The global Stearic Acid Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Feedstock (Animal-based Raw Materials, Vegetable-based Raw Materials), By Application (Soaps and Detergents, Personal Care, Textiles, Plastics, Rubber Processing, Other).

The stearic acid market is experiencing steady growth, driven by its widespread applications across various industries including personal care, pharmaceuticals, plastics, and rubber. A key trend shaping the future of the stearic acid market is the rising demand for sustainable and plant-based alternatives to animal-derived stearic acid. Manufacturers are increasingly focusing on sourcing stearic acid from renewable vegetable oils such as palm oil, coconut oil, and soybean oil, in response to growing consumer preferences for eco-friendly products. Furthermore, technological advancements in extraction and purification processes are enabling the production of high-purity stearic acid with enhanced functional properties, driving its adoption in specialty applications such as lubricants, candles, and food additives. Moreover, the growing emphasis on product innovation and customization is fueling research and development efforts to develop stearic acid derivatives with novel functionalities, further expanding its market potential.

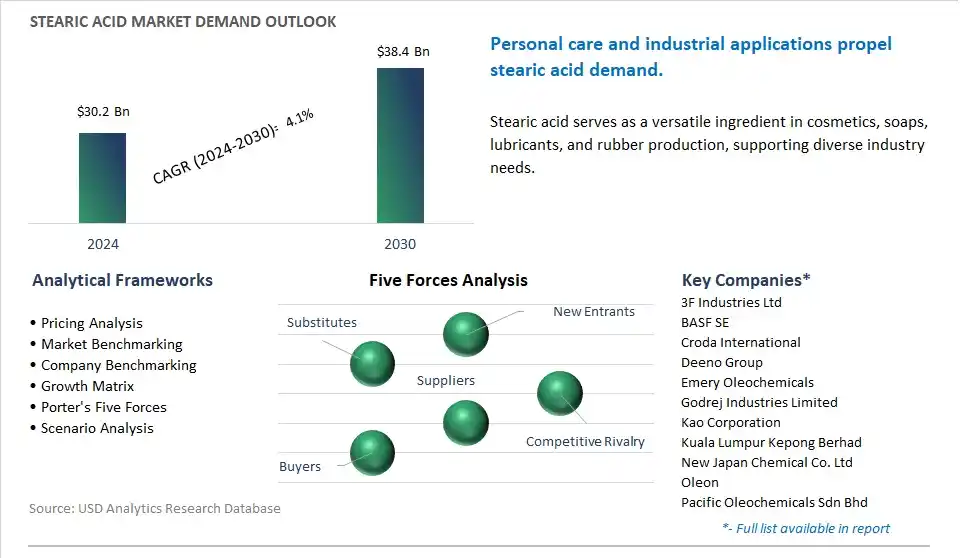

The market report analyses the leading companies in the industry including 3F Industries Ltd, BASF SE, Croda International, Deeno Group, Emery Oleochemicals, Godrej Industries Limited, Kao Corporation, Kuala Lumpur Kepong Berhad, New Japan Chemical Co. Ltd, Oleon, Pacific Oleochemicals Sdn Bhd, Procter & Gamble, RUGAO Shuangma Chemical Co. Ltd, Twin River Technologies, VVF (Global) Limited, Wilmar International.

A prominent trend in the stearic acid market is the growing demand for personal care and cosmetics products. Stearic acid, commonly used as an ingredient in skincare, haircare, and cosmetics formulations, plays a crucial role in providing texture, stability, and moisturizing properties to various beauty and personal care products. With increasing consumer awareness of skincare and grooming routines, there's a rising demand for products that offer effective hydration, nourishment, and anti-aging benefits, driving the demand for stearic acid in the cosmetics industry. The trend is fueled by changing consumer lifestyles, beauty trends, and preferences for natural and sustainable ingredients in personal care products.

The primary driver behind the stearic acid market's growth is the expansion of the soap and detergent industry. Stearic acid is a key ingredient in the production of soap bars, laundry detergents, and household cleaners due to its ability to create stable lather, improve cleansing properties, and enhance the overall quality of cleaning products. With increasing urbanization, population growth, and hygiene awareness, there's a growing demand for soap and detergent products across residential, commercial, and industrial sectors worldwide. This driver is significant as it stimulates market demand for stearic acid as a raw material in soap and detergent manufacturing, driving market growth and revenue opportunities for stearic acid producers and suppliers.

An attractive opportunity within the stearic acid market lies in diversification into food and pharmaceutical applications. While stearic acid is primarily known for its use in personal care and cleaning products, it also finds applications in the food and pharmaceutical industries. In the food industry, stearic acid is used as a food additive and emulsifier in the production of confectionery, bakery products, and dietary supplements. In the pharmaceutical industry, stearic acid is utilized as an excipient in tablet and capsule formulations, providing lubrication and aiding in the uniform distribution of active ingredients. By expanding into these sectors, stearic acid manufacturers can tap into new markets, leverage their existing production capabilities, and explore additional revenue streams while meeting the growing demand for functional ingredients in food and pharmaceutical products.

there is a growing trend towards sustainability and environmental consciousness in industries such as cosmetics, personal care, and food processing. Vegetable-based raw materials for stearic acid production are derived from renewable sources such as palm oil, coconut oil, and soybean oil, making them more environmentally friendly compared to animal-based raw materials. Additionally, vegetable-based stearic acid offers a cruelty-free alternative to animal-derived stearic acid, appealing to consumers who prioritize ethical and eco-friendly products. Furthermore, vegetable-based stearic acid is often preferred for its higher purity, consistency, and compatibility with vegan and organic formulations in various applications such as cosmetics, pharmaceuticals, candles, and lubricants. As a result of these factors, the Vegetable-based Raw Materials segment remains the largest in the Stearic Acid Market, driven by increasing demand for sustainable and natural ingredients in end-user industries.

there is a rising demand for stearic acid in personal care products such as cosmetics, skincare, and haircare formulations due to its versatile properties and functional benefits. Stearic acid acts as an emulsifier, thickener, and stabilizer in cosmetic formulations, enhancing texture, consistency, and shelf life. Additionally, stearic acid is valued for its moisturizing and conditioning properties, making it a popular ingredient in lotions, creams, and moisturizers. Furthermore, the growing consumer preference for natural and sustainable ingredients in personal care products is driving the demand for stearic acid derived from vegetable-based sources such as palm oil, coconut oil, and shea butter. As consumers become more aware of the ingredients in their skincare and beauty products and seek products that are gentle, effective, and environmentally friendly, the demand for stearic acid in the Personal Care segment is expected to continue growing rapidly.

By Feedstock

Animal-based Raw Materials

Vegetable-based Raw Materials

By Application

Soaps and Detergents

Personal Care

Textiles

Plastics

Rubber Processing

Other

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3F Industries Ltd

BASF SE

Croda International

Deeno Group

Emery Oleochemicals

Godrej Industries Limited

Kao Corporation

Kuala Lumpur Kepong Berhad

New Japan Chemical Co. Ltd

Oleon

Pacific Oleochemicals Sdn Bhd

Procter & Gamble

RUGAO Shuangma Chemical Co. Ltd

Twin River Technologies

VVF (Global) Limited

Wilmar International

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Stearic Acid Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Stearic Acid Market Size Outlook, $ Million, 2021 to 2030

3.2 Stearic Acid Market Outlook by Type, $ Million, 2021 to 2030

3.3 Stearic Acid Market Outlook by Product, $ Million, 2021 to 2030

3.4 Stearic Acid Market Outlook by Application, $ Million, 2021 to 2030

3.5 Stearic Acid Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Stearic Acid Industry

4.2 Key Market Trends in Stearic Acid Industry

4.3 Potential Opportunities in Stearic Acid Industry

4.4 Key Challenges in Stearic Acid Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Stearic Acid Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Stearic Acid Market Outlook by Segments

7.1 Stearic Acid Market Outlook by Segments, $ Million, 2021- 2030

By Feedstock

Animal-based Raw Materials

Vegetable-based Raw Materials

By Application

Soaps and Detergents

Personal Care

Textiles

Plastics

Rubber Processing

Other

8 North America Stearic Acid Market Analysis and Outlook To 2030

8.1 Introduction to North America Stearic Acid Markets in 2024

8.2 North America Stearic Acid Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Stearic Acid Market size Outlook by Segments, 2021-2030

By Feedstock

Animal-based Raw Materials

Vegetable-based Raw Materials

By Application

Soaps and Detergents

Personal Care

Textiles

Plastics

Rubber Processing

Other

9 Europe Stearic Acid Market Analysis and Outlook To 2030

9.1 Introduction to Europe Stearic Acid Markets in 2024

9.2 Europe Stearic Acid Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Stearic Acid Market Size Outlook by Segments, 2021-2030

By Feedstock

Animal-based Raw Materials

Vegetable-based Raw Materials

By Application

Soaps and Detergents

Personal Care

Textiles

Plastics

Rubber Processing

Other

10 Asia Pacific Stearic Acid Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Stearic Acid Markets in 2024

10.2 Asia Pacific Stearic Acid Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Stearic Acid Market size Outlook by Segments, 2021-2030

By Feedstock

Animal-based Raw Materials

Vegetable-based Raw Materials

By Application

Soaps and Detergents

Personal Care

Textiles

Plastics

Rubber Processing

Other

11 South America Stearic Acid Market Analysis and Outlook To 2030

11.1 Introduction to South America Stearic Acid Markets in 2024

11.2 South America Stearic Acid Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Stearic Acid Market size Outlook by Segments, 2021-2030

By Feedstock

Animal-based Raw Materials

Vegetable-based Raw Materials

By Application

Soaps and Detergents

Personal Care

Textiles

Plastics

Rubber Processing

Other

12 Middle East and Africa Stearic Acid Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Stearic Acid Markets in 2024

12.2 Middle East and Africa Stearic Acid Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Stearic Acid Market size Outlook by Segments, 2021-2030

By Feedstock

Animal-based Raw Materials

Vegetable-based Raw Materials

By Application

Soaps and Detergents

Personal Care

Textiles

Plastics

Rubber Processing

Other

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3F Industries Ltd

BASF SE

Croda International

Deeno Group

Emery Oleochemicals

Godrej Industries Limited

Kao Corporation

Kuala Lumpur Kepong Berhad

New Japan Chemical Co. Ltd

Oleon

Pacific Oleochemicals Sdn Bhd

Procter & Gamble

RUGAO Shuangma Chemical Co. Ltd

Twin River Technologies

VVF (Global) Limited

Wilmar International

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Feedstock

Animal-based Raw Materials

Vegetable-based Raw Materials

By Application

Soaps and Detergents

Personal Care

Textiles

Plastics

Rubber Processing

Other

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Stearic Acid is forecast to reach $38.4 Billion in 2030 from $30.2 Billion in 2024, registering a CAGR of 4.1%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3F Industries Ltd, BASF SE, Croda International, Deeno Group, Emery Oleochemicals, Godrej Industries Limited, Kao Corporation, Kuala Lumpur Kepong Berhad, New Japan Chemical Co. Ltd, Oleon, Pacific Oleochemicals Sdn Bhd, Procter & Gamble, RUGAO Shuangma Chemical Co. Ltd, Twin River Technologies, VVF (Global) Limited, Wilmar International

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume