The global Sodium Hydroxide Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Grade (Solid, 50% Aqueous Solution, Others), By Production Process (Membrane Cell, Diaphragm Cell, Others), By Application (Biodiesel, Alumina, Inorganic Chemicals, Organic Chemicals, Food, Pulp & Paper, Soap & Detergent, Textiles, Water Treatment, Others).

Sodium hydroxide, commonly known as caustic soda, remains a fundamental chemical compound with diverse industrial applications in 2024. This versatile alkali compound is used in various sectors such as pulp and paper, textiles, detergents, water treatment, and chemical manufacturing. In the pulp and paper industry, sodium hydroxide plays a crucial role in the delignification process during paper production, while in the textile industry, it is utilized for mercerization of cotton fibers to improve their strength and luster. Additionally, sodium hydroxide is a key ingredient in the production of soaps, detergents, and cleaning agents due to its strong alkaline properties. With increasing demand for basic chemicals and sustainable manufacturing practices, the market for sodium hydroxide s to evolve, with emphasis on energy-efficient production methods and waste minimization strategies.

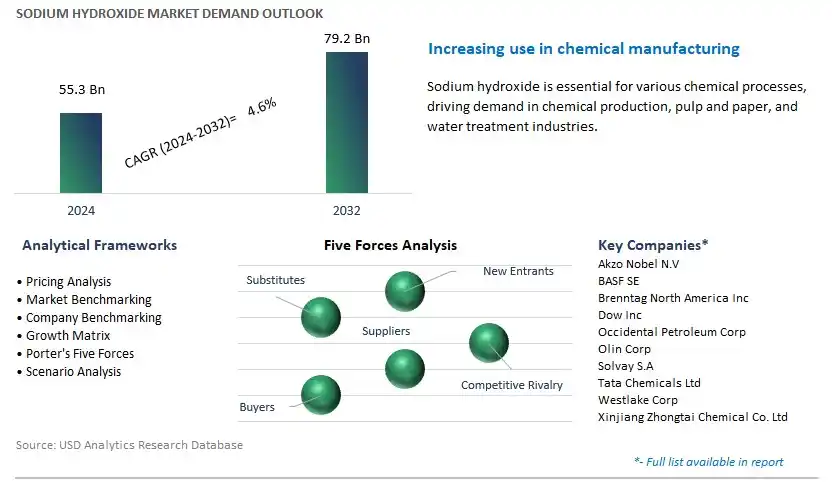

The market report analyses the leading companies in the industry including Akzo Nobel N.V, BASF SE, Brenntag North America Inc, Dow Inc, Occidental Petroleum Corp, Olin Corp, Solvay S.A, Tata Chemicals Ltd, Westlake Corp, Xinjiang Zhongtai Chemical Co. Ltd, and others.

One prominent market trend in sodium hydroxide is the increasing demand for this chemical in chemical manufacturing processes. Sodium hydroxide, also known as caustic soda, is a versatile chemical compound widely used in various industries such as pulp and paper, textiles, detergents, petroleum refining, and water treatment. The trend towards industrial expansion, infrastructure development, and urbanization drives the demand for sodium hydroxide as a key ingredient in the production of numerous chemicals, including soaps, detergents, pharmaceuticals, and specialty chemicals. As industries continue to grow and diversify, the demand for sodium hydroxide is expected to increase steadily, supporting market growth and expansion.

A key market driver for sodium hydroxide is its essential role in water treatment and sanitization processes. Sodium hydroxide is widely used in municipal water treatment plants, industrial wastewater treatment facilities, and swimming pool maintenance to adjust pH levels, neutralize acidic effluents, and disinfect water supplies. Additionally, sodium hydroxide is employed in household cleaning products, surface sanitizers, and disinfectants to remove stains, grease, and bacteria. With growing concerns about water pollution, waterborne diseases, and public health, there is an increasing emphasis on the importance of effective water treatment and sanitation practices. Sodium hydroxide plays a critical role in ensuring safe and clean water supplies for drinking, industrial processes, and recreational activities, thereby driving demand for this chemical compound.

An emerging opportunity in the sodium hydroxide market lies in the expansion into green chemistry and sustainable applications. As environmental regulations become stricter and industries seek to reduce their carbon footprint and environmental impact, there is a growing demand for eco-friendly alternatives to traditional chemical processes. Sodium hydroxide offers opportunities for sustainable development and green manufacturing practices by enabling processes such as biodiesel production, vegetable oil refining, and bio-based polymers synthesis. Additionally, sodium hydroxide can be used in renewable energy applications such as hydrogen production through electrolysis of water. By investing in research and innovation, companies can develop environmentally friendly technologies and applications for sodium hydroxide, thus tapping into new market segments and contributing to sustainability goals.

The Solid segment stands out as the largest segment in the sodium hydroxide market due to its versatility and widespread industrial applications. Solid sodium hydroxide, also known as caustic soda or lye, is a highly soluble white solid that is utilized in various industries such as chemical manufacturing, pulp and paper production, textile processing, water treatment, and soap and detergent manufacturing. It serves as a crucial raw material in the production of numerous chemicals, including detergents, surfactants, textiles, pharmaceuticals, and plastics. Additionally, solid sodium hydroxide is extensively used in water treatment processes for pH adjustment, wastewater neutralization, and removal of heavy metals and impurities. Its importance as an industrial chemical, coupled with its cost-effectiveness, ease of handling, and long shelf life, solidifies its dominance as the largest segment in the sodium hydroxide market.

The Membrane Cell segment is the fastest-growing segment in the sodium hydroxide market due to its environmental advantages and technological advancements. Membrane cell technology is increasingly favored over traditional diaphragm cell and mercury cell processes due to its higher energy efficiency, reduced environmental impact, and lower operating costs. In membrane cell electrolysis, a selective ion-exchange membrane separates the anode and cathode compartments, allowing for the direct production of sodium hydroxide and chlorine gas without the formation of harmful by-products such as mercury or asbestos waste. Additionally, membrane cell technology offers precise control over product purity and concentration, making it suitable for applications that require high-quality sodium hydroxide, such as pharmaceuticals, food processing, and electronics manufacturing. Moreover, stringent environmental regulations and sustainability initiatives worldwide are driving the adoption of membrane cell technology as industries seek cleaner and more sustainable production methods. Therefore, the environmental advantages, cost-effectiveness, and technological advancements associated with membrane cell production position it as the fastest-growing segment in the sodium hydroxide market.

The largest segment in the sodium hydroxide market is the Pulp & Paper sector. This segment holds prominence. Sodium hydroxide, commonly known as caustic soda, is a critical chemical in the pulp and paper industry, where it is primarily used in the pulping and bleaching processes. In pulping, sodium hydroxide is employed to break down lignin and separate fibers from wood or other raw materials, facilitating the production of pulp for papermaking. In bleaching, sodium hydroxide is used in conjunction with chlorine or chlorine dioxide to remove colorants, lignin residues, and other impurities from the pulp, resulting in bright and high-quality paper products. Additionally, sodium hydroxide finds applications in paper recycling processes, where it helps to break down ink and remove contaminants from recycled paper fibers. The extensive use of sodium hydroxide in multiple stages of pulp and paper production, coupled with the large-scale operations of the pulp and paper industry worldwide, solidifies the Pulp & Paper sector as the largest segment in the sodium hydroxide market.

By Grade

Solid

50% Aqueous Solution

Others

By Production Process

Membrane Cell

Diaphragm Cell

Others

By Application

Biodiesel

Alumina

Inorganic Chemicals

Organic Chemicals

Food

Pulp & Paper

Soap & Detergent

Textiles

Water Treatment

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Akzo Nobel N.V

BASF SE

Brenntag North America Inc

Dow Inc

Occidental Petroleum Corp

Olin Corp

Solvay S.A

Tata Chemicals Ltd

Westlake Corp

Xinjiang Zhongtai Chemical Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Sodium Hydroxide Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Sodium Hydroxide Market Size Outlook, $ Million, 2021 to 2032

3.2 Sodium Hydroxide Market Outlook by Type, $ Million, 2021 to 2032

3.3 Sodium Hydroxide Market Outlook by Product, $ Million, 2021 to 2032

3.4 Sodium Hydroxide Market Outlook by Application, $ Million, 2021 to 2032

3.5 Sodium Hydroxide Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Sodium Hydroxide Industry

4.2 Key Market Trends in Sodium Hydroxide Industry

4.3 Potential Opportunities in Sodium Hydroxide Industry

4.4 Key Challenges in Sodium Hydroxide Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Sodium Hydroxide Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Sodium Hydroxide Market Outlook by Segments

7.1 Sodium Hydroxide Market Outlook by Segments, $ Million, 2021- 2032

By Grade

Solid

50% Aqueous Solution

Others

By Production Process

Membrane Cell

Diaphragm Cell

Others

By Application

Biodiesel

Alumina

Inorganic Chemicals

Organic Chemicals

Food

Pulp & Paper

Soap & Detergent

Textiles

Water Treatment

Others

8 North America Sodium Hydroxide Market Analysis and Outlook To 2032

8.1 Introduction to North America Sodium Hydroxide Markets in 2024

8.2 North America Sodium Hydroxide Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Sodium Hydroxide Market size Outlook by Segments, 2021-2032

By Grade

Solid

50% Aqueous Solution

Others

By Production Process

Membrane Cell

Diaphragm Cell

Others

By Application

Biodiesel

Alumina

Inorganic Chemicals

Organic Chemicals

Food

Pulp & Paper

Soap & Detergent

Textiles

Water Treatment

Others

9 Europe Sodium Hydroxide Market Analysis and Outlook To 2032

9.1 Introduction to Europe Sodium Hydroxide Markets in 2024

9.2 Europe Sodium Hydroxide Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Sodium Hydroxide Market Size Outlook by Segments, 2021-2032

By Grade

Solid

50% Aqueous Solution

Others

By Production Process

Membrane Cell

Diaphragm Cell

Others

By Application

Biodiesel

Alumina

Inorganic Chemicals

Organic Chemicals

Food

Pulp & Paper

Soap & Detergent

Textiles

Water Treatment

Others

10 Asia Pacific Sodium Hydroxide Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Sodium Hydroxide Markets in 2024

10.2 Asia Pacific Sodium Hydroxide Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Sodium Hydroxide Market size Outlook by Segments, 2021-2032

By Grade

Solid

50% Aqueous Solution

Others

By Production Process

Membrane Cell

Diaphragm Cell

Others

By Application

Biodiesel

Alumina

Inorganic Chemicals

Organic Chemicals

Food

Pulp & Paper

Soap & Detergent

Textiles

Water Treatment

Others

11 South America Sodium Hydroxide Market Analysis and Outlook To 2032

11.1 Introduction to South America Sodium Hydroxide Markets in 2024

11.2 South America Sodium Hydroxide Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Sodium Hydroxide Market size Outlook by Segments, 2021-2032

By Grade

Solid

50% Aqueous Solution

Others

By Production Process

Membrane Cell

Diaphragm Cell

Others

By Application

Biodiesel

Alumina

Inorganic Chemicals

Organic Chemicals

Food

Pulp & Paper

Soap & Detergent

Textiles

Water Treatment

Others

12 Middle East and Africa Sodium Hydroxide Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Sodium Hydroxide Markets in 2024

12.2 Middle East and Africa Sodium Hydroxide Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Sodium Hydroxide Market size Outlook by Segments, 2021-2032

By Grade

Solid

50% Aqueous Solution

Others

By Production Process

Membrane Cell

Diaphragm Cell

Others

By Application

Biodiesel

Alumina

Inorganic Chemicals

Organic Chemicals

Food

Pulp & Paper

Soap & Detergent

Textiles

Water Treatment

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Akzo Nobel N.V

BASF SE

Brenntag North America Inc

Dow Inc

Occidental Petroleum Corp

Olin Corp

Solvay S.A

Tata Chemicals Ltd

Westlake Corp

Xinjiang Zhongtai Chemical Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Grade

Solid

50% Aqueous Solution

Others

By Production Process

Membrane Cell

Diaphragm Cell

Others

By Application

Biodiesel

Alumina

Inorganic Chemicals

Organic Chemicals

Food

Pulp & Paper

Soap & Detergent

Textiles

Water Treatment

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Sodium Hydroxide Market Size is valued at $55.3 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.6% to reach $79.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Akzo Nobel N.V, BASF SE, Brenntag North America Inc, Dow Inc, Occidental Petroleum Corp, Olin Corp, Solvay S.A, Tata Chemicals Ltd, Westlake Corp, Xinjiang Zhongtai Chemical Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume