The global Spray Adhesives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Solvent-based, Water-based, Hot Melt), By Resin (Epoxy, Polyurethane, Synthetic Rubber, Vinyl Acetate Ethylene), By End-User (Building and Construction, Packaging, Furniture, Transportation, Textile, Others).

Spray adhesives, versatile bonding solutions offering convenience and versatility, to be essential in various industries in 2024. These adhesive formulations are dispensed through aerosol cans or spray systems, allowing for quick and uniform application to surfaces. In industries such as woodworking, automotive, construction, and crafts, spray adhesives are utilized for bonding substrates such as wood, metal, plastic, fabric, and foam. Their ability to provide instant tack and strong adhesion makes them ideal for applications requiring temporary or permanent bonds, such as upholstery, signage, insulation, and packaging. With advancements in adhesive chemistry and aerosol technology, spray adhesives offer improved performance, low odor formulations, and environmentally friendly options, meeting the evolving needs of manufacturers and consumers alike for efficient and reliable bonding solutions.

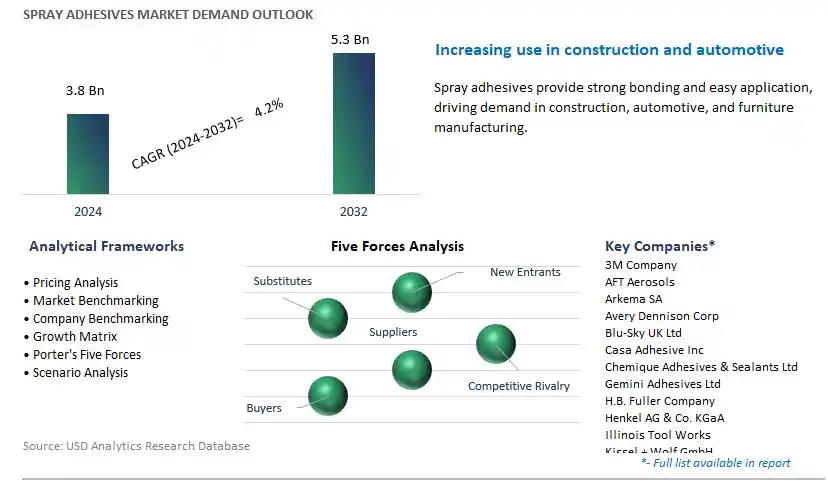

The market report analyses the leading companies in the industry including 3M Company, AFT Aerosols, Arkema SA, Avery Dennison Corp, Blu-Sky UK Ltd, Casa Adhesive Inc, Chemique Adhesives & Sealants Ltd, Gemini Adhesives Ltd, H.B. Fuller Company, Henkel AG & Co. KGaA, Illinois Tool Works, Kissel + Wolf GmbH, Philips Manufacturing, Powerbond, Quin Global, Sika AG, Spray-Lock Inc, The Kroger Co., Westech Aerosol Corp, Worthen Industries, and others.

Under the umbrella of spray adhesives, a notable trend is the increasing demand for eco-friendly and low-VOC (volatile organic compound) formulations. This trend is driven by heightened environmental awareness and regulations aimed at reducing air pollution and promoting sustainable practices in manufacturing and construction. As a result, manufacturers of spray adhesives are focusing on developing formulations that minimize environmental impact, using renewable or recycled materials, and reducing or eliminating harmful chemicals. Additionally, there is a growing preference among consumers and businesses for adhesives that emit fewer volatile organic compounds, improving indoor air quality and ensuring compliance with environmental standards. As sustainability continues to be a priority for industries worldwide, the demand for eco-friendly spray adhesives is expected to escalate.

The primary driver for the spray adhesives market is the versatility and efficiency they offer in bonding solutions across various industries and applications. Spray adhesives provide a convenient and fast-bonding method for a wide range of substrates, including plastics, metals, wood, foam, and textiles. Their ability to form strong and durable bonds with minimal surface preparation makes them suitable for diverse applications such as automotive assembly, construction, woodworking, packaging, and DIY projects. Moreover, spray adhesives offer benefits such as uniform coverage, fast drying times, and ease of application, improving production efficiency and reducing labor costs. As industries seek reliable and cost-effective bonding solutions to streamline processes and enhance product quality, the demand for spray adhesives is expected to continue growing.

A significant opportunity for the spray adhesives market lies in expanding into specialty applications and emerging markets where adhesive requirements are evolving. Specialty applications such as aerospace, marine, medical, and electronics industries demand adhesives with specific properties such as high temperature resistance, chemical resistance, and biocompatibility. By developing specialized formulations tailored to these niche markets, manufacturers can address the unique needs of customers and unlock new revenue streams. Additionally, expanding into emerging markets in regions such as Asia-Pacific, Latin America, and Africa presents opportunities for growth, as rapid industrialization, urbanization, and infrastructure development drive demand for adhesive products. By establishing strategic partnerships, investing in distribution networks, and adapting product offerings to local market preferences and regulations, manufacturers can capitalize on the untapped potential of these markets and gain a competitive advantage in the global spray adhesives industry.

Within the dynamic landscape of the Spray Adhesives Market, the Solvent-based segment is the largest, owing to its versatility and widespread applications across various industries. Solvent-based spray adhesives are prized for their strong bonding capabilities, fast drying times, and compatibility with a wide range of substrates, including plastics, metals, and textiles. These adhesives find extensive use in automotive, construction, packaging, and woodworking industries, where robust and durable bonds are essential. Moreover, solvent-based formulations offer advantages such as resistance to moisture, temperature fluctuations, and chemicals, making them ideal for demanding environments and applications. Despite growing environmental concerns and regulatory pressures to reduce volatile organic compound (VOC) emissions, solvent-based spray adhesives continue to maintain their dominance due to their superior performance and reliability in critical bonding tasks. However, ongoing efforts to develop eco-friendly alternatives and improve the sustainability profile of solvent-based adhesives shape the future trajectory of this segment in the evolving landscape of the spray adhesives market.

Amidst the diverse array of resin types in the Spray Adhesives Market, Polyurethane is the fastest-growing segment, driven by its exceptional versatility, performance, and adaptability to a myriad of applications. Polyurethane-based spray adhesives offer a winning combination of high bond strength, flexibility, and resistance to various environmental factors, making them ideal for a wide range of substrates and end uses. From automotive assembly and construction to woodworking and packaging, polyurethane adhesives excel in demanding bonding tasks where durability and reliability are paramount. Moreover, innovations in polyurethane resin technology, such as moisture-curing formulations and low-VOC options, have further expanded the appeal of these adhesives, addressing environmental concerns and regulatory requirements while maintaining superior performance. As industries continue to seek efficient and cost-effective bonding solutions, the Polyurethane segment is poised to witness sustained growth, driving the evolution of the spray adhesives market towards greater efficiency, sustainability, and versatility.

In the expansive spectrum of the Spray Adhesives Market, the Building and Construction segment is the largest, propelled by the indispensable role of spray adhesives in various construction applications. From bonding insulation materials and drywall to installing flooring and laminates, spray adhesives play a pivotal role in enhancing efficiency, durability, and aesthetics in construction projects. The demand for spray adhesives in the building and construction sector is driven by rapid urbanization, infrastructure development, and a growing emphasis on sustainable building practices. Additionally, the versatility of spray adhesives in accommodating diverse substrates and bonding requirements, coupled with advancements in adhesive technology that offer improved performance and environmental sustainability, further bolster the dominance of this segment. As construction activities continue to expand globally, fuelled by population growth and urbanization trends, the Building and Construction segment is poised to maintain its status as the cornerstone of the spray adhesives market, ensuring robust bonding solutions for a wide range of construction applications.

By Type

Solvent-based

Water-based

Hot Melt

By Resin

Epoxy

Polyurethane

Synthetic Rubber

Vinyl Acetate Ethylene

By End-User

Building and Construction

Packaging

Furniture

Transportation

Textile

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

AFT Aerosols

Arkema SA

Avery Dennison Corp

Blu-Sky UK Ltd

Casa Adhesive Inc

Chemique Adhesives & Sealants Ltd

Gemini Adhesives Ltd

H.B. Fuller Company

Henkel AG & Co. KGaA

Illinois Tool Works

Kissel + Wolf GmbH

Philips Manufacturing

Powerbond

Quin Global

Sika AG

Spray-Lock Inc

The Kroger Co.

Westech Aerosol Corp

Worthen Industries

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Spray Adhesives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Spray Adhesives Market Size Outlook, $ Million, 2021 to 2032

3.2 Spray Adhesives Market Outlook by Type, $ Million, 2021 to 2032

3.3 Spray Adhesives Market Outlook by Product, $ Million, 2021 to 2032

3.4 Spray Adhesives Market Outlook by Application, $ Million, 2021 to 2032

3.5 Spray Adhesives Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Spray Adhesives Industry

4.2 Key Market Trends in Spray Adhesives Industry

4.3 Potential Opportunities in Spray Adhesives Industry

4.4 Key Challenges in Spray Adhesives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Spray Adhesives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Spray Adhesives Market Outlook by Segments

7.1 Spray Adhesives Market Outlook by Segments, $ Million, 2021- 2032

By Type

Solvent-based

Water-based

Hot Melt

By Resin

Epoxy

Polyurethane

Synthetic Rubber

Vinyl Acetate Ethylene

By End-User

Building and Construction

Packaging

Furniture

Transportation

Textile

Others

8 North America Spray Adhesives Market Analysis and Outlook To 2032

8.1 Introduction to North America Spray Adhesives Markets in 2024

8.2 North America Spray Adhesives Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Spray Adhesives Market size Outlook by Segments, 2021-2032

By Type

Solvent-based

Water-based

Hot Melt

By Resin

Epoxy

Polyurethane

Synthetic Rubber

Vinyl Acetate Ethylene

By End-User

Building and Construction

Packaging

Furniture

Transportation

Textile

Others

9 Europe Spray Adhesives Market Analysis and Outlook To 2032

9.1 Introduction to Europe Spray Adhesives Markets in 2024

9.2 Europe Spray Adhesives Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Spray Adhesives Market Size Outlook by Segments, 2021-2032

By Type

Solvent-based

Water-based

Hot Melt

By Resin

Epoxy

Polyurethane

Synthetic Rubber

Vinyl Acetate Ethylene

By End-User

Building and Construction

Packaging

Furniture

Transportation

Textile

Others

10 Asia Pacific Spray Adhesives Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Spray Adhesives Markets in 2024

10.2 Asia Pacific Spray Adhesives Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Spray Adhesives Market size Outlook by Segments, 2021-2032

By Type

Solvent-based

Water-based

Hot Melt

By Resin

Epoxy

Polyurethane

Synthetic Rubber

Vinyl Acetate Ethylene

By End-User

Building and Construction

Packaging

Furniture

Transportation

Textile

Others

11 South America Spray Adhesives Market Analysis and Outlook To 2032

11.1 Introduction to South America Spray Adhesives Markets in 2024

11.2 South America Spray Adhesives Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Spray Adhesives Market size Outlook by Segments, 2021-2032

By Type

Solvent-based

Water-based

Hot Melt

By Resin

Epoxy

Polyurethane

Synthetic Rubber

Vinyl Acetate Ethylene

By End-User

Building and Construction

Packaging

Furniture

Transportation

Textile

Others

12 Middle East and Africa Spray Adhesives Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Spray Adhesives Markets in 2024

12.2 Middle East and Africa Spray Adhesives Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Spray Adhesives Market size Outlook by Segments, 2021-2032

By Type

Solvent-based

Water-based

Hot Melt

By Resin

Epoxy

Polyurethane

Synthetic Rubber

Vinyl Acetate Ethylene

By End-User

Building and Construction

Packaging

Furniture

Transportation

Textile

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

AFT Aerosols

Arkema SA

Avery Dennison Corp

Blu-Sky UK Ltd

Casa Adhesive Inc

Chemique Adhesives & Sealants Ltd

Gemini Adhesives Ltd

H.B. Fuller Company

Henkel AG & Co. KGaA

Illinois Tool Works

Kissel + Wolf GmbH

Philips Manufacturing

Powerbond

Quin Global

Sika AG

Spray-Lock Inc

The Kroger Co.

Westech Aerosol Corp

Worthen Industries

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Solvent-based

Water-based

Hot Melt

By Resin

Epoxy

Polyurethane

Synthetic Rubber

Vinyl Acetate Ethylene

By End-User

Building and Construction

Packaging

Furniture

Transportation

Textile

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Spray Adhesives Market Size is valued at $3.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.2% to reach $5.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, AFT Aerosols, Arkema SA, Avery Dennison Corp, Blu-Sky UK Ltd, Casa Adhesive Inc, Chemique Adhesives & Sealants Ltd, Gemini Adhesives Ltd, H.B. Fuller Company, Henkel AG & Co. KGaA, Illinois Tool Works, Kissel + Wolf GmbH, Philips Manufacturing, Powerbond, Quin Global, Sika AG, Spray-Lock Inc, The Kroger Co., Westech Aerosol Corp, Worthen Industries

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume