The global Solid Sulphur Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Manufacturing Process (Frasch Process, Claus Process), By Application (Fertilizer, Chemical Processing, Metal Manufacturing, Rubber Processing, Others).

Solid sulfur, a non-metallic element with diverse industrial applications, maintains its importance in various sectors in 2024. This naturally occurring element is utilized in the production of sulfuric acid, one of the most widely used industrial chemicals globally. Sulfuric acid finds applications in fertilizer production, metal processing, petroleum refining, and wastewater treatment, driving the demand for solid sulfur as a raw material. Further, solid sulfur is employed in the vulcanization of rubber, where it enhances the crosslinking of polymer chains to improve the strength, elasticity, and resistance of rubber products. Additionally, sulfur is utilized in the pharmaceutical industry for the synthesis of drugs and in agriculture as a pesticide and fungicide. With growing emphasis on sustainable practices and environmental regulations, the market for solid sulfur is witnessing innovation in sulfur recovery technologies and efficient utilization methods to minimize waste and emissions.

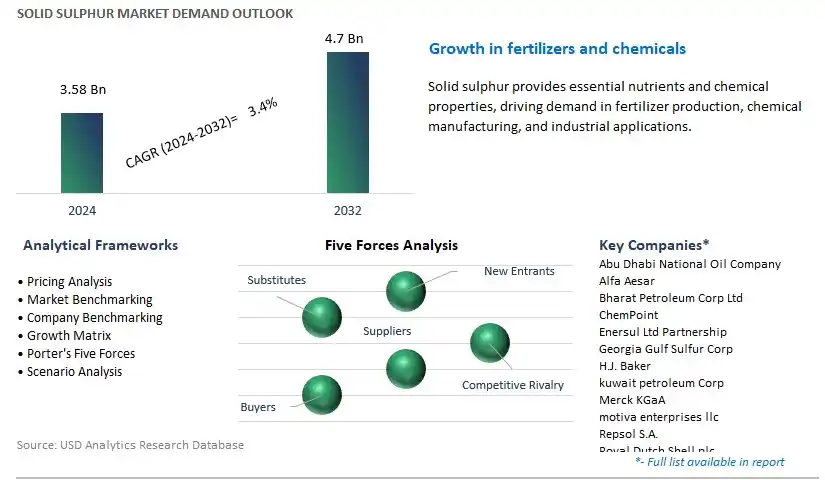

The market report analyses the leading companies in the industry including Abu Dhabi National Oil Company, Alfa Aesar, Bharat Petroleum Corp Ltd, ChemPoint, Enersul Ltd Partnership, Georgia Gulf Sulfur Corp, H.J. Baker, kuwait petroleum Corp, Merck KGaA, motiva enterprises llc, Repsol S.A., Royal Dutch Shell plc, sinopec shanghai petrochemical co. Ltd, TCI America, Thermo Fisher Scientific Inc, Valero Energy Corp, and others.

One prominent market trend in solid sulphur is the growing demand for its use in agricultural applications. Solid sulphur, typically in the form of granules or prills, is widely utilized as a soil amendment and fertilizer in agriculture. It is an essential nutrient for plant growth, playing a critical role in the synthesis of proteins and enzymes, as well as enhancing crop yield and quality. With increasing global population and the need to enhance food security, there is a rising demand for agricultural inputs that can improve soil fertility and productivity. As a result, solid sulphur is witnessing growing adoption by farmers and agribusinesses seeking sustainable and cost-effective solutions for soil health and crop nutrition management.

A key market driver for solid sulphur is the regulations promoting environmentally friendly fertilizers. Governments worldwide are implementing regulations and policies to reduce the environmental impact of agricultural practices, including the use of fertilizers. Solid sulphur offers several environmental benefits compared to traditional fertilizers such as ammonium nitrate or phosphorus-based fertilizers. It is less prone to leaching, runoff, and groundwater contamination, reducing the risk of water pollution and eutrophication. Additionally, solid sulphur can help mitigate soil acidity, enhance nutrient uptake efficiency, and promote sustainable soil management practices. Regulatory support for environmentally friendly fertilizers, coupled with increasing consumer awareness of sustainability issues, drives the demand for solid sulphur as a preferred choice for agriculture.

An emerging opportunity in the solid sulphur market lies in the expansion into industrial applications and chemical manufacturing. Solid sulphur serves as a raw material and feedstock for various industrial processes, including sulfuric acid production, sulfur recovery, and chemical synthesis. It is used in the manufacturing of sulfur-based chemicals such as sulfuric acid, sulfonates, and sulfur dioxide. With the growing demand for sulfuric acid in industries such as mining, metallurgy, pulp and paper, and wastewater treatment, there is an opportunity for solid sulphur producers to diversify their product offerings and expand into industrial markets. By leveraging their expertise in sulfur processing and logistics, companies can capitalize on the demand for solid sulphur as a versatile and cost-effective ingredient in various industrial applications, thus unlocking new revenue streams and market opportunities.

The Frasch Process segment is the largest segment in the solid sulfur market due to its efficiency and widespread application in sulfur extraction. The Frasch Process involves the extraction of sulfur from underground deposits using hot water and compressed air, resulting in high-purity elemental sulfur. This process is particularly advantageous for extracting sulfur from deep underground formations where traditional mining methods are impractical. The Frasch Process ensures minimal environmental impact and resource depletion compared to other sulfur extraction methods, making it a preferred choice for sulfur producers worldwide. Additionally, the high purity of sulfur obtained through the Frasch Process makes it suitable for various industrial applications, including sulfuric acid production, fertilizer manufacturing, and chemical synthesis. Therefore, the efficiency, environmental sustainability, and versatility of the Frasch Process solidify its dominance as the largest segment in the solid sulfur market.

The fastest-growing segment in the solid sulfur market is the Fertilizer sector. In particular, sulfur is an essential nutrient required for plant growth and development, playing a crucial role in protein synthesis, enzyme activity, and chlorophyll formation. As global populations continue to rise, there is an increasing demand for food production to ensure food security, driving the need for fertilizers that contain sulfur to enhance crop yields and quality. Additionally, the depletion of sulfur in agricultural soils due to intensive farming practices necessitates the application of sulfur-containing fertilizers to replenish soil nutrients and maintain soil fertility levels. Moreover, the shift towards sustainable agricultural practices and organic farming methods has led to a growing preference for sulfur-based fertilizers, such as elemental sulfur and sulfate fertilizers, which offer slow-release characteristics and improve soil health over time. Therefore, the rising demand for sulfur in fertilizer applications, driven by the need for increased agricultural productivity and sustainability, positions the Fertilizer segment as the fastest-growing in the solid sulfur market.

By Manufacturing Process

Frasch Process

Claus Process

By Application

Fertilizer

Chemical Processing

Metal Manufacturing

Rubber Processing

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Abu Dhabi National Oil Company

Alfa Aesar

Bharat Petroleum Corp Ltd

ChemPoint

Enersul Ltd Partnership

Georgia Gulf Sulfur Corp

H.J. Baker

kuwait petroleum Corp

Merck KGaA

motiva enterprises llc

Repsol S.A.

Royal Dutch Shell plc

sinopec shanghai petrochemical co. Ltd

TCI America

Thermo Fisher Scientific Inc

Valero Energy Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Solid Sulphur Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Solid Sulphur Market Size Outlook, $ Million, 2021 to 2032

3.2 Solid Sulphur Market Outlook by Type, $ Million, 2021 to 2032

3.3 Solid Sulphur Market Outlook by Product, $ Million, 2021 to 2032

3.4 Solid Sulphur Market Outlook by Application, $ Million, 2021 to 2032

3.5 Solid Sulphur Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Solid Sulphur Industry

4.2 Key Market Trends in Solid Sulphur Industry

4.3 Potential Opportunities in Solid Sulphur Industry

4.4 Key Challenges in Solid Sulphur Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Solid Sulphur Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Solid Sulphur Market Outlook by Segments

7.1 Solid Sulphur Market Outlook by Segments, $ Million, 2021- 2032

By Manufacturing Process

Frasch Process

Claus Process

By Application

Fertilizer

Chemical Processing

Metal Manufacturing

Rubber Processing

Others

8 North America Solid Sulphur Market Analysis and Outlook To 2032

8.1 Introduction to North America Solid Sulphur Markets in 2024

8.2 North America Solid Sulphur Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Solid Sulphur Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Frasch Process

Claus Process

By Application

Fertilizer

Chemical Processing

Metal Manufacturing

Rubber Processing

Others

9 Europe Solid Sulphur Market Analysis and Outlook To 2032

9.1 Introduction to Europe Solid Sulphur Markets in 2024

9.2 Europe Solid Sulphur Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Solid Sulphur Market Size Outlook by Segments, 2021-2032

By Manufacturing Process

Frasch Process

Claus Process

By Application

Fertilizer

Chemical Processing

Metal Manufacturing

Rubber Processing

Others

10 Asia Pacific Solid Sulphur Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Solid Sulphur Markets in 2024

10.2 Asia Pacific Solid Sulphur Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Solid Sulphur Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Frasch Process

Claus Process

By Application

Fertilizer

Chemical Processing

Metal Manufacturing

Rubber Processing

Others

11 South America Solid Sulphur Market Analysis and Outlook To 2032

11.1 Introduction to South America Solid Sulphur Markets in 2024

11.2 South America Solid Sulphur Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Solid Sulphur Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Frasch Process

Claus Process

By Application

Fertilizer

Chemical Processing

Metal Manufacturing

Rubber Processing

Others

12 Middle East and Africa Solid Sulphur Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Solid Sulphur Markets in 2024

12.2 Middle East and Africa Solid Sulphur Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Solid Sulphur Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Frasch Process

Claus Process

By Application

Fertilizer

Chemical Processing

Metal Manufacturing

Rubber Processing

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Abu Dhabi National Oil Company

Alfa Aesar

Bharat Petroleum Corp Ltd

ChemPoint

Enersul Ltd Partnership

Georgia Gulf Sulfur Corp

H.J. Baker

kuwait petroleum Corp

Merck KGaA

motiva enterprises llc

Repsol S.A.

Royal Dutch Shell plc

sinopec shanghai petrochemical co. Ltd

TCI America

Thermo Fisher Scientific Inc

Valero Energy Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Manufacturing Process

Frasch Process

Claus Process

By Application

Fertilizer

Chemical Processing

Metal Manufacturing

Rubber Processing

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Solid Sulphur Market Size is valued at $3.58 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.4% to reach $4.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abu Dhabi National Oil Company, Alfa Aesar, Bharat Petroleum Corp Ltd, ChemPoint, Enersul Ltd Partnership, Georgia Gulf Sulfur Corp, H.J. Baker, kuwait petroleum Corp, Merck KGaA, motiva enterprises llc, Repsol S.A., Royal Dutch Shell plc, sinopec shanghai petrochemical co. Ltd, TCI America, Thermo Fisher Scientific Inc, Valero Energy Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume