The global Solid Tumor Testing Marketstudy analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Genetic Testing, Conventional Testing), By Application (Prostate, Breast, Colorectal, Endometrial, Lung, Melanoma, Brain, Thyroid, Liver, Ovarian, Others), By End-user (Pharmaceutical and Biotechnology Companies, Hospitals, Contract Research Organizations, Academic Research Institutions).

Empowering precision oncology and personalized cancer treatment, the Solid Tumor Testing Market offers comprehensive genomic profiling and molecular diagnostic tests designed to identify genetic alterations, biomarkers, and therapeutic targets in solid tumors for guiding treatment decisions and optimizing patient outcomes. Solid tumor testing encompasses a variety of techniques, including next-generation sequencing (NGS), polymerase chain reaction (PCR), fluorescence in situ hybridization (FISH), and immunohistochemistry (IHC), performed on tumor tissue samples or liquid biopsies. This market serves oncologists, pathologists, and cancer care teams seeking to characterize tumors, predict treatment responses, and select targeted therapies based on individual tumor molecular profiles. Providers include diagnostic laboratories, molecular diagnostics companies, and academic medical centers, offering advanced testing services and comprehensive genomic panels for various cancer types. With the increasing complexity of cancer biology, the advent of targeted therapies, and the emergence of immunotherapy approaches, the demand for solid tumor testing continues to grow, driven by efforts to improve treatment outcomes and reduce treatment-related toxicities in cancer patients. As oncology practices embrace precision medicine and molecularly guided treatment strategies, solid tumor testing plays a pivotal role in advancing personalized cancer care and shaping the future of oncology practice.

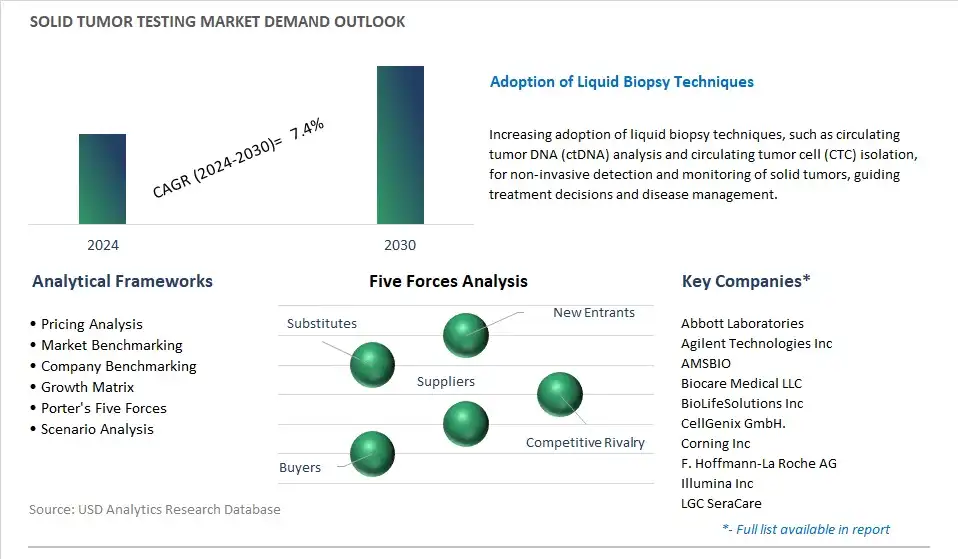

A prominent trend in the Solid Tumor Testing market is the shift towards precision oncology and personalized medicine approaches for cancer diagnosis and treatment. With advancements in genomic sequencing technologies and molecular profiling techniques, there's a growing understanding of the genetic alterations and molecular signatures underlying solid tumors. This trend has led to the development of targeted therapies and immunotherapies that are tailored to individual patients' tumor profiles, offering the potential for more effective and personalized treatment strategies. As a result, there's increasing demand for comprehensive solid tumor testing solutions that provide accurate molecular characterization of tumors to guide treatment decisions and improve patient outcomes.

A key driver propelling the growth of the Solid Tumor Testing market is the rising incidence of solid tumors and the increasing cancer burden globally. Solid tumors, including those of the lung, breast, colon, and prostate, are among the most common cancers worldwide, contributing to significant morbidity and mortality. As cancer incidence continues to rise due to factors such as aging populations, lifestyle changes, and environmental exposures, there's a growing need for accurate and timely diagnosis, prognosis, and treatment selection. Solid tumor testing plays a crucial role in oncology care by enabling the detection of genetic mutations, biomarkers, and molecular alterations that inform treatment decisions and guide personalized therapy approaches, driving market demand for comprehensive testing solutions.

An opportunity in the Solid Tumor Testing market lies in the expansion into liquid biopsy and minimal residual disease (MRD) monitoring technologies for early cancer detection and treatment monitoring. Liquid biopsy techniques, which analyze circulating tumor DNA (ctDNA), RNA, and proteins in blood samples, offer non-invasive methods for detecting tumor-specific mutations and monitoring treatment response over time. Similarly, MRD monitoring involves detecting residual cancer cells in patients who have undergone treatment, allowing for early detection of disease recurrence and adjustment of therapy accordingly. By investing in research and development efforts focused on liquid biopsy technologies and MRD detection assays, companies can expand their offerings to include complementary testing solutions that enhance cancer detection sensitivity, improve patient management, and address unmet needs in cancer care. Additionally, partnering with pharmaceutical companies and healthcare providers to integrate liquid biopsy and MRD monitoring into clinical practice can create opportunities for market growth and adoption of innovative testing approaches in oncology.

By Type

Genetic Testing

-Next generation sequencing

-Real-time PCR

-Fluorescent In-Situ Hybridization

-Fragment Analysis

Conventional Testing

By Application

Prostate

Breast

Colorectal

Endometrial

Lung

Melanoma

Brain

Thyroid

Liver

Ovarian

Others

By End-User

Pharmaceutical and Biotechnology Companies

Hospitals

Contract Research Organizations

Academic Research Institutions

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Abbott Laboratories

Agilent Technologies Inc

AMSBIO

Biocare Medical LLC

BioLifeSolutions Inc

CellGenix GmbH.

Corning Inc

F. Hoffmann-La Roche AG

Illumina Inc

LGC SeraCare

MedGenome Labs Private Ltd

Myriad Genetics Inc

Princeton CryoTech

QIAGEN

Quest Diagnostics Inc

STEMCELL Technologies Inc

Thermo Fisher Scientific Inc

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Solid Tumor Testing Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Solid Tumor Testing Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Solid Tumor Testing Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Solid Tumor Testing Market Size Outlook, $ Million, 2021 to 2030

3.2 Solid Tumor Testing Market Outlook by Type, $ Million, 2021 to 2030

3.3 Solid Tumor Testing Market Outlook by Product, $ Million, 2021 to 2030

3.4 Solid Tumor Testing Market Outlook by Application, $ Million, 2021 to 2030

3.5 Solid Tumor Testing Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Solid Tumor Testing Industry

4.2 Key Market Trends in Solid Tumor Testing Industry

4.3 Potential Opportunities in Solid Tumor Testing Industry

4.4 Key Challenges in Solid Tumor Testing Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Solid Tumor Testing Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Solid Tumor Testing Market Outlook by Segments

7.1 Solid Tumor Testing Market Outlook by Segments, $ Million, 2021- 2030

By Type

Genetic Testing

-Next generation sequencing

-Real-time PCR

-Fluorescent In-Situ Hybridization

-Fragment Analysis

Conventional Testing

By Application

Prostate

Breast

Colorectal

Endometrial

Lung

Melanoma

Brain

Thyroid

Liver

Ovarian

Others

By End-User

Pharmaceutical and Biotechnology Companies

Hospitals

Contract Research Organizations

Academic Research Institutions

8 North America Solid Tumor Testing Market Analysis and Outlook To 2030

8.1 Introduction to North America Solid Tumor Testing Markets in 2024

8.2 North America Solid Tumor Testing Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Solid Tumor Testing Market size Outlook by Segments, 2021-2030

By Type

Genetic Testing

-Next generation sequencing

-Real-time PCR

-Fluorescent In-Situ Hybridization

-Fragment Analysis

Conventional Testing

By Application

Prostate

Breast

Colorectal

Endometrial

Lung

Melanoma

Brain

Thyroid

Liver

Ovarian

Others

By End-User

Pharmaceutical and Biotechnology Companies

Hospitals

Contract Research Organizations

Academic Research Institutions

9 Europe Solid Tumor Testing Market Analysis and Outlook To 2030

9.1 Introduction to Europe Solid Tumor Testing Markets in 2024

9.2 Europe Solid Tumor Testing Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Solid Tumor Testing Market Size Outlook by Segments, 2021-2030

By Type

Genetic Testing

-Next generation sequencing

-Real-time PCR

-Fluorescent In-Situ Hybridization

-Fragment Analysis

Conventional Testing

By Application

Prostate

Breast

Colorectal

Endometrial

Lung

Melanoma

Brain

Thyroid

Liver

Ovarian

Others

By End-User

Pharmaceutical and Biotechnology Companies

Hospitals

Contract Research Organizations

Academic Research Institutions

10 Asia Pacific Solid Tumor Testing Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Solid Tumor Testing Markets in 2024

10.2 Asia Pacific Solid Tumor Testing Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Solid Tumor Testing Market size Outlook by Segments, 2021-2030

By Type

Genetic Testing

-Next generation sequencing

-Real-time PCR

-Fluorescent In-Situ Hybridization

-Fragment Analysis

Conventional Testing

By Application

Prostate

Breast

Colorectal

Endometrial

Lung

Melanoma

Brain

Thyroid

Liver

Ovarian

Others

By End-User

Pharmaceutical and Biotechnology Companies

Hospitals

Contract Research Organizations

Academic Research Institutions

11 South America Solid Tumor Testing Market Analysis and Outlook To 2030

11.1 Introduction to South America Solid Tumor Testing Markets in 2024

11.2 South America Solid Tumor Testing Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Solid Tumor Testing Market size Outlook by Segments, 2021-2030

By Type

Genetic Testing

-Next generation sequencing

-Real-time PCR

-Fluorescent In-Situ Hybridization

-Fragment Analysis

Conventional Testing

By Application

Prostate

Breast

Colorectal

Endometrial

Lung

Melanoma

Brain

Thyroid

Liver

Ovarian

Others

By End-User

Pharmaceutical and Biotechnology Companies

Hospitals

Contract Research Organizations

Academic Research Institutions

12 Middle East and Africa Solid Tumor Testing Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Solid Tumor Testing Markets in 2024

12.2 Middle East and Africa Solid Tumor Testing Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Solid Tumor Testing Market size Outlook by Segments, 2021-2030

By Type

Genetic Testing

-Next generation sequencing

-Real-time PCR

-Fluorescent In-Situ Hybridization

-Fragment Analysis

Conventional Testing

By Application

Prostate

Breast

Colorectal

Endometrial

Lung

Melanoma

Brain

Thyroid

Liver

Ovarian

Others

By End-User

Pharmaceutical and Biotechnology Companies

Hospitals

Contract Research Organizations

Academic Research Institutions

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Abbott Laboratories

Agilent Technologies Inc

AMSBIO

Biocare Medical LLC

BioLifeSolutions Inc

CellGenix GmbH.

Corning Inc

F. Hoffmann-La Roche AG

Illumina Inc

LGC SeraCare

MedGenome Labs Private Ltd

Myriad Genetics Inc

Princeton CryoTech

QIAGEN

Quest Diagnostics Inc

STEMCELL Technologies Inc

Thermo Fisher Scientific Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Genetic Testing

-Next generation sequencing

-Real-time PCR

-Fluorescent In-Situ Hybridization

-Fragment Analysis

Conventional Testing

By Application

Prostate

Breast

Colorectal

Endometrial

Lung

Melanoma

Brain

Thyroid

Liver

Ovarian

Others

By End-User

Pharmaceutical and Biotechnology Companies

Hospitals

Contract Research Organizations

Academic Research Institutions

The global Solid Tumor Testing Market is one of the lucrative growth markets, poised to register a 7.4% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abbott Laboratories, Agilent Technologies Inc, AMSBIO, Biocare Medical LLC, BioLifeSolutions Inc, CellGenix GmbH., Corning Inc, F. Hoffmann-La Roche AG, Illumina Inc, LGC SeraCare, MedGenome Labs Private Ltd, Myriad Genetics Inc, Princeton CryoTech, QIAGEN, Quest Diagnostics Inc, STEMCELL Technologies Inc, Thermo Fisher Scientific Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume