The global Syngas Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Feedstock (Pet Coke, Coal, Natural Gas, Others), By Technology (Steam Reforming, Gasification), By Gasifier (Fixed Bed, Entrained Flow, Fluidized Bed), By Application (Methanol, Ammonia, Hydrogen, Liquid Fuels, Direct Reduced Iron, Synthetic Natural Gas, Electricity, Others).

Syngas, a versatile mixture of carbon monoxide, hydrogen, and other trace gases, is playing a pivotal role in the transition towards cleaner energy sources in 2024. Produced through various methods such as steam reforming, gasification, and biomass conversion, syngas serves as a precursor for a wide array of valuable products, including hydrogen, ammonia, methanol, and synthetic fuels. With growing concerns over carbon emissions and energy security, syngas is gaining traction as a flexible feedstock for both traditional and emerging industries. In addition to its use in chemical synthesis and fuel production, syngas is increasingly being explored for power generation and as a potential energy storage medium, particularly in conjunction with renewable sources such as solar and wind. As technological advancements to improve syngas production efficiency and reduce associated environmental impacts, the market for syngas is poised for significant expansion, driving innovation and sustainability across multiple sectors.

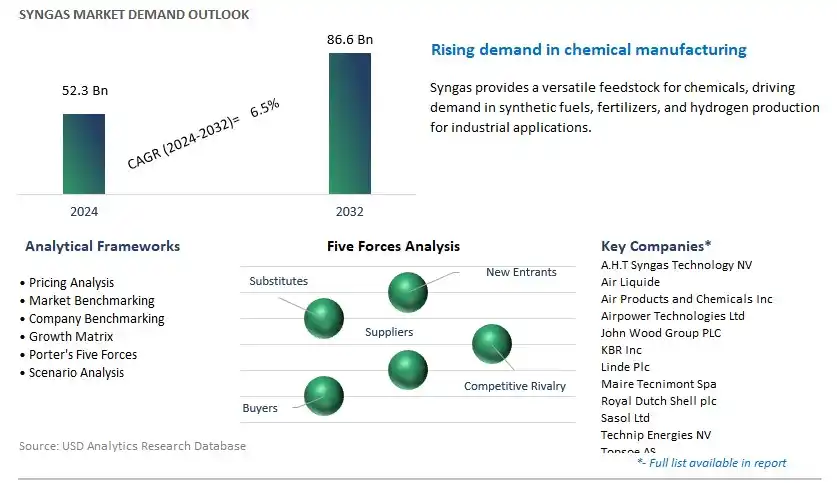

The market report analyses the leading companies in the industry including A.H.T Syngas Technology NV, Air Liquide, Air Products and Chemicals Inc, Airpower Technologies Ltd, John Wood Group PLC, KBR Inc, Linde Plc, Maire Tecnimont Spa, Royal Dutch Shell plc, Sasol Ltd, Technip Energies NV, Topsoe AS, and others.

A significant trend in the syngas market is the increasing demand for renewable and sustainable energy sources. Syngas, a mixture of hydrogen and carbon monoxide, is a versatile intermediate product that can be used to produce various fuels and chemicals, including hydrogen, methane, ammonia, and synthetic fuels. With growing concerns about climate change, air pollution, and energy security, there is a global shift towards cleaner and more sustainable energy solutions. Syngas plays a key role in the transition to renewable energy by enabling the production of biofuels, synthetic natural gas (SNG), and hydrogen from biomass, waste, and renewable electricity sources. As governments, industries, and consumers prioritize decarbonization and environmental sustainability, the demand for syngas as a renewable energy carrier and feedstock for green chemical production is expected to increase, driving market growth and innovation in syngas technologies.

The primary driver behind the growth of the syngas market is the expansion of industrial gasification and chemical manufacturing activities worldwide. Gasification is a thermochemical process that converts carbonaceous feedstocks such as coal, biomass, and municipal solid waste into syngas through high-temperature reactions with a controlled amount of oxygen or steam. Syngas serves as a valuable intermediate for producing a wide range of products, including electricity, fuels, chemicals, and materials. With the increasing demand for energy, chemicals, and materials to support economic growth and development, there is a growing interest in gasification technologies as a means to convert abundant and diverse feedstocks into valuable products. Industries such as power generation, petrochemicals, fertilizers, and steelmaking utilize syngas as a feedstock or fuel in their production processes, driving the demand for gasification technologies and syngas-derived products. As industrial sectors continue to expand and modernize, the market for syngas is expected to grow, driven by the need for efficient and versatile energy and chemical solutions.

An opportunity for the syngas market lies in the integration with carbon capture, utilization, and storage (CCUS) technologies. As concerns about greenhouse gas emissions and climate change intensify, there is a growing need to mitigate CO2 emissions from industrial processes, power generation, and transportation sectors. Syngas production via gasification offers an opportunity to capture and utilize CO2 emissions for beneficial purposes, such as enhanced oil recovery (EOR), chemical synthesis, and mineralization. By integrating CCUS technologies with syngas production facilities, companies can reduce their carbon footprint, comply with emissions regulations, and create value-added products from captured CO2. Moreover, the utilization of CO2 as a feedstock for syngas production can enhance process efficiency, reduce operating costs, and improve the overall sustainability of syngas-based processes. By investing in CCUS infrastructure, developing carbon capture technologies, and implementing carbon utilization strategies, stakeholders in the syngas market can unlock new revenue streams, enhance environmental performance, and contribute to global efforts to address climate change. Expanding into CCUS presents an opportunity for the market to align with sustainability goals, enhance competitiveness, and drive innovation in syngas production and utilization technologies.

Within the syngas market, natural gas is the fastest-growing segment, catalyzing a paradigm shift in global energy dynamics. Natural gas serves as a prime feedstock for syngas production, offering numerous advantages such as high energy efficiency, lower carbon emissions, and ease of processing. The burgeoning demand for clean and sustainable energy sources, coupled with technological advancements in gasification processes, has propelled the rapid expansion of natural gas-based syngas production facilities worldwide. Moreover, the increasing emphasis on reducing greenhouse gas emissions and transitioning towards renewable energy sources has led to a surge in investments in natural gas-based syngas projects. Furthermore, the versatility of syngas derived from natural gas, which can be utilized for the production of a wide range of valuable chemicals and fuels, further amplifies its appeal in various industrial applications. As nations strive to achieve energy security and sustainability goals, the natural gas segment is poised to maintain its exponential growth trajectory, driving innovation and reshaping the landscape of the syngas market.

Gasification is the fastest-growing segment within the syngas market, spearheading a revolution in sustainable energy production and resource utilization. Gasification technology offers a versatile and efficient means of converting various feedstocks, including coal, biomass, and municipal solid waste, into syngas—a valuable synthesis gas consisting primarily of hydrogen and carbon monoxide. The surge in demand for cleaner and more sustainable energy sources, coupled with advancements in gasification technologies, has propelled the rapid expansion of gasification-based syngas production facilities globally. Unlike steam reforming, which predominantly relies on natural gas as a feedstock, gasification enables the utilization of a diverse array of feedstocks, thereby enhancing flexibility and resilience in syngas production. Moreover, the growing emphasis on circular economy principles and the valorization of waste streams has further catalyzed the adoption of gasification technology for syngas production. As industries and governments worldwide prioritize decarbonization and energy transition goals, the gasification segment is poised to witness sustained growth, driving innovation and reshaping the landscape of the syngas market.

Fluidized bed gasifiers emerge as the largest segment within the syngas market, driving significant advancements in clean energy production and industrial processes. These gasifiers offer unparalleled efficiency and flexibility in converting a wide range of feedstocks—including coal, biomass, and waste materials—into syngas through a fluidized bed combustion process. The versatility and adaptability of fluidized bed gasifiers make them indispensable in various applications, including power generation, chemical production, and fuel synthesis. With stringent environmental regulations and increasing pressure to reduce carbon emissions, fluidized bed gasifiers have gained prominence as a preferred technology for sustainable syngas production. Additionally, ongoing research and development efforts aimed at enhancing the performance and scalability of fluidized bed gasification technologies further underscore their dominant position in the syngas market. As industries and governments worldwide intensify their focus on clean energy and resource efficiency, fluidized bed gasifiers are poised to maintain their leadership role, driving innovation and shaping the future of the syngas market.

Among the segments delineated within the syngas market by application, the fastest-growing segment is Hydrogen. Hydrogen is experiencing a surge in demand due to its critical role in the transition towards a low-carbon economy and the increasing focus on renewable energy sources. Hydrogen produced from syngas can serve as a clean fuel for various sectors, including transportation, industrial processes, and power generation. As nations worldwide set ambitious targets to reduce greenhouse gas emissions and combat climate change, hydrogen is gaining traction as a versatile and environmentally friendly energy carrier. Furthermore, advancements in electrolysis and steam methane reforming technologies are driving down the cost of hydrogen production, making it more competitive with conventional fossil fuels. The growing interest in hydrogen as a key component of decarbonization strategies is expected to fuel its rapid growth within the syngas market in the coming years.

By Feedstock

Pet Coke

Coal

Natural Gas

Others

By Technology

Steam Reforming

Gasification

By Gasifier

Fixed Bed

Entrained Flow

Fluidized Bed

By Application

Methanol

Ammonia

Hydrogen

Liquid Fuels

Direct Reduced Iron

Synthetic Natural Gas

Electricity

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

A.H.T Syngas Technology NV

Air Liquide

Air Products and Chemicals Inc

Airpower Technologies Ltd

John Wood Group PLC

KBR Inc

Linde Plc

Maire Tecnimont Spa

Royal Dutch Shell plc

Sasol Ltd

Technip Energies NV

Topsoe AS

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Syngas Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Syngas Market Size Outlook, $ Million, 2021 to 2032

3.2 Syngas Market Outlook by Type, $ Million, 2021 to 2032

3.3 Syngas Market Outlook by Product, $ Million, 2021 to 2032

3.4 Syngas Market Outlook by Application, $ Million, 2021 to 2032

3.5 Syngas Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Syngas Industry

4.2 Key Market Trends in Syngas Industry

4.3 Potential Opportunities in Syngas Industry

4.4 Key Challenges in Syngas Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Syngas Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Syngas Market Outlook by Segments

7.1 Syngas Market Outlook by Segments, $ Million, 2021- 2032

By Feedstock

Pet Coke

Coal

Natural Gas

Others

By Technology

Steam Reforming

Gasification

By Gasifier

Fixed Bed

Entrained Flow

Fluidized Bed

By Application

Methanol

Ammonia

Hydrogen

Liquid Fuels

Direct Reduced Iron

Synthetic Natural Gas

Electricity

Others

8 North America Syngas Market Analysis and Outlook To 2032

8.1 Introduction to North America Syngas Markets in 2024

8.2 North America Syngas Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Syngas Market size Outlook by Segments, 2021-2032

By Feedstock

Pet Coke

Coal

Natural Gas

Others

By Technology

Steam Reforming

Gasification

By Gasifier

Fixed Bed

Entrained Flow

Fluidized Bed

By Application

Methanol

Ammonia

Hydrogen

Liquid Fuels

Direct Reduced Iron

Synthetic Natural Gas

Electricity

Others

9 Europe Syngas Market Analysis and Outlook To 2032

9.1 Introduction to Europe Syngas Markets in 2024

9.2 Europe Syngas Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Syngas Market Size Outlook by Segments, 2021-2032

By Feedstock

Pet Coke

Coal

Natural Gas

Others

By Technology

Steam Reforming

Gasification

By Gasifier

Fixed Bed

Entrained Flow

Fluidized Bed

By Application

Methanol

Ammonia

Hydrogen

Liquid Fuels

Direct Reduced Iron

Synthetic Natural Gas

Electricity

Others

10 Asia Pacific Syngas Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Syngas Markets in 2024

10.2 Asia Pacific Syngas Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Syngas Market size Outlook by Segments, 2021-2032

By Feedstock

Pet Coke

Coal

Natural Gas

Others

By Technology

Steam Reforming

Gasification

By Gasifier

Fixed Bed

Entrained Flow

Fluidized Bed

By Application

Methanol

Ammonia

Hydrogen

Liquid Fuels

Direct Reduced Iron

Synthetic Natural Gas

Electricity

Others

11 South America Syngas Market Analysis and Outlook To 2032

11.1 Introduction to South America Syngas Markets in 2024

11.2 South America Syngas Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Syngas Market size Outlook by Segments, 2021-2032

By Feedstock

Pet Coke

Coal

Natural Gas

Others

By Technology

Steam Reforming

Gasification

By Gasifier

Fixed Bed

Entrained Flow

Fluidized Bed

By Application

Methanol

Ammonia

Hydrogen

Liquid Fuels

Direct Reduced Iron

Synthetic Natural Gas

Electricity

Others

12 Middle East and Africa Syngas Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Syngas Markets in 2024

12.2 Middle East and Africa Syngas Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Syngas Market size Outlook by Segments, 2021-2032

By Feedstock

Pet Coke

Coal

Natural Gas

Others

By Technology

Steam Reforming

Gasification

By Gasifier

Fixed Bed

Entrained Flow

Fluidized Bed

By Application

Methanol

Ammonia

Hydrogen

Liquid Fuels

Direct Reduced Iron

Synthetic Natural Gas

Electricity

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

A.H.T Syngas Technology NV

Air Liquide

Air Products and Chemicals Inc

Airpower Technologies Ltd

John Wood Group PLC

KBR Inc

Linde Plc

Maire Tecnimont Spa

Royal Dutch Shell plc

Sasol Ltd

Technip Energies NV

Topsoe AS

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Feedstock

Pet Coke

Coal

Natural Gas

Others

By Technology

Steam Reforming

Gasification

By Gasifier

Fixed Bed

Entrained Flow

Fluidized Bed

By Application

Methanol

Ammonia

Hydrogen

Liquid Fuels

Direct Reduced Iron

Synthetic Natural Gas

Electricity

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Syngas Market Size is valued at $52.3 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.5% to reach $86.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

A.H.T Syngas Technology NV, Air Liquide, Air Products and Chemicals Inc, Airpower Technologies Ltd, John Wood Group PLC, KBR Inc, Linde Plc, Maire Tecnimont Spa, Royal Dutch Shell plc, Sasol Ltd, Technip Energies NV, Topsoe AS

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume