The global Pulp and Paper Chemicals Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Binders, Bleaching Agents, Fillers, Pulping, Sizing, Others), By Application (Newsprint, Packaging and Industrial Papers, Printing and Writing Papers, Pulp Mills and Drinking Plants, Others).

Pulp and paper chemicals play a critical role in the manufacturing process, facilitating pulp production, papermaking, and enhancing the quality and performance of paper products. In 2024, the market for pulp and paper chemicals s to thrive, driven by the growing demand for specialty chemicals that improve process efficiency, product quality, and environmental sustainability. Manufacturers are focusing on developing innovative chemical additives and formulations to address evolving industry challenges, including fiber recycling, energy efficiency, and wastewater treatment. Additionally, stringent regulatory standards and consumer preferences for eco-friendly paper products are driving the adoption of sustainable chemical solutions with minimal environmental impact. With ongoing investments in research and development, pulp and paper chemical suppliers are poised to introduce advanced technologies and solutions that optimize pulp and paper production, supporting the sustainable growth of the global paper industry.

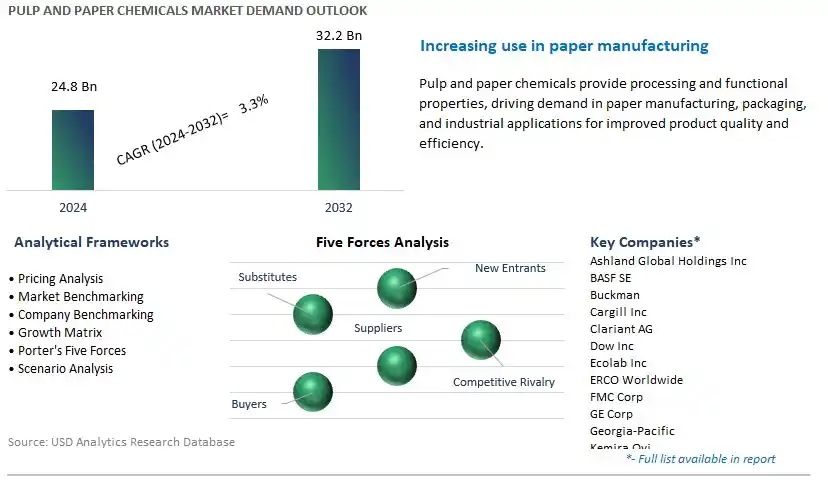

The market report analyses the leading companies in the industry including Ashland Global Holdings Inc, BASF SE, Buckman, Cargill Inc, Clariant AG, Dow Inc, Ecolab Inc, ERCO Worldwide, FMC Corp, GE Corp, Georgia-Pacific, Kemira Oyj, Nouryon, Solvay SA, Sonoco Products Company, Stora Enso, and others.

One prominent market trend in the pulp and paper chemicals industry is the increasing demand for sustainable and eco-friendly solutions, driven by regulatory pressures, consumer preferences, and corporate sustainability initiatives. With growing awareness about environmental issues such as deforestation, water pollution, and carbon emissions, pulp and paper manufacturers are seeking to minimize their environmental footprint and adopt cleaner production methods. This trend is prompting the development of eco-friendly chemicals and additives for pulp and paper processing, including biodegradable chelating agents, bio-based dispersants, and enzymatic bleaching agents. Additionally, there is a rising interest in recycling and waste minimization technologies to reduce the environmental impact of pulp and paper production, driving the adoption of green chemistry principles and circular economy approaches in the industry.

A key market driver for pulp and paper chemicals is the need for enhanced process efficiency and product quality in the pulp and paper manufacturing process. Pulp and paper mills strive to optimize production processes, increase yield, and improve the quality of paper products to remain competitive in the market. Chemical additives play a crucial role in achieving these objectives by facilitating pulp bleaching, improving paper strength and brightness, enhancing retention and drainage properties, and controlling pitch and stickies formation. Furthermore, innovative chemical formulations and process optimization solutions help pulp and paper manufacturers reduce energy consumption, water usage, and waste generation, contributing to cost savings and operational efficiency. This drives the demand for advanced pulp and paper chemicals that offer superior performance, consistency, and reliability, leading to their widespread adoption across the industry.

An opportunity for market growth lies in innovation in specialty chemical formulations for pulp and paper applications to address emerging market needs and challenges. Chemical manufacturers specializing in pulp and paper chemicals can capitalize on this opportunity by developing customized solutions tailored to specific process requirements, paper grades, and end-user applications. This includes the introduction of novel additives for improving paper strength, printability, and recyclability, as well as eco-friendly alternatives to traditional chemicals with reduced environmental impact. Additionally, investing in research and development to enhance the functionality and efficiency of chemical additives, such as enzymatic bleaching agents, biocides, and retention aids, presents opportunities to differentiate products and capture market share. By providing innovative and tailored chemical solutions that address the evolving needs of pulp and paper manufacturers, companies can strengthen customer relationships, drive market expansion, and contribute to the sustainability goals of the industry.

Within the Pulp and Paper Chemicals Market, the Fillers segment is the largest. Fillers play a crucial role in enhancing the properties of paper products, including brightness, opacity, and smoothness, while also improving printability and reducing production costs. Calcium carbonate and kaolin are among the most commonly used fillers in the papermaking process due to their abundance, low cost, and ability to enhance paper quality. Additionally, fillers act as bulking agents, increasing paper bulk and stiffness, which is essential for producing high-quality paper products such as printing papers, packaging materials, and coated papers. Moreover, the growing demand for eco-friendly paper products and sustainable production practices has led to the increased use of fillers derived from renewable and recycled sources. With the continual innovation in filler technology and the rising demand for high-quality paper products across various industries, the Fillers segment remains the largest and most essential segment in the pulp and paper chemicals market.

Within the Pulp and Paper Chemicals Market, the Packaging and Industrial Papers segment is the fastest-growing. In particular, the increasing demand for sustainable packaging solutions driven by e-commerce growth, changing consumer preferences, and environmental regulations has led to a surge in demand for packaging papers and boards. Pulp and paper chemicals play a critical role in enhancing the strength, durability, and moisture resistance of packaging materials, ensuring the integrity and protection of packaged goods throughout the supply chain. Additionally, the rise of online shopping and the need for efficient and eco-friendly packaging solutions have spurred investments in advanced papermaking technologies and chemical additives to meet the evolving demands of the packaging industry. Moreover, the growing emphasis on recyclability and circular economy principles further drives the adoption of pulp and paper chemicals in the production of sustainable packaging materials. With the continued expansion of the e-commerce sector and the increasing awareness of environmental sustainability, the Packaging and Industrial Papers segment is poised for significant growth in the pulp and paper chemicals market.

By Type

Binders

Bleaching Agents

Fillers

Pulping

Sizing

Others

By Application

Newsprint

Packaging and Industrial Papers

Printing and Writing Papers

Pulp Mills and Drinking Plants

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Ashland Global Holdings Inc

BASF SE

Buckman

Cargill Inc

Clariant AG

Dow Inc

Ecolab Inc

ERCO Worldwide

FMC Corp

GE Corp

Georgia-Pacific

Kemira Oyj

Nouryon

Solvay SA

Sonoco Products Company

Stora Enso

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Pulp and Paper Chemicals Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Pulp and Paper Chemicals Market Size Outlook, $ Million, 2021 to 2032

3.2 Pulp and Paper Chemicals Market Outlook by Type, $ Million, 2021 to 2032

3.3 Pulp and Paper Chemicals Market Outlook by Product, $ Million, 2021 to 2032

3.4 Pulp and Paper Chemicals Market Outlook by Application, $ Million, 2021 to 2032

3.5 Pulp and Paper Chemicals Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Pulp and Paper Chemicals Industry

4.2 Key Market Trends in Pulp and Paper Chemicals Industry

4.3 Potential Opportunities in Pulp and Paper Chemicals Industry

4.4 Key Challenges in Pulp and Paper Chemicals Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Pulp and Paper Chemicals Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Pulp and Paper Chemicals Market Outlook by Segments

7.1 Pulp and Paper Chemicals Market Outlook by Segments, $ Million, 2021- 2032

By Type

Binders

Bleaching Agents

Fillers

Pulping

Sizing

Others

By Application

Newsprint

Packaging and Industrial Papers

Printing and Writing Papers

Pulp Mills and Drinking Plants

Others

8 North America Pulp and Paper Chemicals Market Analysis and Outlook To 2032

8.1 Introduction to North America Pulp and Paper Chemicals Markets in 2024

8.2 North America Pulp and Paper Chemicals Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Pulp and Paper Chemicals Market size Outlook by Segments, 2021-2032

By Type

Binders

Bleaching Agents

Fillers

Pulping

Sizing

Others

By Application

Newsprint

Packaging and Industrial Papers

Printing and Writing Papers

Pulp Mills and Drinking Plants

Others

9 Europe Pulp and Paper Chemicals Market Analysis and Outlook To 2032

9.1 Introduction to Europe Pulp and Paper Chemicals Markets in 2024

9.2 Europe Pulp and Paper Chemicals Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Pulp and Paper Chemicals Market Size Outlook by Segments, 2021-2032

By Type

Binders

Bleaching Agents

Fillers

Pulping

Sizing

Others

By Application

Newsprint

Packaging and Industrial Papers

Printing and Writing Papers

Pulp Mills and Drinking Plants

Others

10 Asia Pacific Pulp and Paper Chemicals Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Pulp and Paper Chemicals Markets in 2024

10.2 Asia Pacific Pulp and Paper Chemicals Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Pulp and Paper Chemicals Market size Outlook by Segments, 2021-2032

By Type

Binders

Bleaching Agents

Fillers

Pulping

Sizing

Others

By Application

Newsprint

Packaging and Industrial Papers

Printing and Writing Papers

Pulp Mills and Drinking Plants

Others

11 South America Pulp and Paper Chemicals Market Analysis and Outlook To 2032

11.1 Introduction to South America Pulp and Paper Chemicals Markets in 2024

11.2 South America Pulp and Paper Chemicals Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Pulp and Paper Chemicals Market size Outlook by Segments, 2021-2032

By Type

Binders

Bleaching Agents

Fillers

Pulping

Sizing

Others

By Application

Newsprint

Packaging and Industrial Papers

Printing and Writing Papers

Pulp Mills and Drinking Plants

Others

12 Middle East and Africa Pulp and Paper Chemicals Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Pulp and Paper Chemicals Markets in 2024

12.2 Middle East and Africa Pulp and Paper Chemicals Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Pulp and Paper Chemicals Market size Outlook by Segments, 2021-2032

By Type

Binders

Bleaching Agents

Fillers

Pulping

Sizing

Others

By Application

Newsprint

Packaging and Industrial Papers

Printing and Writing Papers

Pulp Mills and Drinking Plants

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Ashland Global Holdings Inc

BASF SE

Buckman

Cargill Inc

Clariant AG

Dow Inc

Ecolab Inc

ERCO Worldwide

FMC Corp

GE Corp

Georgia-Pacific

Kemira Oyj

Nouryon

Solvay SA

Sonoco Products Company

Stora Enso

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Binders

Bleaching Agents

Fillers

Pulping

Sizing

Others

By Application

Newsprint

Packaging and Industrial Papers

Printing and Writing Papers

Pulp Mills and Drinking Plants

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Pulp and Paper Chemicals Market Size is valued at $24.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.3% to reach $32.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Ashland Global Holdings Inc, BASF SE, Buckman, Cargill Inc, Clariant AG, Dow Inc, Ecolab Inc, ERCO Worldwide, FMC Corp, GE Corp, Georgia-Pacific, Kemira Oyj, Nouryon, Solvay SA, Sonoco Products Company, Stora Enso

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume