The global Reactive Diluents Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Aliphatic, Aromatic, Cycloaliphatic), By Application (Paints & coatings, Composites, Adhesives & sealants, Others).

In 2024, the reactive diluents market is experiencing steady growth driven by the increasing demand for environmentally friendly and high-performance additives in coatings, adhesives, composites, and electronic materials. Reactive diluents are low-viscosity compounds added to reactive formulations to reduce viscosity, improve handling, and modify properties such as curing speed, adhesion, and mechanical strength. The coatings industry is a major consumer of reactive diluents, with applications ranging from automotive paints and industrial coatings to architectural finishes and protective coatings, benefiting from their ability to enhance film formation, durability, and chemical resistance. Further, the adhesives and sealants sector utilizes reactive diluents for structural bonding, laminating, and potting applications, contributing to improved adhesion, toughness, and performance of bonded assemblies. Additionally, the composites industry relies on reactive diluents for resin infusion, pultrusion, and filament winding processes, enabling the production of lightweight, high-strength components for aerospace, automotive, and marine applications. With a growing emphasis on sustainability, regulatory compliance, and performance requirements, the reactive diluents market is poised for d growth, driven by innovations in formulation chemistry, process optimization, and end-user applications.

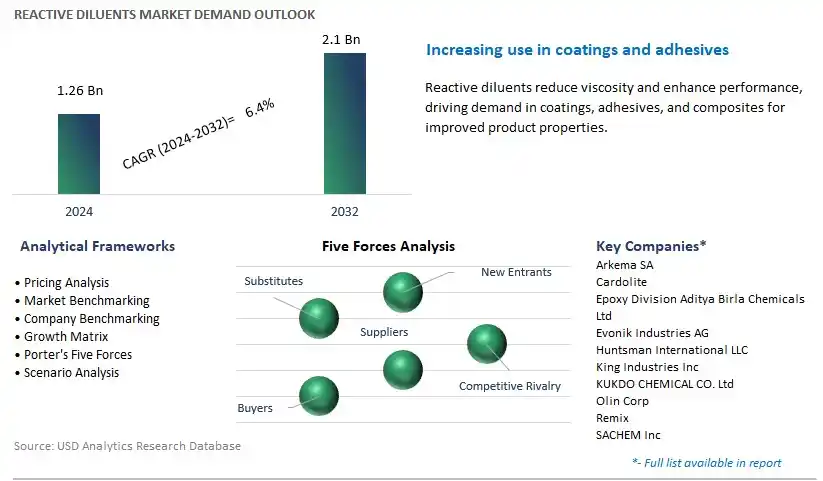

The market report analyses the leading companies in the industry including Arkema SA, Cardolite, Epoxy Division Aditya Birla Chemicals Ltd, Evonik Industries AG, Huntsman International LLC, King Industries Inc, KUKDO CHEMICAL CO. Ltd, Olin Corp, Remix, SACHEM Inc, and others.

One prominent market trend in reactive diluents is the shift towards environmentally friendly formulations. With increasing regulatory pressure and consumer demand for sustainable products, manufacturers are transitioning towards eco-friendly formulations for various applications such as coatings, adhesives, composites, and sealants. Reactive diluents play a crucial role in formulating low-VOC (volatile organic compound) and solvent-free products, which offer benefits such as reduced environmental impact, improved indoor air quality, and compliance with stringent regulations. This trend is driving the development and adoption of reactive diluents derived from renewable feedstocks, bio-based materials, and green chemistry principles to meet sustainability goals and market demands.

A key market driver for reactive diluents is the growth in end-use industries such as construction, automotive, aerospace, electronics, and packaging. Reactive diluents are essential components in formulating coatings, adhesives, and other specialty chemicals used in these industries for applications such as surface protection, bonding, sealing, and encapsulation. The expansion of construction activities, automotive production, electronics manufacturing, and packaging applications worldwide is driving the demand for high-performance materials with enhanced durability, adhesion, and mechanical properties. Reactive diluents enable the formulation of tailor-made solutions that meet the specific performance requirements of different end-use applications, thereby fueling market growth.

An emerging opportunity in the reactive diluents market lies in innovation in performance-enhancing additives. As industries continue to demand higher performance, durability, and functionality from coatings, adhesives, and composites, there is a growing need for additives that can enhance the properties and performance of reactive diluents-based formulations. Companies are investing in research and development to develop additives such as crosslinkers, modifiers, stabilizers, and functional fillers that can improve curing kinetics, adhesion, chemical resistance, UV stability, and other key properties of finished products. By offering innovative additives that complement reactive diluents, manufacturers can differentiate their products, expand their market presence, and capitalize on the growing demand for high-performance materials across various industries.

The aliphatic reactive diluents segment is the largest segment in the Reactive Diluents Market due to its diverse range of applications and favorable properties. Aliphatic reactive diluents are characterized by their linear or branched molecular structure, which imparts properties such as low viscosity, high flexibility, and excellent chemical resistance. These diluents are widely used in the formulation of coatings, adhesives, composites, and sealants to improve viscosity control, enhance curing properties, and optimize mechanical performance. Moreover, aliphatic reactive diluents offer advantages such as low volatility, low odor, and compatibility with a wide range of resins and additives, making them suitable for various formulations and end-use applications. As industries such as construction, automotive, aerospace, and electronics continue to demand high-performance and environmentally friendly materials, the demand for aliphatic reactive diluents is expected to grow steadily, solidifying its position as the largest segment in the Reactive Diluents Market.

The composites segment is the fastest-growing segment in the Reactive Diluents Market due to the increasing demand for lightweight and high-performance materials across various industries. Composites are widely used in aerospace, automotive, wind energy, and construction sectors for their exceptional strength-to-weight ratio, corrosion resistance, and design flexibility. Reactive diluents play a crucial role in composite manufacturing processes by improving resin flow, wetting of reinforcing fibers, and controlling viscosity during fabrication. Additionally, reactive diluents enhance the mechanical properties and durability of composite materials by facilitating proper curing and crosslinking of resin systems. As industries continue to prioritize the development of advanced composite materials to meet stringent performance requirements and sustainability goals, the demand for reactive diluents in composite applications is expected to surge, driving rapid growth in the Reactive Diluents Market.

By Type

Aliphatic

Aromatic

Cycloaliphatic

By Application

Paints & coatings

Composites

Adhesives & sealants

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arkema SA

Cardolite

Epoxy Division Aditya Birla Chemicals Ltd

Evonik Industries AG

Huntsman International LLC

King Industries Inc

KUKDO CHEMICAL CO. Ltd

Olin Corp

Remix

SACHEM Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Reactive Diluents Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Reactive Diluents Market Size Outlook, $ Million, 2021 to 2032

3.2 Reactive Diluents Market Outlook by Type, $ Million, 2021 to 2032

3.3 Reactive Diluents Market Outlook by Product, $ Million, 2021 to 2032

3.4 Reactive Diluents Market Outlook by Application, $ Million, 2021 to 2032

3.5 Reactive Diluents Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Reactive Diluents Industry

4.2 Key Market Trends in Reactive Diluents Industry

4.3 Potential Opportunities in Reactive Diluents Industry

4.4 Key Challenges in Reactive Diluents Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Reactive Diluents Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Reactive Diluents Market Outlook by Segments

7.1 Reactive Diluents Market Outlook by Segments, $ Million, 2021- 2032

By Type

Aliphatic

Aromatic

Cycloaliphatic

By Application

Paints & coatings

Composites

Adhesives & sealants

Others

8 North America Reactive Diluents Market Analysis and Outlook To 2032

8.1 Introduction to North America Reactive Diluents Markets in 2024

8.2 North America Reactive Diluents Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Reactive Diluents Market size Outlook by Segments, 2021-2032

By Type

Aliphatic

Aromatic

Cycloaliphatic

By Application

Paints & coatings

Composites

Adhesives & sealants

Others

9 Europe Reactive Diluents Market Analysis and Outlook To 2032

9.1 Introduction to Europe Reactive Diluents Markets in 2024

9.2 Europe Reactive Diluents Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Reactive Diluents Market Size Outlook by Segments, 2021-2032

By Type

Aliphatic

Aromatic

Cycloaliphatic

By Application

Paints & coatings

Composites

Adhesives & sealants

Others

10 Asia Pacific Reactive Diluents Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Reactive Diluents Markets in 2024

10.2 Asia Pacific Reactive Diluents Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Reactive Diluents Market size Outlook by Segments, 2021-2032

By Type

Aliphatic

Aromatic

Cycloaliphatic

By Application

Paints & coatings

Composites

Adhesives & sealants

Others

11 South America Reactive Diluents Market Analysis and Outlook To 2032

11.1 Introduction to South America Reactive Diluents Markets in 2024

11.2 South America Reactive Diluents Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Reactive Diluents Market size Outlook by Segments, 2021-2032

By Type

Aliphatic

Aromatic

Cycloaliphatic

By Application

Paints & coatings

Composites

Adhesives & sealants

Others

12 Middle East and Africa Reactive Diluents Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Reactive Diluents Markets in 2024

12.2 Middle East and Africa Reactive Diluents Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Reactive Diluents Market size Outlook by Segments, 2021-2032

By Type

Aliphatic

Aromatic

Cycloaliphatic

By Application

Paints & coatings

Composites

Adhesives & sealants

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arkema SA

Cardolite

Epoxy Division Aditya Birla Chemicals Ltd

Evonik Industries AG

Huntsman International LLC

King Industries Inc

KUKDO CHEMICAL CO. Ltd

Olin Corp

Remix

SACHEM Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Aliphatic

Aromatic

Cycloaliphatic

By Application

Paints & coatings

Composites

Adhesives & sealants

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Reactive Diluents Market Size is valued at $1.26 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.4% to reach $2.1 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arkema SA, Cardolite, Epoxy Division Aditya Birla Chemicals Ltd, Evonik Industries AG, Huntsman International LLC, King Industries Inc, KUKDO CHEMICAL CO. Ltd, Olin Corp, Remix, SACHEM Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume