The global Sustainable Pharmaceutical Packaging Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Plastics, Paper & paperboard, Glass, Metal, Others), By Packaging (Primary Packaging, Secondary Packaging), By Product (Plastic bottles, Blister, Labels & accessories, Caps & closures, Pre-filled syringes, Others), By Process (Recyclable, Reusable, Biodegradable).

Sustainable pharmaceutical packaging s to gain traction as pharmaceutical companies and consumers alike prioritize environmental stewardship and sustainability in 2024. This encompasses a range of packaging solutions designed to minimize environmental impact throughout the lifecycle of pharmaceutical products, from production to disposal. Sustainable packaging materials such as recycled plastics, bioplastics, and paperboard sourced from responsibly managed forests are increasingly being used to reduce reliance on virgin plastics and minimize carbon footprint. Additionally, innovations in packaging design, such as lightweighting, minimalist packaging, and recyclable materials, are being implemented to optimize material usage and minimize waste generation. With regulatory pressures and consumer preferences driving the adoption of sustainable practices, pharmaceutical companies are increasingly investing in sustainable packaging solutions to meet environmental targets and enhance brand reputation.

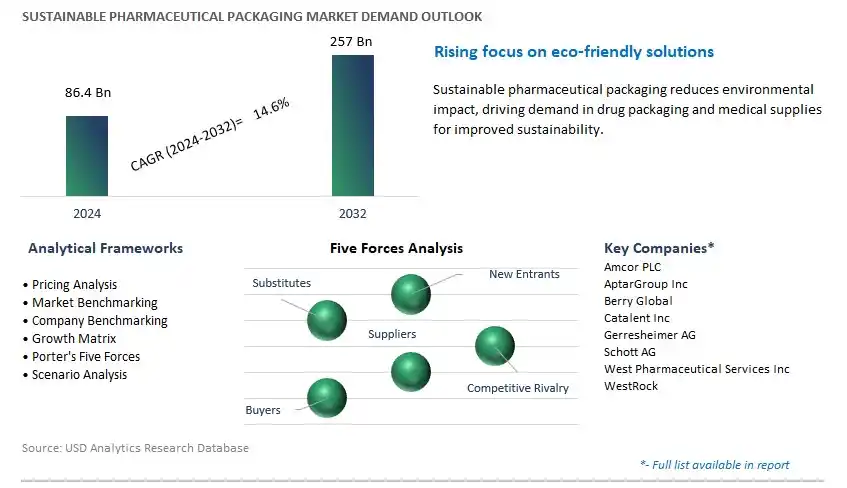

The market report analyses the leading companies in the industry including Amcor PLC, AptarGroup Inc, Berry Global, Catalent Inc, Gerresheimer AG, Schott AG, West Pharmaceutical Services Inc, WestRock, and others.

A significant trend in the sustainable pharmaceutical packaging market is the growing emphasis on sustainability within the pharmaceutical industry. With increasing awareness of environmental issues and concerns about plastic waste, there is a shift towards eco-friendly packaging solutions that reduce carbon footprint, minimize plastic usage, and promote recyclability. Pharmaceutical companies are adopting sustainable packaging practices as part of their corporate social responsibility initiatives and to meet regulatory requirements for environmental stewardship. Sustainable pharmaceutical packaging options include biodegradable materials, recyclable plastics, compostable packaging, and innovative packaging designs that optimize material usage and minimize packaging waste. As consumers and regulatory bodies prioritize sustainability, the demand for sustainable pharmaceutical packaging is expected to rise.

The primary driver for the sustainable pharmaceutical packaging market is regulatory mandates and consumer preferences for green packaging solutions. Governments worldwide are implementing regulations to reduce plastic pollution, promote recycling, and encourage the use of sustainable materials in packaging. Pharmaceutical companies are under pressure to comply with these regulations and adopt sustainable packaging practices to minimize environmental impact throughout the product lifecycle. Additionally, consumer preferences are shifting towards environmentally friendly products, and patients are increasingly seeking pharmaceuticals packaged in sustainable materials that align with their values and lifestyle choices. As pharmaceutical companies respond to regulatory requirements and consumer demands, the adoption of sustainable packaging solutions becomes a strategic imperative to maintain brand reputation and competitiveness in the market.

A significant opportunity for the sustainable pharmaceutical packaging market lies in innovation in renewable and biodegradable packaging materials tailored to the unique requirements of the pharmaceutical industry. Manufacturers are investing in research and development to create sustainable packaging alternatives using bio-based polymers, plant-based materials, and biodegradable plastics derived from renewable sources such as corn starch, sugarcane, and cellulose. These materials offer comparable performance to conventional plastics in terms of barrier properties, stability, and compatibility with pharmaceutical products while providing environmental benefits such as reduced greenhouse gas emissions and decreased reliance on fossil fuels. By developing innovative packaging materials that meet regulatory standards for safety, stability, and compatibility with pharmaceutical formulations, manufacturers can capitalize on the growing demand for sustainable pharmaceutical packaging and position themselves as leaders in the green packaging market. Additionally, partnerships with pharmaceutical companies, collaboration with research institutions, and investment in sustainable supply chains present opportunities for market expansion and differentiation in the evolving landscape of sustainable packaging solutions for the pharmaceutical industry.

Within the Sustainable Pharmaceutical Packaging Market segmented by material, the Plastics segment is the largest, driven by its widespread use, versatility, and cost-effectiveness in packaging solutions for pharmaceutical products. Plastics offer numerous advantages, including lightweight properties, durability, flexibility in design, and barrier protection against moisture, oxygen, and contaminants, ensuring the safety and integrity of pharmaceutical products throughout their lifecycle. Additionally, advancements in polymer technology have led to the development of bio-based and biodegradable plastics, addressing environmental concerns and aligning with sustainability goals in the pharmaceutical industry. Despite increasing interest in alternative materials such as paper and glass, plastics remain the preferred choice for pharmaceutical packaging due to their superior performance, compatibility with various drug formulations, and ability to meet stringent regulatory requirements. Moreover, the demand for pharmaceutical products continues to rise globally, further driving the consumption of plastic packaging materials in the industry. As pharmaceutical companies prioritize sustainable packaging solutions to reduce environmental impact, the Plastics segment maintains its dominance in the sustainable pharmaceutical packaging market, driving significant revenue and market growth.

Within the Sustainable Pharmaceutical Packaging Market segmented by packaging, the Primary Packaging segment is the fastest-growing, fuelled by increasing emphasis on product safety, integrity, and sustainability in the pharmaceutical industry. Primary packaging plays a critical role in directly containing and protecting pharmaceutical products, including tablets, capsules, vials, and syringes, from external factors such as moisture, light, and contamination. With growing awareness of environmental concerns and regulatory mandates, pharmaceutical companies are transitioning towards sustainable primary packaging solutions that minimize environmental impact while maintaining product efficacy and safety. Sustainable primary packaging materials, such as bio-based plastics, recycled plastics, and biodegradable materials, are gaining traction due to their reduced carbon footprint and recyclability. Additionally, advancements in eco-friendly packaging technologies, such as compostable films and recyclable blister packs, further drive the adoption of sustainable primary packaging solutions. As pharmaceutical manufacturers prioritize sustainability throughout the supply chain, the Primary Packaging segment experiences rapid growth, driving innovation and market expansion in the sustainable pharmaceutical packaging market.

Within the Sustainable Pharmaceutical Packaging Market segmented by product, the Plastic Bottles segment is the largest, driven by its widespread use, versatility, and cost-effectiveness in packaging various pharmaceutical formulations. Plastic bottles offer numerous advantages, including lightweight properties, durability, and resistance to breakage, making them ideal for storing liquid medications, syrups, and oral suspensions. Additionally, advancements in polymer technology have led to the development of eco-friendly plastic bottles made from recycled materials or bio-based plastics, addressing environmental concerns and promoting sustainability in the pharmaceutical industry. Plastic bottles also provide excellent barrier properties, protecting pharmaceutical products from moisture, light, and contamination, ensuring product safety and integrity throughout their shelf life. Moreover, the ease of manufacturing and customization options offered by plastic bottles make them a preferred choice for pharmaceutical packaging solutions, driving their dominance in the sustainable pharmaceutical packaging market. As pharmaceutical companies increasingly adopt sustainable practices and regulatory bodies emphasize the importance of eco-friendly packaging, the Plastic Bottles segment continues to lead the market, driving significant revenue and market growth.

Among the segments delineated by process in the Sustainable Pharmaceutical Packaging Market, the Biodegradable segment stands out as the fastest-growing, driven by increasing environmental concerns, stringent regulations, and a growing emphasis on sustainable packaging solutions within the pharmaceutical industry. Biodegradable packaging materials, derived from renewable sources such as plant-based polymers or starch, offer a compelling solution to reduce the environmental impact associated with traditional packaging materials. These materials undergo decomposition by natural processes, such as microbial action or composting, resulting in the breakdown of packaging waste into harmless substances, such as water, carbon dioxide, and biomass. With rising awareness of plastic pollution and the need for eco-friendly alternatives, pharmaceutical companies are increasingly opting for biodegradable packaging solutions to minimize their carbon footprint and contribute to sustainability initiatives. Moreover, regulatory support and incentives for eco-friendly packaging further accelerate the adoption of biodegradable packaging in the pharmaceutical sector. As demand for environmentally responsible packaging solutions continues to escalate, the Biodegradable segment experiences rapid growth, driving innovation and market expansion in the sustainable pharmaceutical packaging market.

By Material

Plastics

Paper & paperboard

Glass

Metal

Others

By Packaging

Primary Packaging

Secondary Packaging

By Product

Plastic bottles

Blister

Labels & accessories

Caps & closures

Pre-filled syringes

Others

By Process

Recyclable

Reusable

BiodegradableCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amcor PLC

AptarGroup Inc

Berry Global

Catalent Inc

Gerresheimer AG

Schott AG

West Pharmaceutical Services Inc

WestRock

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Sustainable Pharmaceutical Packaging Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Sustainable Pharmaceutical Packaging Market Size Outlook, $ Million, 2021 to 2032

3.2 Sustainable Pharmaceutical Packaging Market Outlook by Type, $ Million, 2021 to 2032

3.3 Sustainable Pharmaceutical Packaging Market Outlook by Product, $ Million, 2021 to 2032

3.4 Sustainable Pharmaceutical Packaging Market Outlook by Application, $ Million, 2021 to 2032

3.5 Sustainable Pharmaceutical Packaging Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Sustainable Pharmaceutical Packaging Industry

4.2 Key Market Trends in Sustainable Pharmaceutical Packaging Industry

4.3 Potential Opportunities in Sustainable Pharmaceutical Packaging Industry

4.4 Key Challenges in Sustainable Pharmaceutical Packaging Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Sustainable Pharmaceutical Packaging Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Sustainable Pharmaceutical Packaging Market Outlook by Segments

7.1 Sustainable Pharmaceutical Packaging Market Outlook by Segments, $ Million, 2021- 2032

By Material

Plastics

Paper & paperboard

Glass

Metal

Others

By Packaging

Primary Packaging

Secondary Packaging

By Product

Plastic bottles

Blister

Labels & accessories

Caps & closures

Pre-filled syringes

Others

By Process

Recyclable

Reusable

Biodegradable

8 North America Sustainable Pharmaceutical Packaging Market Analysis and Outlook To 2032

8.1 Introduction to North America Sustainable Pharmaceutical Packaging Markets in 2024

8.2 North America Sustainable Pharmaceutical Packaging Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Sustainable Pharmaceutical Packaging Market size Outlook by Segments, 2021-2032

By Material

Plastics

Paper & paperboard

Glass

Metal

Others

By Packaging

Primary Packaging

Secondary Packaging

By Product

Plastic bottles

Blister

Labels & accessories

Caps & closures

Pre-filled syringes

Others

By Process

Recyclable

Reusable

Biodegradable

9 Europe Sustainable Pharmaceutical Packaging Market Analysis and Outlook To 2032

9.1 Introduction to Europe Sustainable Pharmaceutical Packaging Markets in 2024

9.2 Europe Sustainable Pharmaceutical Packaging Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Sustainable Pharmaceutical Packaging Market Size Outlook by Segments, 2021-2032

By Material

Plastics

Paper & paperboard

Glass

Metal

Others

By Packaging

Primary Packaging

Secondary Packaging

By Product

Plastic bottles

Blister

Labels & accessories

Caps & closures

Pre-filled syringes

Others

By Process

Recyclable

Reusable

Biodegradable

10 Asia Pacific Sustainable Pharmaceutical Packaging Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Sustainable Pharmaceutical Packaging Markets in 2024

10.2 Asia Pacific Sustainable Pharmaceutical Packaging Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Sustainable Pharmaceutical Packaging Market size Outlook by Segments, 2021-2032

By Material

Plastics

Paper & paperboard

Glass

Metal

Others

By Packaging

Primary Packaging

Secondary Packaging

By Product

Plastic bottles

Blister

Labels & accessories

Caps & closures

Pre-filled syringes

Others

By Process

Recyclable

Reusable

Biodegradable

11 South America Sustainable Pharmaceutical Packaging Market Analysis and Outlook To 2032

11.1 Introduction to South America Sustainable Pharmaceutical Packaging Markets in 2024

11.2 South America Sustainable Pharmaceutical Packaging Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Sustainable Pharmaceutical Packaging Market size Outlook by Segments, 2021-2032

By Material

Plastics

Paper & paperboard

Glass

Metal

Others

By Packaging

Primary Packaging

Secondary Packaging

By Product

Plastic bottles

Blister

Labels & accessories

Caps & closures

Pre-filled syringes

Others

By Process

Recyclable

Reusable

Biodegradable

12 Middle East and Africa Sustainable Pharmaceutical Packaging Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Sustainable Pharmaceutical Packaging Markets in 2024

12.2 Middle East and Africa Sustainable Pharmaceutical Packaging Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Sustainable Pharmaceutical Packaging Market size Outlook by Segments, 2021-2032

By Material

Plastics

Paper & paperboard

Glass

Metal

Others

By Packaging

Primary Packaging

Secondary Packaging

By Product

Plastic bottles

Blister

Labels & accessories

Caps & closures

Pre-filled syringes

Others

By Process

Recyclable

Reusable

Biodegradable

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amcor PLC

AptarGroup Inc

Berry Global

Catalent Inc

Gerresheimer AG

Schott AG

West Pharmaceutical Services Inc

WestRock

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Plastics

Paper & paperboard

Glass

Metal

Others

By Packaging

Primary Packaging

Secondary Packaging

By Product

Plastic bottles

Blister

Labels & accessories

Caps & closures

Pre-filled syringes

Others

By Process

Recyclable

Reusable

Biodegradable

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Sustainable Pharmaceutical Packaging Market Size is valued at $86.4 Billion in 2024 and is forecast to register a growth rate (CAGR) of 14.6% to reach $257 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amcor PLC, AptarGroup Inc, Berry Global, Catalent Inc, Gerresheimer AG, Schott AG, West Pharmaceutical Services Inc, WestRock

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume