook by Product, $ Million, 2021 to 2032

3.4 Syntactic Foam Market Outlook by Application, $ Million, 2021 to 2032

3.5 Syntactic Foam Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Syntactic Foam Industry

4.2 Key Market Trends in Syntactic Foam Industry

4.3 Potential Opportunities in Syntactic Foam Industry

4.4 Key Challenges in Syntactic Foam Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Syntactic Foam Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Syntactic Foam Market Outlook by Segments

7.1 Syntactic Foam Market Outlook by Segments, $ Million, 2021- 2032

By Product

Metal

Polymer

Ceramic

By Application

Marine and Subsea

Automotive and Transportation

Aerospace and Defense

Others

8 North America Syntactic Foam Market Analysis and Outlook To 2032

8.1 Introduction to North America Syntactic Foam Markets in 2024

8.2 North America Syntactic Foam Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Syntactic Foam Market size Outlook by Segments, 2021-2032

By Product

Metal

Polymer

Ceramic

By Application

Marine and Subsea

Automotive and Transportation

Aerospace and Defense

Others

9 Europe Syntactic Foam Market Analysis and Outlook To 2032

9.1 Introduction to Europe Syntactic Foam Markets in 2024

9.2 Europe Syntactic Foam Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Syntactic Foam Market Size Outlook by Segments, 2021-2032

By Product

Metal

Polymer

Ceramic

By Application

Marine and Subsea

Automotive and Transportation

Aerospace and Defense

Others

10 Asia Pacific Syntactic Foam Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Syntactic Foam Markets in 2024

10.2 Asia Pacific Syntactic Foam Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Syntactic Foam Market size Outlook by Segments, 2021-2032

By Product

Metal

Polymer

Ceramic

By Application

Marine and Subsea

Automotive and Transportation

Aerospace and Defense

Others

11 South America Syntactic Foam Market Analysis and Outlook To 2032

11.1 Introduction to South America Syntactic Foam Markets in 2024

11.2 South America Syntactic Foam Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Syntactic Foam Market size Outlook by Segments, 2021-2032

By Product

Metal

Polymer

Ceramic

By Application

Marine and Subsea

Automotive and Transportation

Aerospace and Defense

Others

12 Middle East and Africa Syntactic Foam Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Syntactic Foam Markets in 2024

12.2 Middle East and Africa Syntactic Foam Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Syntactic Foam Market size Outlook by Segments, 2021-2032

By Product

Metal

Polymer

Ceramic

By Application

Marine and Subsea

Automotive and Transportation

Aerospace and Defense

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Acoustic Polymer Ltd

AFGlobal

ALSEAMAR

Balmoral

CBM International

CMT Materials

Cuming Microwave Corp

Deepwater Buoyancy

Diab Group

Engineered Syntactic Systems

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Metal

Polymer

Ceramic

By Application

Marine and Subsea

Automotive and Transportation

Aerospace and Defense

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Syntactic Foam Market Size is valued at $174.6 Million in 2024 and is forecast to register a growth rate (CAGR) of 5.5% to reach $268 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Acoustic Polymer Ltd, AFGlobal, ALSEAMAR, Balmoral, CBM International, CMT Materials, Cuming Microwave Corp, Deepwater Buoyancy, Diab Group, Engineered Syntactic Systems

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume