The Surgical Navigation Systems Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Application (ENT, Orthopedic, Neurology, Dental, Others), By Technology (Electromagnetic, Optical, Others), By End-User (Hospitals, Ambulatory Surgical Centers, Others).

Surgical Navigation Systems are computer-assisted tools used to enhance surgical precision, accuracy, and safety by providing real-time spatial information and guidance during surgical procedures. These systems utilize preoperative imaging data, such as CT scans or MRI images, to create 3D anatomical models and intraoperative navigation maps that aid surgeons in planning and executing surgical interventions. Surgical navigation systems track the position and movements of surgical instruments in relation to patient anatomy, allowing for precise navigation through complex anatomical structures and accurate targeting of lesions or treatment sites. These systems are particularly valuable in neurosurgery, orthopedic surgery, and minimally invasive procedures where precise localization and navigation are critical. With advancements in imaging modalities, tracking technology, and software algorithms, surgical navigation systems continue to evolve as indispensable tools for improving surgical outcomes, reducing operative time, and minimizing complications in various surgical specialties.

A significant trend in the surgical navigation systems market is the integration of augmented reality (AR) technology. Surgical navigation systems are increasingly incorporating AR features, allowing surgeons to overlay digital images and information onto the patient's anatomy in real-time. These AR-enhanced navigation systems provide surgeons with valuable visual guidance during procedures, facilitating more precise and efficient surgical interventions. Additionally, AR technology enables better preoperative planning, intraoperative visualization, and postoperative assessment, leading to improved surgical outcomes and patient safety. The integration of AR into surgical navigation systems represents a transformative trend that is revolutionizing the way surgeries are performed, driving the demand for advanced navigation solutions in the healthcare sector.

A key driver fueling the growth of the surgical navigation systems market is the increasing demand for minimally invasive procedures and precision surgery. Minimally invasive techniques offer several advantages over traditional open surgeries, including reduced trauma, shorter recovery times, and improved patient outcomes. Surgical navigation systems play a crucial role in enabling minimally invasive procedures by providing surgeons with real-time, 3D navigation guidance through complex anatomical structures. Moreover, there's a growing emphasis on precision surgery, where accurate navigation and localization of targets are paramount for successful outcomes, particularly in fields such as neurosurgery, orthopedics, and ENT surgery. As the demand for minimally invasive and precision surgery continues to rise, the adoption of advanced surgical navigation systems is expected to escalate, driving market growth.

An opportunity for growth in the surgical navigation systems market lies in expanding into emerging healthcare markets and integrating with robotic surgery platforms. Emerging economies in regions such as Asia, Latin America, and the Middle East are witnessing rapid economic development and investments in healthcare infrastructure, creating a conducive environment for the adoption of advanced medical technologies. Companies can capitalize on this opportunity by expanding their presence in these markets and offering innovative navigation solutions tailored to local needs. Additionally, there's potential for integration with robotic surgery systems, where surgical navigation technology can enhance the accuracy and efficiency of robotic-assisted procedures across various surgical specialties. By strategically leveraging opportunities in emerging markets and robotic surgery integration, companies can drive revenue growth and strengthen their position in the global surgical navigation systems market.

Among the segments listed, the orthopedic application segment is experiencing the fastest growth in the surgical navigation systems market. This growth is driven by several factors. Surgical navigation systems offer advanced tools for orthopedic procedures, aiding surgeons in achieving precise implant placement and alignment during joint replacement surgeries such as hip and knee arthroplasty. These systems utilize sophisticated technology, including electromagnetic and optical tracking, to provide real-time, three-dimensional navigation guidance, enhancing surgical accuracy and reducing the risk of complications. Additionally, the rising prevalence of orthopedic conditions, coupled with the increasing demand for minimally invasive surgical techniques, has led to greater adoption of surgical navigation systems in orthopedic practices worldwide. With hospitals and ambulatory surgical centers investing in these advanced navigation technologies to improve patient outcomes and streamline orthopedic procedures, the orthopedic application segment emerges as the fastest-growing segment in the surgical navigation systems market.

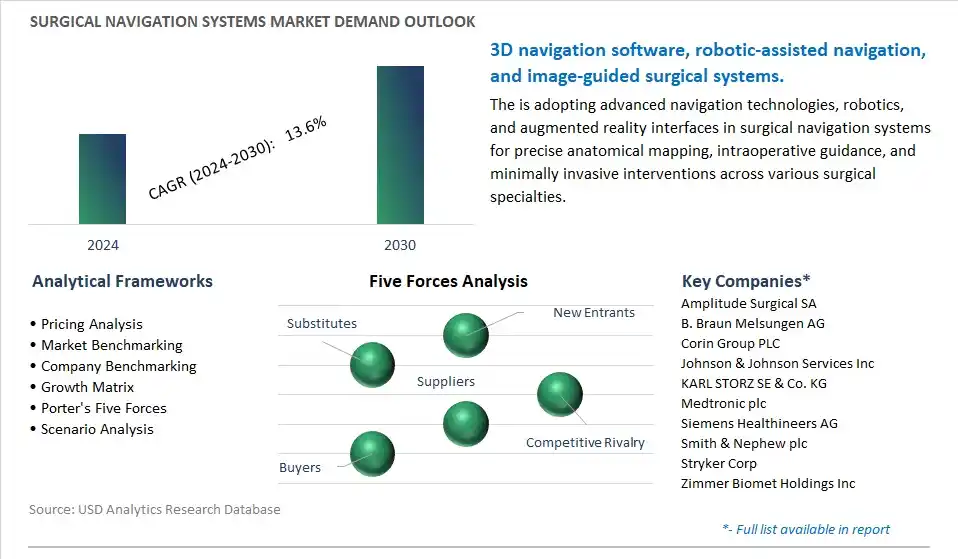

The market research study provides in-depth insights into leading companies including the SWOT analyses, product profile, financial details, and recent developments acrossAmplitude Surgical SA, B. Braun Melsungen AG, Corin Group PLC, Johnson & Johnson Services Inc, KARL STORZ SE & Co. KG, Medtronic plc, Siemens Healthineers AG, Smith & Nephew plc, Stryker Corp, Zimmer Biomet Holdings Inc

By Application

ENT

Orthopedic

Neurology

Dental

Others

By Technology

Electromagnetic

Optical

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amplitude Surgical SA

B. Braun Melsungen AG

Corin Group PLC

Johnson & Johnson Services Inc

KARL STORZ SE & Co. KG

Medtronic plc

Siemens Healthineers AG

Smith & Nephew plc

Stryker Corp

Zimmer Biomet Holdings Inc

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Surgical Navigation Systems Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Surgical Navigation Systems Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Surgical Navigation Systems Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Surgical Navigation Systems Market Size Outlook, $ Million, 2021 to 2030

3.2 Surgical Navigation Systems Market Outlook by Type, $ Million, 2021 to 2030

3.3 Surgical Navigation Systems Market Outlook by Product, $ Million, 2021 to 2030

3.4 Surgical Navigation Systems Market Outlook by Application, $ Million, 2021 to 2030

3.5 Surgical Navigation Systems Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Surgical Navigation Systems Industry

4.2 Key Market Trends in Surgical Navigation Systems Industry

4.3 Potential Opportunities in Surgical Navigation Systems Industry

4.4 Key Challenges in Surgical Navigation Systems Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Surgical Navigation Systems Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Surgical Navigation Systems Market Outlook by Segments

7.1 Surgical Navigation Systems Market Outlook by Segments, $ Million, 2021- 2030

By Application

ENT

Orthopedic

Neurology

Dental

Others

By Technology

Electromagnetic

Optical

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Others

8 North America Surgical Navigation Systems Market Analysis and Outlook To 2030

8.1 Introduction to North America Surgical Navigation Systems Markets in 2024

8.2 North America Surgical Navigation Systems Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Surgical Navigation Systems Market size Outlook by Segments, 2021-2030

By Application

ENT

Orthopedic

Neurology

Dental

Others

By Technology

Electromagnetic

Optical

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Others

9 Europe Surgical Navigation Systems Market Analysis and Outlook To 2030

9.1 Introduction to Europe Surgical Navigation Systems Markets in 2024

9.2 Europe Surgical Navigation Systems Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Surgical Navigation Systems Market Size Outlook by Segments, 2021-2030

By Application

ENT

Orthopedic

Neurology

Dental

Others

By Technology

Electromagnetic

Optical

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Others

10 Asia Pacific Surgical Navigation Systems Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Surgical Navigation Systems Markets in 2024

10.2 Asia Pacific Surgical Navigation Systems Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Surgical Navigation Systems Market size Outlook by Segments, 2021-2030

By Application

ENT

Orthopedic

Neurology

Dental

Others

By Technology

Electromagnetic

Optical

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Others

11 South America Surgical Navigation Systems Market Analysis and Outlook To 2030

11.1 Introduction to South America Surgical Navigation Systems Markets in 2024

11.2 South America Surgical Navigation Systems Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Surgical Navigation Systems Market size Outlook by Segments, 2021-2030

By Application

ENT

Orthopedic

Neurology

Dental

Others

By Technology

Electromagnetic

Optical

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Others

12 Middle East and Africa Surgical Navigation Systems Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Surgical Navigation Systems Markets in 2024

12.2 Middle East and Africa Surgical Navigation Systems Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Surgical Navigation Systems Market size Outlook by Segments, 2021-2030

By Application

ENT

Orthopedic

Neurology

Dental

Others

By Technology

Electromagnetic

Optical

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Amplitude Surgical SA

B. Braun Melsungen AG

Corin Group PLC

Johnson & Johnson Services Inc

KARL STORZ SE & Co. KG

Medtronic plc

Siemens Healthineers AG

Smith & Nephew plc

Stryker Corp

Zimmer Biomet Holdings Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

ENT

Orthopedic

Neurology

Dental

Others

By Technology

Electromagnetic

Optical

Others

By End-User

Hospitals

Ambulatory Surgical Centers

Others

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Surgical Navigation Systems Market is one of the lucrative growth markets, poised to register a 13.6% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amplitude Surgical SA, B. Braun Melsungen AG, Corin Group PLC, Johnson & Johnson Services Inc, KARL STORZ SE & Co. KG, Medtronic plc, Siemens Healthineers AG, Smith & Nephew plc, Stryker Corp, Zimmer Biomet Holdings Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume