The global Sports Composites Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Glass-Fibre Reinforced, Carbon-Fibre Reinforced, Others), By Resin (Epoxy, Polyurethane, Others), By Application (Golf Shafts, Hockey Sticks, Rackets, Bicycles, Skis and Snowboards, Others).

Sports composites, engineered materials combining high-performance fibers with resin matrices, remain at the forefront of innovation in sports equipment and automotive industries in 2024. These advanced materials offer superior strength-to-weight ratio, impact resistance, and vibration damping properties, making them ideal for applications such as bicycles, tennis rackets, golf clubs, and automotive components. In sports equipment, carbon fiber and fiberglass composites provide athletes with lightweight yet durable products that enhance performance and durability. Further, in automotive manufacturing, sports composites enable the production of lightweight, fuel-efficient vehicles with improved safety and performance characteristics. With continuous research and development efforts aimed at optimizing material properties, manufacturing processes, and cost-effectiveness, the market for sports composites s to expand, offering exciting opportunities for innovation in sports technology and automotive engineering.

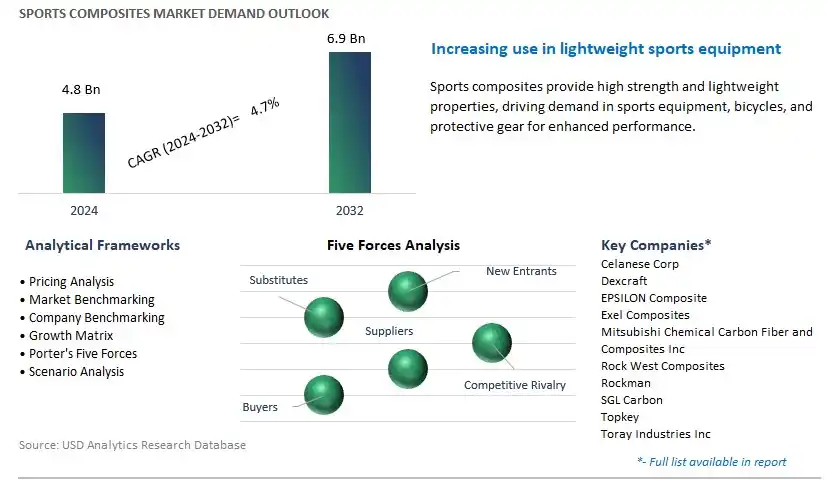

The market report analyses the leading companies in the industry including Celanese Corp, Dexcraft, EPSILON Composite, Exel Composites, Mitsubishi Chemical Carbon Fiber and Composites Inc, Rock West Composites, Rockman, SGL Carbon, Topkey, Toray Industries Inc, and others.

In the realm of sports composites, a significant trend revolves around the demand for lightweight and high-performance materials for sports equipment. Athletes and sports enthusiasts are increasingly seeking equipment that offers enhanced performance without compromising durability or safety. This trend has led to the widespread adoption of composite materials such as carbon fiber, fiberglass, and aramid fibers in the manufacturing of sporting goods such as tennis rackets, golf clubs, bicycles, and snowboards. Sports equipment manufacturers are continuously innovating to develop composites that provide superior strength-to-weight ratios, stiffness, and impact resistance, enabling athletes to push the boundaries of their performance.

The primary driver for the sports composites market is the pursuit of performance enhancement and customization in sports equipment. Athletes at all levels, from amateurs to professionals, are constantly seeking ways to improve their performance and gain a competitive edge. Composite materials offer the versatility to tailor equipment to individual preferences and playing styles, allowing athletes to optimize their performance based on specific needs and requirements. Additionally, the use of composites enables manufacturers to design equipment with intricate shapes, aerodynamic profiles, and optimized weight distribution, leading to improved handling, power transfer, and control. As sports continue to evolve and become more competitive, the demand for sports composites that offer superior performance and customization capabilities is expected to grow.

A promising opportunity for the sports composites market lies in expanding into wearable sports technology, where composites can be integrated into performance-enhancing apparel and accessories. Wearable sports technology encompasses a wide range of products such as smart fabrics, sensor-equipped garments, and biomechanical monitoring devices that enhance athletes' performance, safety, and training effectiveness. Composite materials can be incorporated into sportswear to provide features such as moisture management, impact protection, and muscle support, improving comfort and performance during athletic activities. Furthermore, composites can be used to reinforce protective gear such as helmets, shin guards, and body armor, enhancing impact resistance and reducing the risk of injuries. By leveraging their expertise in composite materials and collaborating with wearable technology companies, sports equipment manufacturers can capitalize on the growing demand for innovative solutions that merge performance-enhancing materials with cutting-edge technology, thus creating new revenue streams and market opportunities in the rapidly evolving wearable sports technology sector.

In the Sports Composites Market, the Glass-Fibre Reinforced segment stands out as the largest segment, primarily due to its widespread use and versatile applications across various sports equipment and accessories. Glass-fibre reinforced composites offer a compelling combination of strength, stiffness, durability, and cost-effectiveness, making them the material of choice for a wide range of sporting goods. From bicycles and golf clubs to tennis rackets and hockey sticks, glass-fibre reinforced composites play a crucial role in enhancing performance, durability, and lightweight design in sports equipment. Moreover, the affordability and ease of manufacturing of glass-fibre reinforced composites contribute to their extensive adoption by sports equipment manufacturers worldwide. With the growing participation in sports activities and increasing demand for high-performance sporting goods, especially in emerging markets, the demand for glass-fibre reinforced composites continues to rise, reinforcing its position as the largest segment in the Sports Composites Market. Additionally, ongoing advancements in composite materials and manufacturing processes further drive the growth and innovation within the glass-fibre reinforced segment, sustaining its dominance in the market.

Among the resins shaping the Sports Composites Market, Polyurethane is the standout performer, boasting remarkable growth. Polyurethane's ascendancy is propelled by its unique properties, which cater perfectly to the demands of sports equipment manufacturing. Its exceptional durability, lightweight nature, and ability to withstand extreme conditions make it an ideal choice for producing high-performance sporting goods. From lightweight bicycle frames to durable hockey sticks, polyurethane composites are revolutionizing the sports equipment industry. Additionally, advancements in polyurethane resin technology have led to the development of innovative products that enhance athlete performance while ensuring safety and longevity. As consumer preferences increasingly lean towards lighter, more durable sports equipment, the demand for polyurethane composites continues to surge, driving unprecedented growth in the Sports Composites Market. With its versatility and adaptability, Polyurethane stands out as the most lucrative segment in shaping the future of sports composites.

Within the diverse landscape of the Sports Composites Market, Bicycles emerge as the largest segment, and for good reason. The exponential growth of the bicycle industry, fuelled by a global shift towards sustainable transportation and a growing focus on health and fitness, has significantly bolstered the demand for high-performance bicycle components. Composite materials, including carbon fiber reinforced polymers, have become integral to the manufacturing of bicycle frames, wheels, and other critical parts due to their exceptional strength-to-weight ratio and flexibility in design. As cycling gains momentum as both a recreational activity and a mode of transportation, manufacturers are continually innovating to produce lighter, stronger, and more aerodynamic bicycles, driving the expansion of the sports composites market. Moreover, the increasing adoption of composite materials by professional cyclists and enthusiasts alike underscores the pivotal role of bicycles in shaping the growth trajectory of the sports composites industry.

By Type

Glass-Fibre Reinforced

Carbon-Fibre Reinforced

Others

By Resin

Epoxy

Polyurethane

Others

By Application

Golf Shafts

Hockey Sticks

Rackets

Bicycles

Skis and Snowboards

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Celanese Corp

Dexcraft

EPSILON Composite

Exel Composites

Mitsubishi Chemical Carbon Fiber and Composites Inc

Rock West Composites

Rockman

SGL Carbon

Topkey

Toray Industries Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Sports Composites Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Sports Composites Market Size Outlook, $ Million, 2021 to 2032

3.2 Sports Composites Market Outlook by Type, $ Million, 2021 to 2032

3.3 Sports Composites Market Outlook by Product, $ Million, 2021 to 2032

3.4 Sports Composites Market Outlook by Application, $ Million, 2021 to 2032

3.5 Sports Composites Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Sports Composites Industry

4.2 Key Market Trends in Sports Composites Industry

4.3 Potential Opportunities in Sports Composites Industry

4.4 Key Challenges in Sports Composites Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Sports Composites Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Sports Composites Market Outlook by Segments

7.1 Sports Composites Market Outlook by Segments, $ Million, 2021- 2032

By Type

Glass-Fibre Reinforced

Carbon-Fibre Reinforced

Others

By Resin

Epoxy

Polyurethane

Others

By Application

Golf Shafts

Hockey Sticks

Rackets

Bicycles

Skis and Snowboards

Others

8 North America Sports Composites Market Analysis and Outlook To 2032

8.1 Introduction to North America Sports Composites Markets in 2024

8.2 North America Sports Composites Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Sports Composites Market size Outlook by Segments, 2021-2032

By Type

Glass-Fibre Reinforced

Carbon-Fibre Reinforced

Others

By Resin

Epoxy

Polyurethane

Others

By Application

Golf Shafts

Hockey Sticks

Rackets

Bicycles

Skis and Snowboards

Others

9 Europe Sports Composites Market Analysis and Outlook To 2032

9.1 Introduction to Europe Sports Composites Markets in 2024

9.2 Europe Sports Composites Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Sports Composites Market Size Outlook by Segments, 2021-2032

By Type

Glass-Fibre Reinforced

Carbon-Fibre Reinforced

Others

By Resin

Epoxy

Polyurethane

Others

By Application

Golf Shafts

Hockey Sticks

Rackets

Bicycles

Skis and Snowboards

Others

10 Asia Pacific Sports Composites Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Sports Composites Markets in 2024

10.2 Asia Pacific Sports Composites Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Sports Composites Market size Outlook by Segments, 2021-2032

By Type

Glass-Fibre Reinforced

Carbon-Fibre Reinforced

Others

By Resin

Epoxy

Polyurethane

Others

By Application

Golf Shafts

Hockey Sticks

Rackets

Bicycles

Skis and Snowboards

Others

11 South America Sports Composites Market Analysis and Outlook To 2032

11.1 Introduction to South America Sports Composites Markets in 2024

11.2 South America Sports Composites Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Sports Composites Market size Outlook by Segments, 2021-2032

By Type

Glass-Fibre Reinforced

Carbon-Fibre Reinforced

Others

By Resin

Epoxy

Polyurethane

Others

By Application

Golf Shafts

Hockey Sticks

Rackets

Bicycles

Skis and Snowboards

Others

12 Middle East and Africa Sports Composites Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Sports Composites Markets in 2024

12.2 Middle East and Africa Sports Composites Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Sports Composites Market size Outlook by Segments, 2021-2032

By Type

Glass-Fibre Reinforced

Carbon-Fibre Reinforced

Others

By Resin

Epoxy

Polyurethane

Others

By Application

Golf Shafts

Hockey Sticks

Rackets

Bicycles

Skis and Snowboards

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Celanese Corp

Dexcraft

EPSILON Composite

Exel Composites

Mitsubishi Chemical Carbon Fiber and Composites Inc

Rock West Composites

Rockman

SGL Carbon

Topkey

Toray Industries Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Glass-Fibre Reinforced

Carbon-Fibre Reinforced

Others

By Resin

Epoxy

Polyurethane

Others

By Application

Golf Shafts

Hockey Sticks

Rackets

Bicycles

Skis and Snowboards

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Sports Composites Market Size is valued at $4.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.7% to reach $6.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Celanese Corp, Dexcraft, EPSILON Composite, Exel Composites, Mitsubishi Chemical Carbon Fiber and Composites Inc, Rock West Composites, Rockman, SGL Carbon, Topkey, Toray Industries Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume