The global Soft Magnetic Materials Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Electric Steel, Cobalt, Iron, Nickel, Others), By End-User (Electronics, Automotive, Energy, Industrial, Others).

Soft magnetic materials, characterized by their ability to quickly magnetize and demagnetize in response to changing magnetic fields, maintain their significance across various industries in 2024. These materials, including iron, nickel, cobalt, and their alloys, are essential components in electromagnetic devices such as transformers, electric motors, and inductors. In the automotive industry, soft magnetic materials are used in electric vehicle drivetrains and power electronics to efficiently convert and control electrical energy. Additionally, in telecommunications, consumer electronics, and renewable energy systems, soft magnetic materials play a crucial role in the efficient operation of transformers, generators, and magnetic storage devices. With advancements in material science and manufacturing techniques, the market for soft magnetic materials s to evolve, with a focus on improving magnetic performance, reducing energy losses, and enabling miniaturization in electronic devices.

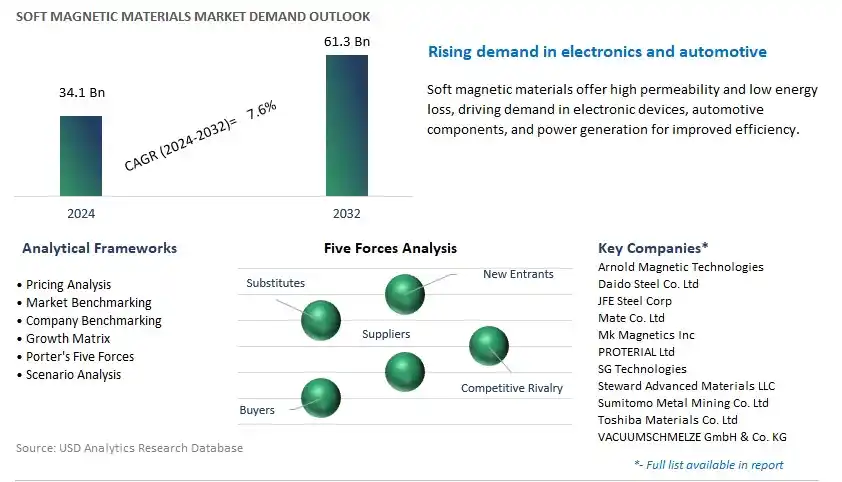

The market report analyses the leading companies in the industry including Arnold Magnetic Technologies, Daido Steel Co. Ltd, JFE Steel Corp, Mate Co. Ltd, Mk Magnetics Inc, PROTERIAL Ltd, SG Technologies, Steward Advanced Materials LLC, Sumitomo Metal Mining Co. Ltd, Toshiba Materials Co. Ltd, VACUUMSCHMELZE GmbH & Co. KG, and others.

One prominent market trend in soft magnetic materials is the increasing demand driven by the rise of electric vehicles (EVs) and renewable energy technologies. Soft magnetic materials, such as electrical steel, soft ferrites, and amorphous metals, are essential components in electric motors, transformers, and generators used in EV propulsion systems, wind turbines, and solar inverters. As the automotive industry shifts towards electrification and governments worldwide implement policies to promote renewable energy adoption, there is a growing need for efficient and lightweight soft magnetic materials to improve energy conversion and transmission efficiency. This trend is expected to drive the demand for soft magnetic materials in the coming years, particularly in applications requiring high efficiency, compact design, and reliability.

A key market driver for soft magnetic materials is the continuous technological advancements in power electronics and magnetics. With ongoing research and development efforts, manufacturers are innovating soft magnetic materials with improved magnetic properties, reduced losses, and enhanced thermal stability to meet the evolving requirements of modern applications. Advancements in materials science, manufacturing processes, and magnetic characterization techniques enable the development of tailored soft magnetic materials optimized for specific applications, such as high-frequency power conversion, wireless charging, and electromagnetic interference suppression. These technological advancements drive the adoption of soft magnetic materials in a wide range of industries, including automotive, aerospace, telecommunications, and consumer electronics, fueling market growth and innovation.

An emerging opportunity in the soft magnetic materials market lies in the expansion into energy storage and magnetostrictive devices. Soft magnetic materials play a crucial role in energy storage systems, such as flywheel energy storage, magnetic refrigeration, and magnetic induction batteries, where they are used to efficiently store and release electrical energy. Additionally, soft magnetic materials exhibit magnetostrictive properties, making them suitable for sensors, actuators, and vibration damping devices in industrial automation, robotics, and structural health monitoring applications. By exploring new applications and technologies, such as magnetostrictive energy harvesters and magnetic sensors for IoT devices, companies can leverage the unique properties of soft magnetic materials to diversify their product portfolios and capture new market opportunities in emerging sectors.

The Iron segment stands out as the largest segment in the soft magnetic materials market due to its widespread use and advantageous properties. Iron-based soft magnetic materials, such as electrical steel (also known as silicon steel), are extensively utilized in the manufacturing of electrical transformers, motors, generators, and other electromagnetic devices. Electrical steel exhibits high magnetic permeability and low core losses, making it ideal for applications where efficient energy conversion and minimal power loss are paramount. Additionally, iron-based soft magnetic materials offer excellent saturation magnetization and temperature stability, ensuring reliable performance across a wide range of operating conditions. The dominance of the Iron segment in the soft magnetic materials market is further reinforced by its cost-effectiveness and abundance compared to other materials such as cobalt and nickel. Therefore, the essential role of iron-based soft magnetic materials in electrical and electronic applications, coupled with their favorable properties and cost-effectiveness, solidifies the Iron segment as the largest in the soft magnetic materials market.

The Automotive segment is the fastest-growing segment in the soft magnetic materials market. With the rapid electrification and evolution of automotive technologies, there is a growing demand for soft magnetic materials in electric and hybrid vehicles. Soft magnetic materials are essential components in electric motors, power electronics, and battery systems, where they play a crucial role in energy conversion, power distribution, and electromagnetic shielding. The increasing adoption of electric propulsion systems and advanced driver assistance systems (ADAS) in modern vehicles further accelerates the demand for soft magnetic materials. Moreover, stringent regulations on fuel efficiency, emissions reduction, and vehicle electrification initiatives by governments worldwide propel automotive manufacturers to invest in lightweight and energy-efficient components, driving the uptake of soft magnetic materials in the automotive sector. Therefore, the pivotal role of soft magnetic materials in enabling the transition towards electric mobility and enhancing automotive performance positions the Automotive segment as the fastest-growing in the soft magnetic materials market.

By Material

Electric Steel

Cobalt

Iron

Nickel

Others

By End-User

Electronics

Automotive

Energy

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arnold Magnetic Technologies

Daido Steel Co. Ltd

JFE Steel Corp

Mate Co. Ltd

Mk Magnetics Inc

PROTERIAL Ltd

SG Technologies

Steward Advanced Materials LLC

Sumitomo Metal Mining Co. Ltd

Toshiba Materials Co. Ltd

VACUUMSCHMELZE GmbH & Co. KG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Soft Magnetic Materials Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Soft Magnetic Materials Market Size Outlook, $ Million, 2021 to 2032

3.2 Soft Magnetic Materials Market Outlook by Type, $ Million, 2021 to 2032

3.3 Soft Magnetic Materials Market Outlook by Product, $ Million, 2021 to 2032

3.4 Soft Magnetic Materials Market Outlook by Application, $ Million, 2021 to 2032

3.5 Soft Magnetic Materials Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Soft Magnetic Materials Industry

4.2 Key Market Trends in Soft Magnetic Materials Industry

4.3 Potential Opportunities in Soft Magnetic Materials Industry

4.4 Key Challenges in Soft Magnetic Materials Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Soft Magnetic Materials Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Soft Magnetic Materials Market Outlook by Segments

7.1 Soft Magnetic Materials Market Outlook by Segments, $ Million, 2021- 2032

By Material

Electric Steel

Cobalt

Iron

Nickel

Others

By End-User

Electronics

Automotive

Energy

Industrial

Others

8 North America Soft Magnetic Materials Market Analysis and Outlook To 2032

8.1 Introduction to North America Soft Magnetic Materials Markets in 2024

8.2 North America Soft Magnetic Materials Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Soft Magnetic Materials Market size Outlook by Segments, 2021-2032

By Material

Electric Steel

Cobalt

Iron

Nickel

Others

By End-User

Electronics

Automotive

Energy

Industrial

Others

9 Europe Soft Magnetic Materials Market Analysis and Outlook To 2032

9.1 Introduction to Europe Soft Magnetic Materials Markets in 2024

9.2 Europe Soft Magnetic Materials Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Soft Magnetic Materials Market Size Outlook by Segments, 2021-2032

By Material

Electric Steel

Cobalt

Iron

Nickel

Others

By End-User

Electronics

Automotive

Energy

Industrial

Others

10 Asia Pacific Soft Magnetic Materials Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Soft Magnetic Materials Markets in 2024

10.2 Asia Pacific Soft Magnetic Materials Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Soft Magnetic Materials Market size Outlook by Segments, 2021-2032

By Material

Electric Steel

Cobalt

Iron

Nickel

Others

By End-User

Electronics

Automotive

Energy

Industrial

Others

11 South America Soft Magnetic Materials Market Analysis and Outlook To 2032

11.1 Introduction to South America Soft Magnetic Materials Markets in 2024

11.2 South America Soft Magnetic Materials Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Soft Magnetic Materials Market size Outlook by Segments, 2021-2032

By Material

Electric Steel

Cobalt

Iron

Nickel

Others

By End-User

Electronics

Automotive

Energy

Industrial

Others

12 Middle East and Africa Soft Magnetic Materials Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Soft Magnetic Materials Markets in 2024

12.2 Middle East and Africa Soft Magnetic Materials Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Soft Magnetic Materials Market size Outlook by Segments, 2021-2032

By Material

Electric Steel

Cobalt

Iron

Nickel

Others

By End-User

Electronics

Automotive

Energy

Industrial

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arnold Magnetic Technologies

Daido Steel Co. Ltd

JFE Steel Corp

Mate Co. Ltd

Mk Magnetics Inc

PROTERIAL Ltd

SG Technologies

Steward Advanced Materials LLC

Sumitomo Metal Mining Co. Ltd

Toshiba Materials Co. Ltd

VACUUMSCHMELZE GmbH & Co. KG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Electric Steel

Cobalt

Iron

Nickel

Others

By End-User

Electronics

Automotive

Energy

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Soft Magnetic Materials Market Size is valued at $34.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.6% to reach $61.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arnold Magnetic Technologies, Daido Steel Co. Ltd, JFE Steel Corp, Mate Co. Ltd, Mk Magnetics Inc, PROTERIAL Ltd, SG Technologies, Steward Advanced Materials LLC, Sumitomo Metal Mining Co. Ltd, Toshiba Materials Co. Ltd, VACUUMSCHMELZE GmbH & Co. KG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume