The global Surgical Scalpel Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Blade, Handle), By Application (Hospital, Clinic, Others).

The Surgical Scalpel Market includes surgical blades, scalpel handles, disposable scalpels, and safety scalpels used by surgeons and healthcare professionals in surgical procedures for precise incisions, tissue dissection, and surgical site access. Surgical scalpels offer sharpness, blade durability, and ergonomic handle designs, enabling surgeons to perform accurate surgical techniques, tissue sampling, and excision procedures across diverse medical specialties. Market dynamics encompass scalpel blade materials, safety scalpel innovations, blade size options, and surgical scalpel disposal practices for optimal surgical instrument management and surgical workflow efficiency.

The global Surgical Scalpel Industry is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Surgical Scalpel Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Surgical Scalpel Industry include- Becton, Dickinson and Company, Feather Safety Razor Co Ltd, Hill-Rom, KAI Industries, Swann-Morton Ltd.

One of the prominent trends in the Surgical Scalpel market is the increasing adoption of safety scalpels. With a growing emphasis on healthcare worker safety and the prevention of sharps injuries, healthcare facilities are transitioning from traditional scalpel blades to safety scalpels. Safety scalpels feature built-in mechanisms or retractable blades designed to minimize the risk of accidental cuts and punctures, reducing the incidence of sharps-related injuries among surgeons, nurses, and other operating room staff. This trend is driven by regulatory mandates, occupational health guidelines, and initiatives to enhance workplace safety, prompting healthcare providers to invest in safer alternatives to conventional scalpels. As awareness of sharps injuries and their associated risks continues to rise, the demand for safety scalpels is expected to escalate, driving market growth and innovation in the Surgical Scalpel segment.

The primary driver for the Surgical Scalpel market is the increasing volume of surgical procedures performed globally. Surgical scalpels are indispensable tools used in various surgical specialties, including general surgery, orthopedics, obstetrics and gynecology, and dermatology, among others. Factors such as population growth, aging demographics, and the prevalence of chronic diseases contribute to the growing demand for surgical interventions and procedures. Additionally, advancements in medical technology, minimally invasive surgical techniques, and the expansion of healthcare infrastructure in emerging markets further propel the demand for surgical scalpels. As surgical procedures become more complex and diverse, surgeons and healthcare facilities require a wide range of high-quality scalpels to meet the evolving needs of patients and surgical specialties, driving market expansion and innovation in the Surgical Scalpel segment.

An opportunity exists in the integration of advanced materials and coatings to enhance the performance and functionality of surgical scalpels. Manufacturers can leverage innovations in materials science and surface engineering to develop scalpels with superior sharpness, durability, and corrosion resistance, thereby improving cutting precision and extending instrument longevity. Titanium alloys, ceramic materials, and diamond-like carbon coatings are examples of advanced materials that offer exceptional hardness, biocompatibility, and resistance to wear, making them ideal for surgical scalpel applications. Additionally, antimicrobial coatings and nanostructured surfaces can help mitigate the risk of surgical site infections and promote aseptic surgical practices, enhancing patient safety and outcomes. By collaborating with materials suppliers and investing in research and development, manufacturers can introduce next-generation surgical scalpels with enhanced performance characteristics, differentiation, and market competitiveness, addressing the evolving needs of surgeons and healthcare providers.

The fastest-growing segment in the surgical scalpel market, by type, is blades. This growth is driven by the ongoing demand for disposable blades, which are considered more hygienic and reduce the risk of cross-contamination compared to reusable options. Technological advancements in blade manufacturing, such as the development of sharper, more durable materials, further boost their adoption. Moreover, the increasing focus on minimally invasive procedures, which require precise and high-quality cutting tools, accelerates the demand for specialized surgical blades. The rise in outpatient surgeries and the expanding healthcare infrastructure in emerging economies also contribute to the rapid growth of this segment.

The largest segment within the surgical scalpel market, by application, is hospitals. This dominance is attributed to the high volume of surgeries performed in hospital settings, which cater to diverse medical specializations such as general surgery, orthopedics, cardiovascular, and neurology. Hospitals typically handle critical cases that require advanced surgical tools, ensuring a steady demand for scalpels. Furthermore, hospitals often have well-established procurement channels and larger budgets, allowing them to purchase scalpel supplies in bulk. The increasing prevalence of chronic diseases and the growing aging population globally also contribute to the high surgical caseload in hospitals, solidifying their position as the largest market segment.

|

Parameter |

Details |

|

Market Size (2024) |

$228.1 Million |

|

Market Size (2034) |

$389.6 Million |

|

Market Growth Rate |

5.5% |

|

Segments |

By Type (Blade, Handle), By Application (Hospital, Clinic, Others) |

|

Study Period |

2019- 2024 and 2025-2034 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Becton, Dickinson and Company, Feather Safety Razor Co Ltd, Hill-Rom, KAI Industries, Swann-Morton Ltd, and Others. |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

By Type

Blade

Handle

By Application

Hospital

Clinic

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Becton, Dickinson and Company

Feather Safety Razor Co Ltd

Hill-Rom

KAI Industries

Swann-Morton Ltd

* List not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Surgical Scalpel Market, encompassing current market size, growth trends, and forecasts till 2034.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Surgical Scalpel Industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Surgical Scalpel Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Surgical Scalpel Market Size Outlook, $ Million, 2021 to 2030

3.2 Surgical Scalpel Market Outlook by Type, $ Million, 2021 to 2030

3.3 Surgical Scalpel Market Outlook by Product, $ Million, 2021 to 2030

3.4 Surgical Scalpel Market Outlook by Application, $ Million, 2021 to 2030

3.5 Surgical Scalpel Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Surgical Scalpel Industry

4.2 Key Market Trends in Surgical Scalpel Industry

4.3 Potential Opportunities in Surgical Scalpel Industry

4.4 Key Challenges in Surgical Scalpel Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Surgical Scalpel Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Surgical Scalpel Market Outlook by Segments

7.1 Surgical Scalpel Market Outlook by Segments, $ Million, 2021- 2030

By Type

Blade

Handle

By Application

Hospital

Clinic

Others

8 North America Surgical Scalpel Market Analysis and Outlook To 2030

8.1 Introduction to North America Surgical Scalpel Markets in 2024

8.2 North America Surgical Scalpel Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Surgical Scalpel Market size Outlook by Segments, 2021-2030

By Type

Blade

Handle

By Application

Hospital

Clinic

Others

9 Europe Surgical Scalpel Market Analysis and Outlook To 2030

9.1 Introduction to Europe Surgical Scalpel Markets in 2024

9.2 Europe Surgical Scalpel Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Surgical Scalpel Market Size Outlook by Segments, 2021-2030

By Type

Blade

Handle

By Application

Hospital

Clinic

Others

10 Asia Pacific Surgical Scalpel Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Surgical Scalpel Markets in 2024

10.2 Asia Pacific Surgical Scalpel Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Surgical Scalpel Market size Outlook by Segments, 2021-2030

By Type

Blade

Handle

By Application

Hospital

Clinic

Others

11 South America Surgical Scalpel Market Analysis and Outlook To 2030

11.1 Introduction to South America Surgical Scalpel Markets in 2024

11.2 South America Surgical Scalpel Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Surgical Scalpel Market size Outlook by Segments, 2021-2030

By Type

Blade

Handle

By Application

Hospital

Clinic

Others

12 Middle East and Africa Surgical Scalpel Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Surgical Scalpel Markets in 2024

12.2 Middle East and Africa Surgical Scalpel Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Surgical Scalpel Market size Outlook by Segments, 2021-2030

By Type

Blade

Handle

By Application

Hospital

Clinic

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Becton, Dickinson and Company

Feather Safety Razor Co Ltd

Hill-Rom

KAI Industries

Swann-Morton Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Blade

Handle

By Application

Hospital

Clinic

Others

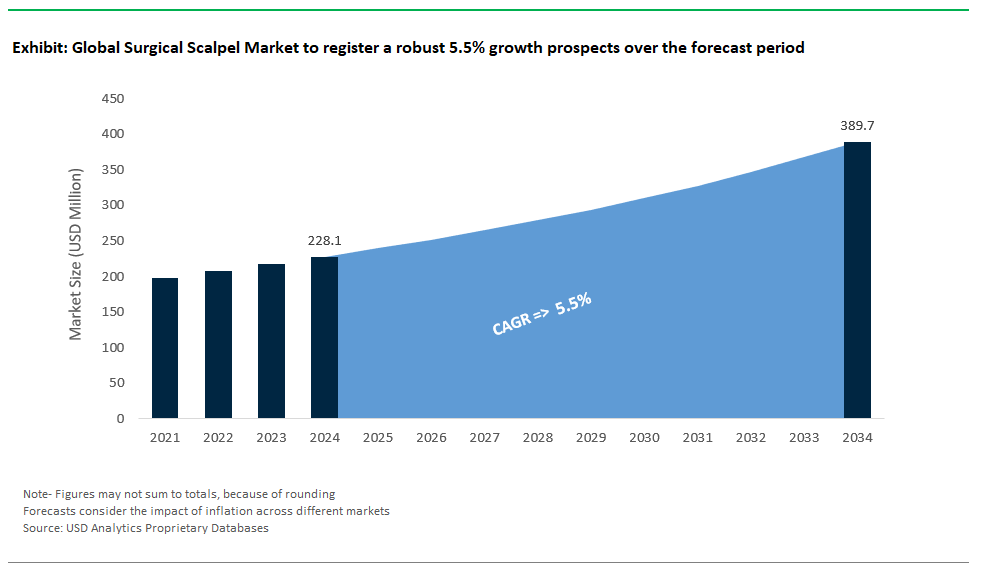

Surgical Scalpel Market Size is valued at $228.1 Million in 2024 and is forecast to register a growth rate (CAGR) of 5.5% to reach $389.6 Million by 2034.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Becton, Dickinson and Company, Feather Safety Razor Co Ltd, Hill-Rom, KAI Industries, Swann-Morton Ltd

Base Year- 2024; Estimated Year- 2025; Historic Period- 2019-2024; Forecast period- 2025 to 2034; Currency: Revenue (USD); Volume