The global Structural Adhesive Tapes Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Resin (Acrylic, Rubber, Silicone, Others), By Backing Material (PVC, Paper, Woven/Non-woven, PET, Foam, PP, Others), By Product (Single-sided bonding, Double-sided bonding), By Technology (Solvent-based, Water-based, Hot-melt, Reactive), By End-User (Automotive, Healthcare, Electrical & Electronics, Renewable Energy, E-Mobility, Building & Construction, Others).

Structural adhesive tapes, engineered to provide durable and high-strength bonding solutions for structural and assembly applications, to be essential in manufacturing and construction industries in 2024. These tapes utilize advanced adhesive formulations and backing materials to bond substrates such as metals, plastics, composites, and glass, offering advantages such as uniform stress distribution, vibration damping, and corrosion resistance. In industries such as aerospace, automotive, marine, and building construction, structural adhesive tapes are used for joining components, sealing joints, and reinforcing structures, replacing traditional mechanical fasteners such as screws, rivets, and welds. With ongoing innovations in adhesive chemistry, tape design, and application methods, structural adhesive tapes offer efficient, lightweight, and cost-effective alternatives for achieving strong and durable bonds in diverse structural and assembly applications.

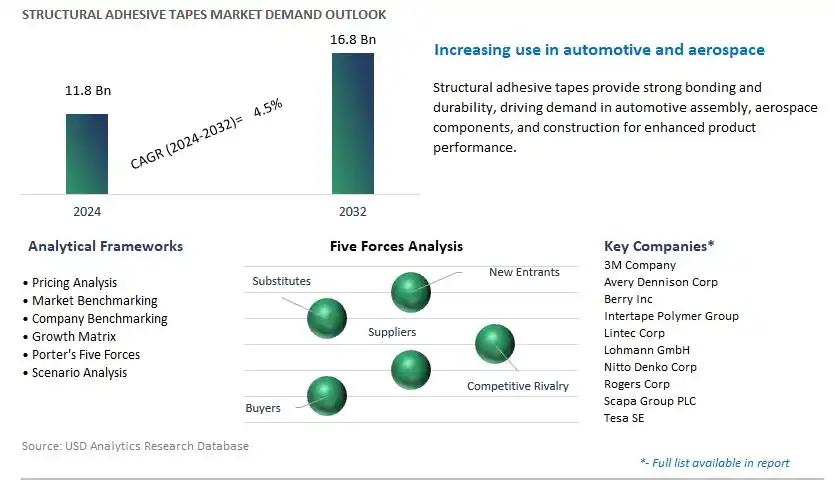

The market report analyses the leading companies in the industry including 3M Company, Avery Dennison Corp, Berry Inc, Intertape Polymer Group, Lintec Corp, Lohmann GmbH, Nitto Denko Corp, Rogers Corp, Scapa Group PLC, Tesa SE, and others.

A significant trend in the structural adhesive tapes market is the shift towards lightweight and high-strength bonding solutions across various industries. This trend is driven by the demand for alternatives to traditional fastening methods such as screws, bolts, and welding, particularly in applications where weight reduction, flexibility, and aesthetic considerations are paramount. Structural adhesive tapes offer advantages such as uniform stress distribution, vibration damping, and resistance to temperature extremes, making them suitable for bonding dissimilar materials, joining irregular surfaces, and enhancing structural integrity in automotive, aerospace, construction, and electronics industries. As manufacturers seek innovative solutions to optimize product performance and reduce assembly costs, the adoption of structural adhesive tapes is expected to increase.

The primary driver for the structural adhesive tapes market is the need for improved manufacturing efficiency and product performance in diverse industries. Structural adhesive tapes offer advantages such as fast assembly times, reduced labor costs, and enhanced design flexibility compared to traditional bonding methods, making them ideal for high-volume production environments. Additionally, structural adhesive tapes provide excellent bond strength, durability, and resistance to environmental factors such as moisture, chemicals, and UV radiation, ensuring long-term reliability and performance in end-use applications. As industries strive to streamline manufacturing processes, minimize downtime, and optimize product quality, the demand for structural adhesive tapes that offer superior bonding performance and process efficiency is expected to grow.

A significant opportunity for the structural adhesive tapes market lies in expanding into advanced materials and composite bonding applications, where lightweight and high-performance bonding solutions are crucial. With the increasing use of composites, plastics, and lightweight metals in industries such as automotive, aerospace, and renewable energy, there is a growing demand for adhesive tapes that can bond these materials effectively while maintaining structural integrity and durability. Structural adhesive tapes offer advantages such as conformability, stress distribution, and compatibility with a wide range of substrates, making them suitable for joining composite panels, reinforcing bonded joints, and assembling lightweight structures. By developing specialized tapes tailored to the requirements of advanced materials and composite bonding, manufacturers can capitalize on the growing demand for lightweight, durable, and efficient bonding solutions in high-tech industries, thus unlocking new opportunities for market expansion and differentiation.

Within the Structural Adhesive Tapes Market segmented by resin type, Acrylic is the largest segment, driven by its versatility, durability, and wide-ranging applications across industries. Acrylic-based adhesive tapes offer excellent adhesion to a variety of substrates, including plastics, metals, and glass, making them suitable for diverse bonding applications. These tapes provide strong and long-lasting bonds, even in challenging environments with exposure to temperature extremes, UV radiation, and moisture. Additionally, acrylic adhesive tapes offer benefits such as resistance to chemicals, solvents, and aging, ensuring reliable performance over time. Moreover, advancements in acrylic adhesive technology have led to the development of high-performance tapes tailored to specific applications, further expanding their market dominance. As industries increasingly rely on structural adhesive tapes for assembly, construction, automotive, aerospace, and electronics applications, the Acrylic segment continues to lead the structural adhesive tapes market, offering superior bonding solutions for a wide range of requirements.

In the Structural Adhesive Tapes Market segmented by backing material, Foam is the fastest-growing segment, driven by its unique properties, versatility, and expanding applications across diverse industries. Foam-backed adhesive tapes offer potential advantages, including excellent cushioning, vibration damping, and conformability to irregular surfaces, making them ideal for bonding applications where shock absorption and surface irregularities are concerns. These tapes find increasing use in industries such as automotive, electronics, construction, and healthcare, where they are employed for applications such as gasketing, sealing, mounting, and insulation. Moreover, advancements in foam technology have led to the development of specialized foam tapes with enhanced performance characteristics, such as high temperature resistance, fire retardancy, and sound insulation properties, further driving their adoption across industries. As manufacturers seek innovative solutions for bonding challenges and demand for lightweight, versatile, and durable adhesive tapes grows, the Foam segment is poised to maintain its rapid growth trajectory, shaping the future of the structural adhesive tapes market.

Within the Structural Adhesive Tapes Market segmented by product type, Double-sided Bonding is the largest segment, driven by its versatility, efficiency, and wide-ranging applications across various industries. Double-sided adhesive tapes offer the advantage of bonding two surfaces together with a strong and durable bond, eliminating the need for traditional fasteners such as screws, nails, and rivets. This enables manufacturers to streamline assembly processes, reduce material and labor costs, and achieve cleaner and more aesthetically pleasing finished products. Double-sided tapes find extensive use in industries such as automotive, electronics, construction, signage, and packaging, where they are employed for applications such as mounting, laminating, splicing, and sealing. Moreover, advancements in adhesive technology have led to the development of double-sided tapes with tailored properties such as high temperature resistance, solvent resistance, and conformability to irregular surfaces, further driving their adoption across industries. As manufacturers increasingly prioritize efficiency, flexibility, and cost-effectiveness in their production processes, the Double-sided Bonding segment continues to dominate the structural adhesive tapes market, offering innovative solutions for diverse bonding requirements.

In the Structural Adhesive Tapes Market segmented by technology, the Hot-melt segment is the fastest-growing, driven by its efficiency, versatility, and environmental advantages. Hot-melt adhesive tapes are formulated with thermoplastic resins that are melted and applied as a liquid onto the backing material, forming a strong bond upon cooling. The technology offers diverse benefits over traditional solvent-based and water-based adhesives, including faster production speeds, minimal curing time, and improved adhesion to a wide range of substrates. Additionally, hot-melt adhesives are solvent-free and emit lower levels of volatile organic compounds (VOCs), making them environmentally friendly and compliant with stringent regulations. These advantages make hot-melt adhesive tapes increasingly popular in industries such as packaging, automotive, construction, and electronics, where efficiency, reliability, and sustainability are paramount. As manufacturers seek innovative bonding solutions that optimize production processes and minimize environmental impact, the Hot-melt segment is poised to continue its rapid growth trajectory, shaping the future of the structural adhesive tapes market.

By Resin

Acrylic

Rubber

Silicone

Others

By Backing Material

PVC

Paper

Woven/Non-woven

PET

Foam

PP

Others

By Product

Single-sided bonding

Double-sided bonding

By Technology

Solvent-based

Water-based

Hot-melt

Reactive

By End-User

Automotive

Healthcare

Electrical & Electronics

Renewable Energy

E-Mobility

Building & Construction

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Avery Dennison Corp

Berry Inc

Intertape Polymer Group

Lintec Corp

Lohmann GmbH

Nitto Denko Corp

Rogers Corp

Scapa Group PLC

Tesa SE

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Structural Adhesive Tapes Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Structural Adhesive Tapes Market Size Outlook, $ Million, 2021 to 2032

3.2 Structural Adhesive Tapes Market Outlook by Type, $ Million, 2021 to 2032

3.3 Structural Adhesive Tapes Market Outlook by Product, $ Million, 2021 to 2032

3.4 Structural Adhesive Tapes Market Outlook by Application, $ Million, 2021 to 2032

3.5 Structural Adhesive Tapes Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Structural Adhesive Tapes Industry

4.2 Key Market Trends in Structural Adhesive Tapes Industry

4.3 Potential Opportunities in Structural Adhesive Tapes Industry

4.4 Key Challenges in Structural Adhesive Tapes Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Structural Adhesive Tapes Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Structural Adhesive Tapes Market Outlook by Segments

7.1 Structural Adhesive Tapes Market Outlook by Segments, $ Million, 2021- 2032

By Resin

Acrylic

Rubber

Silicone

Others

By Backing Material

PVC

Paper

Woven/Non-woven

PET

Foam

PP

Others

By Product

Single-sided bonding

Double-sided bonding

By Technology

Solvent-based

Water-based

Hot-melt

Reactive

By End-User

Automotive

Healthcare

Electrical & Electronics

Renewable Energy

E-Mobility

Building & Construction

Others

8 North America Structural Adhesive Tapes Market Analysis and Outlook To 2032

8.1 Introduction to North America Structural Adhesive Tapes Markets in 2024

8.2 North America Structural Adhesive Tapes Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Structural Adhesive Tapes Market size Outlook by Segments, 2021-2032

By Resin

Acrylic

Rubber

Silicone

Others

By Backing Material

PVC

Paper

Woven/Non-woven

PET

Foam

PP

Others

By Product

Single-sided bonding

Double-sided bonding

By Technology

Solvent-based

Water-based

Hot-melt

Reactive

By End-User

Automotive

Healthcare

Electrical & Electronics

Renewable Energy

E-Mobility

Building & Construction

Others

9 Europe Structural Adhesive Tapes Market Analysis and Outlook To 2032

9.1 Introduction to Europe Structural Adhesive Tapes Markets in 2024

9.2 Europe Structural Adhesive Tapes Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Structural Adhesive Tapes Market Size Outlook by Segments, 2021-2032

By Resin

Acrylic

Rubber

Silicone

Others

By Backing Material

PVC

Paper

Woven/Non-woven

PET

Foam

PP

Others

By Product

Single-sided bonding

Double-sided bonding

By Technology

Solvent-based

Water-based

Hot-melt

Reactive

By End-User

Automotive

Healthcare

Electrical & Electronics

Renewable Energy

E-Mobility

Building & Construction

Others

10 Asia Pacific Structural Adhesive Tapes Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Structural Adhesive Tapes Markets in 2024

10.2 Asia Pacific Structural Adhesive Tapes Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Structural Adhesive Tapes Market size Outlook by Segments, 2021-2032

By Resin

Acrylic

Rubber

Silicone

Others

By Backing Material

PVC

Paper

Woven/Non-woven

PET

Foam

PP

Others

By Product

Single-sided bonding

Double-sided bonding

By Technology

Solvent-based

Water-based

Hot-melt

Reactive

By End-User

Automotive

Healthcare

Electrical & Electronics

Renewable Energy

E-Mobility

Building & Construction

Others

11 South America Structural Adhesive Tapes Market Analysis and Outlook To 2032

11.1 Introduction to South America Structural Adhesive Tapes Markets in 2024

11.2 South America Structural Adhesive Tapes Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Structural Adhesive Tapes Market size Outlook by Segments, 2021-2032

By Resin

Acrylic

Rubber

Silicone

Others

By Backing Material

PVC

Paper

Woven/Non-woven

PET

Foam

PP

Others

By Product

Single-sided bonding

Double-sided bonding

By Technology

Solvent-based

Water-based

Hot-melt

Reactive

By End-User

Automotive

Healthcare

Electrical & Electronics

Renewable Energy

E-Mobility

Building & Construction

Others

12 Middle East and Africa Structural Adhesive Tapes Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Structural Adhesive Tapes Markets in 2024

12.2 Middle East and Africa Structural Adhesive Tapes Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Structural Adhesive Tapes Market size Outlook by Segments, 2021-2032

By Resin

Acrylic

Rubber

Silicone

Others

By Backing Material

PVC

Paper

Woven/Non-woven

PET

Foam

PP

Others

By Product

Single-sided bonding

Double-sided bonding

By Technology

Solvent-based

Water-based

Hot-melt

Reactive

By End-User

Automotive

Healthcare

Electrical & Electronics

Renewable Energy

E-Mobility

Building & Construction

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Avery Dennison Corp

Berry Inc

Intertape Polymer Group

Lintec Corp

Lohmann GmbH

Nitto Denko Corp

Rogers Corp

Scapa Group PLC

Tesa SE

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Resin

Acrylic

Rubber

Silicone

Others

By Backing Material

PVC

Paper

Woven/Non-woven

PET

Foam

PP

Others

By Product

Single-sided bonding

Double-sided bonding

By Technology

Solvent-based

Water-based

Hot-melt

Reactive

By End-User

Automotive

Healthcare

Electrical & Electronics

Renewable Energy

E-Mobility

Building & Construction

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Structural Adhesive Tapes Market Size is valued at $11.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.5% to reach $16.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Avery Dennison Corp, Berry Inc, Intertape Polymer Group, Lintec Corp, Lohmann GmbH, Nitto Denko Corp, Rogers Corp, Scapa Group PLC, Tesa SE

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume