The global Rubber Bonded Abrasives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Synthetic Rubber, Natural Rubber), By Application (Powertrain, Gear, Bearing, Turbines, Others), By End-User (Industrial Machinery, Automotive, Electrical & Electronics, Healthcare, Others).

In 2024, the rubber bonded abrasives market is experiencing robust growth driven by the increasing demand for precision grinding, polishing, and finishing solutions in industries such as automotive, aerospace, metalworking, and medical devices. Rubber bonded abrasives consist of abrasive grains bonded with synthetic or natural rubber matrices, offering advantages such as flexibility, resilience, and uniform abrasive distribution for surface preparation, deburring, and material removal applications. The automotive industry is a major consumer of rubber bonded abrasives, with applications ranging from engine components and gears to brake pads and camshafts, benefiting from their ability to achieve tight tolerances, surface smoothness, and dimensional accuracy. Further, the aerospace sector utilizes rubber bonded abrasives for turbine blades, aircraft engine parts, and composite materials, achieving critical surface finishes and geometric tolerances. Additionally, the metalworking industry relies on rubber bonded abrasives for precision grinding of tools, dies, and molds, ensuring high-quality surface finishes and dimensional accuracy in manufacturing processes. With advancements in abrasive technology, bonding systems, and automation solutions, the rubber bonded abrasives market is poised for d growth, driven by innovations in product design, process optimization, and end-user applications.

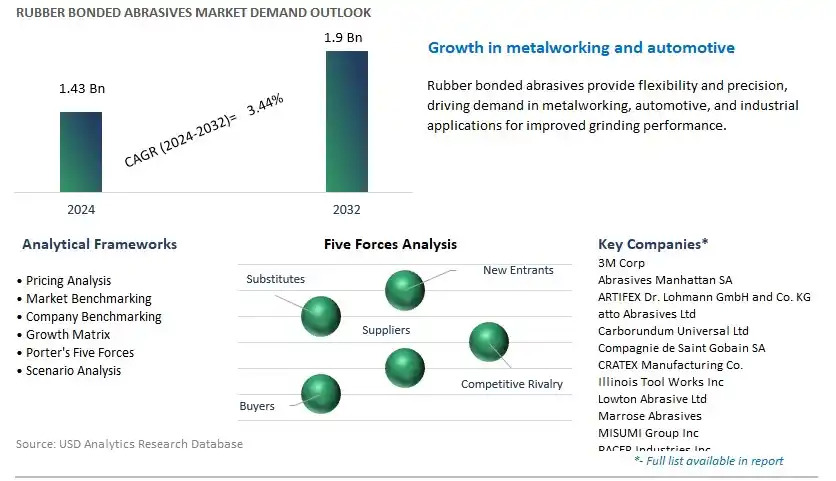

The market report analyses the leading companies in the industry including 3M Corp, Abrasives Manhattan SA, ARTIFEX Dr. Lohmann GmbH and Co. KG, atto Abrasives Ltd, Carborundum Universal Ltd, Compagnie de Saint Gobain SA, CRATEX Manufacturing Co., Illinois Tool Works Inc, Lowton Abrasive Ltd, Marrose Abrasives, MISUMI Group Inc, PACER Industries Inc, PFERD Inc, SAK ABRASIVES Ltd, Schwarzhaupt GmbH and Co. KG, Super Abrasives, Tyrolit Schleifmittelwerke Swarovski KG, and others.

One prominent market trend in rubber bonded abrasives is the increasing demand for precision grinding solutions. With advancements in manufacturing technologies and the need for high-precision components in various industries such as automotive, aerospace, and medical devices, there is a growing demand for abrasive tools that can achieve tight tolerances, fine surface finishes, and intricate geometries. Rubber bonded abrasives offer advantages such as flexibility, conformability, and uniform abrasive distribution, making them ideal for precision grinding applications where tight control over material removal and surface quality is essential. This trend is driven by the pursuit of quality, efficiency, and cost-effectiveness in manufacturing processes, driving the adoption of rubber bonded abrasives for precision grinding operations.

A key market driver for rubber bonded abrasives is industrial expansion and automation. As manufacturing industries expand and modernize to meet growing consumer demands and technological advancements, there is an increasing need for abrasive tools that can meet the requirements of automated production processes. Rubber bonded abrasives play a critical role in automated grinding and finishing operations, offering consistent performance, reduced cycle times, and improved process control. The adoption of robotics, CNC machining, and other automation technologies in manufacturing drives the demand for rubber bonded abrasives as manufacturers seek to enhance productivity, reduce labor costs, and maintain high-quality standards in their operations.

An emerging opportunity in the rubber bonded abrasives market lies in the development of specialized bonding systems for specific applications and industries. While rubber bonding is widely used in abrasive tools for general grinding and finishing tasks, there is potential to innovate new bonding formulations tailored to unique requirements such as heat resistance, chemical compatibility, or specialized machining processes. Opportunities exist to develop bonding systems optimized for challenging materials such as superalloys, ceramics, composites, and exotic metals, as well as for specialized applications such as gear grinding, turbine blade finishing, and medical implant manufacturing. By collaborating with end-users, material scientists, and equipment manufacturers, suppliers of rubber bonded abrasives can develop customized solutions that address niche market needs, expand their product offerings, and differentiate themselves in the competitive abrasive tooling market.

The Synthetic Rubber segment is the largest segment within the Rubber Bonded Abrasives Market. Synthetic rubber, including various elastomers such as styrene-butadiene rubber (SBR), polybutadiene rubber (BR), and polyurethane (PU), offers superior mechanical properties, chemical resistance, and consistency compared to natural rubber. These characteristics make synthetic rubber an ideal choice for bonding abrasive grains in grinding wheels, polishing stones, and other bonded abrasive products. Synthetic rubber exhibits excellent adhesion to abrasive grains, providing a strong bond that enhances the durability, stability, and cutting performance of bonded abrasives during grinding and finishing operations. Moreover, synthetic rubber formulations can be tailored to specific application requirements, allowing manufacturers to optimize the hardness, flexibility, and resilience of bonded abrasive products for various machining tasks, surface finishes, and workpiece materials. Additionally, synthetic rubber offers better resistance to heat, oil, solvents, and environmental factors, ensuring prolonged tool life and consistent performance in demanding industrial environments. Furthermore, the availability of a wide range of synthetic rubber grades and formulations enables manufacturers to develop specialized bonded abrasives tailored to specific industries, such as automotive, aerospace, metal fabrication, and woodworking. As industries increasingly prioritize efficiency, productivity, and surface quality in machining and finishing processes, the demand for high-performance bonded abrasives bonded with synthetic rubber continues to grow. Furthermore, ongoing advancements in synthetic rubber technology, including the development of new formulations with enhanced properties and sustainability features, further reinforce the dominance of the Synthetic Rubber segment in the Rubber Bonded Abrasives Market.

The Powertrain segment is the fastest-growing segment within the Rubber Bonded Abrasives Market. The powertrain components, including engine parts, transmission gears, and drivetrain components, are critical for the efficient operation and performance of vehicles, machinery, and industrial equipment. As the automotive, aerospace, and manufacturing industries witness continuous innovation, efficiency improvements, and demand for lightweight materials, the machining and finishing of powertrain components become increasingly sophisticated and demanding. Rubber bonded abrasives play a crucial role in the precision grinding, honing, and polishing of powertrain parts to achieve tight tolerances, surface finish requirements, and functional specifications. Powertrain components often feature complex geometries, hardened surfaces, and delicate features that require specialized abrasive tools with precise control over material removal rates, surface integrity, and dimensional accuracy. Rubber bonded abrasives offer unique advantages in this regard, providing efficient stock removal, uniform surface finishes, and minimal part distortion during grinding and finishing operations. Moreover, rubber bonded abrasive wheels and stones exhibit superior damping properties and conformability, reducing chatter, vibration, and heat generation during high-speed machining of hardened steel, cast iron, and other alloy materials commonly used in powertrain manufacturing. Furthermore, advancements in rubber formulation technology, abrasive grain types, and bonding systems enable manufacturers to develop specialized bonded abrasives tailored to specific powertrain applications, such as crankshaft grinding, camshaft polishing, and gear tooth finishing. As automotive manufacturers transition towards electric and hybrid powertrains, which often require precision machining of lightweight materials and composite components, the demand for advanced rubber bonded abrasives in powertrain manufacturing is expected to surge, driving rapid growth in the Powertrain segment of the Rubber Bonded Abrasives Market.

The Automotive segment is the largest segment within the Rubber Bonded Abrasives Market. The automotive industry is one of the largest consumers of rubber bonded abrasives due to its extensive use of precision-engineered components and the stringent requirements for surface finish, dimensional accuracy, and performance. Rubber bonded abrasives play a crucial role in the manufacturing and maintenance of various automotive parts, including engine components, transmission gears, brake components, steering systems, and body panels. In automotive manufacturing, rubber bonded abrasives are utilized for precision grinding, deburring, polishing, and surface finishing operations to achieve tight tolerances and high-quality surface finishes on critical components. These components require precise machining to ensure optimal performance, durability, and safety in vehicles. Additionally, rubber bonded abrasives offer versatility and flexibility in addressing a wide range of materials used in automotive applications, including ferrous and non-ferrous metals, composites, plastics, and ceramics. Furthermore, the automotive aftermarket represents a significant segment for rubber bonded abrasives, where these abrasives are used for repair, refurbishment, and maintenance of automotive parts and components. Whether it's grinding engine valves, polishing cylinder heads, or deburring brake rotors, rubber bonded abrasives are indispensable tools for automotive technicians and repair shops. Moreover, as the automotive industry continues to evolve with advancements in electric and autonomous vehicles, the demand for precise machining and finishing of lightweight materials, such as aluminum alloys and carbon fiber composites, is expected to increase, further driving the demand for rubber bonded abrasives in the automotive sector. As a result, the Automotive segment maintains its dominance in the Rubber Bonded Abrasives Market, underpinned by the continual demand for high-performance abrasive solutions in automotive manufacturing and aftermarket applications.

By Material

Synthetic Rubber

Natural Rubber

By Application

Powertrain

Gear

Bearing

Turbines

Others

By End-User

Industrial Machinery

Automotive

Electrical & Electronics

Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Corp

Abrasives Manhattan SA

ARTIFEX Dr. Lohmann GmbH and Co. KG

atto Abrasives Ltd

Carborundum Universal Ltd

Compagnie de Saint Gobain SA

CRATEX Manufacturing Co.

Illinois Tool Works Inc

Lowton Abrasive Ltd

Marrose Abrasives

MISUMI Group Inc

PACER Industries Inc

PFERD Inc

SAK ABRASIVES Ltd

Schwarzhaupt GmbH and Co. KG

Super Abrasives

Tyrolit Schleifmittelwerke Swarovski KG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Rubber Bonded Abrasives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Rubber Bonded Abrasives Market Size Outlook, $ Million, 2021 to 2032

3.2 Rubber Bonded Abrasives Market Outlook by Type, $ Million, 2021 to 2032

3.3 Rubber Bonded Abrasives Market Outlook by Product, $ Million, 2021 to 2032

3.4 Rubber Bonded Abrasives Market Outlook by Application, $ Million, 2021 to 2032

3.5 Rubber Bonded Abrasives Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Rubber Bonded Abrasives Industry

4.2 Key Market Trends in Rubber Bonded Abrasives Industry

4.3 Potential Opportunities in Rubber Bonded Abrasives Industry

4.4 Key Challenges in Rubber Bonded Abrasives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Rubber Bonded Abrasives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Rubber Bonded Abrasives Market Outlook by Segments

7.1 Rubber Bonded Abrasives Market Outlook by Segments, $ Million, 2021- 2032

By Material

Synthetic Rubber

Natural Rubber

By Application

Powertrain

Gear

Bearing

Turbines

Others

By End-User

Industrial Machinery

Automotive

Electrical & Electronics

Healthcare

Others

8 North America Rubber Bonded Abrasives Market Analysis and Outlook To 2032

8.1 Introduction to North America Rubber Bonded Abrasives Markets in 2024

8.2 North America Rubber Bonded Abrasives Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Rubber Bonded Abrasives Market size Outlook by Segments, 2021-2032

By Material

Synthetic Rubber

Natural Rubber

By Application

Powertrain

Gear

Bearing

Turbines

Others

By End-User

Industrial Machinery

Automotive

Electrical & Electronics

Healthcare

Others

9 Europe Rubber Bonded Abrasives Market Analysis and Outlook To 2032

9.1 Introduction to Europe Rubber Bonded Abrasives Markets in 2024

9.2 Europe Rubber Bonded Abrasives Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Rubber Bonded Abrasives Market Size Outlook by Segments, 2021-2032

By Material

Synthetic Rubber

Natural Rubber

By Application

Powertrain

Gear

Bearing

Turbines

Others

By End-User

Industrial Machinery

Automotive

Electrical & Electronics

Healthcare

Others

10 Asia Pacific Rubber Bonded Abrasives Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Rubber Bonded Abrasives Markets in 2024

10.2 Asia Pacific Rubber Bonded Abrasives Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Rubber Bonded Abrasives Market size Outlook by Segments, 2021-2032

By Material

Synthetic Rubber

Natural Rubber

By Application

Powertrain

Gear

Bearing

Turbines

Others

By End-User

Industrial Machinery

Automotive

Electrical & Electronics

Healthcare

Others

11 South America Rubber Bonded Abrasives Market Analysis and Outlook To 2032

11.1 Introduction to South America Rubber Bonded Abrasives Markets in 2024

11.2 South America Rubber Bonded Abrasives Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Rubber Bonded Abrasives Market size Outlook by Segments, 2021-2032

By Material

Synthetic Rubber

Natural Rubber

By Application

Powertrain

Gear

Bearing

Turbines

Others

By End-User

Industrial Machinery

Automotive

Electrical & Electronics

Healthcare

Others

12 Middle East and Africa Rubber Bonded Abrasives Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Rubber Bonded Abrasives Markets in 2024

12.2 Middle East and Africa Rubber Bonded Abrasives Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Rubber Bonded Abrasives Market size Outlook by Segments, 2021-2032

By Material

Synthetic Rubber

Natural Rubber

By Application

Powertrain

Gear

Bearing

Turbines

Others

By End-User

Industrial Machinery

Automotive

Electrical & Electronics

Healthcare

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Corp

Abrasives Manhattan SA

ARTIFEX Dr. Lohmann GmbH and Co. KG

atto Abrasives Ltd

Carborundum Universal Ltd

Compagnie de Saint Gobain SA

CRATEX Manufacturing Co.

Illinois Tool Works Inc

Lowton Abrasive Ltd

Marrose Abrasives

MISUMI Group Inc

PACER Industries Inc

PFERD Inc

SAK ABRASIVES Ltd

Schwarzhaupt GmbH and Co. KG

Super Abrasives

Tyrolit Schleifmittelwerke Swarovski KG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Synthetic Rubber

Natural Rubber

By Application

Powertrain

Gear

Bearing

Turbines

Others

By End-User

Industrial Machinery

Automotive

Electrical & Electronics

Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Rubber Bonded Abrasives Market Size is valued at $1.43 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.44% to reach $1.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Corp, Abrasives Manhattan SA, ARTIFEX Dr. Lohmann GmbH and Co. KG, atto Abrasives Ltd, Carborundum Universal Ltd, Compagnie de Saint Gobain SA, CRATEX Manufacturing Co., Illinois Tool Works Inc, Lowton Abrasive Ltd, Marrose Abrasives, MISUMI Group Inc, PACER Industries Inc, PFERD Inc, SAK ABRASIVES Ltd, Schwarzhaupt GmbH and Co. KG, Super Abrasives, Tyrolit Schleifmittelwerke Swarovski KG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume