The Single use Bioreactors Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Product (Single Use Bioreactor Systems, Single Use Media Bags, Single Use Filtration Assemblies, Others), By Molecule (Stirred-tank single use bioreactors, Wave-induced single use bioreactors, Bubble-column single use bioreactors, Others), By Type of Cell (Mammalian cells, Bacterial cells, Yeast cells, Others), By Application (Bioproduction, Process development, Research & development), By End-User (Pharmaceutical & biotechnology companies, CROs & CMOs, Academic & research institutes).

Single-use Bioreactors are disposable vessels used for cell culture and fermentation processes in biopharmaceutical manufacturing. These bioreactors are designed to culture cells, microorganisms, or mammalian cell lines for the production of recombinant proteins, monoclonal antibodies, vaccines, and cell-based therapies. Single-use bioreactors feature pre-sterilized, disposable plastic bags or chambers with integrated sensors, controllers, and agitation systems, eliminating the need for cleaning, sterilization, and validation associated with traditional stainless steel bioreactors. Single-use bioreactors offer advantages such as reduced risk of cross-contamination, shorter turnaround times, and increased flexibility in bioprocess development and scale-up. With advancements in cell culture media, process analytics, and disposable bioreactor designs, single-use bioreactors continue to gain traction in biopharmaceutical manufacturing, enabling cost-effective and agile production of biologics to meet global healthcare needs.

A significant trend in the single-use bioreactors market is the increasing adoption of continuous bioprocessing techniques. Continuous bioprocessing offers several advantages over traditional batch processes, including higher productivity, reduced footprint, and improved process control. Single-use bioreactors are well-suited for continuous operations due to their flexibility, scalability, and ease of implementation. With the growing demand for biopharmaceuticals and the need for more efficient manufacturing processes, there is a shift towards continuous bioprocessing to enhance productivity, reduce costs, and accelerate time to market. The adoption of continuous bioprocessing represents a prominent trend in the single-use bioreactors market, driving innovation and growth in the sector.

A key driver for the single-use bioreactors market is the expansion of the biopharmaceutical pipeline. Biologics, including monoclonal antibodies, recombinant proteins, vaccines, and cell and gene therapies, are increasingly becoming the focus of drug development efforts due to their potential for treating complex diseases with high specificity and efficacy. As the biopharmaceutical pipeline continues to grow, there is an increasing demand for bioprocessing technologies that can efficiently produce these therapeutics at commercial scale. Single-use bioreactors offer several advantages, including faster setup times, reduced cleaning and validation requirements, and lower capital investment compared to traditional stainless steel bioreactors, making them attractive options for biopharmaceutical manufacturers. The expansion of the biopharmaceutical pipeline drives the demand for single-use bioreactors and stimulates market growth in the sector.

An emerging opportunity within the single-use bioreactors market lies in the adoption in emerging markets and technologies. While single-use bioreactors have gained significant traction in established biopharmaceutical markets, there are opportunities to penetrate emerging markets, including Asia-Pacific, Latin America, and the Middle East, where there is a growing demand for biologics and biosimilars. Additionally, the adoption of single-use bioreactors is expanding beyond traditional mammalian cell culture applications into emerging fields such as microbial fermentation, plant cell culture, and tissue engineering. By targeting emerging markets and applications, single-use bioreactor manufacturers can diversify their customer base, expand market reach, and capitalize on the growing demand for flexible and scalable bioprocessing solutions.

Among the segments listed, the single use bioreactor systems product segment is experiencing the fastest growth within the single-use bioreactors market. This growth is primarily driven by several factors. Single use bioreactor systems offer numerous advantages over traditional stainless steel bioreactors, including reduced risk of cross-contamination, elimination of cleaning and validation procedures, and increased flexibility and scalability in bioprocess operations. With the growing demand for biopharmaceuticals, vaccines, and cell therapies, there is a need for efficient and cost-effective bioprocessing solutions that can accommodate varying production scales and process requirements. Single use bioreactor systems, available in a range of volumes from up to 10 L to above 1500 L, cater to the diverse needs of biopharmaceutical manufacturers, contract research organizations (CROs), and academic and research institutes. Moreover, advancements in single use bioreactor technology, such as improved cell culture performance, enhanced monitoring and control capabilities, and integration with automated systems, further drive the adoption of single use bioreactor systems in bioproduction, process development, and research and development applications. As pharmaceutical and biotechnology companies, CROs and contract manufacturing organizations (CMOs), and academic and research institutes seek to accelerate bioprocess development, optimize resource utilization, and reduce time-to-market for biopharmaceutical products, the single use bioreactor systems product segment emerges as the fastest-growing segment within the single-use bioreactors market.

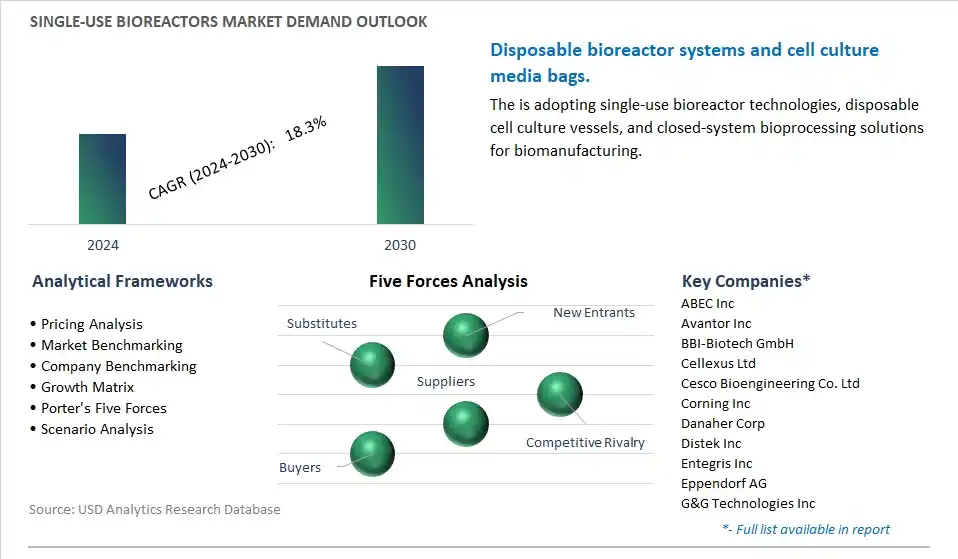

The market research study provides in-depth insights into leading companies including the SWOT analyses, product profile, financial details, and recent developments acrossABEC Inc, Avantor Inc, BBI-Biotech GmbH, Cellexus Ltd, Cesco Bioengineering Co. Ltd, Corning Inc, Danaher Corp, Distek Inc, Entegris Inc, Eppendorf AG, G&G Technologies Inc, Getinge AB, Kühner AG, Merck KGaA, PBS Biotech Inc, ReproCell Inc, Sartorius AG, SATAKE MULTIMIX Corp, Tecnic Bioprocess Equipment Manufacturing, Thermo Fisher Scientific Inc

By Product

Single Use Bioreactor Systems

-Up to 10 L

-11 to 100 L

-101 to 500 L

-501 to 1500 L

-Above 1500 L

Single Use Media Bags

-2D Bags

-3D Bags

-Others

Single Use Filtration Assemblies

Others

By Molecule

Stirred-tank single use bioreactors

Wave-induced single use bioreactors

Bubble-column single use bioreactors

Others

By Type of Cell

Mammalian cells

Bacterial cells

Yeast cells

Others

By Application

Bioproduction

Process development

Research & development

By End-User

Pharmaceutical & biotechnology companies

CROs & CMOs

Academic & research institutes

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ABEC Inc

Avantor Inc

BBI-Biotech GmbH

Cellexus Ltd

Cesco Bioengineering Co. Ltd

Corning Inc

Danaher Corp

Distek Inc

Entegris Inc

Eppendorf AG

G&G Technologies Inc

Getinge AB

Kühner AG

Merck KGaA

PBS Biotech Inc

ReproCell Inc

Sartorius AG

SATAKE MULTIMIX Corp

Tecnic Bioprocess Equipment Manufacturing

Thermo Fisher Scientific Inc

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Single use Bioreactors Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Single use Bioreactors Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Single use Bioreactors Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Single use Bioreactors Market Size Outlook, $ Million, 2021 to 2030

3.2 Single use Bioreactors Market Outlook by Type, $ Million, 2021 to 2030

3.3 Single use Bioreactors Market Outlook by Product, $ Million, 2021 to 2030

3.4 Single use Bioreactors Market Outlook by Application, $ Million, 2021 to 2030

3.5 Single use Bioreactors Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Single use Bioreactors Industry

4.2 Key Market Trends in Single use Bioreactors Industry

4.3 Potential Opportunities in Single use Bioreactors Industry

4.4 Key Challenges in Single use Bioreactors Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Single use Bioreactors Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Single use Bioreactors Market Outlook by Segments

7.1 Single use Bioreactors Market Outlook by Segments, $ Million, 2021- 2030

By Product

Single Use Bioreactor Systems

-Up to 10 L

-11 to 100 L

-101 to 500 L

-501 to 1500 L

-Above 1500 L

Single Use Media Bags

-2D Bags

-3D Bags

-Others

Single Use Filtration Assemblies

Others

By Molecule

Stirred-tank single use bioreactors

Wave-induced single use bioreactors

Bubble-column single use bioreactors

Others

By Type of Cell

Mammalian cells

Bacterial cells

Yeast cells

Others

By Application

Bioproduction

Process development

Research & development

By End-User

Pharmaceutical & biotechnology companies

CROs & CMOs

Academic & research institutes

8 North America Single use Bioreactors Market Analysis and Outlook To 2030

8.1 Introduction to North America Single use Bioreactors Markets in 2024

8.2 North America Single use Bioreactors Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Single use Bioreactors Market size Outlook by Segments, 2021-2030

By Product

Single Use Bioreactor Systems

-Up to 10 L

-11 to 100 L

-101 to 500 L

-501 to 1500 L

-Above 1500 L

Single Use Media Bags

-2D Bags

-3D Bags

-Others

Single Use Filtration Assemblies

Others

By Molecule

Stirred-tank single use bioreactors

Wave-induced single use bioreactors

Bubble-column single use bioreactors

Others

By Type of Cell

Mammalian cells

Bacterial cells

Yeast cells

Others

By Application

Bioproduction

Process development

Research & development

By End-User

Pharmaceutical & biotechnology companies

CROs & CMOs

Academic & research institutes

9 Europe Single use Bioreactors Market Analysis and Outlook To 2030

9.1 Introduction to Europe Single use Bioreactors Markets in 2024

9.2 Europe Single use Bioreactors Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Single use Bioreactors Market Size Outlook by Segments, 2021-2030

By Product

Single Use Bioreactor Systems

-Up to 10 L

-11 to 100 L

-101 to 500 L

-501 to 1500 L

-Above 1500 L

Single Use Media Bags

-2D Bags

-3D Bags

-Others

Single Use Filtration Assemblies

Others

By Molecule

Stirred-tank single use bioreactors

Wave-induced single use bioreactors

Bubble-column single use bioreactors

Others

By Type of Cell

Mammalian cells

Bacterial cells

Yeast cells

Others

By Application

Bioproduction

Process development

Research & development

By End-User

Pharmaceutical & biotechnology companies

CROs & CMOs

Academic & research institutes

10 Asia Pacific Single use Bioreactors Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Single use Bioreactors Markets in 2024

10.2 Asia Pacific Single use Bioreactors Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Single use Bioreactors Market size Outlook by Segments, 2021-2030

By Product

Single Use Bioreactor Systems

-Up to 10 L

-11 to 100 L

-101 to 500 L

-501 to 1500 L

-Above 1500 L

Single Use Media Bags

-2D Bags

-3D Bags

-Others

Single Use Filtration Assemblies

Others

By Molecule

Stirred-tank single use bioreactors

Wave-induced single use bioreactors

Bubble-column single use bioreactors

Others

By Type of Cell

Mammalian cells

Bacterial cells

Yeast cells

Others

By Application

Bioproduction

Process development

Research & development

By End-User

Pharmaceutical & biotechnology companies

CROs & CMOs

Academic & research institutes

11 South America Single use Bioreactors Market Analysis and Outlook To 2030

11.1 Introduction to South America Single use Bioreactors Markets in 2024

11.2 South America Single use Bioreactors Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Single use Bioreactors Market size Outlook by Segments, 2021-2030

By Product

Single Use Bioreactor Systems

-Up to 10 L

-11 to 100 L

-101 to 500 L

-501 to 1500 L

-Above 1500 L

Single Use Media Bags

-2D Bags

-3D Bags

-Others

Single Use Filtration Assemblies

Others

By Molecule

Stirred-tank single use bioreactors

Wave-induced single use bioreactors

Bubble-column single use bioreactors

Others

By Type of Cell

Mammalian cells

Bacterial cells

Yeast cells

Others

By Application

Bioproduction

Process development

Research & development

By End-User

Pharmaceutical & biotechnology companies

CROs & CMOs

Academic & research institutes

12 Middle East and Africa Single use Bioreactors Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Single use Bioreactors Markets in 2024

12.2 Middle East and Africa Single use Bioreactors Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Single use Bioreactors Market size Outlook by Segments, 2021-2030

By Product

Single Use Bioreactor Systems

-Up to 10 L

-11 to 100 L

-101 to 500 L

-501 to 1500 L

-Above 1500 L

Single Use Media Bags

-2D Bags

-3D Bags

-Others

Single Use Filtration Assemblies

Others

By Molecule

Stirred-tank single use bioreactors

Wave-induced single use bioreactors

Bubble-column single use bioreactors

Others

By Type of Cell

Mammalian cells

Bacterial cells

Yeast cells

Others

By Application

Bioproduction

Process development

Research & development

By End-User

Pharmaceutical & biotechnology companies

CROs & CMOs

Academic & research institutes

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

ABEC Inc

Avantor Inc

BBI-Biotech GmbH

Cellexus Ltd

Cesco Bioengineering Co. Ltd

Corning Inc

Danaher Corp

Distek Inc

Entegris Inc

Eppendorf AG

G&G Technologies Inc

Getinge AB

Kühner AG

Merck KGaA

PBS Biotech Inc

ReproCell Inc

Sartorius AG

SATAKE MULTIMIX Corp

Tecnic Bioprocess Equipment Manufacturing

Thermo Fisher Scientific Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Single Use Bioreactor Systems

-Up to 10 L

-11 to 100 L

-101 to 500 L

-501 to 1500 L

-Above 1500 L

Single Use Media Bags

-2D Bags

-3D Bags

-Others

Single Use Filtration Assemblies

Others

By Molecule

Stirred-tank single use bioreactors

Wave-induced single use bioreactors

Bubble-column single use bioreactors

Others

By Type of Cell

Mammalian cells

Bacterial cells

Yeast cells

Others

By Application

Bioproduction

Process development

Research & development

By End-User

Pharmaceutical & biotechnology companies

CROs & CMOs

Academic & research institutes

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Single use Bioreactors Market is one of the lucrative growth markets, poised to register a 18.3% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ABEC Inc, Avantor Inc, BBI-Biotech GmbH, Cellexus Ltd, Cesco Bioengineering Co. Ltd, Corning Inc, Danaher Corp, Distek Inc, Entegris Inc, Eppendorf AG, G&G Technologies Inc, Getinge AB, Kühner AG, Merck KGaA, PBS Biotech Inc, ReproCell Inc, Sartorius AG, SATAKE MULTIMIX Corp, Tecnic Bioprocess Equipment Manufacturing, Thermo Fisher Scientific Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume