The global Squalene Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Source (Animal Source, Vegetable Source, Synthetic), By End-User (Pharmaceuticals, Personal Care & Cosmetics, Nutraceuticals, Food & Beverages, Others).

Squalene, a natural compound found in shark liver oil, olive oil, and some plant sources, s to attract attention for its diverse applications in cosmetics, pharmaceuticals, and nutrition in 2024. This hydrocarbon compound serves as a precursor to cholesterol synthesis and is also a potent antioxidant with potential health benefits. In the cosmetics industry, squalene is prized for its moisturizing and emollient properties, making it a common ingredient in skincare products such as creams, lotions, and serums. Further, in pharmaceuticals, squalene is investigated for its immune-boosting properties and potential applications in vaccine adjuvants. With growing consumer demand for natural and sustainable ingredients, squalene sourced from plant-derived sources such as olive oil and amaranth seeds is gaining popularity as an alternative to shark-derived squalene. As research into squalene's health benefits and sustainable sourcing methods s, the market for squalene is expected to expand, driven by its versatility and potential applications in various industries.

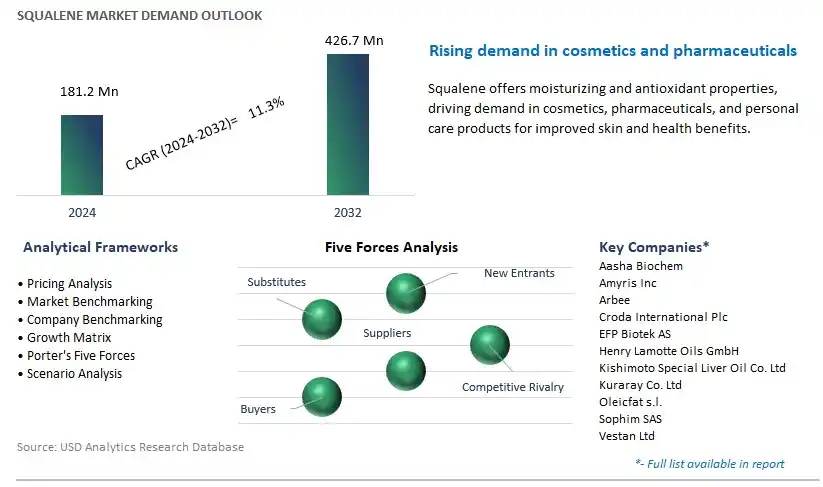

The market report analyses the leading companies in the industry including Aasha Biochem, Amyris Inc, Arbee, Croda International Plc, EFP Biotek AS, Henry Lamotte Oils GmbH, Kishimoto Special Liver Oil Co. Ltd, Kuraray Co. Ltd, Oleicfat s.l., Sophim SAS, Vestan Ltd, and others.

A significant trend in the squalene market is the increasing demand for natural and sustainable ingredients in cosmetics and personal care products. Squalene, a naturally occurring compound found in plants, animals, and humans, is renowned for its moisturizing and skin-nourishing properties. As consumers become more conscious of the ingredients in their skincare products and seek natural alternatives to synthetic chemicals, there is a growing preference for squalene derived from renewable sources such as olive oil, amaranth seeds, and sugarcane. Additionally, the trend towards sustainability drives the demand for squalene produced through environmentally friendly extraction methods and certified organic farming practices. As the skincare industry shifts towards clean, green, and ethical formulations, the demand for natural squalene is expected to continue rising.

The primary driver for the squalene market is the growing awareness of its skincare benefits and anti-aging properties among consumers. Squalene is known for its ability to moisturize and protect the skin by restoring its lipid barrier, preventing moisture loss, and reducing the appearance of fine lines and wrinkles. Furthermore, squalene exhibits antioxidant properties that help neutralize free radicals and protect the skin from environmental stressors such as UV radiation and pollution. As consumers seek skincare products that deliver visible results and promote overall skin health, the demand for squalene as a key ingredient in moisturizers, serums, and anti-aging treatments continues to grow. Moreover, the versatility of squalene extends beyond skincare, with applications in hair care, lip care, and sun care products, further driving market demand.

A significant opportunity for the squalene market lies in expanding into nutraceuticals and dietary supplements, where squalene offers potential health benefits beyond skincare. Squalene derived from sources such as shark liver oil and deep-sea fish is rich in nutrients and bioactive compounds that support immune function, cardiovascular health, and overall well-being. By promoting the use of squalene supplements as part of a healthy diet and lifestyle, manufacturers can tap into the growing demand for natural health products and address consumer concerns about immune support and disease prevention. Additionally, research into the potential anti-inflammatory and anti-cancer properties of squalene opens up opportunities for developing specialized formulations targeting specific health conditions. By leveraging the nutritional benefits and versatility of squalene, companies can diversify their product offerings and capture a larger share of the burgeoning nutraceutical market.

Within the diverse landscape of the Squalene Market, the Vegetable Source segment is the largest, driven by factors such as sustainability, consumer preferences, and regulatory considerations. Squalene derived from vegetable sources, primarily olive oil, amaranth seed oil, and sugarcane, has gained traction in recent years due to its perceived health benefits and ethical production practices. With growing awareness of environmental issues and animal welfare concerns, consumers are increasingly opting for plant-based alternatives in various industries, including cosmetics, pharmaceuticals, and food supplements. Additionally, vegetable-derived squalene offers high purity and stability, making it suitable for a wide range of applications, from skincare products and dietary supplements to vaccine adjuvants. Moreover, regulatory restrictions on animal-derived squalene in some regions further bolster the demand for vegetable-derived alternatives. As the trend towards plant-based ingredients continues to rise, driven by health consciousness and sustainability, the Vegetable Source segment is poised to maintain its dominance in the squalene market.

Amidst the segmentation of the Squalene Market by end-user, the Personal Care & Cosmetics segment is the fastest-growing, fuelled by increasing consumer demand for natural and sustainable ingredients in skincare and cosmetic products. Squalene, renowned for its moisturizing and antioxidant properties, has become a sought-after ingredient in the beauty industry, valued for its ability to hydrate the skin, improve elasticity, and combat signs of aging. As consumers become more discerning about the products they use and seek formulations that align with their values of health and sustainability, there has been a notable shift towards natural and plant-derived ingredients in personal care and cosmetic products. Squalene, derived from sources such as olives, amaranth seed oil, and sugarcane, fits this trend perfectly, offering skincare solutions that are both effective and environmentally friendly. Additionally, the versatility of squalene enables its incorporation into various cosmetic formulations, including moisturizers, serums, creams, and lip balms, further driving its demand in the personal care and cosmetics industry. With beauty consumers increasingly prioritizing clean and green beauty options, the Personal Care & Cosmetics segment is poised to experience rapid growth, shaping the future landscape of the squalene market.

By Source

Animal Source

-Shark Liver Oil

-Others

Plants

-Amaranth Oil

-Olive Oil

-Rice Bran Oil Plants

-Others

Synthetic

By End-User

Pharmaceuticals

Personal Care & Cosmetics

Nutraceuticals

Food & Beverages

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Aasha Biochem

Amyris Inc

Arbee

Croda International Plc

EFP Biotek AS

Henry Lamotte Oils GmbH

Kishimoto Special Liver Oil Co. Ltd

Kuraray Co. Ltd

Oleicfat s.l.

Sophim SAS

Vestan Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Squalene Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Squalene Market Size Outlook, $ Million, 2021 to 2032

3.2 Squalene Market Outlook by Type, $ Million, 2021 to 2032

3.3 Squalene Market Outlook by Product, $ Million, 2021 to 2032

3.4 Squalene Market Outlook by Application, $ Million, 2021 to 2032

3.5 Squalene Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Squalene Industry

4.2 Key Market Trends in Squalene Industry

4.3 Potential Opportunities in Squalene Industry

4.4 Key Challenges in Squalene Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Squalene Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Squalene Market Outlook by Segments

7.1 Squalene Market Outlook by Segments, $ Million, 2021- 2032

By Source

Animal Source

-Shark Liver Oil

-Others

Plants

-Amaranth Oil

-Olive Oil

-Rice Bran Oil Plants

-Others

Synthetic

By End-User

Pharmaceuticals

Personal Care & Cosmetics

Nutraceuticals

Food & Beverages

Others

8 North America Squalene Market Analysis and Outlook To 2032

8.1 Introduction to North America Squalene Markets in 2024

8.2 North America Squalene Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Squalene Market size Outlook by Segments, 2021-2032

By Source

Animal Source

-Shark Liver Oil

-Others

Plants

-Amaranth Oil

-Olive Oil

-Rice Bran Oil Plants

-Others

Synthetic

By End-User

Pharmaceuticals

Personal Care & Cosmetics

Nutraceuticals

Food & Beverages

Others

9 Europe Squalene Market Analysis and Outlook To 2032

9.1 Introduction to Europe Squalene Markets in 2024

9.2 Europe Squalene Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Squalene Market Size Outlook by Segments, 2021-2032

By Source

Animal Source

-Shark Liver Oil

-Others

Plants

-Amaranth Oil

-Olive Oil

-Rice Bran Oil Plants

-Others

Synthetic

By End-User

Pharmaceuticals

Personal Care & Cosmetics

Nutraceuticals

Food & Beverages

Others

10 Asia Pacific Squalene Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Squalene Markets in 2024

10.2 Asia Pacific Squalene Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Squalene Market size Outlook by Segments, 2021-2032

By Source

Animal Source

-Shark Liver Oil

-Others

Plants

-Amaranth Oil

-Olive Oil

-Rice Bran Oil Plants

-Others

Synthetic

By End-User

Pharmaceuticals

Personal Care & Cosmetics

Nutraceuticals

Food & Beverages

Others

11 South America Squalene Market Analysis and Outlook To 2032

11.1 Introduction to South America Squalene Markets in 2024

11.2 South America Squalene Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Squalene Market size Outlook by Segments, 2021-2032

By Source

Animal Source

-Shark Liver Oil

-Others

Plants

-Amaranth Oil

-Olive Oil

-Rice Bran Oil Plants

-Others

Synthetic

By End-User

Pharmaceuticals

Personal Care & Cosmetics

Nutraceuticals

Food & Beverages

Others

12 Middle East and Africa Squalene Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Squalene Markets in 2024

12.2 Middle East and Africa Squalene Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Squalene Market size Outlook by Segments, 2021-2032

By Source

Animal Source

-Shark Liver Oil

-Others

Plants

-Amaranth Oil

-Olive Oil

-Rice Bran Oil Plants

-Others

Synthetic

By End-User

Pharmaceuticals

Personal Care & Cosmetics

Nutraceuticals

Food & Beverages

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aasha Biochem

Amyris Inc

Arbee

Croda International Plc

EFP Biotek AS

Henry Lamotte Oils GmbH

Kishimoto Special Liver Oil Co. Ltd

Kuraray Co. Ltd

Oleicfat s.l.

Sophim SAS

Vestan Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Source

Animal Source

-Shark Liver Oil

-Others

Plants

-Amaranth Oil

-Olive Oil

-Rice Bran Oil Plants

-Others

Synthetic

By End-User

Pharmaceuticals

Personal Care & Cosmetics

Nutraceuticals

Food & Beverages

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Squalene Market Size is valued at $181.2 Million in 2024 and is forecast to register a growth rate (CAGR) of 11.3% to reach $426.7 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aasha Biochem, Amyris Inc, Arbee, Croda International Plc, EFP Biotek AS, Henry Lamotte Oils GmbH, Kishimoto Special Liver Oil Co. Ltd, Kuraray Co. Ltd, Oleicfat s.l., Sophim SAS, Vestan Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume