The global Sanitary Pumps Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Kinetic sanitary pumps, Positive displacement (PD) sanitary pumps), By End-user (Food and beverage, Pharmaceutical and biotechnology applications, Others).

The Sanitary Pumps Market is expected to grow significantly in 2025, driven by the rising demand in industries like food and beverage, pharmaceuticals, and cosmetics, where hygiene and precision are critical. Increasing regulatory requirements for sanitary operations, coupled with advancements in pump technologies like self-priming and energy efficiency, are bolstering demand. The market is also benefiting from the expansion of production facilities in emerging economies. However, high initial costs and maintenance requirements may limit adoption for smaller businesses.

The market report analyses the leading companies in the industry including Ampco Pumps Co., Axiflow Technologies Inc, Dover Corp, Erich NETZSCH BV and Co. Holding KG, FRISTAM Pumpen KG GmbH and Co., GEA Group AG, IDEX Corp, INOXPA India Pvt. Ltd, ITT Inc, KSB SE and Co. KGaA, LEWA GmbH, Moyno Inc, Pentair Plc, Q Pumps, Spirax Sarco Engineering Plc, SPX FLOW Inc, Sulzer Ltd, Verder Liquids BV, Xylem Inc, and others.

A key trend in the Sanitary Pumps Market is the growing focus on hygiene and food safety standards, particularly in the food and beverage industry. With increased awareness around the safety and quality of food products, industries are increasingly adopting sanitary pumps that meet stringent hygiene requirements. These pumps are designed with materials that are resistant to bacteria and contaminants, ensuring that liquids and food products are transported without risk of contamination. As regulations surrounding food safety continue to tighten globally, the demand for sanitary pumps is expected to grow in sectors such as dairy, beverages, pharmaceuticals, and chemicals, where maintaining a high level of cleanliness is critical.

The main driver of the Sanitary Pumps Market is the increasing demand for hygienic processing solutions in the food and pharmaceutical industries. Both sectors require equipment that complies with strict regulatory standards and guarantees the safety of their products. Sanitary pumps, which are easy to clean and maintain, are particularly sought after for their ability to prevent contamination while handling liquids, pastes, and other sensitive substances. As these industries expand globally, there is a growing need for pumps that not only meet safety standards but also improve efficiency in processing, which directly drives the market for sanitary pumps.

A Market Opportunity in the Sanitary Pumps Market lies in the development of new materials and self-cleaning technologies. Manufacturers are increasingly focused on producing pumps made from advanced materials, such as stainless steel and high-grade polymers, which offer superior resistance to corrosion, wear, and bacteria. Additionally, self-cleaning technologies that automate cleaning processes are gaining traction, particularly in industries where hygiene standards are critical. These innovations help reduce downtime, lower maintenance costs, and improve overall operational efficiency. With advancements in materials and technology, the sanitary pumps market is poised to offer even more value to food, beverage, and pharmaceutical manufacturers, creating significant opportunities for growth.

The food and beverage industry is the largest segment in the sanitary pumps market due to the critical need for hygienic, contamination-free pumping solutions in food processing and packaging. In this sector, sanitary pumps are essential for the safe transfer of liquids, semi-liquids, and viscous materials without compromising product quality or safety. Strict hygiene and food safety standards, such as those set by the FDA and other regulatory bodies, require the use of pumps that meet high cleanliness and maintenance standards. As the global food and beverage sector continues to grow, driven by increased consumer demand and the expansion of processed food products, the need for sanitary pumps remains strong, making this end-user segment the largest in the market.

Positive Displacement (PD) sanitary pumps are expected to be the fastest-growing segment in the sanitary pumps market over the forecast period to 2034. This growth is driven by their superior efficiency in handling highly viscous, shear-sensitive, or fragile materials, making them ideal for industries like food & beverage, pharmaceuticals, and cosmetics. Their ability to maintain a consistent flow regardless of pressure variations further enhances their appeal in applications requiring precision and reliability. Additionally, increasing regulatory emphasis on hygiene standards and the demand for advanced sanitary solutions are fueling the adoption of PD sanitary pumps, positioning them as a critical choice in this market.

|

Parameter |

Details |

|

Market Size (2025) |

2.5 Billion |

|

Market Size (2034) |

3.8 Billion |

|

Market Growth Rate |

4.8% |

|

Segments |

By Type (Kinetic sanitary pumps, Positive displacement (PD) sanitary pumps), By End-user (Food and beverage, Pharmaceutical and biotechnology applications, Others) |

|

Study Period |

2019- 2024 and 2025-2034 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Ampco Pumps Co., Axiflow Technologies Inc, Dover Corp, Erich NETZSCH BV and Co. Holding KG, FRISTAM Pumpen KG GmbH and Co., GEA Group AG, IDEX Corp, INOXPA India Pvt. Ltd, ITT Inc, KSB SE and Co. KGaA, LEWA GmbH, Moyno Inc, Pentair Plc, Q Pumps, Spirax Sarco Engineering Plc, SPX FLOW Inc, Sulzer Ltd, Verder Liquids BV, Xylem Inc |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

By Type

Kinetic sanitary pumps

Positive displacement (PD) sanitary pumps

By End-user

Food and beverage

Pharmaceutical and biotechnology applications

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Ampco Pumps Co.

Axiflow Technologies Inc

Dover Corp

Erich NETZSCH BV and Co. Holding KG

FRISTAM Pumpen KG GmbH and Co.

GEA Group AG

IDEX Corp

INOXPA India Pvt. Ltd

ITT Inc

KSB SE and Co. KGaA

LEWA GmbH

Moyno Inc

Pentair Plc

Q Pumps

Spirax Sarco Engineering Plc

SPX FLOW Inc

Sulzer Ltd

Verder Liquids BV

Xylem Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2025 Sanitary Pumps Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Sanitary Pumps Market Size Outlook, $ Million, 2021 to 2034

3.2 Sanitary Pumps Market Outlook by Type, $ Million, 2021 to 2034

3.3 Sanitary Pumps Market Outlook by Product, $ Million, 2021 to 2034

3.4 Sanitary Pumps Market Outlook by Application, $ Million, 2021 to 2034

3.5 Sanitary Pumps Market Outlook by Key Countries, $ Million, 2021 to 2034

4 Market Dynamics

4.1 Key Driving Forces of Sanitary Pumps Industry

4.2 Key Market Trends in Sanitary Pumps Industry

4.3 Potential Opportunities in Sanitary Pumps Industry

4.4 Key Challenges in Sanitary Pumps Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Sanitary Pumps Market Share by Company (%), 2024

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Sanitary Pumps Market Outlook by Segments

7.1 Sanitary Pumps Market Outlook by Segments, $ Million, 2021- 2034

By Type

Kinetic sanitary pumps

Positive displacement (PD) sanitary pumps

By End-user

Food and beverage

Pharmaceutical and biotechnology applications

Others

8 North America Sanitary Pumps Market Analysis and Outlook To 2034

8.1 Introduction to North America Sanitary Pumps Markets in 2025

8.2 North America Sanitary Pumps Market Size Outlook by Country, 2021-2034

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Sanitary Pumps Market size Outlook by Segments, 2021-2034

By Type

Kinetic sanitary pumps

Positive displacement (PD) sanitary pumps

By End-user

Food and beverage

Pharmaceutical and biotechnology applications

Others

9 Europe Sanitary Pumps Market Analysis and Outlook To 2034

9.1 Introduction to Europe Sanitary Pumps Markets in 2025

9.2 Europe Sanitary Pumps Market Size Outlook by Country, 2021-2034

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Sanitary Pumps Market Size Outlook by Segments, 2021-2034

By Type

Kinetic sanitary pumps

Positive displacement (PD) sanitary pumps

By End-user

Food and beverage

Pharmaceutical and biotechnology applications

Others

10 Asia Pacific Sanitary Pumps Market Analysis and Outlook To 2034

10.1 Introduction to Asia Pacific Sanitary Pumps Markets in 2025

10.2 Asia Pacific Sanitary Pumps Market Size Outlook by Country, 2021-2034

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Sanitary Pumps Market size Outlook by Segments, 2021-2034

By Type

Kinetic sanitary pumps

Positive displacement (PD) sanitary pumps

By End-user

Food and beverage

Pharmaceutical and biotechnology applications

Others

11 South America Sanitary Pumps Market Analysis and Outlook To 2034

11.1 Introduction to South America Sanitary Pumps Markets in 2025

11.2 South America Sanitary Pumps Market Size Outlook by Country, 2021-2034

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Sanitary Pumps Market size Outlook by Segments, 2021-2034

By Type

Kinetic sanitary pumps

Positive displacement (PD) sanitary pumps

By End-user

Food and beverage

Pharmaceutical and biotechnology applications

Others

12 Middle East and Africa Sanitary Pumps Market Analysis and Outlook To 2034

12.1 Introduction to Middle East and Africa Sanitary Pumps Markets in 2025

12.2 Middle East and Africa Sanitary Pumps Market Size Outlook by Country, 2021-2034

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Sanitary Pumps Market size Outlook by Segments, 2021-2034

By Type

Kinetic sanitary pumps

Positive displacement (PD) sanitary pumps

By End-user

Food and beverage

Pharmaceutical and biotechnology applications

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Ampco Pumps Co.

Axiflow Technologies Inc

Dover Corp

Erich NETZSCH BV and Co. Holding KG

FRISTAM Pumpen KG GmbH and Co.

GEA Group AG

IDEX Corp

INOXPA India Pvt. Ltd

ITT Inc

KSB SE and Co. KGaA

LEWA GmbH

Moyno Inc

Pentair Plc

Q Pumps

Spirax Sarco Engineering Plc

SPX FLOW Inc

Sulzer Ltd

Verder Liquids BV

Xylem Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Kinetic sanitary pumps

Positive displacement (PD) sanitary pumps

By End-user

Food and beverage

Pharmaceutical and biotechnology applications

Others

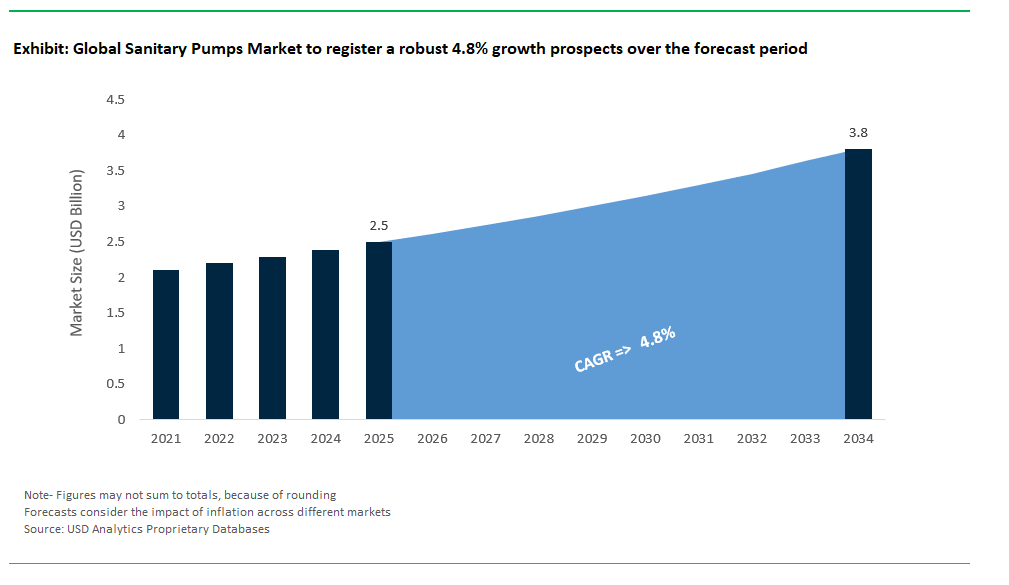

The Global Sanitary Pumps Market Size is estimated at $2.5 Billion in 2025 and is forecast to register an annual growth rate (CAGR) of 4.8% to reach $3.8 Billion by 2034.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Ampco Pumps Co., Axiflow Technologies Inc, Dover Corp, Erich NETZSCH BV and Co. Holding KG, FRISTAM Pumpen KG GmbH and Co., GEA Group AG, IDEX Corp, INOXPA India Pvt. Ltd, ITT Inc, KSB SE and Co. KGaA, LEWA GmbH, Moyno Inc, Pentair Plc, Q Pumps, Spirax Sarco Engineering Plc, SPX FLOW Inc, Sulzer Ltd, Verder Liquids BV, Xylem Inc

Base Year- 2024; Estimated Year- 2025; Historic Period- 2019-2024; Forecast period- 2025 to 2034; Currency: Revenue (USD); Volume