The global Precision Fermentation Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Bacteria, Yeast, Algae, Fungi, Others), By Ingredient (Egg White, Whey, and Casein Protein, Collagen Protein, Hemeprotein), By End-User (Food and Beverage, Pharmaceutical, Cosmetic, Others), By Application (Dairy, Egg, Others, Meat, Seafood)

Precision fermentation is revolutionizing the food and beverage industry in 2024, offering innovative solutions for sustainable protein production, flavor enhancement, and ingredient development. This cutting-edge technology harnesses the power of microbial fermentation to produce a wide range of ingredients, including alternative proteins, enzymes, flavors, and functional additives, without the need for traditional agriculture or animal husbandry. Precision fermentation enables precise control over ingredient composition, purity, and scalability, making it a versatile tool for meeting the growing demand for plant-based and cell-based products while reducing environmental impact and resource consumption. From meat alternatives and dairy-free cheeses to plant-based sweeteners and bioactive compounds, precision fermentation is driving unprecedented innovation and disruption across the food and beverage value chain.

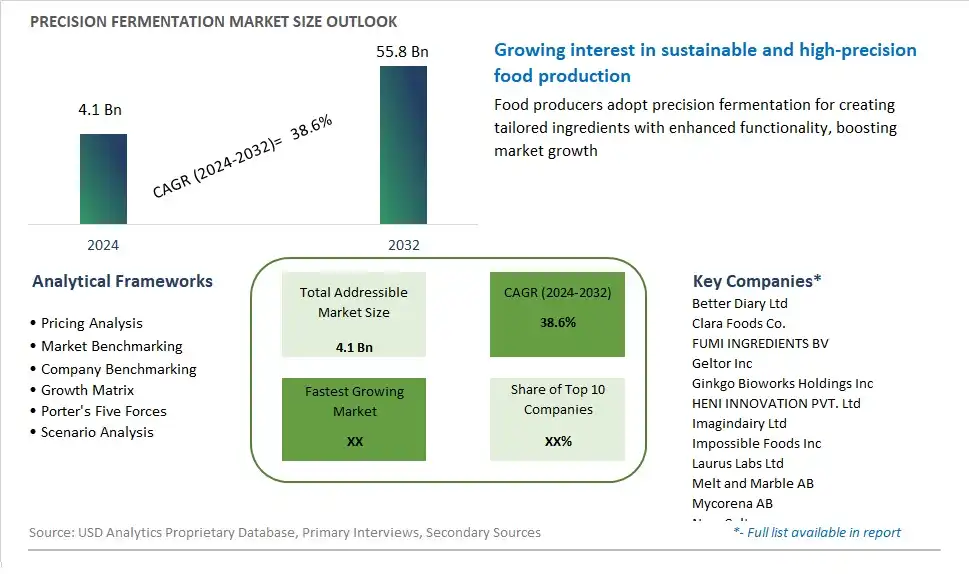

The market report analyses the leading companies in the industry including Better Diary Ltd, Clara Foods Co., FUMI INGREDIENTS BV, Geltor Inc, Ginkgo Bioworks Holdings Inc, HENI INNOVATION PVT. Ltd, Imagindairy Ltd, Impossible Foods Inc, Laurus Labs Ltd, Melt and Marble AB, Mycorena AB, New Culture, Nourish Ingredients Pty Ltd, Perfect Day Inc, Remilk Ltd, Shiru Inc, Triton Algae Innovations, and Others.

One prominent trend in the precision fermentation market is the increasing adoption of precision fermentation techniques in food production. Precision fermentation, also known as microbial fermentation or synthetic biology, involves the controlled cultivation of microorganisms to produce specific proteins, enzymes, flavors, and other valuable ingredients for use in food and beverage products. This trend is driven by advancements in biotechnology, genetic engineering, and fermentation science, enabling the production of a wide range of sustainable and scalable alternatives to traditional animal and plant-based ingredients. Precision fermentation offers numerous benefits, including reduced environmental impact, improved resource efficiency, and enhanced product consistency and quality, making it an attractive solution for food manufacturers seeking innovative and sustainable ingredient solutions. As a result, there is a growing interest and investment in precision fermentation technologies across the food industry, driving market growth and innovation in alternative protein and ingredient development.

A key driver propelling the precision fermentation market is the growing consumer demand for sustainable and plant-based alternatives to conventional animal-derived products. With increasing concerns about environmental sustainability, animal welfare, and food security, consumers are seeking alternative protein sources that are produced with minimal environmental impact and ethical considerations. Precision fermentation offers a scalable and customizable approach to producing proteins, functional ingredients, and flavors from microbial sources, bypassing the need for animal agriculture and the associated resource-intensive production processes. This driver is reinforced by changing dietary preferences, health consciousness, and ethical values driving consumer interest in plant-based and alternative protein products. As demand for sustainable food options continues to rise, precision fermentation technologies are poised to play a critical role in meeting the growing need for innovative and environmentally friendly food ingredients and products.

An opportunity for market expansion in the precision fermentation segment lies in the exploration of novel food applications and markets. Precision fermentation technologies enable the production of a wide range of functional ingredients, flavors, and nutritional compounds that can be incorporated into diverse food and beverage products, including meat alternatives, dairy alternatives, plant-based snacks, and functional foods. Manufacturers can capitalize on this opportunity by leveraging precision fermentation to develop innovative and differentiated products that cater to evolving consumer preferences for healthier, sustainable, and ethically sourced foods. Additionally, there is potential to enter new markets and industry sectors, such as pet food, cosmetics, pharmaceuticals, and biotechnology, where precision fermentation-derived ingredients and products offer unique advantages and value propositions. By diversifying product offerings and expanding into new applications, companies can unlock growth opportunities and establish themselves as leaders in the rapidly evolving precision fermentation market.

In the Precision Fermentation Market, the Yeast segment is the largest due to several key factors driving its dominance in the fermentation industry. Yeast is a widely used microorganism in precision fermentation processes due to its versatility and ability to ferment various substrates efficiently. Yeast-based fermentation is integral to the production of a wide range of products, including alcoholic beverages, bread, dairy alternatives, and biofuels, among others. Further, yeast's robust fermentation capabilities, fast growth rates, and tolerance to adverse conditions make it a preferred choice for industrial-scale fermentation processes. Additionally, advancements in genetic engineering and biotechnology have enabled the development of specialized yeast strains optimized for specific fermentation applications, further bolstering the dominance of the Yeast segment in the Precision Fermentation Market. Furthermore, the increasing demand for sustainable and eco-friendly alternatives to traditional fermentation methods, coupled with yeast's ability to produce bio-based products with reduced environmental impact, further drives its widespread adoption across various industries. As a result, the Yeast segment maintains its position as the largest in the Precision Fermentation Market, driven by its versatility, efficiency, and widespread application in fermentation processes.

In the Precision Fermentation Market, the Hemeprotein segment is experiencing the most rapid growth due to several key factors driving its ascent in the market. Hemeproteins, such as myoglobin and hemoglobin, are essential components found in animal tissues and blood, playing a crucial role in oxygen transport and storage. Precision fermentation allows for the production of hemeproteins using microbial hosts, offering a sustainable and scalable alternative to traditional animal-based sources. Hemeproteins serve as key ingredients in plant-based meat analogs and other food products, providing the characteristic taste, aroma, and nutritional benefits associated with meat. Further, the rising demand for plant-based and sustainable food options, coupled with concerns about the environmental impact of animal agriculture, drives the adoption of hemeprotein-based ingredients in plant-based food products. Additionally, advancements in biotechnology and fermentation processes enable the production of hemeproteins with improved functionality, taste, and nutritional profile, further fueling their popularity among food manufacturers and consumers. Furthermore, the versatility of hemeprotein-based ingredients in various food applications, including burgers, sausages, and meat substitutes, contributes to their rapid growth in the Precision Fermentation Market. As a result, the Hemeprotein segment is the fastest-growing, driven by its alignment with consumer preferences for sustainable, plant-based alternatives to animal-derived proteins and the growing demand for innovative food solutions.

In the Precision Fermentation Market, the Food and Beverage segment is the largest due to several key factors shaping its dominance in the industry. Precision fermentation technology revolutionizes the production of ingredients and additives used in food and beverage formulations, offering sustainable, cost-effective, and scalable solutions to meet the demands of the ever-evolving consumer market. This segment encompasses a wide array of applications, including the production of flavors, sweeteners, enzymes, vitamins, and proteins, among others, which play essential roles in enhancing the taste, texture, and nutritional profile of food and beverage products. Further, precision fermentation enables the production of novel ingredients with functional properties, such as plant-based proteins and alternative sweeteners, catering to the growing demand for healthier and sustainable food options. Additionally, the increasing preference for natural and clean-label ingredients, coupled with regulatory requirements for food safety and quality, drives the adoption of precision fermentation technology in the food and beverage industry. Furthermore, the versatility and adaptability of precision fermentation processes make them suitable for a wide range of applications, from dairy alternatives to fermented beverages, reinforcing the dominance of the Food and Beverage segment in the Precision Fermentation Market. As a result, this segment remains at the forefront, propelled by its pivotal role in driving innovation, sustainability, and quality within the food and beverage industry.

By Type

Bacteria

Yeast

Algae

Fungi

Others

By Ingredient

Egg White

Whey and Casein Protein

Collagen Protein

Hemeprotein

By End-User

Food and Beverage

Pharmaceutical

Cosmetic

Others

By Application

Dairy

Egg

Others

Meat

Seafood

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Better Diary Ltd

Clara Foods Co.

FUMI INGREDIENTS BV

Geltor Inc

Ginkgo Bioworks Holdings Inc

HENI INNOVATION PVT. Ltd

Imagindairy Ltd

Impossible Foods Inc

Laurus Labs Ltd

Melt and Marble AB

Mycorena AB

New Culture

Nourish Ingredients Pty Ltd

Perfect Day Inc

Remilk Ltd

Shiru Inc

Triton Algae Innovations

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Precision Fermentation Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Precision Fermentation Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Precision Fermentation Market Share by Company, 2023

4.1.2. Product Offerings of Leading Precision Fermentation Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Precision Fermentation Market Drivers

6.2. Precision Fermentation Market Challenges

6.6. Precision Fermentation Market Opportunities

6.4. Precision Fermentation Market Trends

Chapter 7. Global Precision Fermentation Market Outlook Trends

7.1. Global Precision Fermentation Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Precision Fermentation Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Precision Fermentation Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Type

Bacteria

Yeast

Algae

Fungi

Others

By Ingredient

Egg White

Whey and Casein Protein

Collagen Protein

Hemeprotein

By End-User

Food and Beverage

Pharmaceutical

Cosmetic

Others

By Application

Dairy

Egg

Others

Meat

Seafood

Chapter 8. Global Precision Fermentation Regional Analysis and Outlook

8.1. Global Precision Fermentation Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Precision Fermentation Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Precision Fermentation Regional Analysis and Outlook

8.2.2. Canada Precision Fermentation Regional Analysis and Outlook

8.2.3. Mexico Precision Fermentation Regional Analysis and Outlook

8.3. Europe Precision Fermentation Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Precision Fermentation Regional Analysis and Outlook

8.3.2. France Precision Fermentation Regional Analysis and Outlook

8.3.3. United Kingdom Precision Fermentation Regional Analysis and Outlook

8.3.4. Spain Precision Fermentation Regional Analysis and Outlook

8.3.5. Italy Precision Fermentation Regional Analysis and Outlook

8.3.6. Russia Precision Fermentation Regional Analysis and Outlook

8.3.7. Rest of Europe Precision Fermentation Regional Analysis and Outlook

8.4. Asia Pacific Precision Fermentation Revenue (USD Million) by Country (2021-2032)

8.4.1. China Precision Fermentation Regional Analysis and Outlook

8.4.2. Japan Precision Fermentation Regional Analysis and Outlook

8.4.3. India Precision Fermentation Regional Analysis and Outlook

8.4.4. South Korea Precision Fermentation Regional Analysis and Outlook

8.4.5. Australia Precision Fermentation Regional Analysis and Outlook

8.4.6. South East Asia Precision Fermentation Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Precision Fermentation Regional Analysis and Outlook

8.5. South America Precision Fermentation Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Precision Fermentation Regional Analysis and Outlook

8.5.2. Argentina Precision Fermentation Regional Analysis and Outlook

8.5.3. Rest of South America Precision Fermentation Regional Analysis and Outlook

8.6. Middle East and Africa Precision Fermentation Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Precision Fermentation Regional Analysis and Outlook

8.6.2. Africa Precision Fermentation Regional Analysis and Outlook

Chapter 9. North America Precision Fermentation Analysis and Outlook

9.1. North America Precision Fermentation Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Precision Fermentation Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Precision Fermentation Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Precision Fermentation Revenue (USD Million) by Product (2021-2032)

By Type

Bacteria

Yeast

Algae

Fungi

Others

By Ingredient

Egg White

Whey and Casein Protein

Collagen Protein

Hemeprotein

By End-User

Food and Beverage

Pharmaceutical

Cosmetic

Others

By Application

Dairy

Egg

Others

Meat

Seafood

Chapter 10. Europe Precision Fermentation Analysis and Outlook

10.1. Europe Precision Fermentation Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Precision Fermentation Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Precision Fermentation Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Precision Fermentation Revenue (USD Million) by Product (2021-2032)

By Type

Bacteria

Yeast

Algae

Fungi

Others

By Ingredient

Egg White

Whey and Casein Protein

Collagen Protein

Hemeprotein

By End-User

Food and Beverage

Pharmaceutical

Cosmetic

Others

By Application

Dairy

Egg

Others

Meat

Seafood

Chapter 11. Asia Pacific Precision Fermentation Analysis and Outlook

11.1. Asia Pacific Precision Fermentation Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Precision Fermentation Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Precision Fermentation Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Precision Fermentation Revenue (USD Million) by Product (2021-2032)

By Type

Bacteria

Yeast

Algae

Fungi

Others

By Ingredient

Egg White

Whey and Casein Protein

Collagen Protein

Hemeprotein

By End-User

Food and Beverage

Pharmaceutical

Cosmetic

Others

By Application

Dairy

Egg

Others

Meat

Seafood

Chapter 12. South America Precision Fermentation Analysis and Outlook

12.1. South America Precision Fermentation Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Precision Fermentation Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Precision Fermentation Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Precision Fermentation Revenue (USD Million) by Product (2021-2032)

By Type

Bacteria

Yeast

Algae

Fungi

Others

By Ingredient

Egg White

Whey and Casein Protein

Collagen Protein

Hemeprotein

By End-User

Food and Beverage

Pharmaceutical

Cosmetic

Others

By Application

Dairy

Egg

Others

Meat

Seafood

Chapter 13. Middle East and Africa Precision Fermentation Analysis and Outlook

13.1. Middle East and Africa Precision Fermentation Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Precision Fermentation Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Precision Fermentation Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Precision Fermentation Revenue (USD Million) by Product (2021-2032)

By Type

Bacteria

Yeast

Algae

Fungi

Others

By Ingredient

Egg White

Whey and Casein Protein

Collagen Protein

Hemeprotein

By End-User

Food and Beverage

Pharmaceutical

Cosmetic

Others

By Application

Dairy

Egg

Others

Meat

Seafood

Chapter 14. Precision Fermentation Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Better Diary Ltd

Clara Foods Co.

FUMI INGREDIENTS BV

Geltor Inc

Ginkgo Bioworks Holdings Inc

HENI INNOVATION PVT. Ltd

Imagindairy Ltd

Impossible Foods Inc

Laurus Labs Ltd

Melt and Marble AB

Mycorena AB

New Culture

Nourish Ingredients Pty Ltd

Perfect Day Inc

Remilk Ltd

Shiru Inc

Triton Algae Innovations

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Precision Fermentation Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Precision Fermentation Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Precision Fermentation Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Precision Fermentation Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Precision Fermentation Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Precision Fermentation Market Share (%) By Regions (2021-2032)

Table 12 North America Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Table 15 South America Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Precision Fermentation Revenue (USD Million) By Region (2021-2032)

Table 17 North America Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Table 18 North America Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Table 19 North America Precision Fermentation Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Precision Fermentation Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Precision Fermentation Revenue (USD Million) By Product (2021-2032)

Table 26 South America Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Table 27 South America Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Table 28 South America Precision Fermentation Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Precision Fermentation Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Precision Fermentation Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Precision Fermentation Market Share (%) By Regions (2023)

Figure 6. North America Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 12. France Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 12. China Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 14. India Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Precision Fermentation Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Precision Fermentation Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Precision Fermentation Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Precision Fermentation Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Precision Fermentation Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Precision Fermentation Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Precision Fermentation Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Precision Fermentation Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Precision Fermentation Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Precision Fermentation Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Precision Fermentation Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Precision Fermentation Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Precision Fermentation Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Precision Fermentation Revenue (USD Million) By Product (2021-2032)

By Type

Bacteria

Yeast

Algae

Fungi

Others

By Ingredient

Egg White

Whey and Casein Protein

Collagen Protein

Hemeprotein

By End-User

Food and Beverage

Pharmaceutical

Cosmetic

Others

By Application

Dairy

Egg

Others

Meat

Seafood

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Precision Fermentation Market Size is valued at $4.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 38.6% to reach $55.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Better Diary Ltd, Clara Foods Co., FUMI INGREDIENTS BV, Geltor Inc, Ginkgo Bioworks Holdings Inc, HENI INNOVATION PVT. Ltd, Imagindairy Ltd, Impossible Foods Inc, Laurus Labs Ltd, Melt and Marble AB, Mycorena AB, New Culture, Nourish Ingredients Pty Ltd, Perfect Day Inc, Remilk Ltd, Shiru Inc, Triton Algae Innovations

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume