The global Sputter Coater Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Substrate (Metal, Glass, Semiconductor, Others), By Target (Metal, Compound, Others), By End-User (Automotive, Electronics & Semiconductor, Institutes, Others).

Sputter coating technology, a versatile method for depositing thin films onto substrates, remains integral to various industries in 2024. This technique involves bombarding a target material with high-energy ions in a vacuum chamber, causing atoms to dislodge and deposit onto a substrate to form a thin film. In sectors such as electronics, optics, automotive, and aerospace, sputter coating is utilized for applications including thin film deposition, surface modification, and functional coatings. For instance, in the semiconductor industry, sputter coating is essential for depositing metal and dielectric layers in integrated circuits, enabling miniaturization and performance enhancement. Similarly, in the automotive industry, sputter-coated films are used for decorative trim, solar control, and anti-reflective coatings, enhancing aesthetics and functionality. With ongoing advancements in sputtering technology, target materials, and process control, sputter coating s to offer precise, uniform, and high-performance thin film solutions for a wide range of industrial applications.

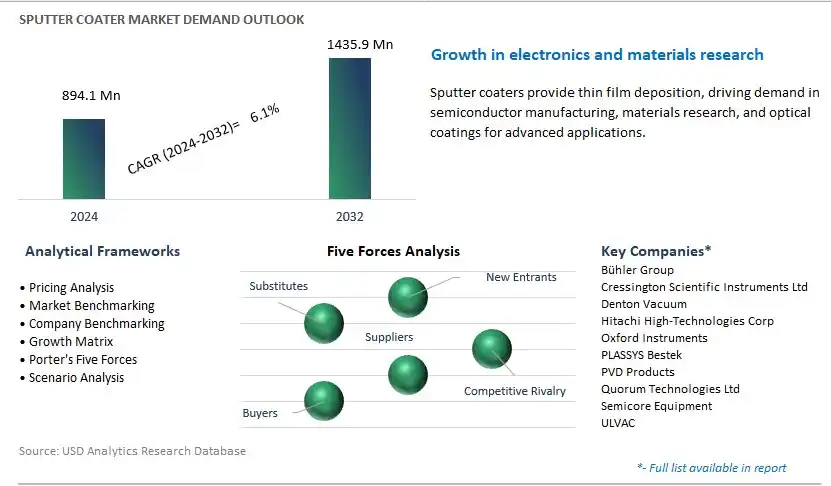

The market report analyses the leading companies in the industry including Bühler Group, Cressington Scientific Instruments Ltd, Denton Vacuum, Hitachi High-Technologies Corp, Oxford Instruments, PLASSYS Bestek, PVD Products, Quorum Technologies Ltd, Semicore Equipment, ULVAC, and others.

One notable trend in the sputter coater market is the growing demand for thin film deposition in the electronics and semiconductor industries. This trend is driven by the increasing complexity and miniaturization of electronic devices, which require precise and uniform thin film coatings to enhance performance, functionality, and reliability. Sputter coaters are widely used for depositing thin films of metals, oxides, and semiconductors onto substrates such as silicon wafers, display panels, and electronic components. Additionally, advancements in sputtering technology, including magnetron sputtering and reactive sputtering, enable the deposition of thin films with tailored properties such as conductivity, optical transparency, and corrosion resistance. As the demand for high-performance electronic devices continues to rise, the need for advanced sputter coating equipment and techniques is expected to increase.

The primary driver for the sputter coater market is advancements in semiconductor and display technologies, which require precise thin film coatings for various applications. The semiconductor industry relies on sputter coating for depositing metal and dielectric films used in integrated circuits, MEMS devices, and photovoltaic cells. Similarly, the display industry utilizes sputter coating for manufacturing thin film transistor (TFT) arrays, touchscreens, and OLED displays with high resolution and color fidelity. Moreover, emerging technologies such as 5G connectivity, augmented reality (AR), and flexible electronics drive innovation in sputter coating techniques to meet the evolving demands for performance, reliability, and scalability. As semiconductor and display technologies continue to advance, the demand for sputter coaters capable of producing thin films with superior properties and uniformity is expected to grow.

A significant opportunity for the sputter coater market lies in expanding into renewable energy and energy storage applications where thin film coatings play a crucial role in improving efficiency and performance. Thin film coatings deposited by sputter coaters are used in solar cells, transparent conductive electrodes, and energy storage devices such as lithium-ion batteries and fuel cells. By developing specialized sputter coating solutions tailored to the requirements of renewable energy and energy storage technologies, manufacturers can capitalize on the growing demand for clean energy solutions and contribute to the global transition towards sustainable energy sources. Additionally, offering services such as process optimization, material characterization, and coating customization enables sputter coater companies to establish themselves as trusted partners in the renewable energy sector and unlock new opportunities for growth and innovation.

Within the comprehensive scope of the Sputter Coater Market, the Metal substrate segment is the largest, driven by its wide-ranging applications across diverse industries and superior performance characteristics. Metals serve as a fundamental substrate for sputter coating processes due to their conductivity, durability, and compatibility with various deposition materials. In industries such as electronics, automotive, aerospace, and optics, metal substrates play a pivotal role in applications ranging from circuit fabrication and decorative coatings to corrosion protection and reflective surfaces. Additionally, advancements in metal coating technologies, such as the development of thin film coatings for enhanced performance and durability, further bolster the dominance of the Metal substrate segment in the sputter coater market. As industries continue to innovate and demand high-performance surface treatments, the Metal substrate segment is poised to maintain its leadership position, driving innovation and growth in the sputter coater market.

Amidst the segmentation of the Sputter Coater Market by target, the Compound segment is the fastest-growing, driven by its versatility, performance, and expanding applications across various industries. Compound targets encompass a wide range of materials, including oxides, nitrides, carbides, and sulfides, which offer unique properties such as optical transparency, electrical conductivity, corrosion resistance, and mechanical strength. These compound coatings find increasing use in advanced technological applications such as thin-film solar cells, optical coatings, electronic devices, and wear-resistant coatings. Moreover, the growing demand for energy-efficient and high-performance materials in industries like electronics, renewable energy, and automotive drives the adoption of compound sputter coatings. Additionally, ongoing advancements in compound target manufacturing processes, such as improved purity and homogeneity, further fuel the growth of this segment. As industries continue to seek innovative solutions for enhancing product performance and efficiency, the Compound segment is poised to sustain its rapid growth trajectory, shaping the future of the sputter coater market.

In the expansive landscape of the Sputter Coater Market, the Electronics & Semiconductor segment is the largest, driven by the critical role of sputter coating in the manufacturing processes of electronic components and semiconductor devices. Sputter coating is extensively utilized in the electronics industry for depositing thin films onto substrates, facilitating the production of integrated circuits, microchips, sensors, and flat panel displays. Additionally, sputter-coated thin films are integral to the functionality and performance of various electronic devices, enhancing conductivity, optical properties, and corrosion resistance. With the continual demand for smaller, faster, and more energy-efficient electronic devices, the Electronics & Semiconductor segment remains at the forefront of innovation and technological advancement. Moreover, the emergence of new applications such as flexible electronics, wearable devices, and Internet of Things (IoT) technologies further drives the growth of this segment. As the electronics industry continues to evolve and expand globally, fuelled by technological advancements and increasing consumer demand, the Electronics & Semiconductor segment maintains its dominant position in the sputter coater market.

By Substrate

Metal

Glass

Semiconductor

Others

By Target

Metal

Compound

Others

By End-User

Automotive

Electronics & Semiconductor

Institutes

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Bühler Group

Cressington Scientific Instruments Ltd

Denton Vacuum

Hitachi High-Technologies Corp

Oxford Instruments

PLASSYS Bestek

PVD Products

Quorum Technologies Ltd

Semicore Equipment

ULVAC

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Sputter Coater Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Sputter Coater Market Size Outlook, $ Million, 2021 to 2032

3.2 Sputter Coater Market Outlook by Type, $ Million, 2021 to 2032

3.3 Sputter Coater Market Outlook by Product, $ Million, 2021 to 2032

3.4 Sputter Coater Market Outlook by Application, $ Million, 2021 to 2032

3.5 Sputter Coater Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Sputter Coater Industry

4.2 Key Market Trends in Sputter Coater Industry

4.3 Potential Opportunities in Sputter Coater Industry

4.4 Key Challenges in Sputter Coater Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Sputter Coater Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Sputter Coater Market Outlook by Segments

7.1 Sputter Coater Market Outlook by Segments, $ Million, 2021- 2032

By Substrate

Metal

Glass

Semiconductor

Others

By Target

Metal

Compound

Others

By End-User

Automotive

Electronics & Semiconductor

Institutes

Others

8 North America Sputter Coater Market Analysis and Outlook To 2032

8.1 Introduction to North America Sputter Coater Markets in 2024

8.2 North America Sputter Coater Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Sputter Coater Market size Outlook by Segments, 2021-2032

By Substrate

Metal

Glass

Semiconductor

Others

By Target

Metal

Compound

Others

By End-User

Automotive

Electronics & Semiconductor

Institutes

Others

9 Europe Sputter Coater Market Analysis and Outlook To 2032

9.1 Introduction to Europe Sputter Coater Markets in 2024

9.2 Europe Sputter Coater Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Sputter Coater Market Size Outlook by Segments, 2021-2032

By Substrate

Metal

Glass

Semiconductor

Others

By Target

Metal

Compound

Others

By End-User

Automotive

Electronics & Semiconductor

Institutes

Others

10 Asia Pacific Sputter Coater Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Sputter Coater Markets in 2024

10.2 Asia Pacific Sputter Coater Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Sputter Coater Market size Outlook by Segments, 2021-2032

By Substrate

Metal

Glass

Semiconductor

Others

By Target

Metal

Compound

Others

By End-User

Automotive

Electronics & Semiconductor

Institutes

Others

11 South America Sputter Coater Market Analysis and Outlook To 2032

11.1 Introduction to South America Sputter Coater Markets in 2024

11.2 South America Sputter Coater Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Sputter Coater Market size Outlook by Segments, 2021-2032

By Substrate

Metal

Glass

Semiconductor

Others

By Target

Metal

Compound

Others

By End-User

Automotive

Electronics & Semiconductor

Institutes

Others

12 Middle East and Africa Sputter Coater Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Sputter Coater Markets in 2024

12.2 Middle East and Africa Sputter Coater Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Sputter Coater Market size Outlook by Segments, 2021-2032

By Substrate

Metal

Glass

Semiconductor

Others

By Target

Metal

Compound

Others

By End-User

Automotive

Electronics & Semiconductor

Institutes

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Bühler Group

Cressington Scientific Instruments Ltd

Denton Vacuum

Hitachi High-Technologies Corp

Oxford Instruments

PLASSYS Bestek

PVD Products

Quorum Technologies Ltd

Semicore Equipment

ULVAC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Substrate

Metal

Glass

Semiconductor

Others

By Target

Metal

Compound

Others

By End-User

Automotive

Electronics & Semiconductor

Institutes

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Sputter Coater Market Size is valued at $894.1 Million in 2024 and is forecast to register a growth rate (CAGR) of 6.1% to reach $1435.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Bühler Group, Cressington Scientific Instruments Ltd, Denton Vacuum, Hitachi High-Technologies Corp, Oxford Instruments, PLASSYS Bestek, PVD Products, Quorum Technologies Ltd, Semicore Equipment, ULVAC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume