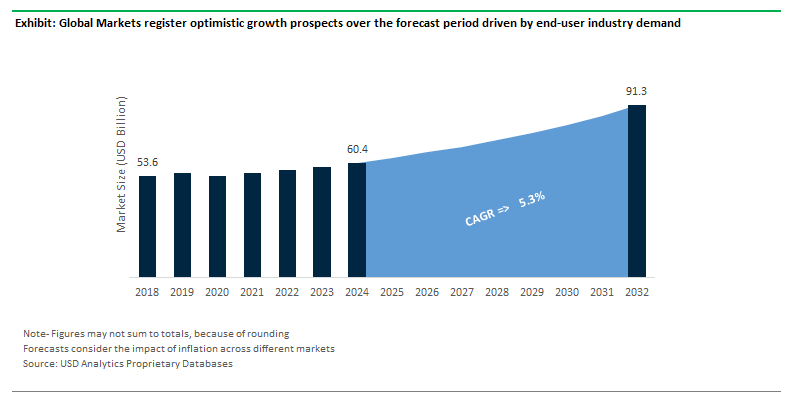

USD Analytics estimates the Purified Terephthalic Acid Market Size to increase at a 5.3% CAGR over the forecast period from $60.4 Billion 2024 to $91.3 Billion in 2032

Purified Terephthalic Acid (PTA) is one of the largest commodity chemicals in volume terms, driven by widespread applications in PET, saturated polyesters, polymer products, aromatic polyamides, CHDM, TCL, 1,4-benzenedicarbonyl chloride, and LCPs. Manufacturers are focusing on competitiveness to boost profitability in the industry. In the short-term future, optimistic demand prospects in Europe are observed despite slow demand in Asia Pacific markets. On the long-term front, the market demand remains robust encouraging new downstream PTA projects.

The rapid expansion of end-user applications driven by e-commerce growth, textile and apparel industries, bioplastics, and other industries drives the market outlook. Superior properties of Purified Terephthalic Acid including High-purity PTA (to improve the mechanical and chemical properties of PET bottles, polyester films, and fibers), durability and thermal stability of PET resins (bottling and food packaging), lightweight and durability (textile and packaging sectors), resistance to chemicals, moisture, and UV light (construction and packaging), high tensile strength and flexibility (automotive and textiles), recyclability of PTA-based materials like PET (packaging), high optical clarity (bottled beverages, medical packaging, and optical films), cost-effectiveness (packaging and consumer goods), and others drive the long-term Purified Terephthalic Acid market size outlook.

The planned projects in Asia and the Middle East continue to boost the global capacity by around 40 MTPA by 2030. Hengli Group, SASA POLYESTER, Jiangsu Honggang Petrochemical Co., Ltd, Reliance Industries, SABIC, Fujian Billion, Sinopec Group, Alpek, and others are continuing their planned projects. Leading companies like ike Indorama Ventures and Reliance Industries are investing in sustainable production compared to conventional production methods such as catalytic liquid-phase oxidation of para-xylene.

Eastman Chemical Company is pioneering the use of renewable PTA, derived from non-fossil feedstocks, to align with the global push for green chemistry, Lotte Chemical is continuing its efforts to enhance its production technologies and reduce environmental impact, China’s Hengli Petrochemical is focusing on cost-competitive production focused on Southeast Asian textile demand.

On the other hand, weak market conditions, typhoon-related disruption in China, and others are forcing manufacturers to close their plants. For instance, in 2024, Pengwei Petrochemical ceased operations of its 900,000 MTPA purified terephthalic acid (PTA) plant at Chongqing, China owing to weak market conditions, Indorama is closing down its PTA plant in Montréal-Est, Quebec, Canada, Ineos also closed Belgium PTA unit amid high costs and cheap imports. Overcapacity, low-cost imports, elevated interest rates and input costs are putting pressure on European manufacturers.

The global PTA production is largely centralized in China, South Korea, the Middle East, and FSU driven by cost-efficiency and concentrated production plants. However, amidst logistical bottlenecks, and rising shipping costs, major end-users in India, Vietnam, Europe, and others are focusing decentralized PTA production to mitigate risks associated with global price and supply fluctuations. In particular, Southeast Asian countries with robust textile and apparel grade PTA demand are developing domestic production capacity and paraxylene sourcing to reduce reliance on Chinese imports.

Lower transportation costs, tariff savings, expanding infrastructure, and end-user demand are encouraging PTA production plans in Brazil, Vietnam, and other emerging countries. The Indian government has rolled out Production Linked Incentive (PLI) schemes to encourage companies like ONGC Petro Additions Limited to expand their production capacities for both paraxylene and PTA. Further, regional PTA production hubs are quickly gaining interest from manufacturers with preferential market access to boost exports to high-demand regions like Southeast Asia and Latin America.

Growing public awareness of the negative environmental impact of microplastics in food chains, water supplies are forcing manufacturers to develop sustainable production solutions. Germany and other European Union countries are setting ambitious targets for the recycled content in plastic packaging, which directly increases demand for PTA to produce recycled PET. The European Chemicals Agency (ECHA) has proposed bans on intentionally added microplastics in various products, including cosmetics, textiles, and packaging.

Coca-Cola and Unilever announced plans to use 100% recycled PET in their packaging to limit the production of virgin plastics and reduce microplastic pollution. Amidst strong market demand, Loop Industries and other companies are developing chemical recycling technologies that enable PET to be broken into PTA and ethylene glycol. Similarly, NatureWorks is developing bio-based plastics with its Ingeo™ biopolymer, Xeros is launching advanced filtration systems for washing machines to capture microplastics shed from polyester garments, and Corbion announced biodegradable polymers as substitutes for conventional PTA-derived plastics.

The recent fluctuations in global energy markets are directly influencing the cost structure of PTA production. The Energy Information Administration (EIA) estimates the Brent crude oil spot price to average $82/barrel in 4Q24 and average $84/b in 2025 while Henry Hub spot price will rise from less than $2.00 per million British thermal units (MMBtu) in August to around $3.10/MMBtu next year. Purified Terephthalic Acid (PTA) is primarily produced from paraxylene (PX), a petrochemical derivative sourced from crude oil and natural gas.

Consequently, fluctuations in global energy markets directly influence the cost structure of PTA production (C6H4(CO2H)2). The recent oil price spikes driven by the Russia-Ukraine conflict and OPEC's fluctuating production levels have led to sharp increases in paraxylene costs, subsequently affecting the PTA supply chain. In particular, para-xylene FOB prices varied between $0.9 to $1.3 per Kg over the past few years. The European Union’s Fit for 55 plan, which seeks to reduce emissions by 55% by 2030, is reducing investment in fossil fuel production, potentially limiting the availability of raw materials like paraxylene in the future. Feedstock inflation directly affects Chinese PTA producers, raising production costs and creating challenges in maintaining competitive pricing in the global market.

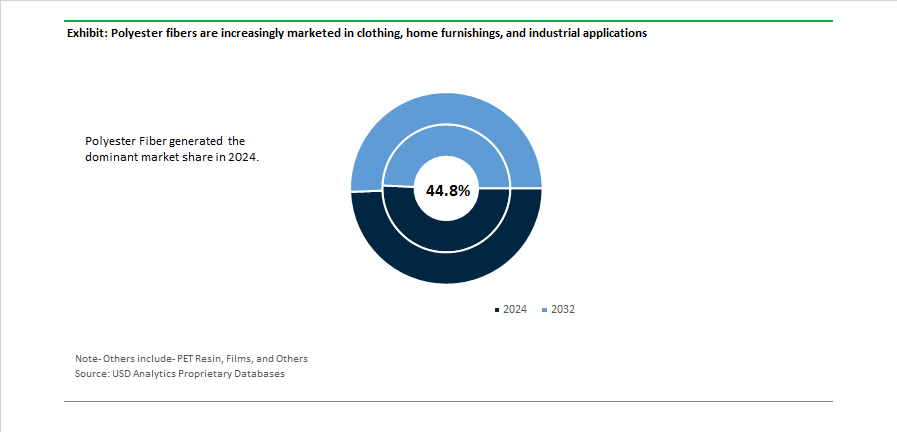

Polyester Fiber held the largest market share of 44.8%, generating a $27 Billion revenue in 2024. Polyester fibers, derived from PTA, are widely used in clothing, home furnishings, and industrial applications due to their versatility, durability, and affordability. The growth of the fast fashion industry, along with the increasing demand for cost-effective, synthetic fibers in emerging economies drives the PTA sales volume. Zara, H&M, and Uniqlo are shifting to polyester fibers from natural fibers like cotton or wool for resilience, ease of care, and adaptability to different textures. Virent and Anellotech are developing bio-based routes for PTA production, reducing reliance on petroleum feedstocks.

According to the Observatory of Economic Complexity (OEC), China exported $303,000 Million of textiles, followed by Bangladesh, Vietnam, India, Germany, Turkey, Italy, United States, Pakistan, Spain, and others.

Table- Textile and Apparel Exports by Country, USD Million

|

|

USD Million |

|

China |

$303,000 |

|

Bangladesh |

$57,700 |

|

Vietnam |

$48,800 |

|

India |

$41,100 |

|

Germany |

$40,000 |

|

Turkey |

$36,700 |

|

Italy |

$36,700 |

|

United States |

$29,800 |

|

Pakistan |

$22,100 |

|

Spain |

$20,300 |

In addition, Polyester fiber is evolving beyond its traditional uses, with a rising demand for high-performance and functional textiles. These include moisture-wicking, UV-resistant, and antimicrobial polyester fabrics, which are rapidly gaining traction in the sportswear, outdoor clothing, and medical textiles industries. Teijin Limited and Toray Industries are developing innovative textiles for niche applications in healthcare and protective wear.

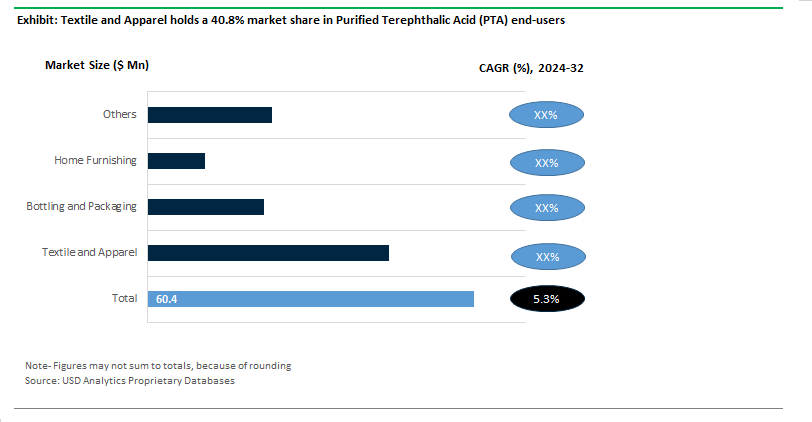

Textile and Apparel holds a 40.8% market share in Purified Terephthalic Acid (PTA) end-users. Technical textiles used in automotive, construction, and geotextiles are gaining significant business growth. Automotive textiles, such as seatbelts, airbags, and upholstery, are growing segments that require durable, high-strength polyester fibers and Geotextiles increasingly use polyester’s durability and cost-effectiveness.

As disposable incomes rise in countries like India, Brazil, and Nigeria, the demand for affordable, mass-produced apparel is increasing. The shift in consumer preferences towards functional apparel, particularly in the athleisure and performance wear sectors is driving the sales in developed markets. PET fabrics that are flame-retardant, water-repellent, waterproof and breathable continue to drive the long-term market outlook. BRICS countries with an estimated 40% of the global population continue to be the dominant markets for PTA based textiles and apparel.

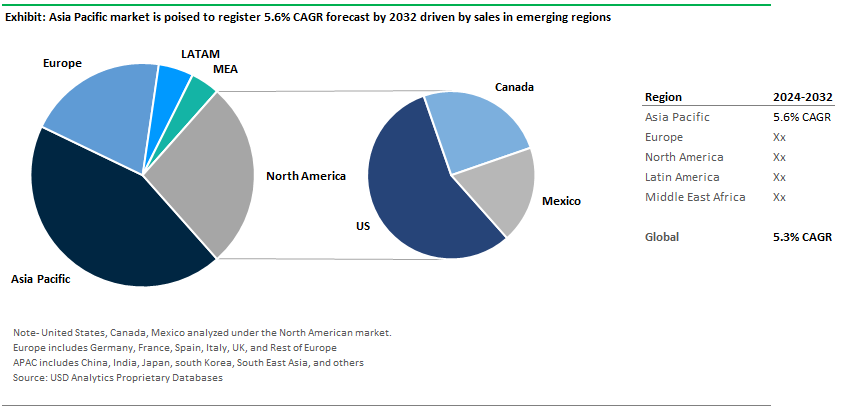

With 58.4% Market Share in global PTA industry, Asia Pacific generated $35.3 Billion in revenue in 2024. The market is poised to register 5.6% CAGR forecast by 2032 driven by massive consumption of polyester in the apparel, home textiles, and fast-moving consumer goods (FMCG) packaging industries. Rapid growth in ecommerce in the region is encouraging robust demand for textiles, packaging, bottling, and other end-users in the region. Amidst robust growth prospects, the industry is increasingly witnessing the increasing trend toward vertical integration among local manufacturers in particular, in China, India, and Thailand with producers expanding into raw material production, machinery manufacturing, and end-product distribution.

China’s Hengli Group and Indorama Ventures, Reliance Industries and IVL Dhunseri Petrochem Industries are scaling up their PTA production to support the country’s growing polyester demand for textiles and packaging. The Chinese 13th Five-Year Plan supports the growth of chemical industries, including PTA, with a focus on green technologies and capacity expansion, India’s National Petrochemical Policy aims to increase domestic production of petrochemical feedstocks, including PTA. China Petroleum & Chemical Corporation (Sinopec) and China National Petroleum Corporation (CNPC), are leveraging the BRI to create new export channels for PTA, particularly for Bangladesh and Vietnam. Zhejiang Yisheng Petrochemical Co. and Sinopec continue to implement advanced oxidation technologies.

As of 2024, the global Purified Terephthalic Acid (PTA) market is fragmented with the presence of both capital-intensive and small-scale companies that dominate both production and supply. Continuous production capacities, strategic expansions, and strong presence across end-use sectors like textiles, packaging, and bottling is widely observed among leading companies. Companies quickly addressing feedstock pricing, sustainability, and trade dynamics are set to gain significant market share over the forecast period.

The report analyses the below companies- Alfa Chemistry Co., Ltd., Alfa Corporativo S.A. de C.V., Arkema S.A., BP p.l.c., China Petrochemical Corporation (Sinopec Group), Colossustex Private Limited, Eastman Chemical Company, Indian Oil Corporation Limited, Indorama Ventures Public Company Limited, INEOS Group Holdings S.A., Jamorin International Limited, Johnson Matthey Public Limited Company, Lotte Chemical Corporation, MCPI Private Limited (Mitsubishi Chemical Polyester India), Mitsubishi Chemical Group Corporation, Petkim Petrokimya Holding Anonim Şirketi, Reliance Industries Limited, Saudi Basic Industries Corporation (SABIC), Sundyne LLC, Taekwang Industrial Co., Ltd.

|

Parameter |

Details |

|

Market Size (2024) |

$60.4 Billion |

|

Market Size (2032) |

$91.3 Billion |

|

Market Growth Rate |

5.3% |

|

Largest Segment- Product |

Polyester Fiber (44.8% Market Share) |

|

Fastest Growing Market- Region |

Asia Pacific (5.6% CAGR) |

|

Largest End-User Industry |

Polyester Fiber (40.8% Market Share) |

|

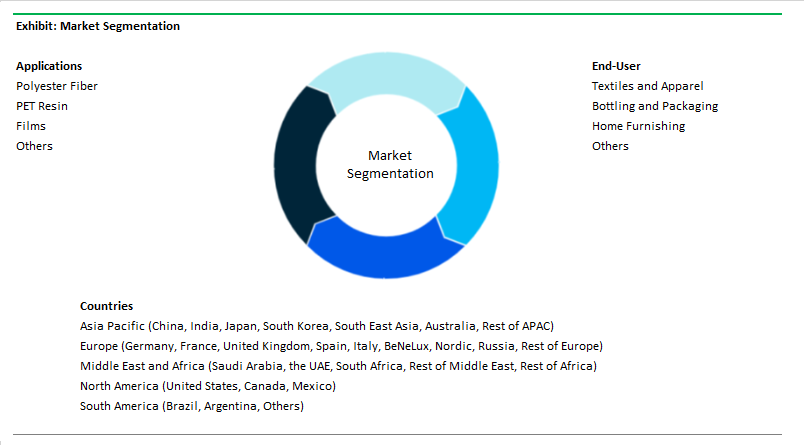

Segments |

Applications, End-Users |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Alfa Chemistry Co., Ltd., Alfa Corporativo S.A. de C.V., Arkema S.A., BP p.l.c., China Petrochemical Corporation (Sinopec Group), Colossustex Private Limited, Eastman Chemical Company, Indian Oil Corporation Limited, Indorama Ventures Public Company Limited, INEOS Group Holdings S.A., Jamorin International Limited, Johnson Matthey Public Limited Company, Lotte Chemical Corporation, MCPI Private Limited (Mitsubishi Chemical Polyester India), Mitsubishi Chemical Group Corporation, Petkim Petrokimya Holding Anonim Şirketi, Reliance Industries Limited, Saudi Basic Industries Corporation (SABIC), Sundyne LLC, Taekwang Industrial Co., Ltd. |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Applications

End-Users

Geography

Companies

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Purified Terephthalic Acid Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Purified Terephthalic Acid Market Size by Segments, 2018- 2023

Key Statistics, 2024

Purified Terephthalic Acid Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Purified Terephthalic Acid Types, 2018-2023

Purified Terephthalic Acid Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Purified Terephthalic Acid Applications, 2018-2023

8. Purified Terephthalic Acid Market Size Outlook by Segments, 2024- 2032

Purified Terephthalic Acid Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Purified Terephthalic Acid Types, 2024-2032

Purified Terephthalic Acid Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Purified Terephthalic Acid Applications, 2024-2032

9. Purified Terephthalic Acid Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

United States Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

United States Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

11. Canada Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Canada Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Canada Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

12. Mexico Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Mexico Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Mexico Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

13. Germany Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Germany Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Germany Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

14. France Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

France Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

France Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

France Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

United Kingdom Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

United Kingdom Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

10. Spain Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Spain Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Spain Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

16. Italy Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Italy Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Italy Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

17. Benelux Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Benelux Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Benelux Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

18. Nordic Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Nordic Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Nordic Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Rest of Europe Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Rest of Europe Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

20. China Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

China Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

China Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

China Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

21. India Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

India Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

India Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

India Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

22. Japan Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Japan Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Japan Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

23. South Korea Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

South Korea Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

South Korea Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

24. Australia Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Australia Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Australia Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

25. South East Asia Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

South East Asia Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

South East Asia Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

27. Brazil Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Brazil Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Brazil Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

28. Argentina Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Argentina Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Argentina Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Rest of South America Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Rest of South America Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

United Arab Emirates Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

United Arab Emirates Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Saudi Arabia Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Saudi Arabia Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Rest of Middle East Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Rest of Middle East Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

33. South Africa Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

South Africa Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

South Africa Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Purified Terephthalic Acid Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Purified Terephthalic Acid Market Size Outlook by Type, 2021- 2032

Rest of Africa Purified Terephthalic Acid Market Size Outlook by Application, 2021- 2032

Rest of Africa Purified Terephthalic Acid Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Applications

End-Users

Geography

Purified Terephthalic Acid Market Size to increase at a 5.3% CAGR over the forecast period from $60.4 Billion 2024 to $91.3 Billion in 2032

Polyester Fiber (44.8% Market Share), Polyester Fiber (40.8% Market Share)

Alfa Chemistry, Arkema SA, BP Plc, China Petrochemical Corp, Colossustex, Eastman Chemical Company, Indian Oil Corp Ltd, Indorama Ventures Public Co. Ltd, INEOS Group Holdings SA, Jamorin International, Johnson Matthey Plc, Lotte Chemical Corp, MCPI, Mitsubishi Chemical Group Corp, Petkim Petrokimya Holding AS, Reliance Industries Ltd, Saudi Basic Industries Corp, Sundyne LLC, Taekwang Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume

Asia Pacific (5.6% CAGR)