The global Sugar Alcohol Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Sorbitol, Mannitol, Xylitol, Maltitol, Others), By Form (Powder & Crystal, Liquid & Syrup), By End-User (Food and Beverages, Pharmaceuticals, Personal Care)

The sugar alcohol market is experiencing steady growth in 2024, fueled by increasing demand for low-calorie sweeteners and alternatives to traditional sugar. Sugar alcohols, such as erythritol, xylitol, and sorbitol, are commonly used as sugar substitutes in a wide range of food and beverage products, including sugar-free confectionery, chewing gum, and diabetic-friendly foods. With consumers becoming more health-conscious and mindful of their sugar intake, sugar alcohols offer a sweetening solution that provides fewer calories and less impact on blood sugar levels compared to sucrose. As dietary trends shift towards low-carb and keto-friendly options, the sugar alcohol market is poised for further expansion, with manufacturers innovating with new formulations, flavors, and applications to meet the diverse needs and preferences of consumers seeking healthier alternatives to sugar.

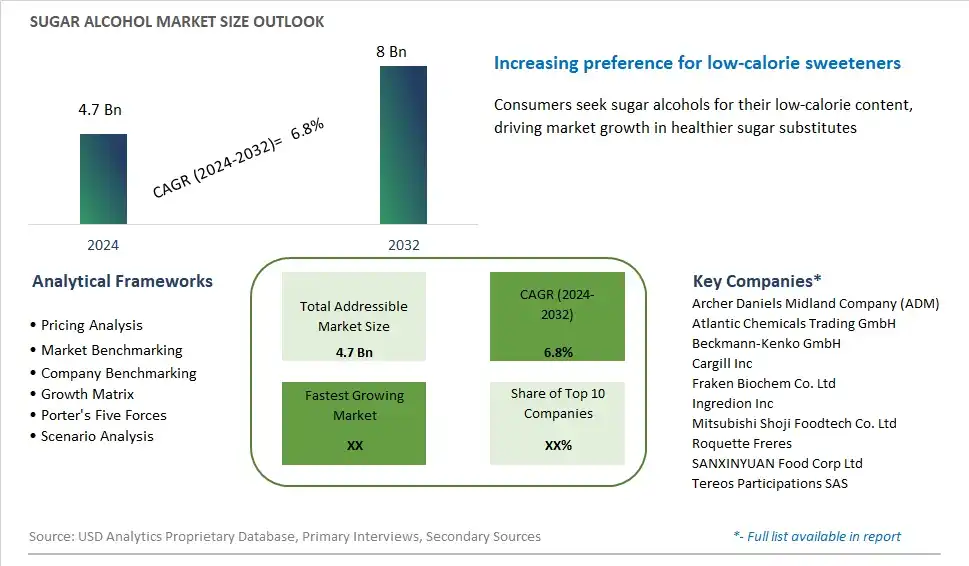

The market report analyses the leading companies in the industry including Archer Daniels Midland Company (ADM), Atlantic Chemicals Trading GmbH, Beckmann-Kenko GmbH, Cargill Inc, Fraken Biochem Co. Ltd, Ingredion Inc, Mitsubishi Shoji Foodtech Co. Ltd, Roquette Freres, SANXINYUAN Food Corp Ltd, Tereos Participations SAS, and Others.

Within the sugar alcohol market, a prominent trend is the rising demand for low-calorie and diabetic-friendly products. As consumers become more health-conscious and seek alternatives to traditional sugars, there's a growing interest in sugar alcohols like erythritol, xylitol, sorbitol, and maltitol. These sweeteners provide sweetness without the same impact on blood sugar levels, making them suitable for individuals with diabetes or those following low-carb diets. Moreover, sugar alcohols contribute fewer calories than regular sugar, appealing to consumers looking to manage their weight or reduce overall calorie intake. This trend is driving the incorporation of sugar alcohols into a wide range of food and beverage products, including confectionery, baked goods, beverages, and dairy alternatives, as manufacturers strive to meet the evolving needs and preferences of health-conscious consumers.

A significant driver influencing the sugar alcohol market is the growing concern over sugar consumption and obesity rates worldwide. With rising awareness of the health risks associated with excessive sugar intake, including obesity, diabetes, and dental issues, consumers are actively seeking alternatives to high-calorie sweeteners. Sugar alcohols offer a solution by providing sweetness with fewer calories and a lower glycemic index, making them attractive options for individuals looking to reduce their sugar intake or manage health conditions. Additionally, regulatory initiatives aimed at curbing sugar consumption, such as sugar taxes and mandatory labeling requirements, are further driving the demand for sugar alcohol-based products as consumers seek healthier alternatives in response to public health concerns. As a result, the market for sugar alcohols is experiencing steady growth as manufacturers and retailers respond to shifting consumer preferences and regulatory pressures.

An opportunity within the sugar alcohol market lies in the innovation of flavor and texture enhancement technologies. While sugar alcohols offer sweetness with fewer calories, they often exhibit certain drawbacks such as cooling sensations, slower onset of sweetness, or digestive discomfort when consumed in large quantities. Addressing these challenges presents an opportunity for companies to develop innovative solutions that improve the taste, mouthfeel, and overall sensory experience of products containing sugar alcohols. This could involve the formulation of blends combining sugar alcohols with natural or artificial sweeteners to optimize sweetness profiles and minimize undesirable characteristics. Additionally, advancements in encapsulation techniques or flavor modulation technologies can help mask off-notes and enhance the palatability of sugar alcohol-based products, expanding their application across various food and beverage categories. By investing in research and development focused on flavor and texture enhancement, companies can unlock new opportunities for market growth and differentiation in the evolving landscape of sugar alcohol alternatives.

In the Sugar Alcohol Market, Xylitol stands as the largest segment, propelled by its widespread usage, versatile applications, and numerous health benefits. Xylitol, a naturally occurring sugar alcohol found in fruits and vegetables, has gained popularity as a low-calorie sweetener and sugar substitute. Its ability to mimic the sweetness of sugar without causing spikes in blood sugar levels makes it a preferred choice for individuals managing diabetes or seeking to reduce their sugar intake. Additionally, Xylitol's dental benefits, such as preventing tooth decay and promoting oral health, further contribute to its appeal among consumers. Its versatility extends to various food and beverage applications, including chewing gum, confectionery, baked goods, and pharmaceuticals. With increasing consumer awareness of the adverse effects of excessive sugar consumption, the demand for Xylitol continues to soar, solidifying its position as the largest segment in the Sugar Alcohol Market.

In the Sugar Alcohol Market, the Liquid & Syrup segment is the fastest-growing category, driven by its convenience, versatility, and expanding applications across various industries. Liquid and syrup forms of sugar alcohols, such as sorbitol and maltitol syrup, offer ease of handling, precise dosing, and seamless integration into a wide range of food and beverage formulations. Their fluid consistency facilitates uniform mixing, blending, and dispersion, making them ideal for use in beverages, sauces, dressings, and confectionery products. Further, liquid and syrup sugar alcohols contribute to product texture, moisture retention, and shelf stability, enhancing their appeal among manufacturers seeking functional ingredients. Additionally, the rising demand for low-calorie and reduced-sugar products, coupled with increasing consumer awareness of sugar alternatives, propels the growth of the Liquid & Syrup segment. As a result, it emerges as a pivotal force in the Sugar Alcohol Market, presenting significant opportunities for innovation and market expansion.

In the Sugar Alcohol Market, the Food and Beverages segment is the largest, driven by the extensive use of sugar alcohols as sweetening agents and functional ingredients in a wide array of food and beverage products. Sugar alcohols, such as sorbitol, xylitol, and maltitol, are favored by food manufacturers for their ability to mimic the sweetness of sugar while providing fewer calories and being less detrimental to dental health. They find widespread application in various food categories, including confectionery, baked goods, dairy products, and beverages, where they enhance taste, texture, and shelf life. Additionally, the rising demand for low-calorie and sugar-free options, driven by health-conscious consumers, further fuels the dominance of the Food and Beverages segment in the Sugar Alcohol Market. As a result, it remains at the forefront of market demand, shaping consumption patterns and driving innovation in the food and beverage industry.

By Type

Sorbitol

Mannitol

Xylitol

Maltitol

Others

By Form

Powder & Crystal

Liquid & Syrup

By End-User

Food and Beverages

Pharmaceuticals

Personal Care

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Archer Daniels Midland Company (ADM)

Atlantic Chemicals Trading GmbH

Beckmann-Kenko GmbH

Cargill Inc

Fraken Biochem Co. Ltd

Ingredion Inc

Mitsubishi Shoji Foodtech Co. Ltd

Roquette Freres

SANXINYUAN Food Corp Ltd

Tereos Participations SAS

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Sugar Alcohol Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Sugar Alcohol Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Sugar Alcohol Market Share by Company, 2023

4.1.2. Product Offerings of Leading Sugar Alcohol Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Sugar Alcohol Market Drivers

6.2. Sugar Alcohol Market Challenges

6.6. Sugar Alcohol Market Opportunities

6.4. Sugar Alcohol Market Trends

Chapter 7. Global Sugar Alcohol Market Outlook Trends

7.1. Global Sugar Alcohol Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Sugar Alcohol Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Sugar Alcohol Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Type

Sorbitol

Mannitol

Xylitol

Maltitol

Others

By Form

Powder & Crystal

Liquid & Syrup

By End-User

Food and Beverages

Pharmaceuticals

Personal Care

Chapter 8. Global Sugar Alcohol Regional Analysis and Outlook

8.1. Global Sugar Alcohol Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Sugar Alcohol Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Sugar Alcohol Regional Analysis and Outlook

8.2.2. Canada Sugar Alcohol Regional Analysis and Outlook

8.2.3. Mexico Sugar Alcohol Regional Analysis and Outlook

8.3. Europe Sugar Alcohol Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Sugar Alcohol Regional Analysis and Outlook

8.3.2. France Sugar Alcohol Regional Analysis and Outlook

8.3.3. United Kingdom Sugar Alcohol Regional Analysis and Outlook

8.3.4. Spain Sugar Alcohol Regional Analysis and Outlook

8.3.5. Italy Sugar Alcohol Regional Analysis and Outlook

8.3.6. Russia Sugar Alcohol Regional Analysis and Outlook

8.3.7. Rest of Europe Sugar Alcohol Regional Analysis and Outlook

8.4. Asia Pacific Sugar Alcohol Revenue (USD Million) by Country (2021-2032)

8.4.1. China Sugar Alcohol Regional Analysis and Outlook

8.4.2. Japan Sugar Alcohol Regional Analysis and Outlook

8.4.3. India Sugar Alcohol Regional Analysis and Outlook

8.4.4. South Korea Sugar Alcohol Regional Analysis and Outlook

8.4.5. Australia Sugar Alcohol Regional Analysis and Outlook

8.4.6. South East Asia Sugar Alcohol Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Sugar Alcohol Regional Analysis and Outlook

8.5. South America Sugar Alcohol Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Sugar Alcohol Regional Analysis and Outlook

8.5.2. Argentina Sugar Alcohol Regional Analysis and Outlook

8.5.3. Rest of South America Sugar Alcohol Regional Analysis and Outlook

8.6. Middle East and Africa Sugar Alcohol Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Sugar Alcohol Regional Analysis and Outlook

8.6.2. Africa Sugar Alcohol Regional Analysis and Outlook

Chapter 9. North America Sugar Alcohol Analysis and Outlook

9.1. North America Sugar Alcohol Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Sugar Alcohol Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Sugar Alcohol Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Sugar Alcohol Revenue (USD Million) by Product (2021-2032)

By Type

Sorbitol

Mannitol

Xylitol

Maltitol

Others

By Form

Powder & Crystal

Liquid & Syrup

By End-User

Food and Beverages

Pharmaceuticals

Personal Care

Chapter 10. Europe Sugar Alcohol Analysis and Outlook

10.1. Europe Sugar Alcohol Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Sugar Alcohol Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Sugar Alcohol Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Sugar Alcohol Revenue (USD Million) by Product (2021-2032)

By Type

Sorbitol

Mannitol

Xylitol

Maltitol

Others

By Form

Powder & Crystal

Liquid & Syrup

By End-User

Food and Beverages

Pharmaceuticals

Personal Care

Chapter 11. Asia Pacific Sugar Alcohol Analysis and Outlook

11.1. Asia Pacific Sugar Alcohol Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Sugar Alcohol Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Sugar Alcohol Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Sugar Alcohol Revenue (USD Million) by Product (2021-2032)

By Type

Sorbitol

Mannitol

Xylitol

Maltitol

Others

By Form

Powder & Crystal

Liquid & Syrup

By End-User

Food and Beverages

Pharmaceuticals

Personal Care

Chapter 12. South America Sugar Alcohol Analysis and Outlook

12.1. South America Sugar Alcohol Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Sugar Alcohol Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Sugar Alcohol Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Sugar Alcohol Revenue (USD Million) by Product (2021-2032)

By Type

Sorbitol

Mannitol

Xylitol

Maltitol

Others

By Form

Powder & Crystal

Liquid & Syrup

By End-User

Food and Beverages

Pharmaceuticals

Personal Care

Chapter 13. Middle East and Africa Sugar Alcohol Analysis and Outlook

13.1. Middle East and Africa Sugar Alcohol Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Sugar Alcohol Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Sugar Alcohol Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Sugar Alcohol Revenue (USD Million) by Product (2021-2032)

By Type

Sorbitol

Mannitol

Xylitol

Maltitol

Others

By Form

Powder & Crystal

Liquid & Syrup

By End-User

Food and Beverages

Pharmaceuticals

Personal Care

Chapter 14. Sugar Alcohol Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Archer Daniels Midland Company (ADM)

Atlantic Chemicals Trading GmbH

Beckmann-Kenko GmbH

Cargill Inc

Fraken Biochem Co. Ltd

Ingredion Inc

Mitsubishi Shoji Foodtech Co. Ltd

Roquette Freres

SANXINYUAN Food Corp Ltd

Tereos Participations SAS

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Sugar Alcohol Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Sugar Alcohol Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Sugar Alcohol Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Sugar Alcohol Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Sugar Alcohol Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Sugar Alcohol Market Share (%) By Regions (2021-2032)

Table 12 North America Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Table 15 South America Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Sugar Alcohol Revenue (USD Million) By Region (2021-2032)

Table 17 North America Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Table 18 North America Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Table 19 North America Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

Table 26 South America Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Table 27 South America Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Table 28 South America Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Sugar Alcohol Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Sugar Alcohol Market Share (%) By Regions (2023)

Figure 6. North America Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 12. France Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 12. China Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 14. India Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Sugar Alcohol Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Sugar Alcohol Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Sugar Alcohol Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Sugar Alcohol Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Sugar Alcohol Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Sugar Alcohol Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Sugar Alcohol Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Sugar Alcohol Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Sugar Alcohol Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Sugar Alcohol Revenue (USD Million) By Product (2021-2032)

By Type

Sorbitol

Mannitol

Xylitol

Maltitol

Others

By Form

Powder & Crystal

Liquid & Syrup

By End-User

Food and Beverages

Pharmaceuticals

Personal Care

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Sugar Alcohol Market Size is valued at $4.7 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.8% to reach $8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Archer Daniels Midland Company (ADM), Atlantic Chemicals Trading GmbH, Beckmann-Kenko GmbH, Cargill Inc, Fraken Biochem Co. Ltd, Ingredion Inc, Mitsubishi Shoji Foodtech Co. Ltd, Roquette Freres, SANXINYUAN Food Corp Ltd, Tereos Participations SAS

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume