The global Surface Protection Tapes Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Polyethylene (PE), Polypropylene (PP), Polyvinyl chloride (PVC)), By Surface Material (Polished metals, Glass, Plastics), By End-User (Electronics & appliances, Building & construction, Automotive).

Surface protection tapes, engineered to safeguard surfaces from scratches, abrasions, and damage during transportation, fabrication, and installation processes, remain essential in manufacturing and construction industries in 2024. These adhesive-backed tapes, typically made from polyethylene, polypropylene, or polyester films, offer temporary protection for surfaces such as glass, metal, plastic, and painted finishes. In industries such as automotive, electronics, furniture, and building construction, surface protection tapes are utilized to preserve the appearance and integrity of finished products during handling, shipping, and installation. With advancements in adhesive technology and film formulations, surface protection tapes offer enhanced adhesion, conformability, and residue-free removal, ensuring efficient and cost-effective surface protection solutions for manufacturers and contractors worldwide.

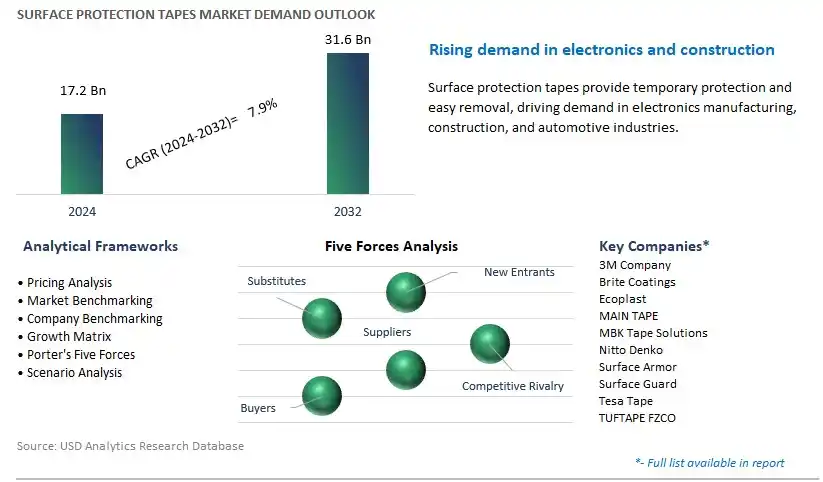

The market report analyses the leading companies in the industry including 3M Company, Brite Coatings, Ecoplast, MAIN TAPE, MBK Tape Solutions, Nitto Denko, Surface Armor, Surface Guard, Tesa Tape, TUFTAPE FZCO, and others.

A significant trend in the surface protection tapes market is the increasing demand for surface protection solutions in manufacturing and construction industries. This trend is driven by factors such as the need to prevent damage, scratches, and contamination during production, transportation, and installation processes. Surface protection tapes, also known as protective films or masking tapes, are used to protect surfaces such as glass, metal, plastic, and painted finishes from scratches, abrasion, UV exposure, and chemical damage. With the growing emphasis on product quality, aesthetics, and brand reputation, manufacturers and contractors rely on surface protection tapes to safeguard surfaces and ensure the integrity and appearance of finished products. As industries adopt lean manufacturing practices and implement stringent quality control measures, the demand for surface protection tapes that offer durable and reliable protection is expected to rise.

The primary driver for the surface protection tapes market is the growth in manufacturing output and construction activities worldwide. As economies develop, infrastructure projects expand, and construction activities accelerate, there is a growing need for surface protection solutions to safeguard valuable assets and materials during handling, storage, and installation. Surface protection tapes are widely used in industries such as automotive, electronics, aerospace, marine, and building construction to protect delicate surfaces, finished products, and critical components from scratches, dents, and damage. Additionally, with the rise of e-commerce and global supply chains, there is an increased focus on packaging materials that offer secure and reliable protection during transit and storage. As manufacturing industries embrace automation, digitalization, and just-in-time production methods, the demand for surface protection tapes that ensure product quality, safety, and integrity is expected to continue growing.

A significant opportunity for the surface protection tapes market lies in expansion into specialty applications and the development of custom solutions tailored to specific industry needs. With advancements in materials science, adhesive technology, and manufacturing processes, there is a growing demand for surface protection tapes that offer specialized features such as high temperature resistance, UV stability, easy removal, and anti-static properties. Manufacturers can capitalize on this opportunity by innovating and offering surface protection tapes optimized for challenging environments and unique substrates, such as stainless steel, aluminum, glass, and sensitive electronic components. Additionally, as industries seek to reduce waste, improve efficiency, and enhance sustainability, there is a growing demand for eco-friendly surface protection tapes made from renewable materials and recyclable adhesives. By partnering with customers to develop custom solutions and addressing emerging market needs, manufacturers can differentiate themselves in the competitive surface protection tapes market and create new opportunities for growth and market expansion.

Within the Surface Protection Tapes Market segmented by type, the Polyethylene (PE) segment is the largest, driven by its widespread use, versatility, and excellent protective properties. Polyethylene tapes are extensively utilized for surface protection in various industries, including construction, automotive, electronics, and manufacturing. These tapes offer superior resistance to abrasion, moisture, and chemicals, making them ideal for safeguarding surfaces during transportation, storage, and handling processes. Additionally, polyethylene tapes are available in different thicknesses and adhesion levels to suit diverse application requirements, further enhancing their utility and demand across different sectors. The affordability and ease of application of polyethylene tapes also contribute to their popularity, as they provide cost-effective protection against scratches, stains, and damages to sensitive surfaces such as glass, metal, and plastics. As industries prioritize product quality and surface integrity, the Polyethylene (PE) segment maintains its leadership in the surface protection tapes market, ensuring the preservation and safety of valuable assets throughout their lifecycle.

Within the Surface Protection Tapes Market segmented by surface material, the Plastics segment is the fastest-growing, driven by the expanding use of plastics in various industries and the need to protect their surfaces during manufacturing, transportation, and installation processes. Plastics are ubiquitous in modern manufacturing, found in products ranging from automotive parts to electronics and consumer goods. However, plastic surfaces are prone to scratches, abrasions, and other damages during handling and assembly, leading to quality issues and increased production costs. Surface protection tapes offer an effective solution by providing temporary shielding against scratches, dirt, and moisture, preserving the pristine appearance and integrity of plastic surfaces until they reach their final destination. With the increasing demand for high-quality finished products and the rising adoption of advanced plastics in industries such as automotive, electronics, and packaging, the need for surface protection tapes for plastic surfaces is witnessing rapid growth. Moreover, as industries focus on sustainability and reducing waste, the use of surface protection tapes helps extend the lifespan of plastic components, contributing to resource efficiency and environmental conservation. Thus, the Plastics segment is experiencing significant growth in the surface protection tapes market, driven by the critical role it plays in safeguarding valuable plastic surfaces throughout the supply chain.

Within the Surface Protection Tapes Market segmented by end-user, the Automotive segment is the largest, propelled by the extensive use of surface protection tapes in the automotive manufacturing process. Automotive manufacturers rely on surface protection tapes to safeguard various components and surfaces during assembly, transportation, and storage. These tapes are applied to critical areas such as painted surfaces, windows, and delicate interior components to prevent scratches, abrasions, and other damages that can occur during handling and shipping. With the automotive industry continually innovating and producing high-quality vehicles, the demand for surface protection tapes in this sector remains robust. Additionally, as automotive manufacturers prioritize customer satisfaction and brand reputation, the use of surface protection tapes ensures that vehicles arrive at dealerships in pristine condition, enhancing the overall perceived quality of the product. Moreover, with the growing trend towards electric vehicles (EVs) and autonomous vehicles, the complexity of automotive components increases, further driving the need for effective surface protection solutions. Therefore, the Automotive segment dominates the surface protection tapes market due to its indispensable role in maintaining the quality and integrity of automotive surfaces throughout the production and distribution chain.

By Type

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl chloride (PVC)

By Surface Material

Polished metals

Glass

Plastics

By End-User

Electronics & appliances

Building & construction

AutomotiveCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Brite Coatings

Ecoplast

MAIN TAPE

MBK Tape Solutions

Nitto Denko

Surface Armor

Surface Guard

Tesa Tape

TUFTAPE FZCO

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Surface Protection Tapes Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Surface Protection Tapes Market Size Outlook, $ Million, 2021 to 2032

3.2 Surface Protection Tapes Market Outlook by Type, $ Million, 2021 to 2032

3.3 Surface Protection Tapes Market Outlook by Product, $ Million, 2021 to 2032

3.4 Surface Protection Tapes Market Outlook by Application, $ Million, 2021 to 2032

3.5 Surface Protection Tapes Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Surface Protection Tapes Industry

4.2 Key Market Trends in Surface Protection Tapes Industry

4.3 Potential Opportunities in Surface Protection Tapes Industry

4.4 Key Challenges in Surface Protection Tapes Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Surface Protection Tapes Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Surface Protection Tapes Market Outlook by Segments

7.1 Surface Protection Tapes Market Outlook by Segments, $ Million, 2021- 2032

By Type

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl chloride (PVC)

By Surface Material

Polished metals

Glass

Plastics

By End-User

Electronics & appliances

Building & construction

Automotive

8 North America Surface Protection Tapes Market Analysis and Outlook To 2032

8.1 Introduction to North America Surface Protection Tapes Markets in 2024

8.2 North America Surface Protection Tapes Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Surface Protection Tapes Market size Outlook by Segments, 2021-2032

By Type

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl chloride (PVC)

By Surface Material

Polished metals

Glass

Plastics

By End-User

Electronics & appliances

Building & construction

Automotive

9 Europe Surface Protection Tapes Market Analysis and Outlook To 2032

9.1 Introduction to Europe Surface Protection Tapes Markets in 2024

9.2 Europe Surface Protection Tapes Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Surface Protection Tapes Market Size Outlook by Segments, 2021-2032

By Type

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl chloride (PVC)

By Surface Material

Polished metals

Glass

Plastics

By End-User

Electronics & appliances

Building & construction

Automotive

10 Asia Pacific Surface Protection Tapes Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Surface Protection Tapes Markets in 2024

10.2 Asia Pacific Surface Protection Tapes Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Surface Protection Tapes Market size Outlook by Segments, 2021-2032

By Type

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl chloride (PVC)

By Surface Material

Polished metals

Glass

Plastics

By End-User

Electronics & appliances

Building & construction

Automotive

11 South America Surface Protection Tapes Market Analysis and Outlook To 2032

11.1 Introduction to South America Surface Protection Tapes Markets in 2024

11.2 South America Surface Protection Tapes Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Surface Protection Tapes Market size Outlook by Segments, 2021-2032

By Type

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl chloride (PVC)

By Surface Material

Polished metals

Glass

Plastics

By End-User

Electronics & appliances

Building & construction

Automotive

12 Middle East and Africa Surface Protection Tapes Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Surface Protection Tapes Markets in 2024

12.2 Middle East and Africa Surface Protection Tapes Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Surface Protection Tapes Market size Outlook by Segments, 2021-2032

By Type

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl chloride (PVC)

By Surface Material

Polished metals

Glass

Plastics

By End-User

Electronics & appliances

Building & construction

Automotive

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Brite Coatings

Ecoplast

MAIN TAPE

MBK Tape Solutions

Nitto Denko

Surface Armor

Surface Guard

Tesa Tape

TUFTAPE FZCO

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl chloride (PVC)

By Surface Material

Polished metals

Glass

Plastics

By End-User

Electronics & appliances

Building & construction

Automotive

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Surface Protection Tapes Market Size is valued at $17.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.9% to reach $31.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Brite Coatings, Ecoplast, MAIN TAPE, MBK Tape Solutions, Nitto Denko, Surface Armor, Surface Guard, Tesa Tape, TUFTAPE FZCO

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume