The global Sludge Treatment Chemicals Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Flocculants, Coagulants, Disinfectants, Anti-Foulants, Anti-Foamers, Activated Carbon), By Application (Paper & Pulp, Food & Beverage, Metal Processing, Chemical & Fertilizer, Automotive, Oil & Gas), By Treatment (Primary, Tertiary).

Sludge treatment chemicals play a crucial role in wastewater treatment plants and industrial facilities, aiding in the efficient management and disposal of sludge generated during the treatment process. In 2024, the demand for sludge treatment chemicals remains robust as industries focus on compliance with stringent environmental regulations and sustainable waste management practices. These chemicals encompass a range of formulations including coagulants, flocculants, dewatering agents, and odor control additives, which help in flocculation, dewatering, and stabilization of sludge for safe disposal or reuse. With the growing emphasis on resource recovery and circular economy principles, the market for sludge treatment chemicals is witnessing innovation in the development of environmentally friendly formulations and advanced treatment technologies that minimize sludge volume, reduce disposal costs, and mitigate environmental impacts.

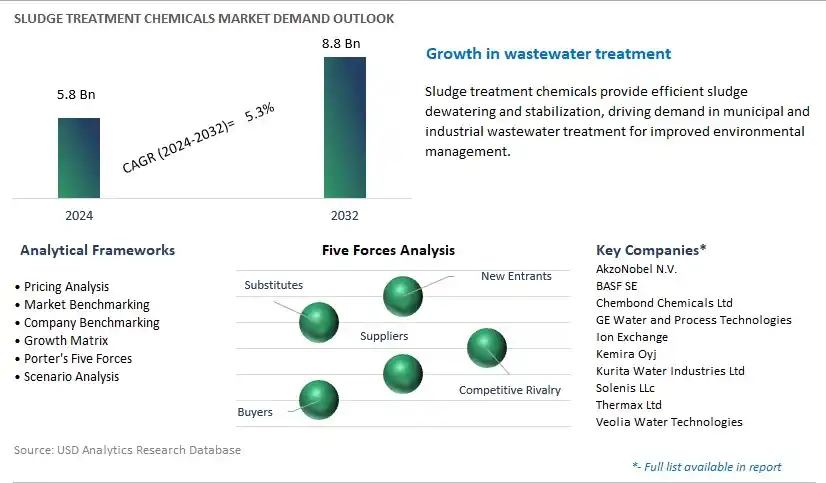

The market report analyses the leading companies in the industry including AkzoNobel N.V., BASF SE, Chembond Chemicals Ltd, GE Water and Process Technologies, Ion Exchange, Kemira Oyj, Kurita Water Industries Ltd, Solenis LLc, Thermax Ltd, Veolia Water Technologies, and others.

One prominent market trend in sludge treatment chemicals is the increasing focus on sustainable and cost-effective solutions. As environmental regulations become more stringent and wastewater treatment plants strive to reduce their environmental footprint, there is a growing trend towards adopting sludge treatment chemicals that are environmentally friendly, energy-efficient, and economically viable. Manufacturers and operators are seeking innovative chemicals and treatment processes that can effectively dewater, stabilize, and dewater sludge while minimizing resource consumption, emissions, and disposal costs. This trend is driven by the need for sustainable solutions that balance environmental stewardship with operational efficiency in wastewater treatment operations.

A key market driver for sludge treatment chemicals is the growth in urbanization and industrialization. With rapid urban population growth and industrial development worldwide, there is a corresponding increase in the generation of wastewater and sewage sludge from municipal and industrial sources. Wastewater treatment plants are under pressure to efficiently treat and manage the growing volumes of sludge while meeting regulatory standards and public health requirements. Sludge treatment chemicals play a critical role in facilitating the treatment process by enhancing dewatering, reducing odor, controlling pathogens, and stabilizing sludge for safe disposal or beneficial reuse. The expansion of urban infrastructure, industrial activities, and wastewater treatment capacity drives the demand for sludge treatment chemicals as municipalities and industries invest in upgrading and expanding their wastewater treatment facilities to meet growing demand and regulatory compliance.

An emerging opportunity in the sludge treatment chemicals market lies in the development of advanced treatment chemicals for resource recovery. Traditional sludge treatment processes often focus on disposal or landfilling of sludge, leading to the loss of valuable resources such as organic matter, nutrients, and energy. However, there is growing interest in developing treatment chemicals and processes that enable the recovery of these resources from sludge for beneficial reuse or recycling. Advanced treatment chemicals, such as phosphorus recovery agents, biogas conditioning additives, and bio-based flocculants, offer opportunities to extract valuable components from sludge and convert them into valuable products or energy sources. By investing in research and innovation, companies can capitalize on the growing demand for sustainable and resource-efficient sludge treatment solutions while creating new revenue streams and contributing to the circular economy goals of resource recovery and waste minimization.

The largest segment in the sludge treatment chemicals market is the Flocculants segment. Flocculants play a pivotal role in sludge treatment processes by promoting the aggregation of suspended particles in wastewater, forming larger flocs that are easier to separate from the liquid phase. This aggregation facilitates the sedimentation or filtration of sludge, leading to more efficient solid-liquid separation and dewatering. Flocculants are widely used in various stages of sludge treatment, including primary sedimentation, secondary clarification, and sludge dewatering processes such as centrifugation and filtration. Additionally, the versatility of flocculants allows for their application across different types of sludge and wastewater compositions, making them indispensable chemicals in sludge treatment plants and wastewater treatment facilities. Moreover, advancements in flocculant formulations and the development of high-performance polymers have further enhanced their efficacy and reliability in sludge treatment applications, consolidating the Flocculants segment as the largest in the sludge treatment chemicals market.

The fastest-growing segment in the sludge treatment chemicals market is the Oil & Gas sector. In particular, the oil and gas sector generate substantial amounts of wastewater and sludge during exploration, production, refining, and petrochemical processes. The increasing global demand for energy has led to intensified production activities in the oil and gas industry, resulting in higher volumes of wastewater and sludge requiring treatment. Additionally, stringent environmental regulations and sustainability initiatives necessitate the implementation of effective sludge treatment solutions to mitigate environmental impacts and comply with regulatory standards. Moreover, advancements in drilling and extraction techniques, such as hydraulic fracturing (fracking) and enhanced oil recovery (EOR), have led to increased water usage and wastewater generation in the oil and gas sector, further driving the demand for sludge treatment chemicals. Therefore, the unique challenges and increasing wastewater volumes in the oil and gas industry position it as the fastest-growing segment in the sludge treatment chemicals market.

The Tertiary Treatment segment is the largest segment in the sludge treatment chemicals market due to its critical role in achieving high-quality effluent standards and meeting regulatory requirements. Tertiary treatment involves advanced processes aimed at removing residual contaminants and suspended solids from wastewater, ensuring that it is safe for discharge into the environment or reuse. Tertiary treatment often includes filtration, disinfection, and chemical treatment processes to further reduce organic and inorganic pollutants present in the wastewater. This segment's dominance is driven by the increasing emphasis on water reuse, resource recovery, and environmental sustainability across industries such as municipal wastewater treatment, industrial manufacturing, and agriculture. Additionally, stringent discharge limits for pollutants set by regulatory bodies worldwide necessitate the implementation of robust tertiary treatment processes and the use of specialized sludge treatment chemicals to achieve compliance. Therefore, the essential role of tertiary treatment in wastewater management and the stringent regulatory landscape position it as the largest segment in the sludge treatment chemicals market.

By Product

Flocculants

Coagulants

Disinfectants

Anti-Foulants

Anti-Foamers

Activated Carbon

By Application

Paper & Pulp

Food & Beverage

Metal Processing

Chemical & Fertilizer

Automotive

Oil & Gas

By Treatment

Primary

TertiaryCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AkzoNobel N.V.

BASF SE

Chembond Chemicals Ltd

GE Water and Process Technologies

Ion Exchange

Kemira Oyj

Kurita Water Industries Ltd

Solenis LLc

Thermax Ltd

Veolia Water Technologies

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Sludge Treatment Chemicals Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Sludge Treatment Chemicals Market Size Outlook, $ Million, 2021 to 2032

3.2 Sludge Treatment Chemicals Market Outlook by Type, $ Million, 2021 to 2032

3.3 Sludge Treatment Chemicals Market Outlook by Product, $ Million, 2021 to 2032

3.4 Sludge Treatment Chemicals Market Outlook by Application, $ Million, 2021 to 2032

3.5 Sludge Treatment Chemicals Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Sludge Treatment Chemicals Industry

4.2 Key Market Trends in Sludge Treatment Chemicals Industry

4.3 Potential Opportunities in Sludge Treatment Chemicals Industry

4.4 Key Challenges in Sludge Treatment Chemicals Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Sludge Treatment Chemicals Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Sludge Treatment Chemicals Market Outlook by Segments

7.1 Sludge Treatment Chemicals Market Outlook by Segments, $ Million, 2021- 2032

By Product

Flocculants

Coagulants

Disinfectants

Anti-Foulants

Anti-Foamers

Activated Carbon

By Application

Paper & Pulp

Food & Beverage

Metal Processing

Chemical & Fertilizer

Automotive

Oil & Gas

By Treatment

Primary

Tertiary

8 North America Sludge Treatment Chemicals Market Analysis and Outlook To 2032

8.1 Introduction to North America Sludge Treatment Chemicals Markets in 2024

8.2 North America Sludge Treatment Chemicals Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Sludge Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Product

Flocculants

Coagulants

Disinfectants

Anti-Foulants

Anti-Foamers

Activated Carbon

By Application

Paper & Pulp

Food & Beverage

Metal Processing

Chemical & Fertilizer

Automotive

Oil & Gas

By Treatment

Primary

Tertiary

9 Europe Sludge Treatment Chemicals Market Analysis and Outlook To 2032

9.1 Introduction to Europe Sludge Treatment Chemicals Markets in 2024

9.2 Europe Sludge Treatment Chemicals Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Sludge Treatment Chemicals Market Size Outlook by Segments, 2021-2032

By Product

Flocculants

Coagulants

Disinfectants

Anti-Foulants

Anti-Foamers

Activated Carbon

By Application

Paper & Pulp

Food & Beverage

Metal Processing

Chemical & Fertilizer

Automotive

Oil & Gas

By Treatment

Primary

Tertiary

10 Asia Pacific Sludge Treatment Chemicals Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Sludge Treatment Chemicals Markets in 2024

10.2 Asia Pacific Sludge Treatment Chemicals Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Sludge Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Product

Flocculants

Coagulants

Disinfectants

Anti-Foulants

Anti-Foamers

Activated Carbon

By Application

Paper & Pulp

Food & Beverage

Metal Processing

Chemical & Fertilizer

Automotive

Oil & Gas

By Treatment

Primary

Tertiary

11 South America Sludge Treatment Chemicals Market Analysis and Outlook To 2032

11.1 Introduction to South America Sludge Treatment Chemicals Markets in 2024

11.2 South America Sludge Treatment Chemicals Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Sludge Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Product

Flocculants

Coagulants

Disinfectants

Anti-Foulants

Anti-Foamers

Activated Carbon

By Application

Paper & Pulp

Food & Beverage

Metal Processing

Chemical & Fertilizer

Automotive

Oil & Gas

By Treatment

Primary

Tertiary

12 Middle East and Africa Sludge Treatment Chemicals Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Sludge Treatment Chemicals Markets in 2024

12.2 Middle East and Africa Sludge Treatment Chemicals Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Sludge Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Product

Flocculants

Coagulants

Disinfectants

Anti-Foulants

Anti-Foamers

Activated Carbon

By Application

Paper & Pulp

Food & Beverage

Metal Processing

Chemical & Fertilizer

Automotive

Oil & Gas

By Treatment

Primary

Tertiary

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AkzoNobel N.V.

BASF SE

Chembond Chemicals Ltd

GE Water and Process Technologies

Ion Exchange

Kemira Oyj

Kurita Water Industries Ltd

Solenis LLc

Thermax Ltd

Veolia Water Technologies

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Flocculants

Coagulants

Disinfectants

Anti-Foulants

Anti-Foamers

Activated Carbon

By Application

Paper & Pulp

Food & Beverage

Metal Processing

Chemical & Fertilizer

Automotive

Oil & Gas

By Treatment

Primary

Tertiary

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Sludge Treatment Chemicals Market Size is valued at $5.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.3% to reach $8.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AkzoNobel N.V., BASF SE, Chembond Chemicals Ltd, GE Water and Process Technologies, Ion Exchange, Kemira Oyj, Kurita Water Industries Ltd, Solenis LLc, Thermax Ltd, Veolia Water Technologies

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume