The global Seamless Pipes Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Hot Finished, Cold Finished), By Material (Steel & Alloys, Copper & Alloys, Nickel & Alloys, Others), By Production Process (Continuous Mandrel rolling, Multi-stand Plug Mill, Cross-roll Piercing & Pilger Rolling), By End-User (Oil & Gas, Infrastructure & Construction, Power Generation, Automotive, Engineering, Others).

In 2024, the seamless pipes market is witnessing significant growth driven by the increasing demand for high-strength, corrosion-resistant, and cost-effective piping solutions in oil and gas, petrochemicals, power generation, and automotive industries. Seamless pipes are manufactured without welding seams or joints, offering advantages such as uniformity, strength, and reliability in conveying fluids and gases under high-pressure and high-temperature conditions. The oil and gas industry is a major consumer of seamless pipes, with applications ranging from exploration and production to transportation and refining, benefiting from their ability to withstand harsh operating conditions and corrosive environments. Further, the petrochemicals sector utilizes seamless pipes for chemical processing, refining, and pipeline infrastructure, ensuring product purity, integrity, and safety in handling hazardous materials. Additionally, the power generation industry relies on seamless pipes for boiler tubes, heat exchangers, and steam piping systems, contributing to energy efficiency, reliability, and plant performance. With advancements in pipe manufacturing technologies, material formulations, and quality control measures, the seamless pipes market is poised for d expansion, driven by innovations in pipe strength, durability, and dimensional accuracy, as well as increasing demand for energy and infrastructure projects globally.

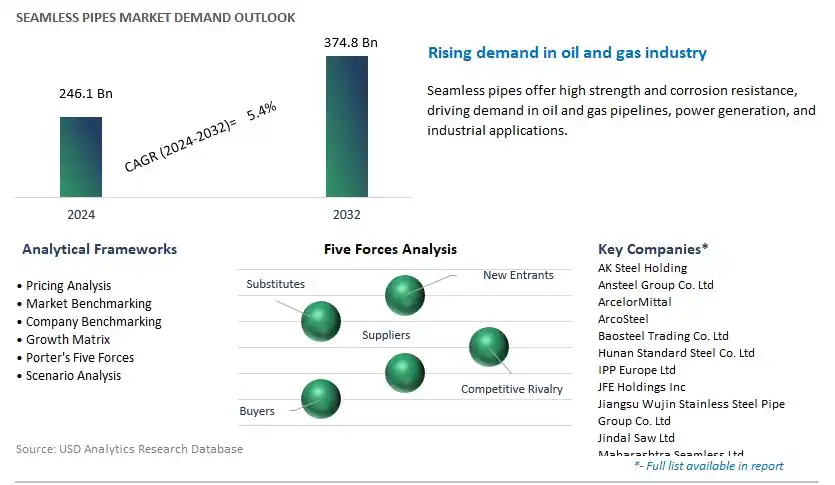

The market report analyses the leading companies in the industry including AK Steel Holding, Ansteel Group Co. Ltd, ArcelorMittal, ArcoSteel, Baosteel Trading Co. Ltd, Hunan Standard Steel Co. Ltd, IPP Europe Ltd, JFE Holdings Inc, Jiangsu Wujin Stainless Steel Pipe Group Co. Ltd, Jindal Saw Ltd, Maharashtra Seamless Ltd, Nippon Steel Corp, Salzgitter AG, Sandvik AB, Santok Steel Corp, Sumitomo Corp, TATA Steel, Tenaris SA, TMK Group., Tubos Reunidos S., United States Steel Corp, Vallourec SA, Wuhan Heavy Industry Casting & Forging Co. Ltd, Zamzam Steel, Zekelman Industries Inc, and others.

One prominent market trend in seamless pipes is the increasing demand for high-quality and corrosion-resistant pipes. As industries such as oil and gas, petrochemicals, and construction require pipes that can withstand harsh operating conditions and corrosive environments, there is a rising preference for seamless pipes due to their superior strength, durability, and resistance to corrosion. Seamless pipes offer advantages such as uniformity in wall thickness, enhanced mechanical properties, and seamless construction without welds, making them ideal for demanding applications where reliability and performance are paramount. This trend is driven by the need for reliable and long-lasting piping solutions to ensure safe and efficient operations in various industries.

A key market driver for seamless pipes is the growth in oil and gas exploration and production activities. With increasing global energy demand and the expansion of unconventional oil and gas resources, there is a growing need for seamless pipes for drilling, production, and transportation of hydrocarbons. Seamless pipes are critical components in oil and gas infrastructure, including drilling rigs, well casings, pipelines, and refineries, where they are used to convey fluids under high pressure, temperature, and corrosive conditions. The expansion of oil and gas exploration and production activities worldwide drives the demand for seamless pipes as operators seek reliable and high-performance piping solutions to support their operations.

An emerging opportunity in the seamless pipes market lies in the expansion into new end-use industries and applications. While seamless pipes are traditionally used in industries such as oil and gas, petrochemicals, power generation, and construction, there is potential to diversify into new sectors and applications that require high-performance piping solutions. Opportunities exist to supply seamless pipes for industries such as automotive, aerospace, marine, renewable energy, and infrastructure development, where the demand for durable and reliable piping systems is growing. By expanding into new markets and applications, seamless pipe manufacturers can diversify their customer base, mitigate risks associated with cyclical industries, and capitalize on emerging opportunities for growth in the dynamic piping market.

The Hot Finished segment is the largest segment in the Seamless Pipes Market. Hot finished seamless pipes undergo a final hot working process that results in a smooth surface finish and improved mechanical properties. These pipes are widely used in various industries such as oil and gas, construction, and automotive due to their superior strength, corrosion resistance, and ability to withstand high temperatures and pressure conditions. Additionally, hot finished seamless pipes are preferred for applications that require precise dimensions and high structural integrity, such as pipelines, refineries, and power generation plants. The efficiency of hot finishing processes and the versatility of hot finished seamless pipes make them a popular choice among manufacturers and end-users alike, solidifying their position as the largest segment in the Seamless Pipes Market.

The Nickel & Alloys segment is the fastest-growing segment in the Seamless Pipes Market. Nickel and its alloys offer exceptional corrosion resistance, high temperature strength, and excellent mechanical properties, making them ideal materials for demanding applications in industries such as aerospace, chemical processing, and power generation. Seamless pipes made from nickel alloys are highly sought after for their ability to withstand harsh environments, corrosive chemicals, and extreme temperatures without compromising performance or structural integrity. With increasing industrialization and the need for specialized materials that can withstand challenging operating conditions, there is a growing demand for seamless pipes made from nickel alloys. Additionally, advancements in manufacturing technologies and the development of new nickel-based alloys further contribute to the growth of this segment. As industries continue to prioritize durability, reliability, and performance, the Nickel & Alloys segment is expected to experience rapid growth, cementing its position as the fastest-growing segment in the Seamless Pipes Market.

Continuous Mandrel Rolling stands out as the largest segment in the Seamless Pipes Market, primarily due to its efficiency, versatility, and widespread application across various industries. In continuous mandrel rolling, a heated steel billet is continuously passed through a series of rolls and mandrels to achieve the desired shape and dimensions of the seamless pipe. This process allows for precise control over the pipe's diameter, wall thickness, and surface finish, resulting in high-quality seamless pipes suitable for a wide range of applications. Continuous mandrel rolling is favored by manufacturers for its ability to produce seamless pipes with uniform properties, excellent dimensional accuracy, and consistent mechanical performance. Moreover, the continuous nature of the process enables high production rates and cost-effective manufacturing, making it the preferred production process for seamless pipes in industries such as oil and gas, automotive, and construction. As demand for seamless pipes continues to rise, driven by infrastructure development and industrial expansion, the Continuous Mandrel Rolling segment maintains its dominance as the largest in the Seamless Pipes Market.

The Infrastructure & Construction segment is the fastest-growing segment in the Seamless Pipes Market, driven by the increasing demand for seamless pipes in various construction projects worldwide. Seamless pipes play a crucial role in infrastructure development, including the construction of pipelines, bridges, tunnels, and high-rise buildings. The superior strength, durability, and corrosion resistance of seamless pipes make them essential components for structural applications, ensuring the integrity and longevity of infrastructure projects. With rapid urbanization, population growth, and government initiatives to improve transportation networks and utilities, the demand for seamless pipes in infrastructure and construction is expected to surge. Additionally, ongoing investments in renewable energy projects such as wind farms and solar power plants further contribute to the growth of this segment, as seamless pipes are used in the construction of transmission lines and support structures. As infrastructure development remains a priority worldwide, the Infrastructure & Construction segment is poised for rapid growth in the Seamless Pipes Market.

By Type

Hot Finished

Cold Finished

By Material

Steel & Alloys

Copper & Alloys

Nickel & Alloys

Others

By Production Process

Continuous Mandrel rolling

Multi-stand Plug Mill

Cross-roll Piercing & Pilger Rolling

By End-User

Oil & Gas

Infrastructure & Construction

Power Generation

Automotive

Engineering

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AK Steel Holding

Ansteel Group Co. Ltd

ArcelorMittal

ArcoSteel

Baosteel Trading Co. Ltd

Hunan Standard Steel Co. Ltd

IPP Europe Ltd

JFE Holdings Inc

Jiangsu Wujin Stainless Steel Pipe Group Co. Ltd

Jindal Saw Ltd

Maharashtra Seamless Ltd

Nippon Steel Corp

Salzgitter AG

Sandvik AB

Santok Steel Corp

Sumitomo Corp

TATA Steel

Tenaris SA

TMK Group.

Tubos Reunidos S.

United States Steel Corp

Vallourec SA

Wuhan Heavy Industry Casting & Forging Co. Ltd

Zamzam Steel

Zekelman Industries Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Seamless Pipes Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Seamless Pipes Market Size Outlook, $ Million, 2021 to 2032

3.2 Seamless Pipes Market Outlook by Type, $ Million, 2021 to 2032

3.3 Seamless Pipes Market Outlook by Product, $ Million, 2021 to 2032

3.4 Seamless Pipes Market Outlook by Application, $ Million, 2021 to 2032

3.5 Seamless Pipes Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Seamless Pipes Industry

4.2 Key Market Trends in Seamless Pipes Industry

4.3 Potential Opportunities in Seamless Pipes Industry

4.4 Key Challenges in Seamless Pipes Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Seamless Pipes Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Seamless Pipes Market Outlook by Segments

7.1 Seamless Pipes Market Outlook by Segments, $ Million, 2021- 2032

By Type

Hot Finished

Cold Finished

By Material

Steel & Alloys

Copper & Alloys

Nickel & Alloys

Others

By Production Process

Continuous Mandrel rolling

Multi-stand Plug Mill

Cross-roll Piercing & Pilger Rolling

By End-User

Oil & Gas

Infrastructure & Construction

Power Generation

Automotive

Engineering

Others

8 North America Seamless Pipes Market Analysis and Outlook To 2032

8.1 Introduction to North America Seamless Pipes Markets in 2024

8.2 North America Seamless Pipes Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Seamless Pipes Market size Outlook by Segments, 2021-2032

By Type

Hot Finished

Cold Finished

By Material

Steel & Alloys

Copper & Alloys

Nickel & Alloys

Others

By Production Process

Continuous Mandrel rolling

Multi-stand Plug Mill

Cross-roll Piercing & Pilger Rolling

By End-User

Oil & Gas

Infrastructure & Construction

Power Generation

Automotive

Engineering

Others

9 Europe Seamless Pipes Market Analysis and Outlook To 2032

9.1 Introduction to Europe Seamless Pipes Markets in 2024

9.2 Europe Seamless Pipes Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Seamless Pipes Market Size Outlook by Segments, 2021-2032

By Type

Hot Finished

Cold Finished

By Material

Steel & Alloys

Copper & Alloys

Nickel & Alloys

Others

By Production Process

Continuous Mandrel rolling

Multi-stand Plug Mill

Cross-roll Piercing & Pilger Rolling

By End-User

Oil & Gas

Infrastructure & Construction

Power Generation

Automotive

Engineering

Others

10 Asia Pacific Seamless Pipes Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Seamless Pipes Markets in 2024

10.2 Asia Pacific Seamless Pipes Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Seamless Pipes Market size Outlook by Segments, 2021-2032

By Type

Hot Finished

Cold Finished

By Material

Steel & Alloys

Copper & Alloys

Nickel & Alloys

Others

By Production Process

Continuous Mandrel rolling

Multi-stand Plug Mill

Cross-roll Piercing & Pilger Rolling

By End-User

Oil & Gas

Infrastructure & Construction

Power Generation

Automotive

Engineering

Others

11 South America Seamless Pipes Market Analysis and Outlook To 2032

11.1 Introduction to South America Seamless Pipes Markets in 2024

11.2 South America Seamless Pipes Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Seamless Pipes Market size Outlook by Segments, 2021-2032

By Type

Hot Finished

Cold Finished

By Material

Steel & Alloys

Copper & Alloys

Nickel & Alloys

Others

By Production Process

Continuous Mandrel rolling

Multi-stand Plug Mill

Cross-roll Piercing & Pilger Rolling

By End-User

Oil & Gas

Infrastructure & Construction

Power Generation

Automotive

Engineering

Others

12 Middle East and Africa Seamless Pipes Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Seamless Pipes Markets in 2024

12.2 Middle East and Africa Seamless Pipes Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Seamless Pipes Market size Outlook by Segments, 2021-2032

By Type

Hot Finished

Cold Finished

By Material

Steel & Alloys

Copper & Alloys

Nickel & Alloys

Others

By Production Process

Continuous Mandrel rolling

Multi-stand Plug Mill

Cross-roll Piercing & Pilger Rolling

By End-User

Oil & Gas

Infrastructure & Construction

Power Generation

Automotive

Engineering

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AK Steel Holding

Ansteel Group Co. Ltd

ArcelorMittal

ArcoSteel

Baosteel Trading Co. Ltd

Hunan Standard Steel Co. Ltd

IPP Europe Ltd

JFE Holdings Inc

Jiangsu Wujin Stainless Steel Pipe Group Co. Ltd

Jindal Saw Ltd

Maharashtra Seamless Ltd

Nippon Steel Corp

Salzgitter AG

Sandvik AB

Santok Steel Corp

Sumitomo Corp

TATA Steel

Tenaris SA

TMK Group.

Tubos Reunidos S.

United States Steel Corp

Vallourec SA

Wuhan Heavy Industry Casting & Forging Co. Ltd

Zamzam Steel

Zekelman Industries Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Hot Finished

Cold Finished

By Material

Steel & Alloys

Copper & Alloys

Nickel & Alloys

Others

By Production Process

Continuous Mandrel rolling

Multi-stand Plug Mill

Cross-roll Piercing & Pilger Rolling

By End-User

Oil & Gas

Infrastructure & Construction

Power Generation

Automotive

Engineering

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Seamless Pipes Market Size is valued at $246.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.4% to reach $374.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AK Steel Holding, Ansteel Group Co. Ltd, ArcelorMittal, ArcoSteel, Baosteel Trading Co. Ltd, Hunan Standard Steel Co. Ltd, IPP Europe Ltd, JFE Holdings Inc, Jiangsu Wujin Stainless Steel Pipe Group Co. Ltd, Jindal Saw Ltd, Maharashtra Seamless Ltd, Nippon Steel Corp, Salzgitter AG, Sandvik AB, Santok Steel Corp, Sumitomo Corp, TATA Steel, Tenaris SA, TMK Group., Tubos Reunidos S., United States Steel Corp, Vallourec SA, Wuhan Heavy Industry Casting & Forging Co. Ltd, Zamzam Steel, Zekelman Industries Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume