The global Seitan Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Nature (Organic Seitan, Conventional Seitan)

The seitan market is experiencing rapid growth in 2024, driven by the rising demand for plant-based protein alternatives, the growing popularity of vegan and vegetarian diets, and the expanding applications of seitan in culinary and foodservice establishments. Seitan, also known as wheat meat or wheat gluten, is a versatile meat substitute made from wheat gluten, water, and seasonings, offering a chewy texture, neutral taste, and high protein content. With consumers seeking healthier and sustainable alternatives to meat, seitan is gaining traction as a nutritious and environmentally friendly protein source, suitable for a wide range of cuisines and cooking styles. Moreover, the food industry is incorporating seitan into a diverse array of products, including plant-based meats, burgers, sausages, deli slices, and ready-to-eat meals, catering to the growing demand for meat-free options among flexitarians, vegetarians, and vegans. Additionally, the rise of plant-based food startups, vegan-friendly restaurants, and meatless meal delivery services is providing new opportunities for seitan manufacturers to expand their market reach and capitalize on the burgeoning plant-based food movement. As consumers embrace plant-based eating for health, environmental, and ethical reasons, the seitan market is poised for continued growth and innovation, with opportunities for product diversification, flavor innovation, and market expansion shaping the future of the global plant-based protein industry.

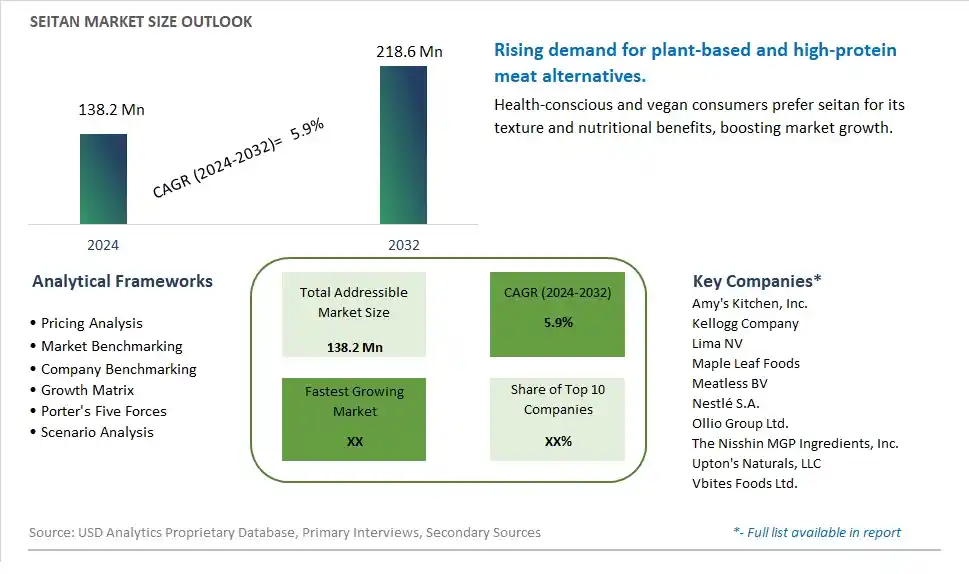

The market report analyses the leading companies in the industry including Amy's Kitchen, Inc., Kellogg Company, Lima NV, Maple Leaf Foods, Meatless BV, Nestlé S.A., Ollio Group Ltd., The Nisshin MGP Ingredients, Inc., Upton's Naturals, LLC, Vbites Foods Ltd., and Others.

One prominent trend in the seitan market is the rising demand for plant-based protein alternatives. As consumers become more health-conscious and environmentally aware, there is a growing interest in plant-based diets and meat substitutes. Seitan, also known as wheat gluten, is a popular meat alternative that offers a high protein content and a texture similar to meat when cooked. With increasing concerns about the environmental impact of meat production and the health risks associated with excessive meat consumption, more consumers are turning to plant-based protein sources like seitan to meet their nutritional needs and reduce their carbon footprint.

A key driver in the seitan market is the growth of vegetarian and vegan lifestyles. As awareness of animal welfare issues, sustainability concerns, and the health benefits of plant-based diets continues to rise, more people are adopting vegetarian, vegan, or flexitarian lifestyles. Seitan serves as an important protein source for individuals following these dietary preferences as it offers a versatile ingredient for creating meat-free dishes with texture and flavor reminiscent of traditional meat-based meals. The increasing number of people choosing plant-based diets drives the demand for seitan products across various foodservice establishments, retail outlets, and home kitchens.

An emerging opportunity in the seitan market is innovation in product formulations and flavors. While seitan is commonly available in its basic form, there's potential to diversify the market by introducing flavored and seasoned varieties that appeal to different taste preferences and culinary applications. Manufacturers can explore options such as barbecue, teriyaki, buffalo, and spicy flavors to enhance the taste and versatility of seitan products. Additionally, there's an opportunity to develop ready-to-eat seitan products such as pre-marinated strips, sausages, burgers, and nuggets to cater to consumers seeking convenient and tasty plant-based meal solutions. By offering a wider range of flavorful and convenient seitan options, companies can attract new consumers, drive sales growth, and capitalize on the expanding market for plant-based protein alternatives.

In the Seitan Market, the conventional seitan segment is the largest, driven by its widespread availability, affordability, and familiarity among consumers. Conventional seitan, made from vital wheat gluten, water, and seasoning, is a versatile plant-based protein popular among vegetarians, vegans, and individuals seeking meat alternatives. Its meat-like texture, neutral flavor, and high protein content make it a staple ingredient in a variety of cuisines and recipes. Additionally, conventional seitan's accessibility in mainstream supermarkets and specialty stores contributes to its dominance in the market. While organic seitan appeals to health-conscious consumers seeking certified organic products, the conventional segment maintains its lead due to its broader market reach and competitive pricing. As consumer demand for plant-based protein options continues to grow, the conventional seitan segment remains poised for sustained dominance in the Seitan Market.

By Nature

Organic Seitan

Conventional Seitan

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amy's Kitchen, Inc.

Kellogg Company

Lima NV

Maple Leaf Foods

Meatless BV

Nestlé S.A.

Ollio Group Ltd.

The Nisshin MGP Ingredients, Inc.

Upton's Naturals, LLC

Vbites Foods Ltd.

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Seitan Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Seitan Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Seitan Market Share by Company, 2023

4.1.2. Product Offerings of Leading Seitan Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Seitan Market Drivers

6.2. Seitan Market Challenges

6.6. Seitan Market Opportunities

6.4. Seitan Market Trends

Chapter 7. Global Seitan Market Outlook Trends

7.1. Global Seitan Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Seitan Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Seitan Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Nature

Organic Seitan

Conventional Seitan

Chapter 8. Global Seitan Regional Analysis and Outlook

8.1. Global Seitan Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Seitan Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Seitan Regional Analysis and Outlook

8.2.2. Canada Seitan Regional Analysis and Outlook

8.2.3. Mexico Seitan Regional Analysis and Outlook

8.3. Europe Seitan Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Seitan Regional Analysis and Outlook

8.3.2. France Seitan Regional Analysis and Outlook

8.3.3. United Kingdom Seitan Regional Analysis and Outlook

8.3.4. Spain Seitan Regional Analysis and Outlook

8.3.5. Italy Seitan Regional Analysis and Outlook

8.3.6. Russia Seitan Regional Analysis and Outlook

8.3.7. Rest of Europe Seitan Regional Analysis and Outlook

8.4. Asia Pacific Seitan Revenue (USD Million) by Country (2021-2032)

8.4.1. China Seitan Regional Analysis and Outlook

8.4.2. Japan Seitan Regional Analysis and Outlook

8.4.3. India Seitan Regional Analysis and Outlook

8.4.4. South Korea Seitan Regional Analysis and Outlook

8.4.5. Australia Seitan Regional Analysis and Outlook

8.4.6. South East Asia Seitan Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Seitan Regional Analysis and Outlook

8.5. South America Seitan Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Seitan Regional Analysis and Outlook

8.5.2. Argentina Seitan Regional Analysis and Outlook

8.5.3. Rest of South America Seitan Regional Analysis and Outlook

8.6. Middle East and Africa Seitan Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Seitan Regional Analysis and Outlook

8.6.2. Africa Seitan Regional Analysis and Outlook

Chapter 9. North America Seitan Analysis and Outlook

9.1. North America Seitan Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Seitan Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Seitan Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Seitan Revenue (USD Million) by Product (2021-2032)

By Nature

Organic Seitan

Conventional Seitan

Chapter 10. Europe Seitan Analysis and Outlook

10.1. Europe Seitan Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Seitan Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Seitan Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Seitan Revenue (USD Million) by Product (2021-2032)

By Nature

Organic Seitan

Conventional Seitan

Chapter 11. Asia Pacific Seitan Analysis and Outlook

11.1. Asia Pacific Seitan Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Seitan Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Seitan Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Seitan Revenue (USD Million) by Product (2021-2032)

By Nature

Organic Seitan

Conventional Seitan

Chapter 12. South America Seitan Analysis and Outlook

12.1. South America Seitan Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Seitan Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Seitan Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Seitan Revenue (USD Million) by Product (2021-2032)

By Nature

Organic Seitan

Conventional Seitan

Chapter 13. Middle East and Africa Seitan Analysis and Outlook

13.1. Middle East and Africa Seitan Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Seitan Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Seitan Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Seitan Revenue (USD Million) by Product (2021-2032)

By Nature

Organic Seitan

Conventional Seitan

Chapter 14. Seitan Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Amy's Kitchen, Inc.

Kellogg Company

Lima NV

Maple Leaf Foods

Meatless BV

Nestlé S.A.

Ollio Group Ltd.

The Nisshin MGP Ingredients, Inc.

Upton's Naturals, LLC

Vbites Foods Ltd.

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Seitan Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Seitan Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Seitan Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Seitan Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Seitan Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Seitan Market Share (%) By Regions (2021-2032)

Table 12 North America Seitan Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Seitan Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Seitan Revenue (USD Million) By Country (2021-2032)

Table 15 South America Seitan Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Seitan Revenue (USD Million) By Region (2021-2032)

Table 17 North America Seitan Revenue (USD Million) By Type (2021-2032)

Table 18 North America Seitan Revenue (USD Million) By Application (2021-2032)

Table 19 North America Seitan Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Seitan Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Seitan Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Seitan Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Seitan Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Seitan Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Seitan Revenue (USD Million) By Product (2021-2032)

Table 26 South America Seitan Revenue (USD Million) By Type (2021-2032)

Table 27 South America Seitan Revenue (USD Million) By Application (2021-2032)

Table 28 South America Seitan Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Seitan Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Seitan Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Seitan Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Seitan Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Seitan Market Share (%) By Regions (2023)

Figure 6. North America Seitan Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Seitan Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Seitan Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Seitan Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Seitan Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Seitan Revenue (USD Million) By Country (2021-2032)

Figure 12. France Seitan Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Seitan Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Seitan Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Seitan Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Seitan Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Seitan Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Seitan Revenue (USD Million) By Country (2021-2032)

Figure 12. China Seitan Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Seitan Revenue (USD Million) By Country (2021-2032)

Figure 14. India Seitan Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Seitan Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Seitan Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Seitan Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Seitan Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Seitan Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Seitan Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Seitan Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Seitan Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Seitan Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Seitan Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Seitan Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Seitan Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Seitan Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Seitan Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Seitan Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Seitan Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Seitan Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Seitan Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Seitan Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Seitan Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Seitan Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Seitan Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Seitan Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Seitan Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Seitan Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Seitan Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Seitan Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Seitan Revenue (USD Million) By Product (2021-2032)

By Nature

Organic Seitan

Conventional Seitan

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Seitan Market Size is valued at $138.2 Million in 2024 and is forecast to register a growth rate (CAGR) of 5.9% to reach $218.6 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amy's Kitchen, Inc., Kellogg Company, Lima NV, Maple Leaf Foods, Meatless BV, Nestlé S.A., Ollio Group Ltd., The Nisshin MGP Ingredients, Inc., Upton's Naturals, LLC, Vbites Foods Ltd.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume