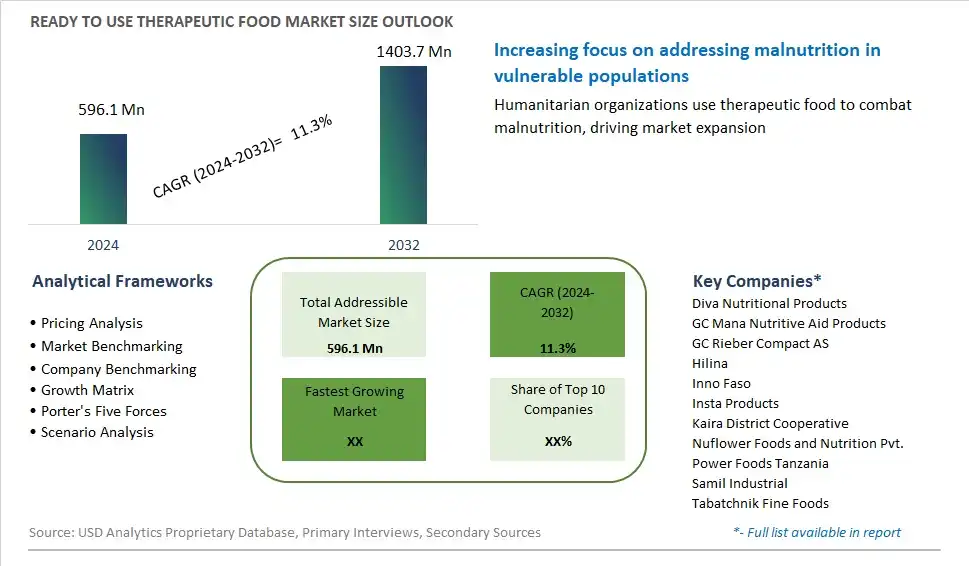

The global Ready to Use Therapeutic Food Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Solid, Paste, Drinkable), By End-User (UNICEF, WFP, Government Agencies, NGOs), By Distribution Channel (Direct Sales, E-Commerce, Others)

In 2024, the ready-to-use therapeutic food (RUTF) market continues to play a crucial role in addressing global malnutrition, particularly among vulnerable populations such as children suffering from severe acute malnutrition (SAM). RUTFs are energy-dense, nutrient-rich, and easy-to-use formulations designed to treat and prevent malnutrition without the need for cooking or refrigeration, making them ideal for use in humanitarian emergencies and resource-limited settings. Typically composed of ingredients such as peanuts, milk powder, vegetable oil, and essential vitamins and minerals, RUTFs provide a complete and balanced nutritional profile to support recovery and growth in malnourished individuals. Moreover, partnerships between governments, non-governmental organizations (NGOs), and private sector stakeholders are driving initiatives to expand access to RUTFs, improve distribution channels, and enhance nutritional education and awareness, thereby contributing to the fight against malnutrition on a global scale.

The market report analyses the leading companies in the industry including Diva Nutritional Products, GC Mana Nutritive Aid Products, GC Rieber Compact AS, Hilina, Inno Faso, Insta Products, Kaira District Cooperative, Nuflower Foods and Nutrition Pvt., Power Foods Tanzania, Samil Industrial, Tabatchnik Fine Foods, and Others.

Ready to Use Therapeutic Food (RUTF) is witnessing a significant trend marked by the expansion of global malnutrition intervention programs. RUTF, a high-energy, nutrient-dense paste, is a key component of therapeutic feeding programs aimed at treating severe acute malnutrition in children and vulnerable populations in resource-limited settings. This trend is driven by the growing recognition of malnutrition as a global health challenge and the increasing investment in nutrition interventions by governments, non-profit organizations, and international agencies. As awareness of the efficacy of RUTF in addressing acute malnutrition grows, there is a rising demand for these products in humanitarian aid efforts and public health programs worldwide.

The market for Ready to Use Therapeutic Food is primarily driven by the focus on child nutrition and development, particularly in low- and middle-income countries where malnutrition prevalence is high. RUTF plays a critical role in addressing severe acute malnutrition, a leading cause of child morbidity and mortality globally. As governments and international organizations prioritize maternal and child health initiatives, there is an increasing emphasis on scaling up access to RUTF as part of comprehensive nutrition programs. The recognition of the lifelong impact of early childhood malnutrition on cognitive development, physical growth, and economic productivity further drives the demand for RUTF as a cost-effective and life-saving intervention to prevent long-term health consequences.

The market for Ready to Use Therapeutic Food presents a significant opportunity for innovation in product formulation and packaging to improve accessibility, acceptability, and nutritional outcomes. Companies can innovate by developing RUTF formulations that are fortified with micronutrients, vitamins, and minerals to address specific nutrient deficiencies and optimize therapeutic outcomes. Additionally, there are opportunities to explore novel packaging formats such as single-serve sachets, squeeze tubes, and ready-to-eat bars to enhance convenience, portion control, and shelf stability, particularly in remote and underserved communities. By collaborating with nutrition experts, healthcare providers, and humanitarian organizations, companies can develop tailored RUTF solutions that meet the diverse needs of malnourished populations, driving impact and scalability in global malnutrition intervention efforts.

Within the Ready To Use Therapeutic Food market, the "Paste" segment is the largest, commanding significant prominence for several compelling reasons. Paste-type therapeutic foods offer a convenient and practical solution for addressing malnutrition, particularly in resource-constrained regions and emergency situations. Their semi-solid consistency allows for easy consumption without the need for additional preparation, making them ideal for infants, children, and adults with compromised nutritional status. Further, pastes are formulated to provide a balanced mix of macronutrients and essential vitamins and minerals, ensuring comprehensive nutritional support for individuals at risk of malnutrition. Additionally, the long shelf life and portability of paste-type therapeutic foods make them suitable for distribution and storage in challenging environments, facilitating large-scale nutrition intervention programs. With their effectiveness, accessibility, and ease of use, the Paste segment remains at the forefront of the Ready To Use Therapeutic Food market, shaping the landscape of global nutrition initiatives aimed at combating malnutrition and improving public health outcomes.

Among the segments delineated in the Ready To Use Therapeutic Food market, the "NGOs" segment is the fastest-growing, propelled by several key factors. Non-governmental organizations (NGOs) play a pivotal role in global nutrition initiatives, spearheading efforts to address malnutrition and food insecurity in vulnerable populations worldwide. Ready To Use Therapeutic Foods (RUTFs) are essential components of NGO-led nutrition programs, providing life-saving treatment and prevention of severe acute malnutrition in children and adults. NGOs leverage their extensive networks, resources, and expertise to implement community-based nutrition interventions, distribute RUTFs, and deliver nutrition education and counseling services. Further, the increasing focus on humanitarian assistance and disaster relief efforts in conflict-affected areas and regions facing food crises drives the demand for RUTFs by NGOs. With their agility, innovation, and commitment to humanitarian principles, NGOs are poised to sustain the rapid growth of the Ready To Use Therapeutic Food market, driving progress towards achieving global nutrition goals and improving health outcomes in underserved communities.

In the Ready To Use Therapeutic Food market, the "Direct Sales" segment is the largest, commanding significant prominence for several compelling reasons. Direct sales channels allow manufacturers and distributors to reach their target audience efficiently and effectively, facilitating direct interactions with healthcare facilities, aid organizations, and government agencies responsible for procuring therapeutic foods. Further, direct sales enable real-time feedback and customization options, ensuring that products meet the specific nutritional needs and preferences of end-users. Additionally, direct sales channels offer greater control over product quality, pricing, and distribution, fostering trust and reliability among customers. With its established market presence and seamless supply chain management, the Direct Sales segment remains at the forefront of the Ready To Use Therapeutic Food market, shaping the landscape of global nutrition interventions and health initiatives aimed at combating malnutrition and improving public health outcomes.

By Type

Solid

Paste

Drinkable

By End-User

UNICEF

WFP

Government Agencies

NGOs

By Distribution Channel

Direct Sales

E Commerce

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Diva Nutritional Products

GC Mana Nutritive Aid Products

GC Rieber Compact AS

Hilina

Inno Faso

Insta Products

Kaira District Cooperative

Nuflower Foods and Nutrition Pvt.

Power Foods Tanzania

Samil Industrial

Tabatchnik Fine Foods

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Ready To Use Therapeutic Food Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Ready To Use Therapeutic Food Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Ready To Use Therapeutic Food Market Share by Company, 2023

4.1.2. Product Offerings of Leading Ready To Use Therapeutic Food Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Ready To Use Therapeutic Food Market Drivers

6.2. Ready To Use Therapeutic Food Market Challenges

6.6. Ready To Use Therapeutic Food Market Opportunities

6.4. Ready To Use Therapeutic Food Market Trends

Chapter 7. Global Ready To Use Therapeutic Food Market Outlook Trends

7.1. Global Ready To Use Therapeutic Food Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Ready To Use Therapeutic Food Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Ready To Use Therapeutic Food Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Type

Solid

Paste

Drinkable

By End-User

UNICEF

WFP

Government Agencies

NGOs

By Distribution Channel

Direct Sales

E Commerce

Others

Chapter 8. Global Ready To Use Therapeutic Food Regional Analysis and Outlook

8.1. Global Ready To Use Therapeutic Food Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Ready To Use Therapeutic Food Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Ready To Use Therapeutic Food Regional Analysis and Outlook

8.2.2. Canada Ready To Use Therapeutic Food Regional Analysis and Outlook

8.2.3. Mexico Ready To Use Therapeutic Food Regional Analysis and Outlook

8.3. Europe Ready To Use Therapeutic Food Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Ready To Use Therapeutic Food Regional Analysis and Outlook

8.3.2. France Ready To Use Therapeutic Food Regional Analysis and Outlook

8.3.3. United Kingdom Ready To Use Therapeutic Food Regional Analysis and Outlook

8.3.4. Spain Ready To Use Therapeutic Food Regional Analysis and Outlook

8.3.5. Italy Ready To Use Therapeutic Food Regional Analysis and Outlook

8.3.6. Russia Ready To Use Therapeutic Food Regional Analysis and Outlook

8.3.7. Rest of Europe Ready To Use Therapeutic Food Regional Analysis and Outlook

8.4. Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) by Country (2021-2032)

8.4.1. China Ready To Use Therapeutic Food Regional Analysis and Outlook

8.4.2. Japan Ready To Use Therapeutic Food Regional Analysis and Outlook

8.4.3. India Ready To Use Therapeutic Food Regional Analysis and Outlook

8.4.4. South Korea Ready To Use Therapeutic Food Regional Analysis and Outlook

8.4.5. Australia Ready To Use Therapeutic Food Regional Analysis and Outlook

8.4.6. South East Asia Ready To Use Therapeutic Food Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Ready To Use Therapeutic Food Regional Analysis and Outlook

8.5. South America Ready To Use Therapeutic Food Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Ready To Use Therapeutic Food Regional Analysis and Outlook

8.5.2. Argentina Ready To Use Therapeutic Food Regional Analysis and Outlook

8.5.3. Rest of South America Ready To Use Therapeutic Food Regional Analysis and Outlook

8.6. Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Ready To Use Therapeutic Food Regional Analysis and Outlook

8.6.2. Africa Ready To Use Therapeutic Food Regional Analysis and Outlook

Chapter 9. North America Ready To Use Therapeutic Food Analysis and Outlook

9.1. North America Ready To Use Therapeutic Food Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Ready To Use Therapeutic Food Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Ready To Use Therapeutic Food Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Ready To Use Therapeutic Food Revenue (USD Million) by Product (2021-2032)

By Type

Solid

Paste

Drinkable

By End-User

UNICEF

WFP

Government Agencies

NGOs

By Distribution Channel

Direct Sales

E Commerce

Others

Chapter 10. Europe Ready To Use Therapeutic Food Analysis and Outlook

10.1. Europe Ready To Use Therapeutic Food Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Ready To Use Therapeutic Food Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Ready To Use Therapeutic Food Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Ready To Use Therapeutic Food Revenue (USD Million) by Product (2021-2032)

By Type

Solid

Paste

Drinkable

By End-User

UNICEF

WFP

Government Agencies

NGOs

By Distribution Channel

Direct Sales

E Commerce

Others

Chapter 11. Asia Pacific Ready To Use Therapeutic Food Analysis and Outlook

11.1. Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) by Product (2021-2032)

By Type

Solid

Paste

Drinkable

By End-User

UNICEF

WFP

Government Agencies

NGOs

By Distribution Channel

Direct Sales

E Commerce

Others

Chapter 12. South America Ready To Use Therapeutic Food Analysis and Outlook

12.1. South America Ready To Use Therapeutic Food Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Ready To Use Therapeutic Food Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Ready To Use Therapeutic Food Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Ready To Use Therapeutic Food Revenue (USD Million) by Product (2021-2032)

By Type

Solid

Paste

Drinkable

By End-User

UNICEF

WFP

Government Agencies

NGOs

By Distribution Channel

Direct Sales

E Commerce

Others

Chapter 13. Middle East and Africa Ready To Use Therapeutic Food Analysis and Outlook

13.1. Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) by Product (2021-2032)

By Type

Solid

Paste

Drinkable

By End-User

UNICEF

WFP

Government Agencies

NGOs

By Distribution Channel

Direct Sales

E Commerce

Others

Chapter 14. Ready To Use Therapeutic Food Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Diva Nutritional Products

GC Mana Nutritive Aid Products

GC Rieber Compact AS

Hilina

Inno Faso

Insta Products

Kaira District Cooperative

Nuflower Foods and Nutrition Pvt.

Power Foods Tanzania

Samil Industrial

Tabatchnik Fine Foods

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Ready To Use Therapeutic Food Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Ready To Use Therapeutic Food Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Ready To Use Therapeutic Food Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Ready To Use Therapeutic Food Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Ready To Use Therapeutic Food Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Ready To Use Therapeutic Food Market Share (%) By Regions (2021-2032)

Table 12 North America Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Table 15 South America Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) By Region (2021-2032)

Table 17 North America Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Table 18 North America Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Table 19 North America Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

Table 26 South America Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Table 27 South America Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Table 28 South America Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Ready To Use Therapeutic Food Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Ready To Use Therapeutic Food Market Share (%) By Regions (2023)

Figure 6. North America Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 12. France Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 12. China Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 14. India Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Ready To Use Therapeutic Food Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Ready To Use Therapeutic Food Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Ready To Use Therapeutic Food Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Ready To Use Therapeutic Food Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Ready To Use Therapeutic Food Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Ready To Use Therapeutic Food Revenue (USD Million) By Product (2021-2032)

By Type

Solid

Paste

Drinkable

By End-User

UNICEF

WFP

Government Agencies

NGOs

By Distribution Channel

Direct Sales

E Commerce

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Ready to Use Therapeutic Food Market Size is valued at $596.1 Million in 2024 and is forecast to register a growth rate (CAGR) of 11.3% to reach $1403.7 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Diva Nutritional Products, GC Mana Nutritive Aid Products, GC Rieber Compact AS, Hilina, Inno Faso, Insta Products, Kaira District Cooperative, Nuflower Foods and Nutrition Pvt., Power Foods Tanzania, Samil Industrial, Tabatchnik Fine Foods

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume