The global Solvent Based Adhesives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Chemistry (Polyurethane, Acrylic, Polyamide, Vinyl Acetate, Chloroprene Rubber, PVC Copolymers, Natural Rubber, Synthesized Rubber, Nitrile Rubber, Others), By End-User (Paper & Packaging, Building & Construction, Woodworking, Automotive, Aerospace, Medical, Leather & Footwear, Others).

Solvent-based adhesives to be widely used in various industries in 2024, despite increasing regulatory scrutiny and environmental concerns associated with volatile organic compounds (VOCs). These adhesives, formulated with organic solvents such as toluene, xylene, and acetone, offer fast curing times, strong bonding strength, and compatibility with a wide range of substrates including plastics, metals, and ceramics. In industries such as automotive, construction, packaging, and woodworking, solvent-based adhesives are preferred for their ability to bond dissimilar materials and withstand harsh environmental conditions. However, with growing awareness of environmental and health hazards posed by VOC emissions, there is a shift towards water-based and solvent-free adhesive formulations. Nevertheless, solvent-based adhesives to be utilized in specialized applications where their unique properties and performance characteristics are essential.

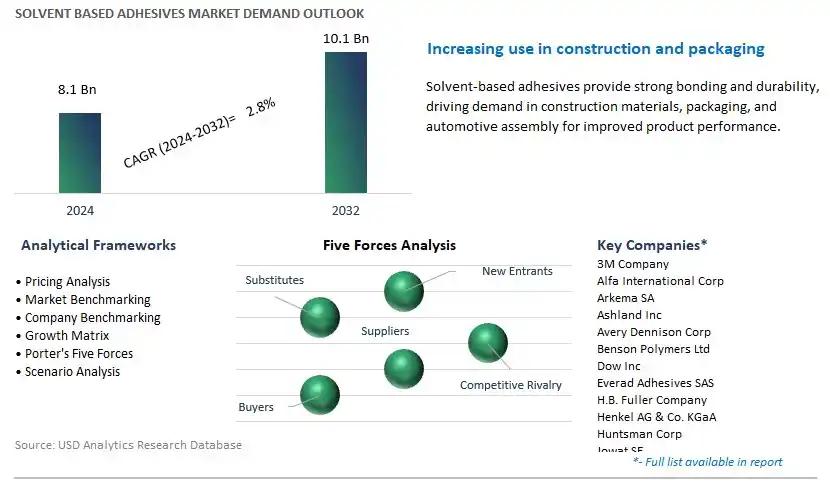

The market report analyses the leading companies in the industry including 3M Company, Alfa International Corp, Arkema SA, Ashland Inc, Avery Dennison Corp, Benson Polymers Ltd, Dow Inc, Everad Adhesives SAS, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corp, Jowat SE, LORD Corp, Sika AG, and others.

One prominent market trend in solvent-based adhesives is the shift towards environmentally friendly formulations and low VOC (volatile organic compound) adhesives. With increasing awareness of environmental concerns and regulatory restrictions on air quality, there is a growing demand for adhesives that have reduced emissions of harmful VOCs. Manufacturers are investing in research and development to formulate solvent-based adhesives with lower VOC content while maintaining high performance and bonding strength. This trend is driven by consumer preferences for sustainable products, as well as by regulations promoting the use of eco-friendly adhesives in various industries such as construction, automotive, and packaging.

A key market driver for solvent-based adhesives is their versatility and performance in bonding applications. Solvent-based adhesives offer strong adhesion to a wide range of substrates, including metals, plastics, wood, and composites, making them suitable for various industrial and commercial applications. They provide fast curing times, high bond strength, and excellent resistance to temperature, moisture, and chemicals, making them ideal for demanding bonding requirements in automotive assembly, construction projects, and packaging applications. The reliability and efficiency of solvent-based adhesives drive their continued adoption in industries where strong and durable bonds are essential for product quality and performance.

An emerging opportunity in the solvent-based adhesives market lies in the development of specialty applications and customized formulations. As industries evolve and demand for tailored adhesive solutions grows, there is an opportunity for adhesive manufacturers to innovate and develop specialized formulations to meet specific customer requirements and niche applications. This includes adhesive formulations optimized for high temperature resistance, flexibility, UV stability, or specific bonding substrates. By collaborating with customers and understanding their unique needs, adhesive manufacturers can create customized formulations that address specific challenges and provide value-added solutions. Additionally, there is an opportunity to expand into emerging markets such as medical devices, electronics, and aerospace, where specialized adhesive properties are critical for performance and reliability. By focusing on innovation and customization, companies can differentiate themselves in the market and capitalize on niche opportunities for growth.

The Polyurethane segment stands out as the largest segment in the solvent-based adhesives market due to its versatility and wide-ranging applications. Polyurethane adhesives offer exceptional bonding strength, flexibility, durability, and resistance to various environmental factors, making them suitable for diverse industries and applications. These adhesives are extensively used in automotive manufacturing, construction, woodworking, footwear, packaging, and assembly operations, among others. The dominance of polyurethane adhesives is attributed to their ability to bond a wide variety of substrates, including metals, plastics, wood, glass, and composites, with excellent adhesion properties even under challenging conditions such as high temperatures and exposure to moisture. Additionally, advancements in polyurethane chemistry have led to the development of low-VOC (volatile organic compound) formulations, water-based polyurethane adhesives, and hybrid polyurethane systems, catering to the growing demand for eco-friendly and sustainable adhesive solutions. Therefore, the exceptional properties, versatility, and continuous innovation in polyurethane adhesives solidify their position as the largest segment in the solvent-based adhesives market.

The Medical segment is the fastest-growing segment in the solvent-based adhesives market. Solvent-based adhesives find increasing applications in the medical industry for bonding various medical devices, surgical instruments, and disposable medical products. These adhesives offer high bond strength, biocompatibility, and sterilization resistance, making them suitable for use in critical medical applications such as wound closure, bandage assembly, medical device assembly, and transdermal drug delivery systems. The growing demand for minimally invasive medical procedures, wearable medical devices, and advanced wound care products further accelerates the adoption of solvent-based adhesives in the medical sector. Additionally, technological advancements in adhesive formulations, such as medical-grade cyanoacrylate adhesives and pressure-sensitive adhesives, cater to the specific requirements of medical device manufacturers and healthcare professionals. Therefore, the increasing demand for solvent-based adhesives in medical applications, driven by the growing healthcare industry and advancements in medical technology, positions the Medical segment as the fastest-growing in the solvent-based adhesives market.

By Chemistry

Polyurethane

Acrylic

Polyamide

Vinyl Acetate

Chloroprene Rubber

PVC Copolymers

Natural Rubber

Synthesized Rubber

Nitrile Rubber

Others

By End-User

Paper & Packaging

Building & Construction

Woodworking

Automotive

Aerospace

Medical

Leather & Footwear

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Alfa International Corp

Arkema SA

Ashland Inc

Avery Dennison Corp

Benson Polymers Ltd

Dow Inc

Everad Adhesives SAS

H.B. Fuller Company

Henkel AG & Co. KGaA

Huntsman Corp

Jowat SE

LORD Corp

Sika AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Solvent Based Adhesives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Solvent Based Adhesives Market Size Outlook, $ Million, 2021 to 2032

3.2 Solvent Based Adhesives Market Outlook by Type, $ Million, 2021 to 2032

3.3 Solvent Based Adhesives Market Outlook by Product, $ Million, 2021 to 2032

3.4 Solvent Based Adhesives Market Outlook by Application, $ Million, 2021 to 2032

3.5 Solvent Based Adhesives Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Solvent Based Adhesives Industry

4.2 Key Market Trends in Solvent Based Adhesives Industry

4.3 Potential Opportunities in Solvent Based Adhesives Industry

4.4 Key Challenges in Solvent Based Adhesives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Solvent Based Adhesives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Solvent Based Adhesives Market Outlook by Segments

7.1 Solvent Based Adhesives Market Outlook by Segments, $ Million, 2021- 2032

By Chemistry

Polyurethane

Acrylic

Polyamide

Vinyl Acetate

Chloroprene Rubber

PVC Copolymers

Natural Rubber

Synthesized Rubber

Nitrile Rubber

Others

By End-User

Paper & Packaging

Building & Construction

Woodworking

Automotive

Aerospace

Medical

Leather & Footwear

Others

8 North America Solvent Based Adhesives Market Analysis and Outlook To 2032

8.1 Introduction to North America Solvent Based Adhesives Markets in 2024

8.2 North America Solvent Based Adhesives Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Solvent Based Adhesives Market size Outlook by Segments, 2021-2032

By Chemistry

Polyurethane

Acrylic

Polyamide

Vinyl Acetate

Chloroprene Rubber

PVC Copolymers

Natural Rubber

Synthesized Rubber

Nitrile Rubber

Others

By End-User

Paper & Packaging

Building & Construction

Woodworking

Automotive

Aerospace

Medical

Leather & Footwear

Others

9 Europe Solvent Based Adhesives Market Analysis and Outlook To 2032

9.1 Introduction to Europe Solvent Based Adhesives Markets in 2024

9.2 Europe Solvent Based Adhesives Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Solvent Based Adhesives Market Size Outlook by Segments, 2021-2032

By Chemistry

Polyurethane

Acrylic

Polyamide

Vinyl Acetate

Chloroprene Rubber

PVC Copolymers

Natural Rubber

Synthesized Rubber

Nitrile Rubber

Others

By End-User

Paper & Packaging

Building & Construction

Woodworking

Automotive

Aerospace

Medical

Leather & Footwear

Others

10 Asia Pacific Solvent Based Adhesives Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Solvent Based Adhesives Markets in 2024

10.2 Asia Pacific Solvent Based Adhesives Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Solvent Based Adhesives Market size Outlook by Segments, 2021-2032

By Chemistry

Polyurethane

Acrylic

Polyamide

Vinyl Acetate

Chloroprene Rubber

PVC Copolymers

Natural Rubber

Synthesized Rubber

Nitrile Rubber

Others

By End-User

Paper & Packaging

Building & Construction

Woodworking

Automotive

Aerospace

Medical

Leather & Footwear

Others

11 South America Solvent Based Adhesives Market Analysis and Outlook To 2032

11.1 Introduction to South America Solvent Based Adhesives Markets in 2024

11.2 South America Solvent Based Adhesives Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Solvent Based Adhesives Market size Outlook by Segments, 2021-2032

By Chemistry

Polyurethane

Acrylic

Polyamide

Vinyl Acetate

Chloroprene Rubber

PVC Copolymers

Natural Rubber

Synthesized Rubber

Nitrile Rubber

Others

By End-User

Paper & Packaging

Building & Construction

Woodworking

Automotive

Aerospace

Medical

Leather & Footwear

Others

12 Middle East and Africa Solvent Based Adhesives Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Solvent Based Adhesives Markets in 2024

12.2 Middle East and Africa Solvent Based Adhesives Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Solvent Based Adhesives Market size Outlook by Segments, 2021-2032

By Chemistry

Polyurethane

Acrylic

Polyamide

Vinyl Acetate

Chloroprene Rubber

PVC Copolymers

Natural Rubber

Synthesized Rubber

Nitrile Rubber

Others

By End-User

Paper & Packaging

Building & Construction

Woodworking

Automotive

Aerospace

Medical

Leather & Footwear

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Alfa International Corp

Arkema SA

Ashland Inc

Avery Dennison Corp

Benson Polymers Ltd

Dow Inc

Everad Adhesives SAS

H.B. Fuller Company

Henkel AG & Co. KGaA

Huntsman Corp

Jowat SE

LORD Corp

Sika AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Chemistry

Polyurethane

Acrylic

Polyamide

Vinyl Acetate

Chloroprene Rubber

PVC Copolymers

Natural Rubber

Synthesized Rubber

Nitrile Rubber

Others

By End-User

Paper & Packaging

Building & Construction

Woodworking

Automotive

Aerospace

Medical

Leather & Footwear

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Solvent Based Adhesives Market Size is valued at $8.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 2.8% to reach $10.1 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Alfa International Corp, Arkema SA, Ashland Inc, Avery Dennison Corp, Benson Polymers Ltd, Dow Inc, Everad Adhesives SAS, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corp, Jowat SE, LORD Corp, Sika AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume