The global Silica Sand Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By End-User (Glass Manufacturing, Foundry, Chemical Production, Construction, Paints and Coatings, Ceramics and Refractories, Filtration, Oil and Gas, Others).

Silica sand, a naturally occurring mineral composed of silicon dioxide, is a versatile industrial material used in various applications including glassmaking, foundry casting, hydraulic fracturing, and construction. In 2024, the market for silica sand is witnessing steady growth, driven by its widespread availability, high purity, and diverse range of particle sizes and shapes suitable for different applications. Silica sand is a key ingredient in glass production, providing clarity, strength, and thermal resistance to glass products used in architectural, automotive, and consumer electronics industries. Further, silica sand is used as a proppant in hydraulic fracturing operations to enhance oil and gas recovery from unconventional reservoirs, supporting the global energy supply. With advancements in mining and processing technologies, silica sand suppliers are improving extraction efficiency, product quality, and environmental sustainability through measures such as water recycling, dust control, and habitat restoration. Additionally, the adoption of alternative binders and additives is enabling the production of high-performance foundry sand and specialty silica products tailored to specific casting requirements. As industries to innovate and diversify applications for silica sand, the market is poised for sustained growth, offering solutions for infrastructure development, manufacturing, and energy production worldwide.

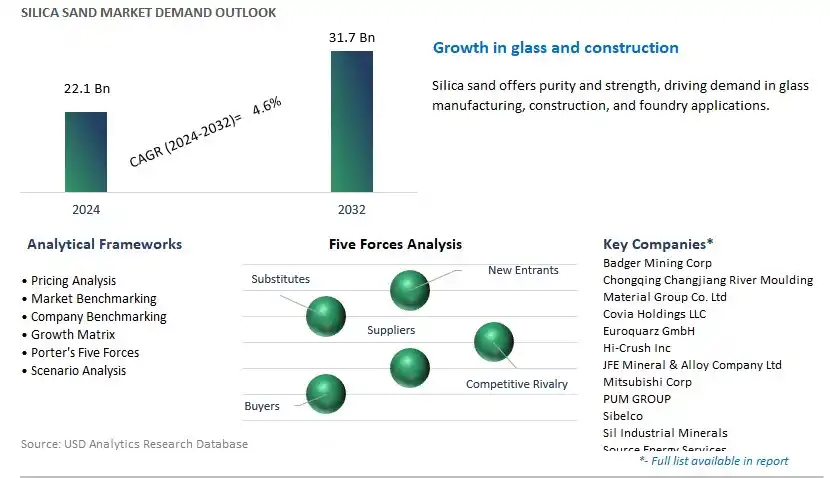

The market report analyses the leading companies in the industry including Badger Mining Corp, Chongqing Changjiang River Moulding Material Group Co. Ltd, Covia Holdings LLC, Euroquarz GmbH, Hi-Crush Inc, JFE Mineral & Alloy Company Ltd, Mitsubishi Corp, PUM GROUP, Sibelco, Sil Industrial Minerals, Source Energy Services, Superior Silica Sands, Tochu Corp, U.S. Silica, and others.

A significant trend in the silica sand market is the increasing demand for industrial silica sand in hydraulic fracturing, also known as fracking, for oil and gas extraction. Industrial silica sand, with its high purity and strength, is a critical proppant used to prop open fractures created in underground rock formations during the fracking process. As the global demand for oil and gas continues to rise, particularly with the expansion of unconventional shale gas and tight oil production, the demand for silica sand as a proppant in hydraulic fracturing is expected to increase. This trend is driven by the continued growth of the oil and gas industry and the ongoing development of fracking techniques to access previously inaccessible hydrocarbon reserves.

The primary driver behind the growth of the silica sand market is the expansion of construction and infrastructure development worldwide. Silica sand is a key component in the production of concrete, asphalt, and other construction materials used in building roads, bridges, residential and commercial buildings, and infrastructure projects. As urbanization accelerates and governments invest in infrastructure to support economic growth, there's a growing demand for silica sand in construction applications. Additionally, silica sand's unique properties, such as its hardness, shape, and size distribution, make it a preferred material for various construction purposes, driving its demand in the market.

An opportunity for the silica sand market lies in diversifying its applications into high-value sectors such as glass manufacturing and foundry industries. Silica sand is a primary raw material used in the production of glass, where it serves as a key ingredient in glassmaking processes to impart clarity, strength, and thermal stability to glass products. Similarly, silica sand is essential in foundry applications for molding and core-making processes to produce metal castings. By targeting these high-value applications and promoting the unique properties of silica sand, such as its purity, particle size distribution, and thermal resistance, manufacturers can tap into new market segments and create additional revenue streams. Expanding into these sectors presents an opportunity for growth and diversification in the silica sand market, beyond its traditional uses in construction and fracking.

In the Silica Sand Market, the Glass Manufacturing segment stands out as the largest due to its fundamental role in glass production. Silica sand serves as a crucial raw material in the manufacturing of various types of glass, including flat glass, container glass, fiberglass, and specialty glass. The glass industry accounts for a significant share of silica sand consumption globally, driven by the growing demand for glass products in construction, automotive, packaging, and electronics sectors. Silica sand's high purity and specific physical properties, such as high melting point, chemical inertness, and uniform particle size distribution, make it indispensable in glassmaking processes, ensuring the production of high-quality glass with desirable optical clarity, strength, and thermal resistance. Additionally, the increasing construction activities worldwide, coupled with rising investments in infrastructure development and urbanization, continue to propel the demand for glass products, thus sustaining the dominance of the Glass Manufacturing segment in the silica sand market.

By End-User

Glass Manufacturing

Foundry

Chemical Production

Construction

Paints and Coatings

Ceramics and Refractories

Filtration

Oil and Gas

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Badger Mining Corp

Chongqing Changjiang River Moulding Material Group Co. Ltd

Covia Holdings LLC

Euroquarz GmbH

Hi-Crush Inc

JFE Mineral & Alloy Company Ltd

Mitsubishi Corp

PUM GROUP

Sibelco

Sil Industrial Minerals

Source Energy Services

Superior Silica Sands

Tochu Corp

U.S. Silica

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Silica Sand Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Silica Sand Market Size Outlook, $ Million, 2021 to 2032

3.2 Silica Sand Market Outlook by Type, $ Million, 2021 to 2032

3.3 Silica Sand Market Outlook by Product, $ Million, 2021 to 2032

3.4 Silica Sand Market Outlook by Application, $ Million, 2021 to 2032

3.5 Silica Sand Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Silica Sand Industry

4.2 Key Market Trends in Silica Sand Industry

4.3 Potential Opportunities in Silica Sand Industry

4.4 Key Challenges in Silica Sand Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Silica Sand Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Silica Sand Market Outlook by Segments

7.1 Silica Sand Market Outlook by Segments, $ Million, 2021- 2032

By End-User

Glass Manufacturing

Foundry

Chemical Production

Construction

Paints and Coatings

Ceramics and Refractories

Filtration

Oil and Gas

Others

8 North America Silica Sand Market Analysis and Outlook To 2032

8.1 Introduction to North America Silica Sand Markets in 2024

8.2 North America Silica Sand Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Silica Sand Market size Outlook by Segments, 2021-2032

By End-User

Glass Manufacturing

Foundry

Chemical Production

Construction

Paints and Coatings

Ceramics and Refractories

Filtration

Oil and Gas

Others

9 Europe Silica Sand Market Analysis and Outlook To 2032

9.1 Introduction to Europe Silica Sand Markets in 2024

9.2 Europe Silica Sand Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Silica Sand Market Size Outlook by Segments, 2021-2032

By End-User

Glass Manufacturing

Foundry

Chemical Production

Construction

Paints and Coatings

Ceramics and Refractories

Filtration

Oil and Gas

Others

10 Asia Pacific Silica Sand Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Silica Sand Markets in 2024

10.2 Asia Pacific Silica Sand Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Silica Sand Market size Outlook by Segments, 2021-2032

By End-User

Glass Manufacturing

Foundry

Chemical Production

Construction

Paints and Coatings

Ceramics and Refractories

Filtration

Oil and Gas

Others

11 South America Silica Sand Market Analysis and Outlook To 2032

11.1 Introduction to South America Silica Sand Markets in 2024

11.2 South America Silica Sand Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Silica Sand Market size Outlook by Segments, 2021-2032

By End-User

Glass Manufacturing

Foundry

Chemical Production

Construction

Paints and Coatings

Ceramics and Refractories

Filtration

Oil and Gas

Others

12 Middle East and Africa Silica Sand Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Silica Sand Markets in 2024

12.2 Middle East and Africa Silica Sand Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Silica Sand Market size Outlook by Segments, 2021-2032

By End-User

Glass Manufacturing

Foundry

Chemical Production

Construction

Paints and Coatings

Ceramics and Refractories

Filtration

Oil and Gas

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Badger Mining Corp

Chongqing Changjiang River Moulding Material Group Co. Ltd

Covia Holdings LLC

Euroquarz GmbH

Hi-Crush Inc

JFE Mineral & Alloy Company Ltd

Mitsubishi Corp

PUM GROUP

Sibelco

Sil Industrial Minerals

Source Energy Services

Superior Silica Sands

Tochu Corp

U.S. Silica

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By End-User

Glass Manufacturing

Foundry

Chemical Production

Construction

Paints and Coatings

Ceramics and Refractories

Filtration

Oil and Gas

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Silica Sand Market Size is valued at $22.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.6% to reach $31.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Badger Mining Corp, Chongqing Changjiang River Moulding Material Group Co. Ltd, Covia Holdings LLC, Euroquarz GmbH, Hi-Crush Inc, JFE Mineral & Alloy Company Ltd, Mitsubishi Corp, PUM GROUP, Sibelco, Sil Industrial Minerals, Source Energy Services, Superior Silica Sands, Tochu Corp, U.S. Silica

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume