The global Spunbond Nonwovens Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Polypropylene, Polyester, Polyethylene, Others), By Product (Disposable, Durable), By Application (Personal Hygiene, Medical & Healthcare, Geotextiles, Others).

Spunbond nonwovens, engineered fabrics produced through a continuous extrusion process, to find diverse applications in filtration, hygiene products, agriculture, and construction in 2024. These nonwoven fabrics are manufactured by extruding thermoplastic polymers onto a conveyor belt, where they are bonded by heat or mechanical means to form a cohesive web. In the filtration industry, spunbond nonwovens offer high tensile strength, chemical resistance, and uniform pore size distribution, making them ideal for air and liquid filtration applications. Similarly, in hygiene products such as diapers, wipes, and medical garments, spunbond nonwovens provide softness, breathability, and liquid management properties, enhancing user comfort and performance. With increasing demand for lightweight, durable, and sustainable materials, spunbond nonwovens to evolve, with innovations in fiber technology, process efficiency, and end-use applications driving their d growth and adoption.

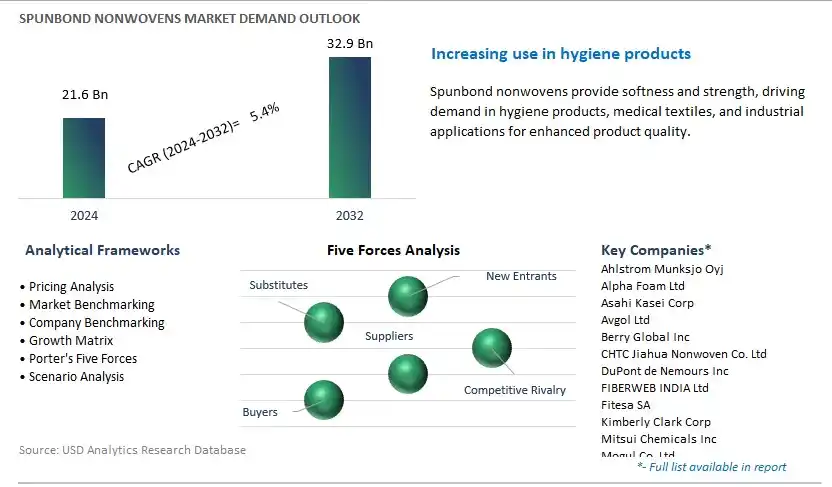

The market report analyses the leading companies in the industry including Ahlstrom Munksjo Oyj, Alpha Foam Ltd, Asahi Kasei Corp, Avgol Ltd, Berry Global Inc, CHTC Jiahua Nonwoven Co. Ltd, DuPont de Nemours Inc, FIBERWEB INDIA Ltd, Fitesa SA, Kimberly Clark Corp, Mitsui Chemicals Inc, Mogul Co. Ltd, PFNonwovens AS, Radici Partecipazioni Spa, Schouw and Co., and others.

A significant trend in the spunbond nonwovens market is the increased demand for hygiene and medical applications. This trend is driven by factors such as growing population awareness about hygiene, increasing healthcare spending, and the rise in global health crises like pandemics. Spunbond nonwovens offer exceptional properties such as breathability, liquid resistance, and barrier protection, making them ideal for use in products like surgical gowns, face masks, diapers, and sanitary napkins. As hygiene standards continue to rise globally and healthcare facilities require reliable and cost-effective solutions, the demand for spunbond nonwovens in hygiene and medical applications is expected to escalate.

The primary driver for the spunbond nonwovens market is the versatility and cost-effectiveness they offer across various industries. Spunbond nonwovens find applications in sectors such as agriculture, automotive, construction, and filtration, where they serve as components in products like crop covers, automotive interiors, geotextiles, and air filters. Their ability to provide strength, durability, and customization options at a competitive price point makes them attractive to manufacturers seeking lightweight and efficient materials for diverse applications. Additionally, advancements in manufacturing processes and material formulations enable spunbond nonwovens to meet specific performance requirements such as UV resistance, flame retardancy, and chemical inertness, further driving market growth.

A significant opportunity for the spunbond nonwovens market lies in expanding into sustainable packaging and filtration solutions. With increasing environmental concerns and regulatory pressures on single-use plastics and pollution, there is a growing demand for eco-friendly packaging materials and filtration media made from biodegradable or recyclable materials. Spunbond nonwovens offer a sustainable alternative to traditional packaging materials such as plastic films and paperboard, providing strength, flexibility, and moisture resistance while being compostable or recyclable. Similarly, spunbond nonwovens can be used in filtration applications for air, water, and industrial processes, offering efficient particle capture, low pressure drop, and long service life. By leveraging their expertise in material science and manufacturing capabilities, spunbond nonwovens manufacturers can capitalize on the increasing demand for sustainable packaging and filtration solutions, thus opening up new market opportunities and revenue streams.

Within the diverse realm of the Spunbond Nonwovens Market, Polypropylene is the largest segment, owing to its versatility, cost-effectiveness, and superior performance characteristics. Polypropylene is widely favored for nonwoven applications due to its exceptional strength-to-weight ratio, resistance to moisture and chemicals, and ease of processability. These attributes make it an ideal material for a myriad of end uses, including hygiene products, medical supplies, agricultural covers, automotive interiors, and packaging materials. Additionally, advancements in polymer technology have led to the development of specialized polypropylene grades tailored to specific applications, further expanding its market dominance. Moreover, as sustainability concerns continue to gain traction, polypropylene's recyclability and compatibility with eco-friendly production processes further solidify its position as the material of choice in the spunbond nonwovens market. As industries across sectors prioritize efficiency, durability, and sustainability in their products, the Polypropylene segment is poised to maintain its leadership, driving innovation and growth in the spunbond nonwovens market.

Amidst the segmentation of the Spunbond Nonwovens Market by product, the Disposable segment is the fastest-growing, propelled by evolving consumer lifestyles, heightened hygiene awareness, and the increasing demand for single-use products across various industries. Disposable spunbond nonwovens find extensive applications in hygiene products such as diapers, feminine hygiene products, and adult incontinence products, where convenience, comfort, and sanitation are paramount. Additionally, the healthcare sector relies heavily on disposable spunbond nonwovens for surgical gowns, masks, and sterile wraps, driven by stringent infection control protocols and the need for cost-effective solutions. Moreover, the COVID-19 pandemic has further accelerated the demand for disposable nonwoven products, including medical PPE and cleaning wipes, as governments, healthcare facilities, and consumers prioritize hygiene and safety measures. As sustainability concerns persist, manufacturers are also exploring biodegradable and compostable alternatives within the disposable nonwovens segment, catering to environmentally conscious consumers. With its versatility, convenience, and hygienic properties, the Disposable segment is poised to sustain its rapid growth trajectory, shaping the future of the spunbond nonwovens market.

In the expansive landscape of the Spunbond Nonwovens Market, the Medical & Healthcare segment is the largest, driven by the critical role of spunbond nonwovens in ensuring hygiene, safety, and performance in medical applications. Spunbond nonwovens are widely utilized in the medical and healthcare industry for various applications, including surgical gowns, drapes, masks, wound dressings, and sterilization wraps. Their exceptional properties, such as barrier protection, breathability, fluid resistance, and softness, make them indispensable for maintaining sterile environments, preventing cross-contamination, and ensuring patient comfort. Additionally, the stringent regulatory standards governing medical textiles further underscore the importance of high-quality spunbond nonwovens in healthcare settings. With the global healthcare sector continuously expanding and evolving, driven by population growth, aging demographics, and advancements in medical technology, the demand for spunbond nonwovens in medical and healthcare applications is poised to remain robust, solidifying the Medical & Healthcare segment's position as the cornerstone of the spunbond nonwovens market.

By Material

Polypropylene

Polyester

Polyethylene

Others

By Product

Disposable

Durable

By Application

Personal Hygiene

Medical & Healthcare

Geotextiles

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Ahlstrom Munksjo Oyj

Alpha Foam Ltd

Asahi Kasei Corp

Avgol Ltd

Berry Global Inc

CHTC Jiahua Nonwoven Co. Ltd

DuPont de Nemours Inc

FIBERWEB INDIA Ltd

Fitesa SA

Kimberly Clark Corp

Mitsui Chemicals Inc

Mogul Co. Ltd

PFNonwovens AS

Radici Partecipazioni Spa

Schouw and Co.

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Spunbond Non wovens Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Spunbond Non wovens Market Size Outlook, $ Million, 2021 to 2032

3.2 Spunbond Non wovens Market Outlook by Type, $ Million, 2021 to 2032

3.3 Spunbond Non wovens Market Outlook by Product, $ Million, 2021 to 2032

3.4 Spunbond Non wovens Market Outlook by Application, $ Million, 2021 to 2032

3.5 Spunbond Non wovens Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Spunbond Non wovens Industry

4.2 Key Market Trends in Spunbond Non wovens Industry

4.3 Potential Opportunities in Spunbond Non wovens Industry

4.4 Key Challenges in Spunbond Non wovens Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Spunbond Non wovens Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Spunbond Non wovens Market Outlook by Segments

7.1 Spunbond Non wovens Market Outlook by Segments, $ Million, 2021- 2032

By Material

Polypropylene

Polyester

Polyethylene

Others

By Product

Disposable

Durable

By Application

Personal Hygiene

Medical & Healthcare

Geotextiles

Others

8 North America Spunbond Non wovens Market Analysis and Outlook To 2032

8.1 Introduction to North America Spunbond Non wovens Markets in 2024

8.2 North America Spunbond Non wovens Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Spunbond Non wovens Market size Outlook by Segments, 2021-2032

By Material

Polypropylene

Polyester

Polyethylene

Others

By Product

Disposable

Durable

By Application

Personal Hygiene

Medical & Healthcare

Geotextiles

Others

9 Europe Spunbond Non wovens Market Analysis and Outlook To 2032

9.1 Introduction to Europe Spunbond Non wovens Markets in 2024

9.2 Europe Spunbond Non wovens Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Spunbond Non wovens Market Size Outlook by Segments, 2021-2032

By Material

Polypropylene

Polyester

Polyethylene

Others

By Product

Disposable

Durable

By Application

Personal Hygiene

Medical & Healthcare

Geotextiles

Others

10 Asia Pacific Spunbond Non wovens Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Spunbond Non wovens Markets in 2024

10.2 Asia Pacific Spunbond Non wovens Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Spunbond Non wovens Market size Outlook by Segments, 2021-2032

By Material

Polypropylene

Polyester

Polyethylene

Others

By Product

Disposable

Durable

By Application

Personal Hygiene

Medical & Healthcare

Geotextiles

Others

11 South America Spunbond Non wovens Market Analysis and Outlook To 2032

11.1 Introduction to South America Spunbond Non wovens Markets in 2024

11.2 South America Spunbond Non wovens Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Spunbond Non wovens Market size Outlook by Segments, 2021-2032

By Material

Polypropylene

Polyester

Polyethylene

Others

By Product

Disposable

Durable

By Application

Personal Hygiene

Medical & Healthcare

Geotextiles

Others

12 Middle East and Africa Spunbond Non wovens Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Spunbond Non wovens Markets in 2024

12.2 Middle East and Africa Spunbond Non wovens Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Spunbond Non wovens Market size Outlook by Segments, 2021-2032

By Material

Polypropylene

Polyester

Polyethylene

Others

By Product

Disposable

Durable

By Application

Personal Hygiene

Medical & Healthcare

Geotextiles

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Ahlstrom Munksjo Oyj

Alpha Foam Ltd

Asahi Kasei Corp

Avgol Ltd

Berry Global Inc

CHTC Jiahua Nonwoven Co. Ltd

DuPont de Nemours Inc

FIBERWEB INDIA Ltd

Fitesa SA

Kimberly Clark Corp

Mitsui Chemicals Inc

Mogul Co. Ltd

PFNonwovens AS

Radici Partecipazioni Spa

Schouw and Co.

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Polypropylene

Polyester

Polyethylene

Others

By Product

Disposable

Durable

By Application

Personal Hygiene

Medical & Healthcare

Geotextiles

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Spunbond Nonwovens Market Size is valued at $21.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.4% to reach $32.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Ahlstrom Munksjo Oyj, Alpha Foam Ltd, Asahi Kasei Corp, Avgol Ltd, Berry Global Inc, CHTC Jiahua Nonwoven Co. Ltd, DuPont de Nemours Inc, FIBERWEB INDIA Ltd, Fitesa SA, Kimberly Clark Corp, Mitsui Chemicals Inc, Mogul Co. Ltd, PFNonwovens AS, Radici Partecipazioni Spa, Schouw and Co.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume