Smart farming is gaining rapid popularity with governments, farmers, and industry stakeholders shifting towards adopting technologies in their farming practices. In particular, precision agriculture through autonomous machinery, GPS-enabled farm management systems, microbial seed treatments and sustainable farming, and the use of drone technology for smart agriculture are gaining rapid market penetration. In addition, farm data analytics and digital agriculture, vertical farming and indoor agriculture, autonomous technology and connectivity solutions, digital crop protection and hybrid seeds, satellite imaging for precision farming, and others are widely observed. Amidst robust market growth prospects, the industry is witnessing rapid foray of new entrants offering hardware, software, and services.

Increasing need for automation of workforce in agriculture activities to boost efficiency coupled with focus on real-time crop monitoring drives the smart farming industry. Advancements in IoT, robotics, drones, and AI and data-driven farm operations supports farmers to address food safety challenges such as non-standardized pest control, varying climate, and contamination. The use of hardware (IoT) and software (Software as a Service or SaaS) for yield improvement is encouraging the adoption across both emerging markets and developed markets. Further, Smart farming technology allows farmers to control their fields using smart devices remotely transparently and enables real-time crop monitoring.

To reduce costs and share advanced practices, farmers are grouping to forming associations such as North America Climate Smart Agriculture (NACSA). The U.S. Department of Agriculture is investing up to $2.8 billion in 70 selected projects under the first pool of the Partnerships for Climate-Smart Commodities funding opportunity.

U.S. Department of Agriculture (USDA) - Conservation Innovation Grants (CIG), USDA - Sustainable Agriculture Research and Education (SARE), USDA - Regional Conservation Partnership Program (RCPP), Farm Service Agency (FSA) Loans for Precision Agriculture, Horizon Europe - Agriculture and Digital Innovation Programs, European Agricultural Fund for Rural Development (EAFRD), Digital Europe Programme, Canadian Agricultural Partnership (CAP), Innovation Superclusters Initiative - Protein Industries Canada, India National Mission on Sustainable Agriculture (NMSA), Agricultural Technology Management Agency (ATMA) Scheme, and others drive the long-term market prospects.

Agri-data platforms offer centralized solutions for managing a wide range of farming operations. Service providers such as FarmLogs, Climate FieldView (Bayer Crop Science) integrate data from weather stations, soil sensors, satellite imagery, and farm machinery. In addition, agri-data platforms analyze weather patterns, soil health, pest infestations, and other factors using machine learning algorithms.

Agremo uses AI and machine learning to analyze aerial images captured by drones to detect problems such as nutrient deficiencies, pest damage, or water stress in crops. Similarly, In Brazil, Taranis partnered with large soybean producers to predict potential pest outbreaks based on environmental conditions. Similarly, CropX, John Deere, and others are relying on Internet of Things (IoT) for real-time data collection through sensors deployed in the field. On the other hand, Planet Labs, EOS Crop Monitoring, and others offer large-scale, continuous monitoring through satellite-based analytics.

IoT sensors and wearable devices are attached to livestock to continuously track heart rate, temperature, and activity levels. For instance, Cainthus tracks individual cows’ feeding and drinking habits, GEA’s automated feeding systems calculate precise rations for each cow based on its health, milk production, and weight. Precision livestock farming technologies also play a vital role in improving reproductive performance. Leading players such as SenseHub by Allflex report a 12% increase in pregnancy rates and reduced costs of artificial insemination. In addition, Automation in livestock farming reduces the need for manual labor to achieve lower operational costs. Lely’s Astronaut Milking Robots automates the entire milking process.

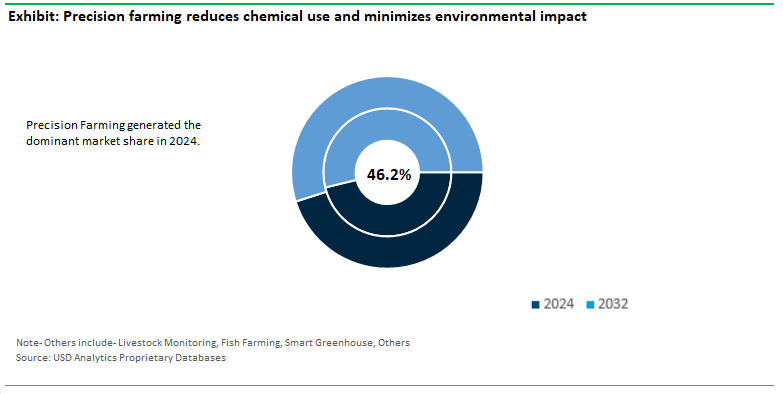

Precision Farming accounted for the dominant 46.2% market share. Advancements in GPS-guided machinery, IoT sensors, and drones drives the demand for precision farming. In particular, the adoption of the precision farming ensures efficient use of water and fertilizers and reducing wastage and operational costs. In addition, data-driven approach equips farmers to customize treatments, yield optimization, and improving profitability.

Over the long-term, government funding, subsidies, and incentives for farmers opting for precision farming drive the market outlook. Further, precision farming reduces chemical use and minimizes environmental impact. John Deere offers GPS-enabled equipment for automated planting, spraying, and harvesting, Trimble markets guidance systems, flow control, and automated steering for tractors. Similarly, Ag Leader Technology offers GPS guidance, precision planting, and soil analysis systems while Raven Industries markets automated sprayers, crop monitoring, and variable-rate application tools.

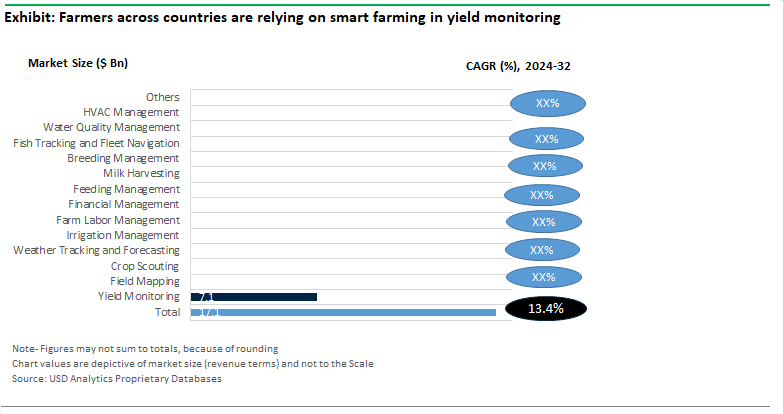

Yield monitoring systems use sensors, drones, and GPS technology to collect precise data on crop yields. To achieve increased profitability, farmers across countries are relying on smart farming in yield monitoring. In addition to optimization of application of fertilizers, water, and pesticides, service providers market tracking yield variations across different crop cycles, efficient resource management, and optimized field management. Leading companies are integrating variable-rate technology (VRT), satellite imaging, and soil monitoring for improved yield monitoring. Key technologies include GPS/GNSS, GIS, Remote Sensing.

North America is the largest market for precision farming with 44.6% revenue share. The dominant share is driven by the large-scale adoption in the US coupled with the presence of hardware and software providers. On the other hand, the Asia-Pacific region is poised to remain the fastest-growing market for Smart Farming vendors, projected to expand at a CAGR of 13.6% during the forecast period.

Smart farming is in early stage of development in most markets but the rate of penetration is robust. In particular, with growing government support and product launches focused to regional market conditions support the long-term growth prospects. Chinese government rolled out ambitious plans to modernize agriculture and Indian National Mission for Sustainable Agriculture (NMSA) relies on smart farming to address soil degradation challenges. The rapid growth in agritech start-ups strengthens the industry over the long-term future.

The global Smart Farming market is fragmented with the presence of both local and global players. Leading companies included in the study are Ag Leader Technology, AGCO Corp., AgJunction Inc., Auroras Srl, Bacancy Technology, Bayer AG, Cropin Technology Solutions Pvt. Ltd., Cultyvate, Deere and Co., Digital Matter, DTN, Farmers Edge Inc., Gamaya, PrecisionHawk Inc., Raven Industries Inc., Robert Bosch GmbH, Telit Communications Plc, Topcon Positioning Systems Inc., Trimble Inc., TSI Inc., and others.

|

Parameter |

Details |

|

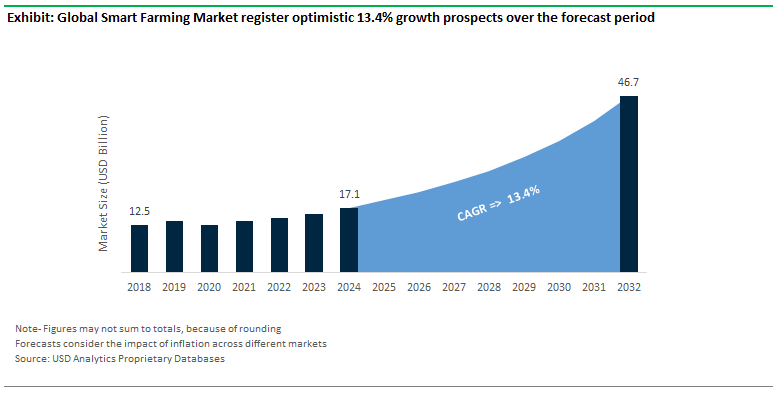

Market Size (2024) |

$17.1 Billion |

|

Market Size (2032) |

$46.8 Billion |

|

Market Growth Rate |

13.4% |

|

Largest Segment- Application |

Yield monitoring (41.5% Market Share) |

|

Fastest Growing Market- Region |

Asia Pacific (13.6% CAGR) |

|

Largest Segment- Type |

Precision Farming (46.2% Revenue Share) |

|

Segments |

Types, Applications, Sales Channels |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Ag Leader Technology, AGCO Corp., AgJunction Inc., Auroras Srl, Bacancy Technology, Bayer AG, Cropin Technology Solutions Pvt. Ltd., Cultyvate, Deere and Co., Digital Matter, DTN, Farmers Edge Inc., Gamaya, PrecisionHawk Inc., Raven Industries Inc., Robert Bosch GmbH, Telit Communications Plc, Topcon Positioning Systems Inc., Trimble Inc., TSI Inc. |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Type

Service

Solution

Application

Countries Analyzed

Smart Farming Companies Profiled in the Study

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the Industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies Opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

4. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

5. Market Size Outlook to 2032

Global Smart Farming Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

6. Historical Smart Farming Market Size by Segments, 2018- 2023

Key Statistics, 2024

Smart Farming Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Smart Farming Types, 2018-2023

Smart Farming Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Smart Farming Applications, 2018-2023

7. Smart Farming Market Size Outlook by Segments, 2024- 2032

Smart Farming Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Smart Farming Types, 2024-2032

Smart Farming Market Size Outlook by Service, USD Million, 2024-2032

Growth Comparison (y-o-y) across Smart Farming Services, 2024-2032

Smart Farming Market Size Outlook by Solution, USD Million, 2024-2032

Growth Comparison (y-o-y) across Smart Farming Solutions, 2024-2032

Smart Farming Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Smart Farming Applications, 2024-2032

8. Smart Farming Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

9. United States Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Smart Farming Market Size Outlook by Type, 2021- 2032

United States Smart Farming Market Size Outlook by Application, 2021- 2032

United States Smart Farming Market Size Outlook by End-User, 2021- 2032

10. Canada Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Smart Farming Market Size Outlook by Type, 2021- 2032

Canada Smart Farming Market Size Outlook by Application, 2021- 2032

Canada Smart Farming Market Size Outlook by End-User, 2021- 2032

11. Mexico Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Smart Farming Market Size Outlook by Type, 2021- 2032

Mexico Smart Farming Market Size Outlook by Application, 2021- 2032

Mexico Smart Farming Market Size Outlook by End-User, 2021- 2032

12. Germany Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Smart Farming Market Size Outlook by Type, 2021- 2032

Germany Smart Farming Market Size Outlook by Application, 2021- 2032

Germany Smart Farming Market Size Outlook by End-User, 2021- 2032

13. France Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

France Smart Farming Market Size Outlook by Type, 2021- 2032

France Smart Farming Market Size Outlook by Application, 2021- 2032

France Smart Farming Market Size Outlook by End-User, 2021- 2032

14. United Kingdom Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Smart Farming Market Size Outlook by Type, 2021- 2032

United Kingdom Smart Farming Market Size Outlook by Application, 2021- 2032

United Kingdom Smart Farming Market Size Outlook by End-User, 2021- 2032

15. Spain Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Smart Farming Market Size Outlook by Type, 2021- 2032

Spain Smart Farming Market Size Outlook by Application, 2021- 2032

Spain Smart Farming Market Size Outlook by End-User, 2021- 2032

16. Italy Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Smart Farming Market Size Outlook by Type, 2021- 2032

Italy Smart Farming Market Size Outlook by Application, 2021- 2032

Italy Smart Farming Market Size Outlook by End-User, 2021- 2032

17. Benelux Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Smart Farming Market Size Outlook by Type, 2021- 2032

Benelux Smart Farming Market Size Outlook by Application, 2021- 2032

Benelux Smart Farming Market Size Outlook by End-User, 2021- 2032

18. Nordic Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Smart Farming Market Size Outlook by Type, 2021- 2032

Nordic Smart Farming Market Size Outlook by Application, 2021- 2032

Nordic Smart Farming Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Smart Farming Market Size Outlook by Type, 2021- 2032

Rest of Europe Smart Farming Market Size Outlook by Application, 2021- 2032

Rest of Europe Smart Farming Market Size Outlook by End-User, 2021- 2032

20. China Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

China Smart Farming Market Size Outlook by Type, 2021- 2032

China Smart Farming Market Size Outlook by Application, 2021- 2032

China Smart Farming Market Size Outlook by End-User, 2021- 2032

21. India Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

India Smart Farming Market Size Outlook by Type, 2021- 2032

India Smart Farming Market Size Outlook by Application, 2021- 2032

India Smart Farming Market Size Outlook by End-User, 2021- 2032

22. Japan Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Smart Farming Market Size Outlook by Type, 2021- 2032

Japan Smart Farming Market Size Outlook by Application, 2021- 2032

Japan Smart Farming Market Size Outlook by End-User, 2021- 2032

23. South Korea Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Smart Farming Market Size Outlook by Type, 2021- 2032

South Korea Smart Farming Market Size Outlook by Application, 2021- 2032

South Korea Smart Farming Market Size Outlook by End-User, 2021- 2032

24. Australia Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Smart Farming Market Size Outlook by Type, 2021- 2032

Australia Smart Farming Market Size Outlook by Application, 2021- 2032

Australia Smart Farming Market Size Outlook by End-User, 2021- 2032

25. South East Asia Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Smart Farming Market Size Outlook by Type, 2021- 2032

South East Asia Smart Farming Market Size Outlook by Application, 2021- 2032

South East Asia Smart Farming Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Smart Farming Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Smart Farming Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Smart Farming Market Size Outlook by End-User, 2021- 2032

27. Brazil Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Smart Farming Market Size Outlook by Type, 2021- 2032

Brazil Smart Farming Market Size Outlook by Application, 2021- 2032

Brazil Smart Farming Market Size Outlook by End-User, 2021- 2032

28. Argentina Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Smart Farming Market Size Outlook by Type, 2021- 2032

Argentina Smart Farming Market Size Outlook by Application, 2021- 2032

Argentina Smart Farming Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Smart Farming Market Size Outlook by Type, 2021- 2032

Rest of South America Smart Farming Market Size Outlook by Application, 2021- 2032

Rest of South America Smart Farming Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Smart Farming Market Size Outlook by Type, 2021- 2032

United Arab Emirates Smart Farming Market Size Outlook by Application, 2021- 2032

United Arab Emirates Smart Farming Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Smart Farming Market Size Outlook by Type, 2021- 2032

Saudi Arabia Smart Farming Market Size Outlook by Application, 2021- 2032

Saudi Arabia Smart Farming Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Smart Farming Market Size Outlook by Type, 2021- 2032

Rest of Middle East Smart Farming Market Size Outlook by Application, 2021- 2032

Rest of Middle East Smart Farming Market Size Outlook by End-User, 2021- 2032

33. South Africa Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Smart Farming Market Size Outlook by Type, 2021- 2032

South Africa Smart Farming Market Size Outlook by Application, 2021- 2032

South Africa Smart Farming Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Smart Farming Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Smart Farming Market Size Outlook by Type, 2021- 2032

Rest of Africa Smart Farming Market Size Outlook by Application, 2021- 2032

Rest of Africa Smart Farming Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

SWOT Analysis

36. Recent Market Developments

Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Service

Solution

Application

Countries Analyzed

USD Analytics forecasts the global Smart Farming market size to increase from $17.1 Billion in 2024 to $46.8 Billion in 2032, registering a CAGR of 13.4% during the forecast period

Yield monitoring (41.5% Market Share), Precision Farming (46.2% Revenue Share)

Ag Leader Technology, AGCO Corp., AgJunction Inc., Auroras Srl, Bacancy Technology, Bayer AG, Cropin Technology Solutions Pvt. Ltd., Cultyvate, Deere and Co., Digital Matter, DTN, Farmers Edge Inc., Gamaya, PrecisionHawk Inc., Raven Industries Inc., Robert Bosch GmbH, Telit Communications Plc, Topcon Positioning Systems Inc., Trimble Inc., TSI Inc.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: USD; Volume

Asia Pacific (13.6% CAGR)