Evolving tastes and preferences of consumers, increasing concerns about overweight and obese conditions, and the availability of diverse seafood varieties drive the demand for seafood in restaurants and retail segments. The per-capita seafood demand is poised to increase rapidly compared to terrestrial meat demand across markets. Consumers are demanding fresh and high-quality-seafood encouraging restaurants to source their fish responsibly by using sustainable fishing practices.

Introduction of healthy eating options, such as dishes with lower levels of fat and fewer calories are widely marketed. Younger consumers are more adventurous and willing to try new food and beverages, driving restaurants to offer variety of ways to serve items and offer customization to their guests. In addition, increasing inflation drives the value for money with strong prospects for lower price options, specials, and promotions. With rising awareness about the nutritional benefits of seafood, such as its high protein content and rich sources of omega-3 fatty acids, the market is poised to continue expanding.

China is the largest producer of seafood products in the world, followed by India, Indonesia, Vietnam, and Bangladesh. Stable economic conditions across emerging markets is encouraging the consumption of processed seafood. Seafood restaurants cater to a variety of dining preferences, from casual to fine dining, and encompass a wide range of seafood cuisines, including local specialties and international delicacies. The global tourism industry, especially in coastal regions, plays a crucial role in driving the seafood restaurant market.

Tourists often seek out local seafood specialties, boosting revenues for seafood-focused eateries. High-end restaurants that emphasize exclusive seafood offerings and gourmet preparations are gaining popularity among affluent consumers. The increasing demand for online food delivery has created opportunities for seafood restaurants to offer takeaway options. The growth of food delivery platforms like UberEats and DoorDash enables restaurants to reach a broader customer base beyond their physical locations.

As more individuals prioritize healthier eating habits and look for nutritious food options, seafood has emerged as a key player due to its well-known health benefits. According to the Global Seafood Alliance, 79% of seafood consumers choose seafood for its health benefits, particularly due to its omega-3 content, which is linked to heart and brain health.

Fish and shellfish are excellent sources of lean protein, which is crucial for muscle repair and growth. A 100-gram serving of salmon, for example, provides about 25 grams of protein, making it an ideal choice for those looking to meet their daily protein needs. Studies by the American Heart Association suggest that regular consumption of omega-3-rich seafood can lower the risk of cardiovascular diseases by up to 36%.

The growing demand for convenient food options, combined with technological advancements is driving the significant expansion of seafood delivery and takeout services. he global online food delivery market is growing at an unprecedented rate, with seafood restaurants tapping into this trend to reach new customers. The global online food delivery market is expected to reach $1.2 Trillion by 2030, driven by apps such as apps such as Uber Eats, DoorDash, and Grubhub. The growing preference for home dining has given seafood restaurants a new avenue to grow their customer base without depending solely on foot traffic.

Seafood restaurants are increasingly partnering with third-party food delivery platforms like Uber Eats, Grubhub, DoorDash, and Zomato to extend their reach. An estimated one-third of revenue is generated from delivery orders via third-party apps. Cloud kitchens allow seafood restaurants to operate in areas with high demand for delivery services without investing in expensive real estate. This enables restaurants to expand into cities or neighborhoods where they wouldn’t have opened a full-service restaurant, increasing brand reach and customer access to seafood dishes.

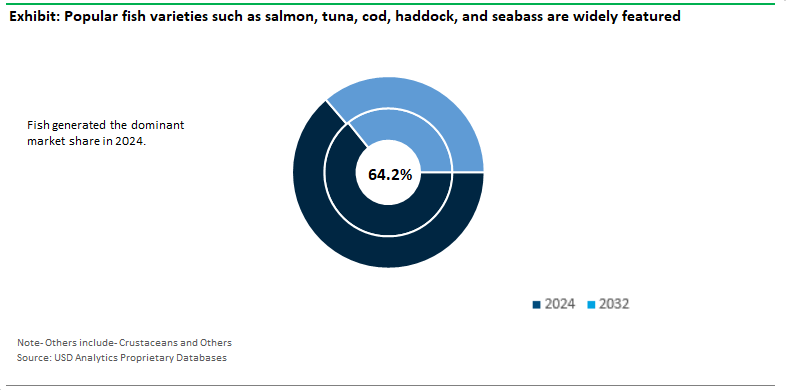

Fish is the largest segment in the seafood restaurant industry due to its versatility and global consumption. Popular fish varieties such as salmon, tuna, cod, haddock, and seabass are commonly featured in seafood menus worldwide. Fish is rich in Omega-3 fatty acids and other essential nutrients, making it a popular choice among health-conscious consumers.

As consumers become more adventurous, restaurants are introducing less common fish species like barramundi or Arctic char, offering differentiation from competitors. Different regions favor different fish species. For instance, in the U.S., salmon, tilapia, and cod are highly popular, while Asian markets may focus more on species like mackerel and seabass. Freshness and local sourcing remain key differentiators in fish dishes.

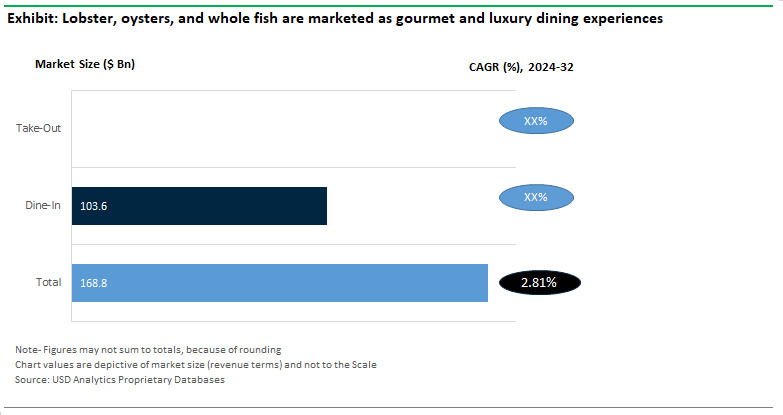

Seafood dining, often seen as a premium experience, is associated with fresh preparation, high-quality service, and elaborate presentation. Seafood items like lobster, oysters, and whole fish, are often considered gourmet or luxury dining experiences. Many seafood dishes, such as those involving delicate plating or raw bar options, are difficult to replicate in a takeout setting. Consumers often prefer to enjoy these dishes in a restaurant where presentation, freshness, and atmosphere enhance the meal.

Dine-in offers optimal control over the freshness and quality of seafood dishes. Items like sushi, oysters, or grilled fish are best enjoyed immediately after preparation. Restaurants can ensure better control over temperature, texture, and presentation when guests dine in-house. Seafood restaurants, especially upscale establishments, often cater to groups, special occasions, and social gatherings.

The U.S. seafood restaurant industry is anticipated to lead North America with a $32.5 billion in projected revenue during the forecast period. The market growth is driven by the strong consumer shift toward healthier, protein-rich diets, increasing demand for premium, sustainably sourced seafood. Leading brands and independent restaurants are featuring responsibly caught fish, traceability programs, and diverse flavors that appeal to health-conscious and environmentally aware consumers.

Enhanced digital ordering and delivery options are further driving market expansion, with top chains investing in technology to improve accessibility and customer convenience. In addition, experiential dining has gained significant traction, as seafood establishments embrace coastal-inspired interiors, live seafood tanks, and chef-curated tastings to create immersive dining experiences.

The industry is fragmented in nature and is characterized by the presence of both capital-intensive global players and medium-scale local companies. Leading companies in the industry include- Red Lobster , Joe’s Crab Shack , The Boiling Crab , Bubba Gump Shrimp Co. , Legal Sea Foods , Bonefish Grill , Captain D’s , Hook & Reel Cajun Seafood & Bar , McCormick & Schmick's , Pappadeaux Seafood Kitchen, Thai Union Group PCL, Maruha-Nichiro Corporation, Austevoll Seafood ASA, Nippon Suisan Kaisha Ltd., Sysco Corporation, and others.

|

Stage |

Role |

Companies |

|

Seafood Suppliers |

Provide fresh and sustainable seafood |

Pacific Seafood, Clearwater Seafoods, High Liner Foods, Nordic Seafood |

|

Distributors |

Facilitate distribution of seafood to restaurants |

Sysco, US Foods, Gordon Food Service, Performance Food Group |

|

Restaurant Chains (Casual) |

Large casual seafood restaurant chains |

Red Lobster, Joe's Crab Shack, The Boiling Crab, Captain D's |

|

Restaurant Chains (Fast Casual) |

Affordable, fast-casual dining with seafood focus |

Hook & Reel Cajun Seafood & Bar, Long John Silver’s |

|

Fine Dining Restaurants |

Upscale seafood dining experiences |

McCormick & Schmick's, Eddie V's Prime Seafood, The Oceanaire Seafood Room |

|

Independent Seafood Restaurants |

Unique and locally owned establishments |

Swan Oyster Depot (San Francisco), Neptune Oyster (Boston), Pearl’s Oyster Bar (New York) |

|

Technology & Ordering Platforms |

Enable online ordering, reservations, and delivery |

DoorDash, Grubhub, OpenTable, Toast, ChowNow |

|

Marketing & Review Platforms |

Customer discovery and review management |

Yelp, TripAdvisor, Google My Business, Zagat |

|

Food Safety & Compliance |

Ensure regulatory compliance for seafood safety |

NSF International, Food and Drug Administration (FDA), National Fisheries Institute (NFI) |

|

Sustainability Certifications |

Certify sustainable and responsible sourcing |

Marine Stewardship Council (MSC), Aquaculture Stewardship Council (ASC), Seafood Watch |

|

Parameter |

Details |

|

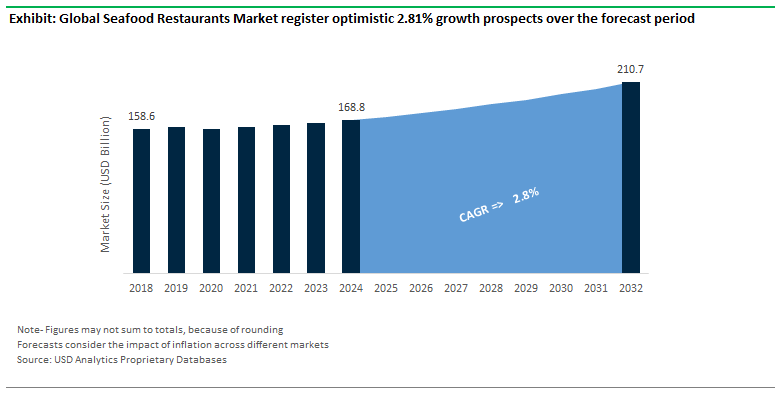

Market Size (2024) |

$168.8 Billion |

|

Market Size (2032) |

$210.7 Billion |

|

Market Growth Rate |

2.81% |

|

Largest Segment- Types |

Fish (64.2% Market Share) |

|

Largest Growing Segment- Applications |

Restaurant Dine-In ($103.6 Billion Revenue) |

|

Potential Market |

United States ($32.5 Billion Sales) |

|

Segments |

Types, Sales Channels, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Red Lobster , Joe’s Crab Shack , The Boiling Crab , Bubba Gump Shrimp Co. , Legal Sea Foods , Bonefish Grill , Captain D’s , Hook & Reel Cajun Seafood & Bar , McCormick & Schmick's , Pappadeaux Seafood Kitchen, Thai Union Group PCL, Maruha-Nichiro Corporation, Austevoll Seafood ASA, Nippon Suisan Kaisha Ltd., Sysco Corporation |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Type

Applications

Countries Analyzed

Seafood Restaurants Companies Profiled in the Study

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the Industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies Opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

4. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

5. Market Size Outlook to 2032

Global Seafood Restaurants Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

6. Historical Seafood Restaurants Market Size by Segments, 2018- 2023

Key Statistics, 2024

Seafood Restaurants Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Seafood Restaurants Types, 2018-2023

Seafood Restaurants Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Seafood Restaurants Applications, 2018-2023

7. Seafood Restaurants Market Size Outlook by Segments, 2024- 2032

Seafood Restaurants Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Seafood Restaurants Types, 2024-2032

Seafood Restaurants Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Seafood Restaurants Applications, 2024-2032

8. Seafood Restaurants Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

9. United States Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Seafood Restaurants Market Size Outlook by Type, 2021- 2032

United States Seafood Restaurants Market Size Outlook by Application, 2021- 2032

United States Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

10. Canada Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Canada Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Canada Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

11. Mexico Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Mexico Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Mexico Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

12. Germany Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Germany Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Germany Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

13. France Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

France Seafood Restaurants Market Size Outlook by Type, 2021- 2032

France Seafood Restaurants Market Size Outlook by Application, 2021- 2032

France Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

14. United Kingdom Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Seafood Restaurants Market Size Outlook by Type, 2021- 2032

United Kingdom Seafood Restaurants Market Size Outlook by Application, 2021- 2032

United Kingdom Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

15. Spain Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Spain Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Spain Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

16. Italy Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Italy Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Italy Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

17. Benelux Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Benelux Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Benelux Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

18. Nordic Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Nordic Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Nordic Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Rest of Europe Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Rest of Europe Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

20. China Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

China Seafood Restaurants Market Size Outlook by Type, 2021- 2032

China Seafood Restaurants Market Size Outlook by Application, 2021- 2032

China Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

21. India Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

India Seafood Restaurants Market Size Outlook by Type, 2021- 2032

India Seafood Restaurants Market Size Outlook by Application, 2021- 2032

India Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

22. Japan Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Japan Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Japan Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

23. South Korea Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Seafood Restaurants Market Size Outlook by Type, 2021- 2032

South Korea Seafood Restaurants Market Size Outlook by Application, 2021- 2032

South Korea Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

24. Australia Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Australia Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Australia Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

25. South East Asia Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Seafood Restaurants Market Size Outlook by Type, 2021- 2032

South East Asia Seafood Restaurants Market Size Outlook by Application, 2021- 2032

South East Asia Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

27. Brazil Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Brazil Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Brazil Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

28. Argentina Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Argentina Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Argentina Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Rest of South America Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Rest of South America Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Seafood Restaurants Market Size Outlook by Type, 2021- 2032

United Arab Emirates Seafood Restaurants Market Size Outlook by Application, 2021- 2032

United Arab Emirates Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Saudi Arabia Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Saudi Arabia Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Rest of Middle East Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Rest of Middle East Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

33. South Africa Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Seafood Restaurants Market Size Outlook by Type, 2021- 2032

South Africa Seafood Restaurants Market Size Outlook by Application, 2021- 2032

South Africa Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Seafood Restaurants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Seafood Restaurants Market Size Outlook by Type, 2021- 2032

Rest of Africa Seafood Restaurants Market Size Outlook by Application, 2021- 2032

Rest of Africa Seafood Restaurants Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

SWOT Analysis

36. Recent Market Developments

Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Applications

Countries Analyzed

USD Analytics forecasts the global Seafood Restaurants market size to increase from $168.8 Billion in 2024 to $210.7 Billion in 2032, registering a CAGR of 2.81% during the forecast period

Largest Segment by Type is Fish (64.2% Market Share), Largest Growing Segment by Application is Restaurant Dine-In ($103.6 Billion Revenue)

Red Lobster , Joe’s Crab Shack , The Boiling Crab , Bubba Gump Shrimp Co. , Legal Sea Foods , Bonefish Grill , Captain D’s , Hook & Reel Cajun Seafood & Bar , McCormick & Schmick's , Pappadeaux Seafood Kitchen, Thai Union Group PCL, Maruha-Nichiro Corporation, Austevoll Seafood ASA, Nippon Suisan Kaisha Ltd., Sysco Corporation

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume

United States ($32.5 Billion Sales)