The global Surfactants Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Substrate (Synthetic Surfactants, Bio-Based Surfactants, Chemically Synthesized Bio-Based Surfactants, Biosurfactants), By Type (Anionic Surfactants, Non-ionic Surfactants, Cationic Surfactants, Amphoteric Surfactants), By Application (Home Care, Personal Care, Industrial & Institutional Cleaning, Textile, Elastomers & Plastics, Oilfield Chemicals, Agrochemicals, Food & Beverage, Others).

Surfactants, amphiphilic molecules capable of reducing surface tension between two liquids or between a liquid and a solid, to serve as key ingredients in various industrial and consumer products in 2024. These versatile compounds find applications in detergents, personal care products, agrochemicals, paints, and coatings, among others. In detergents and cleaning agents, surfactants enable the removal of dirt and grease by emulsifying them in water, enhancing cleaning efficiency. Further, in personal care products such as shampoos, soaps, and cosmetics, surfactants provide foaming, wetting, and emulsification properties, contributing to product performance and consumer experience. With ongoing efforts to develop sustainable and eco-friendly formulations, the market for surfactants is witnessing innovations in biodegradable and renewable surfactants, as well as in novel applications such as enhanced oil recovery and environmental remediation.

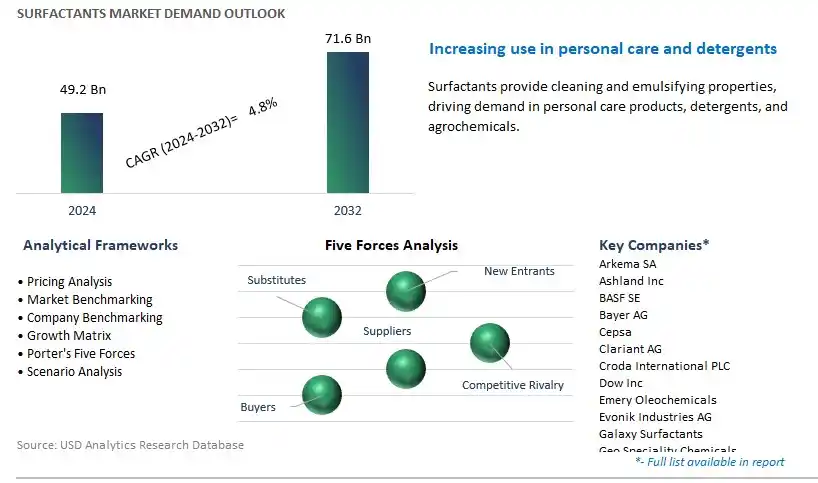

The market report analyses the leading companies in the industry including Arkema SA, Ashland Inc, BASF SE, Bayer AG, Cepsa, Clariant AG, Croda International PLC, Dow Inc, Emery Oleochemicals, Evonik Industries AG, Galaxy Surfactants, Geo Speciality Chemicals, Godrej Industries Ltd, Huntsman International LLC, KAO Corp, KLK Oleo, Lonza Group Ltd, Nouryon, Procter & Gamble Chemicals, Reliance Industries Ltd, Sasol Ltd, Sinopec Jinling Petrochemical Co. Ltd, Solvay SA, Stepan Company, Sumitomo Chemical Co. Ltd, and others.

A significant trend in the surfactants market is the increasing demand for environmentally friendly surfactants driven by regulatory pressure and consumer preferences for sustainable products. With growing awareness of environmental issues and concerns about the impact of traditional surfactants on ecosystems and human health, there is a shift towards the use of biodegradable, non-toxic, and renewable surfactants derived from natural sources such as plant oils, sugars, and amino acids. Manufacturers are investing in research and development to develop eco-friendly surfactants with reduced environmental footprint and improved performance characteristics, catering to the evolving needs of industries such as personal care, household cleaning, agriculture, and industrial applications. As sustainability becomes a key criterion for product selection and brand loyalty, the demand for environmentally friendly surfactants is expected to continue growing.

The primary driver for the surfactants market is the growth in the personal care and home care industries, where surfactants are essential ingredients in a wide range of products such as shampoos, soaps, detergents, and cosmetics. As global population and disposable incomes rise, there is an increasing demand for personal hygiene, grooming, and household cleaning products, driving the consumption of surfactants. Surfactants play critical roles in these products by providing foaming, cleansing, emulsifying, and wetting properties necessary for effective performance. Additionally, the growing trend towards premiumization, product innovation, and customization in the personal care and home care sectors further fuels the demand for specialty surfactants with unique functionalities and sensory attributes. As consumer preferences evolve and market dynamics change, manufacturers of surfactants are focusing on developing innovative formulations and tailored solutions to meet the diverse needs of customers and gain a competitive edge in the market.

A significant opportunity for the surfactants market lies in expansion into emerging markets and application areas with untapped growth potential. As developing economies experience rapid urbanization, industrialization, and rising standards of living, there is an increasing demand for surfactants in sectors such as agriculture, construction, textiles, and oil and gas. Surfactants are used as wetting agents, dispersants, emulsifiers, and foaming agents in various industrial processes and applications, presenting opportunities for market expansion and diversification. By targeting emerging markets and developing tailored surfactant solutions for specific applications such as agrochemicals, construction chemicals, and oilfield chemicals, manufacturers can capitalize on the growing demand for specialty surfactants and establish themselves as key suppliers in these fast-growing segments. Additionally, partnerships with local distributors, investment in infrastructure, and market penetration strategies can help surfactant companies leverage the growth opportunities offered by emerging markets and gain a competitive foothold in the global surfactants industry.

Within the Surfactants Market segmented by substrate, the Synthetic Surfactants segment is the largest, driven by their widespread use across various industries and applications. Synthetic surfactants are chemically synthesized compounds that exhibit surface-active properties, making them indispensable in formulations for detergents, personal care products, pharmaceuticals, agricultural chemicals, and industrial processes. Their versatility, stability, and cost-effectiveness make synthetic surfactants highly preferred by manufacturers seeking consistent performance and scalability in product formulations. Additionally, advancements in surfactant chemistry have led to the development of specialized synthetic surfactants tailored for specific applications, further expanding their market penetration. Despite the increasing interest in bio-based alternatives, synthetic surfactants continue to dominate the market due to their established performance, reliability, and extensive industrial infrastructure. As industries strive for innovation and sustainability, the Synthetic Surfactants segment remains at the forefront, driving growth and evolution in the global surfactants market.

Within the Surfactants Market segmented by type, the Non-ionic Surfactants segment is the fastest-growing, driven by their broad applicability, biocompatibility, and environmental friendliness. Non-ionic surfactants are characterized by their lack of charged groups in their molecular structure, making them highly versatile and compatible with a wide range of formulations and substrates. These surfactants exhibit excellent wetting, dispersing, emulsifying, and solubilizing properties, making them ideal for use in various industries, including personal care, household detergents, pharmaceuticals, and agricultural chemicals. Moreover, non-ionic surfactants are often preferred in formulations where high foaming or harshness is undesirable, such as in mild cleansing products or formulations for sensitive skin. Additionally, their biodegradability and low toxicity profile contribute to their growing popularity as environmentally sustainable alternatives to traditional surfactants. As consumer preferences shift towards safer and greener products, the Non-ionic Surfactants segment experiences rapid growth, driving innovation and market expansion in the surfactants industry.

Within the Surfactants Market segmented by application, the Home Care segment is the largest, driven by the widespread use of surfactants in household cleaning products and laundry detergents. Surfactants play a crucial role in these formulations by lowering the surface tension of water, facilitating the removal of dirt, grease, and stains from various surfaces, including fabrics, dishes, and hard surfaces. Home care products such as dishwashing liquids, laundry detergents, surface cleaners, and bathroom cleaners heavily rely on surfactants to achieve effective cleaning performance. Additionally, the growing demand for convenience, hygiene, and cleanliness in households worldwide further fuels the consumption of surfactants in the home care segment. Moreover, manufacturers continuously innovate to develop surfactant formulations that offer improved cleaning efficiency, compatibility with different water hardness levels, and environmental sustainability, driving further growth in this segment. As consumers prioritize cleanliness and seek more efficient cleaning solutions, the Home Care segment continues to dominate the surfactants market, driving significant revenue and market expansion.

By Substrate

Synthetic Surfactants

Bio-Based Surfactants

Chemically Synthesized Bio-Based Surfactants

Biosurfactants

By Type

Anionic Surfactants

Non-ionic Surfactants

Cationic Surfactants

Amphoteric Surfactants

By Application

Home Care

Personal Care

Industrial & Institutional Cleaning

Textile

Elastomers & Plastics

Oilfield Chemicals

Agrochemicals

Food & Beverage

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arkema SA

Ashland Inc

BASF SE

Bayer AG

Cepsa

Clariant AG

Croda International PLC

Dow Inc

Emery Oleochemicals

Evonik Industries AG

Galaxy Surfactants

Geo Speciality Chemicals

Godrej Industries Ltd

Huntsman International LLC

KAO Corp

KLK Oleo

Lonza Group Ltd

Nouryon

Procter & Gamble Chemicals

Reliance Industries Ltd

Sasol Ltd

Sinopec Jinling Petrochemical Co. Ltd

Solvay SA

Stepan Company

Sumitomo Chemical Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Surfactants Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Surfactants Market Size Outlook, $ Million, 2021 to 2032

3.2 Surfactants Market Outlook by Type, $ Million, 2021 to 2032

3.3 Surfactants Market Outlook by Product, $ Million, 2021 to 2032

3.4 Surfactants Market Outlook by Application, $ Million, 2021 to 2032

3.5 Surfactants Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Surfactants Industry

4.2 Key Market Trends in Surfactants Industry

4.3 Potential Opportunities in Surfactants Industry

4.4 Key Challenges in Surfactants Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Surfactants Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Surfactants Market Outlook by Segments

7.1 Surfactants Market Outlook by Segments, $ Million, 2021- 2032

By Substrate

Synthetic Surfactants

Bio-Based Surfactants

Chemically Synthesized Bio-Based Surfactants

Biosurfactants

By Type

Anionic Surfactants

Non-ionic Surfactants

Cationic Surfactants

Amphoteric Surfactants

By Application

Home Care

Personal Care

Industrial & Institutional Cleaning

Textile

Elastomers & Plastics

Oilfield Chemicals

Agrochemicals

Food & Beverage

Others

8 North America Surfactants Market Analysis and Outlook To 2032

8.1 Introduction to North America Surfactants Markets in 2024

8.2 North America Surfactants Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Surfactants Market size Outlook by Segments, 2021-2032

By Substrate

Synthetic Surfactants

Bio-Based Surfactants

Chemically Synthesized Bio-Based Surfactants

Biosurfactants

By Type

Anionic Surfactants

Non-ionic Surfactants

Cationic Surfactants

Amphoteric Surfactants

By Application

Home Care

Personal Care

Industrial & Institutional Cleaning

Textile

Elastomers & Plastics

Oilfield Chemicals

Agrochemicals

Food & Beverage

Others

9 Europe Surfactants Market Analysis and Outlook To 2032

9.1 Introduction to Europe Surfactants Markets in 2024

9.2 Europe Surfactants Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Surfactants Market Size Outlook by Segments, 2021-2032

By Substrate

Synthetic Surfactants

Bio-Based Surfactants

Chemically Synthesized Bio-Based Surfactants

Biosurfactants

By Type

Anionic Surfactants

Non-ionic Surfactants

Cationic Surfactants

Amphoteric Surfactants

By Application

Home Care

Personal Care

Industrial & Institutional Cleaning

Textile

Elastomers & Plastics

Oilfield Chemicals

Agrochemicals

Food & Beverage

Others

10 Asia Pacific Surfactants Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Surfactants Markets in 2024

10.2 Asia Pacific Surfactants Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Surfactants Market size Outlook by Segments, 2021-2032

By Substrate

Synthetic Surfactants

Bio-Based Surfactants

Chemically Synthesized Bio-Based Surfactants

Biosurfactants

By Type

Anionic Surfactants

Non-ionic Surfactants

Cationic Surfactants

Amphoteric Surfactants

By Application

Home Care

Personal Care

Industrial & Institutional Cleaning

Textile

Elastomers & Plastics

Oilfield Chemicals

Agrochemicals

Food & Beverage

Others

11 South America Surfactants Market Analysis and Outlook To 2032

11.1 Introduction to South America Surfactants Markets in 2024

11.2 South America Surfactants Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Surfactants Market size Outlook by Segments, 2021-2032

By Substrate

Synthetic Surfactants

Bio-Based Surfactants

Chemically Synthesized Bio-Based Surfactants

Biosurfactants

By Type

Anionic Surfactants

Non-ionic Surfactants

Cationic Surfactants

Amphoteric Surfactants

By Application

Home Care

Personal Care

Industrial & Institutional Cleaning

Textile

Elastomers & Plastics

Oilfield Chemicals

Agrochemicals

Food & Beverage

Others

12 Middle East and Africa Surfactants Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Surfactants Markets in 2024

12.2 Middle East and Africa Surfactants Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Surfactants Market size Outlook by Segments, 2021-2032

By Substrate

Synthetic Surfactants

Bio-Based Surfactants

Chemically Synthesized Bio-Based Surfactants

Biosurfactants

By Type

Anionic Surfactants

Non-ionic Surfactants

Cationic Surfactants

Amphoteric Surfactants

By Application

Home Care

Personal Care

Industrial & Institutional Cleaning

Textile

Elastomers & Plastics

Oilfield Chemicals

Agrochemicals

Food & Beverage

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arkema SA

Ashland Inc

BASF SE

Bayer AG

Cepsa

Clariant AG

Croda International PLC

Dow Inc

Emery Oleochemicals

Evonik Industries AG

Galaxy Surfactants

Geo Speciality Chemicals

Godrej Industries Ltd

Huntsman International LLC

KAO Corp

KLK Oleo

Lonza Group Ltd

Nouryon

Procter & Gamble Chemicals

Reliance Industries Ltd

Sasol Ltd

Sinopec Jinling Petrochemical Co. Ltd

Solvay SA

Stepan Company

Sumitomo Chemical Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Substrate

Synthetic Surfactants

Bio-Based Surfactants

Chemically Synthesized Bio-Based Surfactants

Biosurfactants

By Type

Anionic Surfactants

Non-ionic Surfactants

Cationic Surfactants

Amphoteric Surfactants

By Application

Home Care

Personal Care

Industrial & Institutional Cleaning

Textile

Elastomers & Plastics

Oilfield Chemicals

Agrochemicals

Food & Beverage

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Surfactants Market Size is valued at $49.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.8% to reach $71.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arkema SA, Ashland Inc, BASF SE, Bayer AG, Cepsa, Clariant AG, Croda International PLC, Dow Inc, Emery Oleochemicals, Evonik Industries AG, Galaxy Surfactants, Geo Speciality Chemicals, Godrej Industries Ltd, Huntsman International LLC, KAO Corp, KLK Oleo, Lonza Group Ltd, Nouryon, Procter & Gamble Chemicals, Reliance Industries Ltd, Sasol Ltd, Sinopec Jinling Petrochemical Co. Ltd, Solvay SA, Stepan Company, Sumitomo Chemical Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume