The global Surfactant EOR Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Onshore, Offshore), By Origin (Surfactants, Biosurfactants), By Technique (Alkaline-surfactant-polymer (ASP) flooding, Surfactant-polymer (SP) flooding), By Type (Anionic surfactants, Others).

Surfactant Enhanced Oil Recovery (EOR) techniques to play a pivotal role in maximizing hydrocarbon production from mature oil fields in 2024. Surfactants, or surface-active agents, are deployed to alter the interfacial tension between oil, water, and rock surfaces, thereby improving the efficiency of oil displacement and recovery. In EOR applications, surfactants are injected into reservoirs to mobilize trapped oil and enhance its flow towards production wells. This process enables the recovery of significant volumes of oil that would otherwise remain unrecovered using conventional production methods. With the global demand for hydrocarbons persisting, especially in the face of declining production rates from conventional reservoirs, surfactant EOR technologies offer a promising solution for maximizing oil production and extending the economic life of mature oil fields.

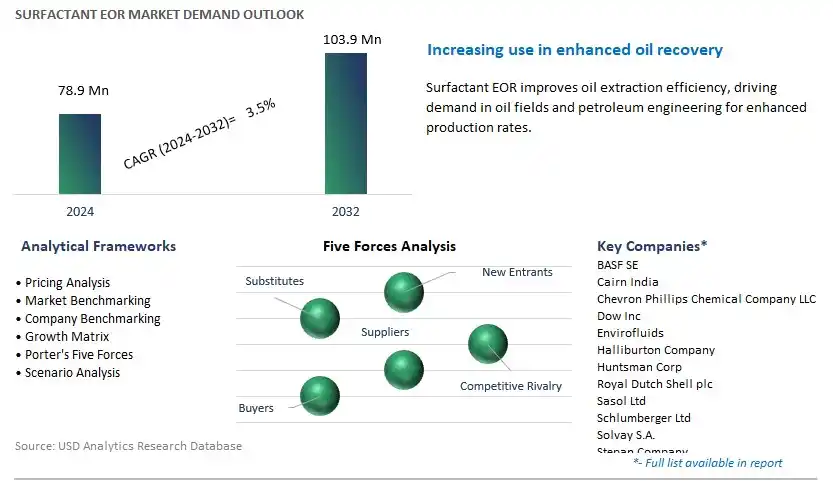

The market report analyses the leading companies in the industry including BASF SE, Cairn India, Chevron Phillips Chemical Company LLC, Dow Inc, Envirofluids, Halliburton Company, Huntsman Corp, Royal Dutch Shell plc, Sasol Ltd, Schlumberger Ltd, Solvay S.A., Stepan Company, The Lubrizol Corp, and others.

A significant trend in the surfactant EOR market is the increasing focus on enhanced oil recovery (EOR) technologies to maximize oil production from mature and unconventional reservoirs. This trend is driven by factors such as declining conventional oil reserves, rising global energy demand, and the need for cost-effective methods to extract remaining hydrocarbon resources. Surfactant EOR, which involves the injection of surfactants into reservoirs to reduce interfacial tension and mobilize trapped oil, is gaining traction as a viable solution to enhance oil recovery rates and extend the life of oil fields. As oil companies seek to optimize production efficiency, reduce operating costs, and mitigate environmental impact, the adoption of surfactant EOR technologies is expected to grow.

The primary driver for the surfactant EOR market is technological advancements in surfactant formulations and reservoir characterization techniques, which enable the development of more efficient and cost-effective EOR solutions. Innovations in surfactant chemistry, such as the design of novel surfactant molecules with improved stability, solubility, and compatibility, enhance the performance of surfactant flooding processes and increase oil recovery rates. Additionally, advancements in reservoir characterization technologies, such as 3D seismic imaging, well logging, and reservoir simulation, enable oil companies to identify suitable candidates for surfactant EOR applications and optimize injection strategies for maximum oil displacement. As research and development efforts continue to improve surfactant formulations and reservoir management practices, the effectiveness and applicability of surfactant EOR technologies are expected to expand, driving market growth.

A significant opportunity for the surfactant EOR market lies in expansion into unconventional oil and gas reservoirs, where traditional recovery methods are often inefficient or uneconomical. Unconventional reservoirs, such as tight oil formations, shale plays, and heavy oil deposits, contain vast reserves of hydrocarbons but are challenging to produce using conventional techniques due to low permeability and complex geology. Surfactant EOR offers a promising solution to unlock the potential of unconventional reservoirs by improving oil mobility, enhancing sweep efficiency, and increasing ultimate recovery factors. By targeting unconventional plays and tailoring surfactant formulations and injection strategies to specific reservoir conditions, oil companies can overcome technical challenges and achieve significant production gains. Additionally, as governments and regulatory bodies incentivize the adoption of EOR technologies to maximize resource recovery and reduce carbon emissions, there is a growing market opportunity for surfactant EOR providers to collaborate with operators and service companies in developing and implementing tailored EOR solutions for unconventional reservoirs.

Within the Surfactant EOR Market segmented by application, the Onshore segment is the largest, primarily due to the abundance of onshore oil reserves and the cost-effectiveness of surfactant enhanced oil recovery (EOR) techniques in these environments. Onshore oil fields typically have shallower reservoirs and more accessible infrastructure compared to offshore fields, making them ideal candidates for surfactant EOR applications. Additionally, the relatively lower operational costs associated with onshore drilling and production activities make surfactant EOR economically viable for maximizing oil recovery from these fields. Moreover, advancements in surfactant formulations and injection techniques have further enhanced the efficiency and effectiveness of EOR processes in onshore reservoirs, driving increased adoption among oil operators. As global energy demand continues to rise and conventional oil reserves deplete, the Onshore segment is expected to maintain its dominance in the surfactant EOR market, playing a crucial role in unlocking the full potential of onshore oil resources.

Within the Surfactant EOR Market segmented by origin, the Biosurfactants segment is the fastest-growing, driven by increasing environmental concerns, regulatory pressures, and the desire for sustainable oil recovery solutions. Biosurfactants are naturally derived surfactants produced by microorganisms such as bacteria, yeast, and fungi. Unlike conventional surfactants, which are often derived from petrochemical sources and pose environmental risks, biosurfactants offer potential advantages, including biodegradability, low toxicity, and compatibility with various reservoir conditions. These eco-friendly characteristics make biosurfactants an attractive choice for oil operators seeking to minimize environmental impact and comply with stringent regulations. Additionally, biosurfactants exhibit excellent surface activity and oil displacement properties, making them effective agents for enhancing oil recovery from reservoirs. With growing emphasis on sustainable practices and the transition towards greener technologies across industries, the Biosurfactants segment is experiencing rapid growth in the surfactant EOR market, poised to play a significant role in shaping the future of oil extraction processes.

Within the Surfactant EOR Market segmented by technique, the Alkaline-Surfactant-Polymer (ASP) Flooding segment is the largest, driven by its proven effectiveness in enhancing oil recovery from mature and challenging reservoirs. ASP flooding involves the simultaneous injection of alkali, surfactant, and polymer solutions into the reservoir to improve oil displacement and sweep efficiency. This technique addresses various challenges encountered in conventional oil recovery methods, such as high water cut, reservoir heterogeneity, and oil viscosity. Alkali agents help to neutralize reservoir acidity and release trapped oil, surfactants reduce interfacial tension between oil and water, and polymers enhance the viscosity of injected fluids, improving their mobility and sweep efficiency. The synergistic action of these components enables ASP flooding to achieve higher oil recovery factors compared to other EOR techniques. Additionally, ASP flooding can be tailored to specific reservoir conditions, making it suitable for a wide range of geological formations and crude oil types. As oil operators seek cost-effective solutions to maximize hydrocarbon production and extend the life of mature fields, the ASP Flooding segment continues to dominate the surfactant EOR market, driving significant growth and innovation in enhanced oil recovery technologies.

Within the Surfactant EOR Market segmented by type, the Anionic Surfactants segment is the fastest-growing, propelled by their superior performance and versatility in enhancing oil recovery efficiency. Anionic surfactants possess a negatively charged hydrophilic head and are widely utilized in surfactant flooding operations due to their ability to reduce interfacial tension between oil and water, improving oil displacement and sweep efficiency in reservoirs. These surfactants exhibit excellent compatibility with various reservoir conditions and crude oil types, making them suitable for a wide range of EOR applications. Moreover, ongoing research and development efforts aimed at enhancing the properties and effectiveness of anionic surfactants, such as improving thermal stability and reducing adsorption onto reservoir rocks, further contribute to their growing adoption in the market. As oil operators increasingly turn to enhanced oil recovery techniques to maximize hydrocarbon production from mature reservoirs, the Anionic Surfactants segment experiences rapid growth, driving innovation and advancements in surfactant-based EOR technologies.

By Application

Onshore

Offshore

By Origin

Surfactants

Biosurfactants

By Technique

Alkaline-surfactant-polymer (ASP) flooding

Surfactant-polymer (SP) flooding

By Type

Anionic surfactants

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

BASF SE

Cairn India

Chevron Phillips Chemical Company LLC

Dow Inc

Envirofluids

Halliburton Company

Huntsman Corp

Royal Dutch Shell plc

Sasol Ltd

Schlumberger Ltd

Solvay S.A.

Stepan Company

The Lubrizol Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Surfactant EOR Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Surfactant EOR Market Size Outlook, $ Million, 2021 to 2032

3.2 Surfactant EOR Market Outlook by Type, $ Million, 2021 to 2032

3.3 Surfactant EOR Market Outlook by Product, $ Million, 2021 to 2032

3.4 Surfactant EOR Market Outlook by Application, $ Million, 2021 to 2032

3.5 Surfactant EOR Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Surfactant EOR Industry

4.2 Key Market Trends in Surfactant EOR Industry

4.3 Potential Opportunities in Surfactant EOR Industry

4.4 Key Challenges in Surfactant EOR Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Surfactant EOR Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Surfactant EOR Market Outlook by Segments

7.1 Surfactant EOR Market Outlook by Segments, $ Million, 2021- 2032

By Application

Onshore

Offshore

By Origin

Surfactants

Biosurfactants

By Technique

Alkaline-surfactant-polymer (ASP) flooding

Surfactant-polymer (SP) flooding

By Type

Anionic surfactants

Others

8 North America Surfactant EOR Market Analysis and Outlook To 2032

8.1 Introduction to North America Surfactant EOR Markets in 2024

8.2 North America Surfactant EOR Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Surfactant EOR Market size Outlook by Segments, 2021-2032

By Application

Onshore

Offshore

By Origin

Surfactants

Biosurfactants

By Technique

Alkaline-surfactant-polymer (ASP) flooding

Surfactant-polymer (SP) flooding

By Type

Anionic surfactants

Others

9 Europe Surfactant EOR Market Analysis and Outlook To 2032

9.1 Introduction to Europe Surfactant EOR Markets in 2024

9.2 Europe Surfactant EOR Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Surfactant EOR Market Size Outlook by Segments, 2021-2032

By Application

Onshore

Offshore

By Origin

Surfactants

Biosurfactants

By Technique

Alkaline-surfactant-polymer (ASP) flooding

Surfactant-polymer (SP) flooding

By Type

Anionic surfactants

Others

10 Asia Pacific Surfactant EOR Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Surfactant EOR Markets in 2024

10.2 Asia Pacific Surfactant EOR Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Surfactant EOR Market size Outlook by Segments, 2021-2032

By Application

Onshore

Offshore

By Origin

Surfactants

Biosurfactants

By Technique

Alkaline-surfactant-polymer (ASP) flooding

Surfactant-polymer (SP) flooding

By Type

Anionic surfactants

Others

11 South America Surfactant EOR Market Analysis and Outlook To 2032

11.1 Introduction to South America Surfactant EOR Markets in 2024

11.2 South America Surfactant EOR Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Surfactant EOR Market size Outlook by Segments, 2021-2032

By Application

Onshore

Offshore

By Origin

Surfactants

Biosurfactants

By Technique

Alkaline-surfactant-polymer (ASP) flooding

Surfactant-polymer (SP) flooding

By Type

Anionic surfactants

Others

12 Middle East and Africa Surfactant EOR Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Surfactant EOR Markets in 2024

12.2 Middle East and Africa Surfactant EOR Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Surfactant EOR Market size Outlook by Segments, 2021-2032

By Application

Onshore

Offshore

By Origin

Surfactants

Biosurfactants

By Technique

Alkaline-surfactant-polymer (ASP) flooding

Surfactant-polymer (SP) flooding

By Type

Anionic surfactants

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

Cairn India

Chevron Phillips Chemical Company LLC

Dow Inc

Envirofluids

Halliburton Company

Huntsman Corp

Royal Dutch Shell plc

Sasol Ltd

Schlumberger Ltd

Solvay S.A.

Stepan Company

The Lubrizol Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Onshore

Offshore

By Origin

Surfactants

Biosurfactants

By Technique

Alkaline-surfactant-polymer (ASP) flooding

Surfactant-polymer (SP) flooding

By Type

Anionic surfactants

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Surfactant EOR Market Size is valued at $78.9 Million in 2024 and is forecast to register a growth rate (CAGR) of 3.5% to reach $103.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, Cairn India, Chevron Phillips Chemical Company LLC, Dow Inc, Envirofluids, Halliburton Company, Huntsman Corp, Royal Dutch Shell plc, Sasol Ltd, Schlumberger Ltd, Solvay S.A., Stepan Company, The Lubrizol Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume