The global Sheet Metal Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Steel, Aluminum, Others), By End-User (Automotive & Transportation, Building & Construction, Industrial Machinery, Others).

The future of sheet metal fabrication is influenced by advancements in manufacturing technology, automation, and sustainability initiatives. Sheet metal, a fundamental material in manufacturing industries, is used to create a wide range of products, including automotive parts, building components, and consumer appliances. With the adoption of Industry 4.0 principles, such as digitalization, robotics, and additive manufacturing, sheet metal fabrication processes are becoming more efficient, precise, and cost-effective. Automation technologies, such as CNC machining, laser cutting, and robotic welding, enable faster production cycles and higher product consistency. Additionally, sustainability concerns drive the adoption of eco-friendly practices in sheet metal manufacturing, such as recycling scrap metal, reducing material waste, and optimizing energy usage. Furthermore, as industries demand lightweight materials and complex geometries, advanced sheet metal alloys, such as high-strength steels, aluminum alloys, and titanium, are being developed to meet performance requirements while reducing weight and environmental impact. As sheet metal fabrication continues to evolve with technological innovations and sustainable practices, it remains a critical manufacturing process in various industries, driving economic growth and industrial development worldwide.

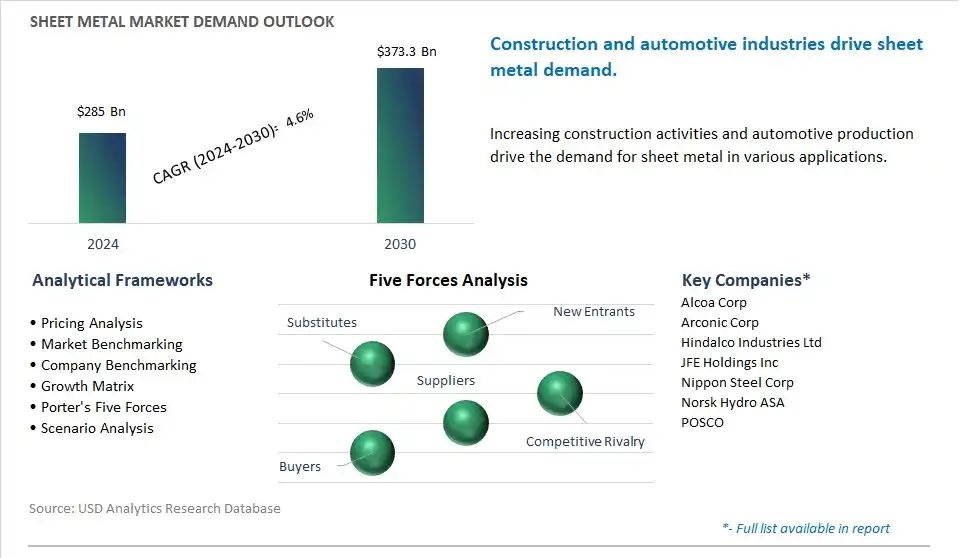

The market report analyses the leading companies in the industry including Alcoa Corp, Arconic Corp, Hindalco Industries Ltd, JFE Holdings Inc, Nippon Steel Corp, Norsk Hydro ASA, POSCO.

A significant trend in the market for sheet metal is the increasing adoption of lightweight materials in the automotive and aerospace industries. With the emphasis on fuel efficiency, emissions reduction, and performance optimization, manufacturers in these sectors are turning to lightweight materials such as aluminum, titanium, and advanced high-strength steel for vehicle and aircraft construction. Sheet metal plays a crucial role in lightweighting initiatives, as it offers a balance of strength, formability, and cost-effectiveness for producing structural components, body panels, and aerospace structures. The trend towards lightweight materials drives the demand for sheet metal in automotive and aerospace applications, as manufacturers seek to meet regulatory requirements, improve fuel economy, and enhance overall performance.

A primary driver for the market of sheet metal is the growth in construction and infrastructure development projects worldwide. Sheet metal is a versatile material used in a wide range of construction applications, including roofing, cladding, facades, framing, and interior finishes. As urbanization accelerates and infrastructure needs expand, there is a rising demand for durable, weather-resistant materials that can withstand environmental conditions and provide long-lasting protection for buildings and infrastructure assets. The construction industry's focus on sustainability, energy efficiency, and architectural design drives the demand for sheet metal as a preferred choice for roofing and cladding solutions in residential, commercial, and industrial construction projects.

An opportunity in the market for sheet metal lies in the expansion into renewable energy and green building applications. With the increasing focus on environmental sustainability and renewable energy sources, there is growing demand for sheet metal products in solar panel mounting systems, wind turbine components, and green building envelopes. Sheet metal offers excellent strength-to-weight ratio, corrosion resistance, and recyclability, making it an ideal choice for supporting structures and protective enclosures in renewable energy projects. Additionally, sheet metal can contribute to energy-efficient building designs by providing thermal insulation, solar reflectance, and ventilation solutions that enhance indoor comfort and reduce energy consumption. By diversifying into renewable energy and green building applications, manufacturers of sheet metal can capitalize on opportunities in the growing market for sustainable construction and clean energy infrastructure.

Steel dominates the sheet metal market due to its widespread use across various industries, its versatility, and its favorable mechanical properties. Steel sheets offer exceptional strength, durability, and corrosion resistance, making them suitable for a wide range of applications in construction, automotive manufacturing, aerospace, machinery, and appliances. In the construction sector, steel sheets are used for roofing, cladding, framing, and structural components due to their high structural integrity and fire resistance. In automotive manufacturing, steel sheets are utilized for body panels, chassis, and structural reinforcements to enhance safety and reduce weight. Additionally, steel sheets find applications in appliances such as refrigerators, ovens, and washing machines, where durability and aesthetic appeal are essential. The abundance of steel resources, established manufacturing infrastructure, and continuous advancements in steel production technologies further contribute to its dominance in the sheet metal market. Thus, steel is the largest segment in the Sheet Metal Market.

The sector is experiencing significant growth in the demand for sheet metal. The automotive industry is undergoing a transformative shift towards electric and autonomous vehicles, which require lightweight materials to improve energy efficiency and extend driving range. Sheet metal, particularly aluminum and advanced high-strength steel alloys, is favored for its lightweight yet durable properties, making it ideal for automotive body panels, chassis components, and structural reinforcements. Additionally, stringent emissions regulations are driving the adoption of lightweight materials to reduce vehicle weight and emissions, further boosting the demand for sheet metal in the automotive sector. Further, the growing trend towards vehicle electrification and connectivity is spurring investments in new technologies and manufacturing processes, driving the demand for sheet metal in electric vehicle battery enclosures, electronic components, and connectivity infrastructure. Accordingly, the Automotive & Transportation segment is the fastest-growing segment in the Sheet Metal Market.

By Material

Steel

Aluminum

Others

By End-User

Automotive & Transportation

Building & Construction

Industrial Machinery

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alcoa Corp

Arconic Corp

Hindalco Industries Ltd

JFE Holdings Inc

Nippon Steel Corp

Norsk Hydro ASA

POSCO

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Sheet Metal Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Sheet Metal Market Size Outlook, $ Million, 2021 to 2030

3.2 Sheet Metal Market Outlook by Type, $ Million, 2021 to 2030

3.3 Sheet Metal Market Outlook by Product, $ Million, 2021 to 2030

3.4 Sheet Metal Market Outlook by Application, $ Million, 2021 to 2030

3.5 Sheet Metal Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Sheet Metal Industry

4.2 Key Market Trends in Sheet Metal Industry

4.3 Potential Opportunities in Sheet Metal Industry

4.4 Key Challenges in Sheet Metal Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Sheet Metal Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Sheet Metal Market Outlook by Segments

7.1 Sheet Metal Market Outlook by Segments, $ Million, 2021- 2030

By Material

Steel

Aluminum

Others

By End-User

Automotive & Transportation

Building & Construction

Industrial Machinery

Others

8 North America Sheet Metal Market Analysis and Outlook To 2030

8.1 Introduction to North America Sheet Metal Markets in 2024

8.2 North America Sheet Metal Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Sheet Metal Market size Outlook by Segments, 2021-2030

By Material

Steel

Aluminum

Others

By End-User

Automotive & Transportation

Building & Construction

Industrial Machinery

Others

9 Europe Sheet Metal Market Analysis and Outlook To 2030

9.1 Introduction to Europe Sheet Metal Markets in 2024

9.2 Europe Sheet Metal Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Sheet Metal Market Size Outlook by Segments, 2021-2030

By Material

Steel

Aluminum

Others

By End-User

Automotive & Transportation

Building & Construction

Industrial Machinery

Others

10 Asia Pacific Sheet Metal Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Sheet Metal Markets in 2024

10.2 Asia Pacific Sheet Metal Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Sheet Metal Market size Outlook by Segments, 2021-2030

By Material

Steel

Aluminum

Others

By End-User

Automotive & Transportation

Building & Construction

Industrial Machinery

Others

11 South America Sheet Metal Market Analysis and Outlook To 2030

11.1 Introduction to South America Sheet Metal Markets in 2024

11.2 South America Sheet Metal Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Sheet Metal Market size Outlook by Segments, 2021-2030

By Material

Steel

Aluminum

Others

By End-User

Automotive & Transportation

Building & Construction

Industrial Machinery

Others

12 Middle East and Africa Sheet Metal Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Sheet Metal Markets in 2024

12.2 Middle East and Africa Sheet Metal Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Sheet Metal Market size Outlook by Segments, 2021-2030

By Material

Steel

Aluminum

Others

By End-User

Automotive & Transportation

Building & Construction

Industrial Machinery

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Alcoa Corp

Arconic Corp

Hindalco Industries Ltd

JFE Holdings Inc

Nippon Steel Corp

Norsk Hydro ASA

POSCO

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Steel

Aluminum

Others

By End-User

Automotive & Transportation

Building & Construction

Industrial Machinery

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Sheet Metal is forecast to reach $373.3 Billion in 2030 from $285 Billion in 2024, registering a CAGR of 4.6%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alcoa Corp, Arconic Corp, Hindalco Industries Ltd, JFE Holdings Inc, Nippon Steel Corp, Norsk Hydro ASA, POSCO

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume