The global Road Freight Transport Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Carrier Type (Full Truckload (FTL), Less-Than-Truckload (LTL)), By Vehicle (Light Commercial Vehicle, Medium Commercial Vehicle, Heavy Commercial Vehicle), By Operation (Domestic, International), By End-User (Agriculture, Fishing And Forestry, Construction, Manufacturing, Oil And Gas, Mining And Quarrying, Wholesale And Retail Trade, Others).

In 2024, the Road Freight Transport Market remains a cornerstone of the global logistics and supply chain industry, facilitating the movement of goods and commodities across regional and international borders. Road freight transport encompasses a diverse array of vehicles, including trucks, trailers, and vans, which serve as the backbone of the transportation network, connecting production centers, distribution hubs, and end consumers. The market experiences sustained demand driven by factors such as globalization of trade, e-commerce expansion, and the need for efficient supply chain solutions. Technological advancements in vehicle telematics, route optimization, and fleet management systems enhance operational efficiency, safety, and environmental sustainability within the road freight transport sector. Additionally, regulatory initiatives aimed at reducing emissions and improving road safety influence fleet modernization efforts and adoption of alternative fuels and propulsion technologies. As industries adapt to changing consumer preferences and market dynamics, the road freight transport market continues to evolve, offering reliable and cost-effective transportation solutions essential for global trade and economic growth.

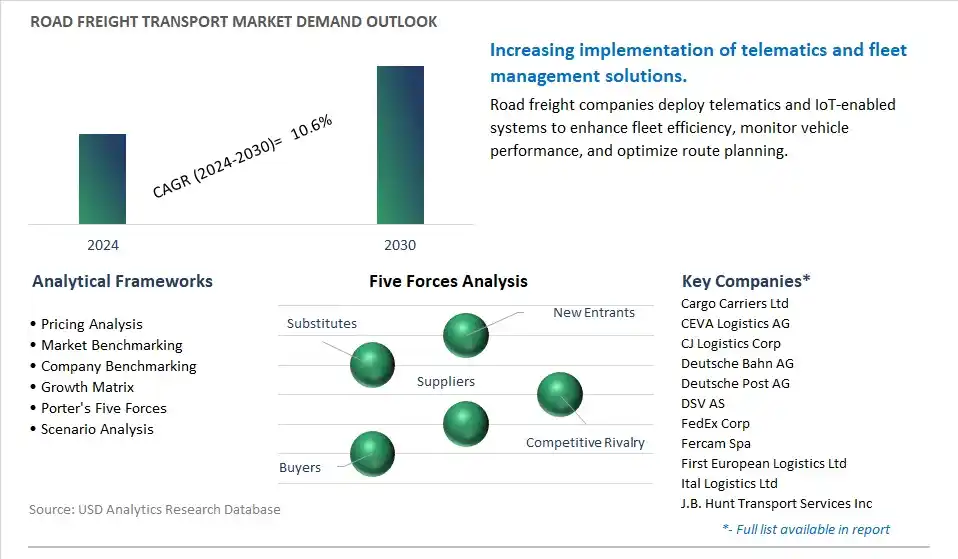

The global Road Freight Transport Market Industry is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Road Freight Transport Market Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Road Freight Transport Market Industry include- Cargo Carriers Ltd, CEVA Logistics AG, CJ Logistics Corp, Deutsche Bahn AG, Deutsche Post AG, DSV AS, FedEx Corp, Fercam Spa, First European Logistics Ltd, Ital Logistics Ltd, J.B. Hunt Transport Services Inc, Kerry Logistics Network Ltd, KLG Europe, Kuehne and Nagel International AG, NGL Gondrand Group SA

A significant trend in the Road Freight Transport market is the increasing adoption of digital freight platforms and technologies to enhance efficiency, visibility, and connectivity in freight operations. With advancements in digitalization, cloud computing, and the Internet of Things (IoT), road freight operators are leveraging digital platforms and technologies to optimize route planning, load matching, fleet management, and cargo tracking. These digital solutions offer real-time visibility into freight movements, streamline communication between stakeholders, and enable data-driven decision-making to improve operational performance and customer service levels. This reflects a shift towards digitized and interconnected supply chains, driving the evolution of road freight transport towards more agile and responsive logistics solutions.

A significant driver propelling the Road Freight Transport market is the growth in e-commerce and the increasing demand for last-mile delivery services driven by changes in consumer behavior and retail preferences. As consumers continue to embrace online shopping and expect fast, convenient delivery options, there's a corresponding increase in demand for road freight transport services to fulfill e-commerce orders and deliver parcels to doorsteps. This is further fueled by urbanization, population growth, and the rise of same-day and next-day delivery expectations, driving the expansion of road freight networks and the modernization of last-mile delivery capabilities to meet the evolving needs of e-commerce logistics.

An untapped opportunity in the Road Freight Transport market lies in the expansion into sustainable and green logistics solutions that address environmental concerns and promote eco-friendly transportation practices. With growing awareness of climate change and sustainability issues, there's a rising demand for road freight operators to adopt cleaner and greener transportation technologies such as electric and hybrid vehicles, alternative fuels, and carbon-neutral logistics solutions. By investing in sustainable infrastructure, optimizing transport routes, and adopting eco-friendly practices such as consolidated shipments and modal shifts, road freight transport companies can reduce their carbon footprint, lower operating costs, and differentiate themselves in the market. This presents an opportunity to position road freight transport services as environmentally responsible and attract customers seeking sustainable logistics partners.

By Carrier Type

By Vehicle

By Operation

By End-User

Geographical Analysis

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Road Freight Transport Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Road Freight Transport Market Size Outlook, $ Million, 2021 to 2030

3.2 Road Freight Transport Market Outlook by Type, $ Million, 2021 to 2030

3.3 Road Freight Transport Market Outlook by Product, $ Million, 2021 to 2030

3.4 Road Freight Transport Market Outlook by Application, $ Million, 2021 to 2030

3.5 Road Freight Transport Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Road Freight Transport Industry

4.2 Key Market Trends in Road Freight Transport Industry

4.3 Potential Opportunities in Road Freight Transport Industry

4.4 Key Challenges in Road Freight Transport Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Road Freight Transport Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Road Freight Transport Market Outlook by Segments

7.1 Road Freight Transport Market Outlook by Segments, $ Million, 2021- 2030

By Carrier Type

Full Truckload

Less-Than-Truckload (LTL)

By Vehicle

Light Commercial Vehicle

Medium Commercial Vehicle

Heavy Commercial Vehicle

By Operation

Domestic

International

By End-User

Agriculture

Fishing And Forestry

Construction

Manufacturing

Oil And Gas

Mining And Quarrying

Wholesale And Retail Trade

Others

8 North America Road Freight Transport Market Analysis and Outlook To 2030

8.1 Introduction to North America Road Freight Transport Markets in 2024

8.2 North America Road Freight Transport Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Road Freight Transport Market size Outlook by Segments, 2021-2030

By Carrier Type

Full Truckload

Less-Than-Truckload (LTL)

By Vehicle

Light Commercial Vehicle

Medium Commercial Vehicle

Heavy Commercial Vehicle

By Operation

Domestic

International

By End-User

Agriculture

Fishing And Forestry

Construction

Manufacturing

Oil And Gas

Mining And Quarrying

Wholesale And Retail Trade

Others

9 Europe Road Freight Transport Market Analysis and Outlook To 2030

9.1 Introduction to Europe Road Freight Transport Markets in 2024

9.2 Europe Road Freight Transport Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Road Freight Transport Market Size Outlook by Segments, 2021-2030

By Carrier Type

Full Truckload

Less-Than-Truckload (LTL)

By Vehicle

Light Commercial Vehicle

Medium Commercial Vehicle

Heavy Commercial Vehicle

By Operation

Domestic

International

By End-User

Agriculture

Fishing And Forestry

Construction

Manufacturing

Oil And Gas

Mining And Quarrying

Wholesale And Retail Trade

Others

10 Asia Pacific Road Freight Transport Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Road Freight Transport Markets in 2024

10.2 Asia Pacific Road Freight Transport Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Road Freight Transport Market size Outlook by Segments, 2021-2030

By Carrier Type

Full Truckload

Less-Than-Truckload (LTL)

By Vehicle

Light Commercial Vehicle

Medium Commercial Vehicle

Heavy Commercial Vehicle

By Operation

Domestic

International

By End-User

Agriculture

Fishing And Forestry

Construction

Manufacturing

Oil And Gas

Mining And Quarrying

Wholesale And Retail Trade

Others

11 South America Road Freight Transport Market Analysis and Outlook To 2030

11.1 Introduction to South America Road Freight Transport Markets in 2024

11.2 South America Road Freight Transport Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Road Freight Transport Market size Outlook by Segments, 2021-2030

By Carrier Type

Full Truckload

Less-Than-Truckload (LTL)

By Vehicle

Light Commercial Vehicle

Medium Commercial Vehicle

Heavy Commercial Vehicle

By Operation

Domestic

International

By End-User

Agriculture

Fishing And Forestry

Construction

Manufacturing

Oil And Gas

Mining And Quarrying

Wholesale And Retail Trade

Others

12 Middle East and Africa Road Freight Transport Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Road Freight Transport Markets in 2024

12.2 Middle East and Africa Road Freight Transport Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Road Freight Transport Market size Outlook by Segments, 2021-2030

By Carrier Type

Full Truckload

Less-Than-Truckload (LTL)

By Vehicle

Light Commercial Vehicle

Medium Commercial Vehicle

Heavy Commercial Vehicle

By Operation

Domestic

International

By End-User

Agriculture

Fishing And Forestry

Construction

Manufacturing

Oil And Gas

Mining And Quarrying

Wholesale And Retail Trade

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Cargo Carriers Ltd

CEVA Logistics AG

CJ Logistics Corp

Deutsche Bahn AG

Deutsche Post AG

DSV AS

FedEx Corp

Fercam Spa

First European Logistics Ltd

Ital Logistics Ltd

J.B. Hunt Transport Services Inc

Kerry Logistics Network Ltd

KLG Europe

Kuehne and Nagel International AG

NGL Gondrand Group SA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Carrier Type

By Vehicle

By Operation

By End-User

Geographical Analysis

The global Road Freight Transport Market is one of the lucrative growth markets, poised to register a 10.6% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Cargo Carriers Ltd, CEVA Logistics AG, CJ Logistics Corp, Deutsche Bahn AG, Deutsche Post AG, DSV AS, FedEx Corp, Fercam Spa, First European Logistics Ltd, Ital Logistics Ltd, J.B. Hunt Transport Services Inc, Kerry Logistics Network Ltd, KLG Europe, Kuehne and Nagel International AG, NGL Gondrand Group SA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume