The global Styrenics Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Polymer (Polystyrene, Styrene Butadiene Rubber, Acrylonitrile Butadiene Styrene, UnsaturatedPolyesterResin, Others), By Application (Automotive, Electrical and Electronics, Building and Construction, Packaging, Consumer Products, Others).

Styrenics, a group of thermoplastic polymers derived from styrene monomers, to be integral to various industries in 2024. These versatile materials, which include polystyrene (PS), styrene-butadiene rubber (SBR), and acrylonitrile-butadiene-styrene (ABS), offer a combination of properties such as rigidity, impact resistance, thermal stability, and moldability. In sectors such as packaging, construction, automotive, and electronics, styrenics find applications in products ranging from food packaging and insulation to automotive components and consumer electronics housings. With ongoing advancements in polymer chemistry and processing technologies, styrenics to evolve, offering innovative solutions for lightweighting, durability, and design flexibility in diverse applications.

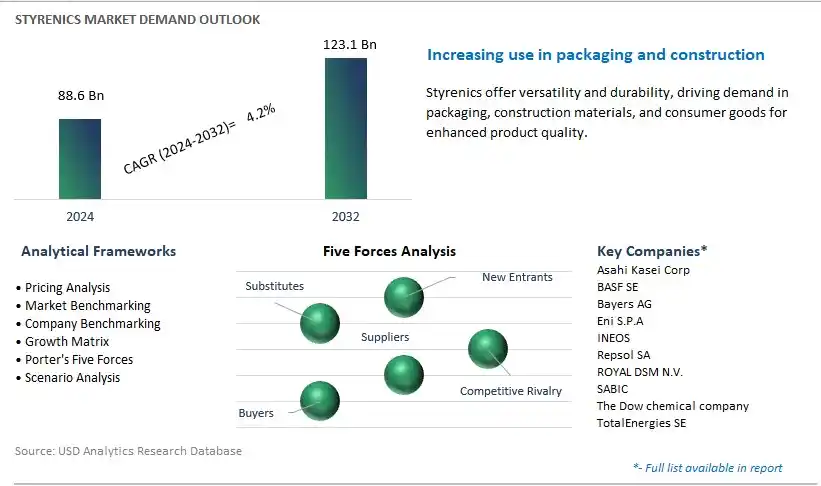

The market report analyses the leading companies in the industry including Asahi Kasei Corp, BASF SE, Bayers AG, Eni S.P.A, INEOS, Repsol SA, ROYAL DSM N.V., SABIC, The Dow chemical company, TotalEnergies SE, and others.

A significant trend in the styrenics market is the increased demand for sustainable and recyclable plastics across various industries. This trend is driven by growing environmental concerns and regulatory pressures to reduce plastic waste and carbon emissions. Styrenics, which include polystyrene (PS), expanded polystyrene (EPS), and acrylonitrile butadiene styrene (ABS), are widely used in packaging, construction, automotive, and consumer goods sectors. Manufacturers are increasingly investing in research and development to create styrenic materials with enhanced recyclability, biodegradability, and renewable content to meet sustainability goals and consumer preferences. As industries transition towards circular economy models and adopt eco-friendly packaging solutions, the demand for sustainable styrenic plastics is expected to continue growing.

The primary driver for the styrenics market is the versatility and cost-effectiveness of styrenic plastics in a wide range of applications. Styrenics offer advantages such as lightweight, rigidity, thermal insulation, and chemical resistance, making them suitable for diverse end-use sectors such as packaging, construction, electronics, and healthcare. Polystyrene is commonly used in food packaging, disposable cups, and insulation boards due to its low cost and excellent insulation properties. Expanded polystyrene finds applications in packaging materials, building insulation, and protective packaging due to its lightweight and cushioning characteristics. Acrylonitrile butadiene styrene is utilized in automotive interiors, electronic housings, and consumer appliances for its toughness, heat resistance, and dimensional stability. As industries seek cost-effective materials that meet performance requirements and regulatory standards, the demand for styrenic plastics remains strong.

A significant opportunity for the styrenics market lies in innovation in bioplastics and renewable styrenic materials, where sustainable alternatives to conventional plastics are in high demand. With the growing emphasis on reducing carbon footprint and transitioning towards renewable resources, there is an increasing need for styrenic materials derived from bio-based feedstocks or recycled content. Manufacturers are investing in research and development to develop biodegradable polystyrene, bio-based ABS, and recyclable EPS to address environmental concerns and meet regulatory requirements. By offering styrenic plastics with sustainable attributes and comparable performance to conventional materials, manufacturers can capitalize on the growing demand for eco-friendly solutions and gain a competitive edge in the market. Additionally, partnerships with bio-based material suppliers, collaboration with recycling initiatives, and adoption of closed-loop manufacturing processes present opportunities for innovation and market differentiation in the evolving landscape of sustainable plastics.

Within the Styrenics Market segmented by polymer type, Polystyrene is the largest segment, driven by its versatile properties, widespread applications, and established market presence. Polystyrene is a thermoplastic polymer known for its rigidity, clarity, and excellent insulation properties, making it suitable for a diverse range of applications. It is commonly used in packaging materials, disposable cups and containers, insulation panels, and consumer goods such as toys and electronic housings. Additionally, polystyrene's affordability and ease of processing contribute to its popularity in various industries. Moreover, advancements in polystyrene technology have led to the development of high-impact and flame-retardant grades, expanding its applications in demanding environments. As industries continue to seek cost-effective and versatile materials for packaging, construction, and consumer products, the Polystyrene segment maintains its dominance in the styrenics market, offering reliable solutions for a myriad of applications.

Within the Styrenics Market segmented by application, the Packaging segment is the fastest-growing, driven by increasing demand for lightweight, durable, and cost-effective packaging solutions across various industries. Styrenics, particularly polystyrene, are widely used in packaging applications due to their versatility, thermal insulation properties, and affordability. Styrenic materials are utilized in a range of packaging formats, including food containers, cups, trays, and protective packaging for fragile items. Additionally, styrenic packaging offers benefits such as moisture resistance, shock absorption, and compatibility with various printing and decorating techniques. As e-commerce continues to expand and consumer preferences shift towards sustainable packaging options, styrenics are increasingly used in the production of recyclable and biodegradable packaging materials. Moreover, the COVID-19 pandemic has further accelerated the demand for styrenic packaging materials, particularly for single-use items such as disposable cups and food containers. As the packaging industry evolves to meet changing market dynamics and sustainability goals, the Packaging segment is poised to continue its rapid growth trajectory, driving innovation and expansion in the styrenics market.

By Polymer

Polystyrene

Styrene Butadiene Rubber

Acrylonitrile Butadiene Styrene

UnsaturatedPolyesterResin

Others

By Application

Automotive

Electrical and Electronics

Building and Construction

Packaging

Consumer Products

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Asahi Kasei Corp

BASF SE

Bayers AG

Eni S.P.A

INEOS

Repsol SA

ROYAL DSM N.V.

SABIC

The Dow chemical company

TotalEnergies SE

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Styrenics Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Styrenics Market Size Outlook, $ Million, 2021 to 2032

3.2 Styrenics Market Outlook by Type, $ Million, 2021 to 2032

3.3 Styrenics Market Outlook by Product, $ Million, 2021 to 2032

3.4 Styrenics Market Outlook by Application, $ Million, 2021 to 2032

3.5 Styrenics Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Styrenics Industry

4.2 Key Market Trends in Styrenics Industry

4.3 Potential Opportunities in Styrenics Industry

4.4 Key Challenges in Styrenics Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Styrenics Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Styrenics Market Outlook by Segments

7.1 Styrenics Market Outlook by Segments, $ Million, 2021- 2032

By Polymer

Polystyrene

Styrene Butadiene Rubber

Acrylonitrile Butadiene Styrene

UnsaturatedPolyesterResin

Others

By Application

Automotive

Electrical and Electronics

Building and Construction

Packaging

Consumer Products

Others

8 North America Styrenics Market Analysis and Outlook To 2032

8.1 Introduction to North America Styrenics Markets in 2024

8.2 North America Styrenics Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Styrenics Market size Outlook by Segments, 2021-2032

By Polymer

Polystyrene

Styrene Butadiene Rubber

Acrylonitrile Butadiene Styrene

UnsaturatedPolyesterResin

Others

By Application

Automotive

Electrical and Electronics

Building and Construction

Packaging

Consumer Products

Others

9 Europe Styrenics Market Analysis and Outlook To 2032

9.1 Introduction to Europe Styrenics Markets in 2024

9.2 Europe Styrenics Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Styrenics Market Size Outlook by Segments, 2021-2032

By Polymer

Polystyrene

Styrene Butadiene Rubber

Acrylonitrile Butadiene Styrene

UnsaturatedPolyesterResin

Others

By Application

Automotive

Electrical and Electronics

Building and Construction

Packaging

Consumer Products

Others

10 Asia Pacific Styrenics Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Styrenics Markets in 2024

10.2 Asia Pacific Styrenics Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Styrenics Market size Outlook by Segments, 2021-2032

By Polymer

Polystyrene

Styrene Butadiene Rubber

Acrylonitrile Butadiene Styrene

UnsaturatedPolyesterResin

Others

By Application

Automotive

Electrical and Electronics

Building and Construction

Packaging

Consumer Products

Others

11 South America Styrenics Market Analysis and Outlook To 2032

11.1 Introduction to South America Styrenics Markets in 2024

11.2 South America Styrenics Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Styrenics Market size Outlook by Segments, 2021-2032

By Polymer

Polystyrene

Styrene Butadiene Rubber

Acrylonitrile Butadiene Styrene

UnsaturatedPolyesterResin

Others

By Application

Automotive

Electrical and Electronics

Building and Construction

Packaging

Consumer Products

Others

12 Middle East and Africa Styrenics Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Styrenics Markets in 2024

12.2 Middle East and Africa Styrenics Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Styrenics Market size Outlook by Segments, 2021-2032

By Polymer

Polystyrene

Styrene Butadiene Rubber

Acrylonitrile Butadiene Styrene

UnsaturatedPolyesterResin

Others

By Application

Automotive

Electrical and Electronics

Building and Construction

Packaging

Consumer Products

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Asahi Kasei Corp

BASF SE

Bayers AG

Eni S.P.A

INEOS

Repsol SA

ROYAL DSM N.V.

SABIC

The Dow chemical company

TotalEnergies SE

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Polymer

Polystyrene

Styrene Butadiene Rubber

Acrylonitrile Butadiene Styrene

UnsaturatedPolyesterResin

Others

By Application

Automotive

Electrical and Electronics

Building and Construction

Packaging

Consumer Products

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Styrenics Market Size is valued at $88.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.2% to reach $123.1 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Asahi Kasei Corp, BASF SE, Bayers AG, Eni S.P.A, INEOS, Repsol SA, ROYAL DSM N.V., SABIC, The Dow chemical company, TotalEnergies SE

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume