The global Refinery Catalyst Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (FCC Catalysts, Hydrotreating Catalysts, Hydrocracking Catalysts, Catalytic Reforming Catalysts), By Ingredient (Zeolites, Metals, Chemical Compounds).

In 2024, the refinery catalyst market is witnessing robust growth driven by the increasing demand for cleaner fuels, higher efficiency processes, and stricter environmental regulations in the refining industry. Refinery catalysts play a crucial role in catalytic cracking, hydrotreating, and reforming processes, facilitating the conversion of crude oil into valuable products such as gasoline, diesel, and petrochemical feedstocks. The refining industry is a major consumer of refinery catalysts, with applications ranging from fluid catalytic cracking (FCC) units to hydroprocessing units for sulfur removal, nitrogen oxide reduction, and aromatic saturation. Further, the petrochemical industry utilizes refinery catalysts for steam cracking, aromatics production, and olefin conversion processes, enabling the production of key building blocks for plastics, fibers, and specialty chemicals. Additionally, environmental regulations mandating lower sulfur content in fuels are driving investments in refinery catalysts for desulfurization and sulfur recovery units, ensuring compliance with emission standards and reducing environmental impact. With advancements in catalyst formulation, process optimization, and catalyst regeneration technologies, the refinery catalyst market is poised for d expansion, driven by innovations in catalyst performance, operational efficiency, and sustainability solutions.

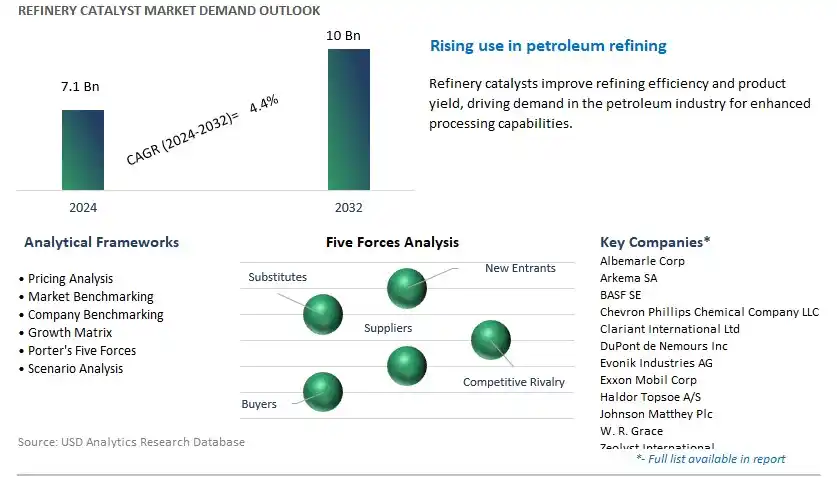

The market report analyses the leading companies in the industry including Albemarle Corp, Arkema SA, BASF SE, Chevron Phillips Chemical Company LLC, Clariant International Ltd, DuPont de Nemours Inc, Evonik Industries AG, Exxon Mobil Corp, Haldor Topsoe A/S, Johnson Matthey Plc, W. R. Grace, Zeolyst International, and others.

One prominent market trend in refinery catalysts is the increasing demand for clean fuels. With tightening environmental regulations and growing concerns about air quality and greenhouse gas emissions, there is a global shift towards cleaner and more efficient fuel production processes. Refinery catalysts play a crucial role in refining operations by facilitating the conversion of crude oil into cleaner fuels with lower sulfur, nitrogen, and aromatic content. As refiners strive to meet stricter fuel quality standards and reduce emissions, there is a rising demand for advanced catalyst technologies that enable efficient and cost-effective production of cleaner fuels.

A key market driver for refinery catalysts is the growth in refining capacity expansion projects worldwide. Despite the rise of renewable energy sources, petroleum remains a dominant energy source, driving investments in refining infrastructure to meet growing energy demand, particularly in emerging economies. Refinery catalysts are essential catalysts used in various refining processes such as fluid catalytic cracking (FCC), hydroprocessing, and alkylation to maximize yields, improve product quality, and optimize process efficiency. The expansion of refining capacity and the modernization of existing refineries are driving the demand for refinery catalysts as refiners seek to increase production volumes and upgrade their facilities to meet evolving market demands.

An emerging opportunity in the refinery catalyst market lies in the focus on hydroprocessing catalysts for clean diesel production. With the increasing demand for ultra-low sulfur diesel (ULSD) to comply with stringent fuel quality regulations, there is a growing need for catalysts that can effectively remove sulfur, nitrogen, and other impurities from diesel feedstocks. Hydroprocessing catalysts, including hydrotreating and hydrocracking catalysts, are vital for achieving sulfur removal targets and producing high-quality diesel fuels with minimal environmental impact. Investing in the development of advanced hydroprocessing catalysts with improved activity, selectivity, and stability presents an opportunity for catalyst manufacturers to address market demand for clean diesel production and capitalize on the growing emphasis on environmental sustainability in the refining industry.

The FCC (Fluid Catalytic Cracking) Catalysts type segment is the largest segment within the Refinery Catalyst Market. FCC catalysts play a crucial role in the refining process by breaking down heavy hydrocarbon molecules into lighter fractions, such as gasoline and diesel, through catalytic cracking. As the demand for transportation fuels continues to rise globally, particularly in emerging economies, there's a corresponding increase in the demand for FCC catalysts to optimize refinery operations and maximize yields of valuable products. Additionally, technological advancements in FCC catalyst formulations have led to improved performance, selectivity, and operational efficiency, further driving their adoption by refineries worldwide. Moreover, stringent environmental regulations mandating lower sulfur content in transportation fuels have spurred the need for FCC catalysts capable of facilitating hydrotreating and desulfurization processes. With refineries focusing on increasing throughput, flexibility, and profitability, the FCC catalysts segment is poised to maintain its dominance in the refinery catalyst market, driving sustained growth and innovation in refining technologies.

The Zeolites ingredient segment is the fastest-growing segment within the Refinery Catalyst Market. Zeolites are crystalline aluminosilicate minerals with unique pore structures and surface properties, making them highly effective catalysts in various refining processes. With the increasing demand for cleaner fuels and stricter environmental regulations, there's a growing emphasis on refining technologies that can produce higher-quality products while minimizing environmental impact. Zeolite-based catalysts offer exceptional catalytic activity, selectivity, and stability, particularly in processes such as hydrocracking, catalytic cracking, and isomerization. Additionally, ongoing research and development efforts to enhance zeolite catalyst formulations and tailor them for specific refining applications further accelerate market growth. Moreover, the versatility of zeolite catalysts, coupled with their ability to facilitate multiple refining reactions simultaneously, makes them indispensable in modern refining operations seeking to maximize efficiency and profitability. As refineries continue to upgrade and expand their operations to meet evolving market demands, the zeolites ingredient segment is poised to experience sustained growth, driving innovation and investment in refining catalyst technologies.

By Type

FCC Catalysts

Hydrotreating Catalysts

Hydrocracking Catalysts

Catalytic Reforming Catalysts

By Ingredient

Zeolites

Metals

Chemical CompoundsCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Albemarle Corp

Arkema SA

BASF SE

Chevron Phillips Chemical Company LLC

Clariant International Ltd

DuPont de Nemours Inc

Evonik Industries AG

Exxon Mobil Corp

Haldor Topsoe A/S

Johnson Matthey Plc

W. R. Grace

Zeolyst International

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Refinery Catalyst Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Refinery Catalyst Market Size Outlook, $ Million, 2021 to 2032

3.2 Refinery Catalyst Market Outlook by Type, $ Million, 2021 to 2032

3.3 Refinery Catalyst Market Outlook by Product, $ Million, 2021 to 2032

3.4 Refinery Catalyst Market Outlook by Application, $ Million, 2021 to 2032

3.5 Refinery Catalyst Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Refinery Catalyst Industry

4.2 Key Market Trends in Refinery Catalyst Industry

4.3 Potential Opportunities in Refinery Catalyst Industry

4.4 Key Challenges in Refinery Catalyst Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Refinery Catalyst Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Refinery Catalyst Market Outlook by Segments

7.1 Refinery Catalyst Market Outlook by Segments, $ Million, 2021- 2032

By Type

FCC Catalysts

Hydrotreating Catalysts

Hydrocracking Catalysts

Catalytic Reforming Catalysts

By Ingredient

Zeolites

Metals

Chemical Compounds

8 North America Refinery Catalyst Market Analysis and Outlook To 2032

8.1 Introduction to North America Refinery Catalyst Markets in 2024

8.2 North America Refinery Catalyst Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Refinery Catalyst Market size Outlook by Segments, 2021-2032

By Type

FCC Catalysts

Hydrotreating Catalysts

Hydrocracking Catalysts

Catalytic Reforming Catalysts

By Ingredient

Zeolites

Metals

Chemical Compounds

9 Europe Refinery Catalyst Market Analysis and Outlook To 2032

9.1 Introduction to Europe Refinery Catalyst Markets in 2024

9.2 Europe Refinery Catalyst Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Refinery Catalyst Market Size Outlook by Segments, 2021-2032

By Type

FCC Catalysts

Hydrotreating Catalysts

Hydrocracking Catalysts

Catalytic Reforming Catalysts

By Ingredient

Zeolites

Metals

Chemical Compounds

10 Asia Pacific Refinery Catalyst Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Refinery Catalyst Markets in 2024

10.2 Asia Pacific Refinery Catalyst Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Refinery Catalyst Market size Outlook by Segments, 2021-2032

By Type

FCC Catalysts

Hydrotreating Catalysts

Hydrocracking Catalysts

Catalytic Reforming Catalysts

By Ingredient

Zeolites

Metals

Chemical Compounds

11 South America Refinery Catalyst Market Analysis and Outlook To 2032

11.1 Introduction to South America Refinery Catalyst Markets in 2024

11.2 South America Refinery Catalyst Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Refinery Catalyst Market size Outlook by Segments, 2021-2032

By Type

FCC Catalysts

Hydrotreating Catalysts

Hydrocracking Catalysts

Catalytic Reforming Catalysts

By Ingredient

Zeolites

Metals

Chemical Compounds

12 Middle East and Africa Refinery Catalyst Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Refinery Catalyst Markets in 2024

12.2 Middle East and Africa Refinery Catalyst Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Refinery Catalyst Market size Outlook by Segments, 2021-2032

By Type

FCC Catalysts

Hydrotreating Catalysts

Hydrocracking Catalysts

Catalytic Reforming Catalysts

By Ingredient

Zeolites

Metals

Chemical Compounds

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Albemarle Corp

Arkema SA

BASF SE

Chevron Phillips Chemical Company LLC

Clariant International Ltd

DuPont de Nemours Inc

Evonik Industries AG

Exxon Mobil Corp

Haldor Topsoe A/S

Johnson Matthey Plc

W. R. Grace

Zeolyst International

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

FCC Catalysts

Hydrotreating Catalysts

Hydrocracking Catalysts

Catalytic Reforming Catalysts

By Ingredient

Zeolites

Metals

Chemical Compounds

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Refinery Catalyst Market Size is valued at $7.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.4% to reach $10 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Albemarle Corp, Arkema SA, BASF SE, Chevron Phillips Chemical Company LLC, Clariant International Ltd, DuPont de Nemours Inc, Evonik Industries AG, Exxon Mobil Corp, Haldor Topsoe A/S, Johnson Matthey Plc, W. R. Grace, Zeolyst International

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume