The global Rigid Plastic Packaging Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Bottles & Jars, Rigid Bulk Products, Trays, Tubs, Cups, Pots), By End-User (Food, Beverages, Healthcare, Cosmetics & Toiletries, Industrial), By Raw Material (Bioplastics, Polyethylene (PE), Polyethylene Terephthalate (PET), Polystyrene (PS), Polypropylene (PP), Polyvinyl Chloride (PVC), Expanded Polystyrene (EPs), Others), By Production Process (Extrusion, Injection Molding, Blow Molding, Thermoforming).

In 2024, the market for rigid plastic packaging is experiencing steady growth driven by the increasing demand for lightweight, durable, and sustainable packaging solutions in industries such as food and beverage, personal care, healthcare, and household products. Rigid plastic packaging encompasses a wide range of containers, bottles, jars, and closures made from materials such as polyethylene terephthalate (PET), polyethylene (PE), polypropylene (PP), and polystyrene (PS), offering properties such as versatility, barrier protection, and recyclability. The food and beverage industry is a major consumer of rigid plastic packaging, with applications ranging from bottles and containers to trays and clamshells, benefiting from their ability to extend shelf life, preserve freshness, and enhance product visibility. Further, the personal care and healthcare sectors utilize rigid plastic packaging for products such as cosmetics, pharmaceuticals, and medical devices, ensuring product safety, hygiene, and compliance with regulatory standards. Additionally, the household products industry relies on rigid plastic packaging for cleaning agents, detergents, and home improvement products, contributing to convenience, durability, and brand differentiation. With a growing emphasis on sustainable packaging solutions, circular economy principles, and consumer preferences for convenience and product safety, the market for rigid plastic packaging is poised for d growth, driven by innovations in material science, packaging design, and end-of-life solutions.

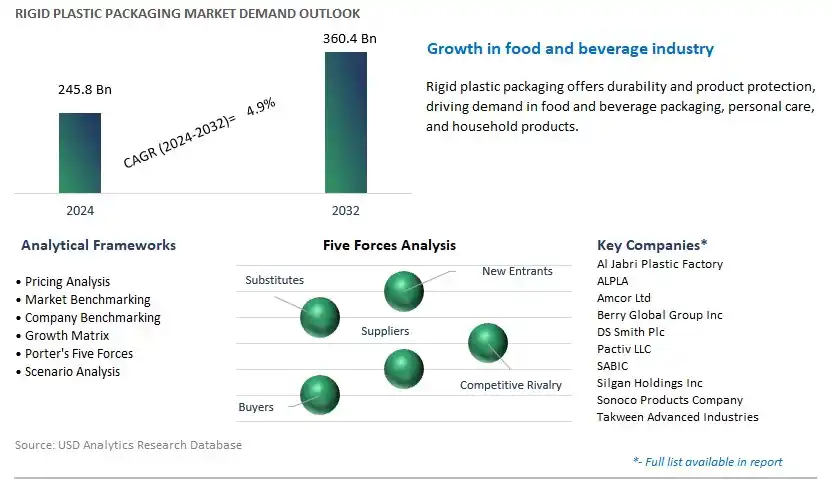

The market report analyses the leading companies in the industry including Al Jabri Plastic Factory, ALPLA, Amcor Ltd, Berry Global Group Inc, DS Smith Plc, Pactiv LLC, SABIC, Silgan Holdings Inc, Sonoco Products Company, Takween Advanced Industries, and others.

One prominent market trend in rigid plastic packaging is the increased emphasis on sustainable packaging solutions. With growing awareness of environmental issues and concerns about plastic waste, consumers, businesses, and governments are increasingly demanding sustainable alternatives to traditional plastic packaging. This trend has led to a shift towards the development and adoption of rigid plastic packaging solutions that are recyclable, reusable, or made from recycled materials. Manufacturers are investing in innovative packaging designs, materials, and production processes to reduce the environmental impact of rigid plastic packaging while maintaining functionality, durability, and shelf appeal.

A key market driver for rigid plastic packaging is consumer preference for convenience and safety. Rigid plastic packaging offers numerous benefits such as durability, lightweight, ease of handling, and product protection, making it a preferred choice for packaging a wide range of consumer goods including food and beverages, personal care products, pharmaceuticals, and household chemicals. Consumers value the convenience, portability, and tamper-evident features of rigid plastic packaging, along with its ability to preserve product freshness and quality. The demand for safe, convenient, and hygienic packaging solutions is driving the growth of the rigid plastic packaging market, as manufacturers strive to meet evolving consumer expectations and preferences.

An emerging opportunity in the rigid plastic packaging market lies in innovation in recyclable and biodegradable materials. While plastic packaging offers numerous advantages, its environmental impact has raised concerns about pollution, resource depletion, and landfill waste. Manufacturers have the opportunity to innovate new materials and technologies that enable the production of rigid plastic packaging with improved sustainability credentials. This includes the development of recyclable plastics, biodegradable polymers, and bio-based materials that offer similar performance characteristics to conventional plastics but with reduced environmental footprint. By investing in research and development, collaboration, and commercialization of sustainable packaging solutions, stakeholders can capitalize on the growing demand for eco-friendly rigid plastic packaging and differentiate their products in the market.

The Bottles & Jars segment is the largest segment within the Rigid Plastic Packaging Market. Bottles and jars are ubiquitous in various industries, including food and beverage, pharmaceuticals, personal care, and household products. They offer a versatile and convenient packaging solution for a wide range of products, including beverages, sauces, condiments, cosmetics, and cleaning agents. Bottles and jars made from rigid plastics such as PET (Polyethylene Terephthalate), HDPE (High-Density Polyethylene), and PP (Polypropylene) provide potential advantages, including lightweight, durability, transparency, and resistance to breakage and leakage. These properties make them ideal for packaging products that require protection from moisture, oxygen, light, and other external factors. Moreover, bottles and jars are available in various shapes, sizes, and designs to suit different product requirements and consumer preferences, further driving their popularity in the market. Additionally, the widespread adoption of bottles and jars by manufacturers and retailers, coupled with the growing consumer demand for convenience and sustainability, fuels the growth of this segment. As industries continue to innovate and introduce new products packaged in bottles and jars, the demand for rigid plastic packaging in this segment is expected to remain robust, solidifying its dominance in the Rigid Plastic Packaging Market.

The Healthcare end-user segment is the fastest-growing segment within the Rigid Plastic Packaging Market. In the healthcare industry, the demand for rigid plastic packaging has surged due to increasing requirements for safe, secure, and sterile packaging solutions for pharmaceuticals, medical devices, and healthcare products. Rigid plastic packaging offers numerous advantages such as durability, chemical resistance, tamper-evident features, and compatibility with sterilization methods, making it the preferred choice for packaging sensitive healthcare products. Additionally, the growing global population, aging demographics, and rising prevalence of chronic diseases contribute to the expanding demand for pharmaceuticals and medical devices, thereby driving the need for innovative and reliable packaging solutions. Moreover, the COVID-19 pandemic has further accelerated the demand for healthcare products, including vaccines, medications, and personal protective equipment (PPE), necessitating robust packaging solutions to ensure product integrity and safety. Rigid plastic packaging meets these stringent requirements and offers enhanced protection against contamination, breakage, and tampering during storage, transportation, and handling. Furthermore, advancements in materials technology, such as the development of lightweight yet durable plastics, contribute to the growth of the healthcare packaging segment. As the healthcare sector continues to evolve and innovate, the demand for rigid plastic packaging solutions tailored to healthcare applications is expected to experience sustained growth, driving the rapid expansion of this segment in the Rigid Plastic Packaging Market.

The Polyethylene (PE) segment is the largest segment within the Rigid Plastic Packaging Market. Polyethylene is one of the most widely used thermoplastic polymers globally, known for its versatility, durability, and cost-effectiveness in packaging applications. As a raw material for rigid plastic packaging, PE offers numerous advantages, including excellent chemical resistance, lightweight nature, impact strength, and flexibility in processing. These properties make it suitable for a wide range of packaging applications across various industries, including food and beverage, healthcare, cosmetics, household products, and industrial goods. In the food and beverage sector, PE packaging is extensively used for bottling liquids, packaging fresh produce, and manufacturing containers and closures due to its ability to preserve product freshness, resist moisture and oxygen ingress, and withstand transportation and handling. Similarly, in the healthcare industry, PE packaging is preferred for its compatibility with sterilization methods, ensuring the safety and integrity of pharmaceuticals, medical devices, and diagnostic products. Additionally, the widespread availability of PE resins, coupled with efficient manufacturing processes, contributes to its dominance in the rigid plastic packaging market. Furthermore, advancements in PE technology, such as the development of bio-based and recyclable PE materials, further enhance its appeal among environmentally conscious consumers and industries. As the demand for sustainable and eco-friendly packaging solutions continues to grow, the Polyethylene segment is poised to maintain its leadership position in the Rigid Plastic Packaging Market.

The Injection Molding Process segment is the fastest-growing segment within the Rigid Plastic Packaging Market. Injection molding is a highly efficient and versatile manufacturing process widely used for producing rigid plastic packaging components such as bottles, caps, closures, containers, and trays. This process involves injecting molten plastic material into a mold cavity under high pressure, allowing for the rapid and precise production of intricate and customized designs. Injection molding offers potential advantages, including high production speeds, tight tolerances, repeatability, and the ability to utilize a wide range of thermoplastic resins, including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS), among others. Additionally, injection-molded packaging components exhibit superior dimensional stability, surface finish, and mechanical properties compared to other production processes, making them ideal for demanding packaging applications. The versatility of injection molding enables the production of packaging solutions tailored to specific customer requirements, including unique shapes, sizes, colors, and features such as handles, inserts, and tamper-evident seals. Moreover, advancements in injection molding technology, such as multi-cavity molds, automation, and computer-aided design (CAD) software, further enhance production efficiency, reduce cycle times, and optimize material usage, driving cost savings and competitive advantages for manufacturers. As industries increasingly demand lightweight, durable, and aesthetically appealing packaging solutions, the Injection Molding Process segment is poised to experience sustained growth, consolidating its position as the leading production process in the Rigid Plastic Packaging Market.

By Type

Bottles & Jars

Rigid Bulk Products

Trays

Tubs

Cups

Pots

By End-User

Food

Beverages

Healthcare

Cosmetics & Toiletries

Industrial

By Raw Material

Bioplastics

Polyethylene (PE)

Polyethylene Terephthalate (PET)

Polystyrene (PS)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Expanded Polystyrene (EPs)

Others

By Production Process

Extrusion

Injection Molding

Blow Molding

ThermoformingCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Al Jabri Plastic Factory

ALPLA

Amcor Ltd

Berry Global Group Inc

DS Smith Plc

Pactiv LLC

SABIC

Silgan Holdings Inc

Sonoco Products Company

Takween Advanced Industries

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Rigid Plastic Packaging Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Rigid Plastic Packaging Market Size Outlook, $ Million, 2021 to 2032

3.2 Rigid Plastic Packaging Market Outlook by Type, $ Million, 2021 to 2032

3.3 Rigid Plastic Packaging Market Outlook by Product, $ Million, 2021 to 2032

3.4 Rigid Plastic Packaging Market Outlook by Application, $ Million, 2021 to 2032

3.5 Rigid Plastic Packaging Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Rigid Plastic Packaging Industry

4.2 Key Market Trends in Rigid Plastic Packaging Industry

4.3 Potential Opportunities in Rigid Plastic Packaging Industry

4.4 Key Challenges in Rigid Plastic Packaging Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Rigid Plastic Packaging Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Rigid Plastic Packaging Market Outlook by Segments

7.1 Rigid Plastic Packaging Market Outlook by Segments, $ Million, 2021- 2032

By Type

Bottles & Jars

Rigid Bulk Products

Trays

Tubs

Cups

Pots

By End-User

Food

Beverages

Healthcare

Cosmetics & Toiletries

Industrial

By Raw Material

Bioplastics

Polyethylene (PE)

Polyethylene Terephthalate (PET)

Polystyrene (PS)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Expanded Polystyrene (EPs)

Others

By Production Process

Extrusion

Injection Molding

Blow Molding

Thermoforming

8 North America Rigid Plastic Packaging Market Analysis and Outlook To 2032

8.1 Introduction to North America Rigid Plastic Packaging Markets in 2024

8.2 North America Rigid Plastic Packaging Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Rigid Plastic Packaging Market size Outlook by Segments, 2021-2032

By Type

Bottles & Jars

Rigid Bulk Products

Trays

Tubs

Cups

Pots

By End-User

Food

Beverages

Healthcare

Cosmetics & Toiletries

Industrial

By Raw Material

Bioplastics

Polyethylene (PE)

Polyethylene Terephthalate (PET)

Polystyrene (PS)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Expanded Polystyrene (EPs)

Others

By Production Process

Extrusion

Injection Molding

Blow Molding

Thermoforming

9 Europe Rigid Plastic Packaging Market Analysis and Outlook To 2032

9.1 Introduction to Europe Rigid Plastic Packaging Markets in 2024

9.2 Europe Rigid Plastic Packaging Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Rigid Plastic Packaging Market Size Outlook by Segments, 2021-2032

By Type

Bottles & Jars

Rigid Bulk Products

Trays

Tubs

Cups

Pots

By End-User

Food

Beverages

Healthcare

Cosmetics & Toiletries

Industrial

By Raw Material

Bioplastics

Polyethylene (PE)

Polyethylene Terephthalate (PET)

Polystyrene (PS)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Expanded Polystyrene (EPs)

Others

By Production Process

Extrusion

Injection Molding

Blow Molding

Thermoforming

10 Asia Pacific Rigid Plastic Packaging Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Rigid Plastic Packaging Markets in 2024

10.2 Asia Pacific Rigid Plastic Packaging Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Rigid Plastic Packaging Market size Outlook by Segments, 2021-2032

By Type

Bottles & Jars

Rigid Bulk Products

Trays

Tubs

Cups

Pots

By End-User

Food

Beverages

Healthcare

Cosmetics & Toiletries

Industrial

By Raw Material

Bioplastics

Polyethylene (PE)

Polyethylene Terephthalate (PET)

Polystyrene (PS)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Expanded Polystyrene (EPs)

Others

By Production Process

Extrusion

Injection Molding

Blow Molding

Thermoforming

11 South America Rigid Plastic Packaging Market Analysis and Outlook To 2032

11.1 Introduction to South America Rigid Plastic Packaging Markets in 2024

11.2 South America Rigid Plastic Packaging Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Rigid Plastic Packaging Market size Outlook by Segments, 2021-2032

By Type

Bottles & Jars

Rigid Bulk Products

Trays

Tubs

Cups

Pots

By End-User

Food

Beverages

Healthcare

Cosmetics & Toiletries

Industrial

By Raw Material

Bioplastics

Polyethylene (PE)

Polyethylene Terephthalate (PET)

Polystyrene (PS)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Expanded Polystyrene (EPs)

Others

By Production Process

Extrusion

Injection Molding

Blow Molding

Thermoforming

12 Middle East and Africa Rigid Plastic Packaging Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Rigid Plastic Packaging Markets in 2024

12.2 Middle East and Africa Rigid Plastic Packaging Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Rigid Plastic Packaging Market size Outlook by Segments, 2021-2032

By Type

Bottles & Jars

Rigid Bulk Products

Trays

Tubs

Cups

Pots

By End-User

Food

Beverages

Healthcare

Cosmetics & Toiletries

Industrial

By Raw Material

Bioplastics

Polyethylene (PE)

Polyethylene Terephthalate (PET)

Polystyrene (PS)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Expanded Polystyrene (EPs)

Others

By Production Process

Extrusion

Injection Molding

Blow Molding

Thermoforming

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Al Jabri Plastic Factory

ALPLA

Amcor Ltd

Berry Global Group Inc

DS Smith Plc

Pactiv LLC

SABIC

Silgan Holdings Inc

Sonoco Products Company

Takween Advanced Industries

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Bottles & Jars

Rigid Bulk Products

Trays

Tubs

Cups

Pots

By End-User

Food

Beverages

Healthcare

Cosmetics & Toiletries

Industrial

By Raw Material

Bioplastics

Polyethylene (PE)

Polyethylene Terephthalate (PET)

Polystyrene (PS)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Expanded Polystyrene (EPs)

Others

By Production Process

Extrusion

Injection Molding

Blow Molding

Thermoforming

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Rigid Plastic Packaging Market Size is valued at $245.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.9% to reach $360.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Al Jabri Plastic Factory, ALPLA, Amcor Ltd, Berry Global Group Inc, DS Smith Plc, Pactiv LLC, SABIC, Silgan Holdings Inc, Sonoco Products Company, Takween Advanced Industries

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume