Polyurethane coatings companies are increasingly investing in eco-friendly formulations, lightweighting, and smart coatings to gain from the robust market demand for PU coatings across sustainability, electric vehicles, infrastructure expansion, 3D printing, and renewable energy industries. With the global EV market expected to grow exponentially over the next decade, the demand for PU coatings tailored for electric mobility is gaining strong demand.

Further, surging demand for durable and weather-resistant coatings is encouraging new product launches and capacity expansions in emerging countries- transportation networks, smart cities, and energy infrastructures. Robust demand from 3D-printed parts is encouraging BASF and Covestro to develop formulations for 3D-printed automotive components with enhanced mechanical properties. Further, offshore wind farms and solar power plant projects worldwide drive sales of durable and weather-resistant polyurethane coatings.

Leading companies are investing in smart polyurethane coatings that offer multifunctional properties, such as self-healing, UV resistance, and thermal regulation. BASF is focusing on reducing volatile organic compounds (VOCs) emissions in its PU coatings through waterborne technologies and in 2023, PPG launched its new PPG ENVIROCRON® Extreme Protection powder coating. Further, AkzoNobel is expanding its Resicoat® line of PU coatings, emphasizing corrosion resistance and chemical durability, particularly in oil & gas pipelines and marine applications.

Sherwin-Williams introduced a new fast-drying polyurethane system targeted at the automotive refinishing industry while Axalta is focusing on automotive refinish coatings with its Imron® polyurethane coatings, which are used by OEMs for their high gloss retention, scratch resistance, and UV durability. In addition, Covestro AG markets high-performance, low-emission polyurethane coatings aimed at the automotive and construction sectors and Huntsman Corp promotes thermal insulation coatings based on polyurethane chemistry, primarily for the construction and oil & gas sectors.

Rapid growth in renewable energy demand is driving the demand for high-performance polyurethane coatings. Total global renewable power generation capacity will need to triple by 2030 to reach more than 11 000 GW under IRENA’s 1.5°C Scenario according to the IRENA (International Renewable Energy Agency). The Global Wind Energy Council (GWEC) reports that the offshore wind capacity is expected to grow from 55.9 GW in 2021 to over 225 GW by 2030, with Asia-Pacific leading the growth.

For the protection of wind turbines, solar panels, and hydroelectric equipment, from extreme environmental factors like UV radiation, saltwater corrosion, and thermal cycling, a large number of vendors are targeting the industry. Polyurethane coatings are essential for protecting offshore wind energy turbines against salt spray, moisture, and high winds. Akzo Nobel's Interthane 990 is marketed as an advanced PU topcoat with superior gloss retention, chemical resistance, and protection against UV degradation.

Polyurethane coatings are being developed to protect solar panels from UV radiation, extreme temperatures, and abrasion caused by environmental exposure. The global solar power market grew by 23% in 2022, reaching an installed capacity of 1 TW (terawatt). Accordingly, PPG Industries' SolarBond™ Sealants provide PU-based protection for solar panel edges, ensuring resistance against moisture infiltration and UV degradation. Further, Hydropower installations including dam walls, penstocks, and turbines use PU Coatings for abrasion, moisture damage, and chemical attack.

The International Hydropower Association (IHA) reported that hydropower is set to increase its global installed capacity from 1,330 GW in 2021 to 1,900 GW by 2040, driven largely by new installations in Asia-Pacific and Africa. Sherwin-Williams' Macropoxy® 646 is a high-performance PU coating designed for use in hydroelectric turbines and water infrastructure.

Advanced PU Coatings designed to respond dynamically to external stimuli such as scratches, heat, and moisture by automatically repairing damage are gaining demand. The emergence of smart and self-healing surface technologies in automotive, electronics, construction, and aerospace are shaping new product launches. According to a report by the European Automobile Manufacturers’ Association (ACEA), automotive sales rebounded with a 17.2% increase in Europe in 2023, largely driven by EVs. In particular, smart PU coatings offering solutions to problems like scratch damage, UV degradation, and paint fading are gaining robust demand in the automotive industry. Axalta Coating Systems' Imron® Self-Healing Coating uses polyurethane-based chemistry while BASF SE launched SmartCoat PU self-healing clear coat.

Further, rapid market penetration of smart PU coatings in smartphones, tablets, and wearables is encouraging Jotun to launch polyurethane coatings for wearable electronics, Samsung and LG are focusing on self-repairing screens that reduce damage from scratches and cracks. With global smartphone sales reaching 1.5 billion units annually and the trend toward foldable screens, self-healing PU coatings are expected to play a pivotal role in shaping the future of electronics durability. In the construction industry, self-healing PU coatings are applied to concrete walls, floors, and bridges to prevent cracking, water infiltration, and weather damage while Smart self-healing polyurethane coatings are widely being used to protect aircraft exteriors.

In 2024, solvent-based polyurethane (PU) coatings held the largest market share among diverse types of polyurethane coatings. Solvent-based PU coatings offer excellent mechanical properties, chemical resistance, and weather resistance compared to other types like water-based and powder coatings. The demand for enhanced durability and performance is driving companies to expand their portfolios of solvent-based PU coatings. In addition to automotive and marine applications, these coatings are now being used in solar power plants, desalination plants, and oil pipelines.

Further, specialized formulations that withstand exposure to aviation fuel, extreme temperatures, and high-altitude UV radiation are gaining demand. In addition, the application in heavy-duty industrial flooring, particularly in e-commerce distribution centers and automated warehouses is a fast-evolving area. Further, companies are working on hybrid solvent-based formulations that offer a mix of polyurea and polyurethane for applications requiring ballistic protection, such as armored vehicles and military drones.

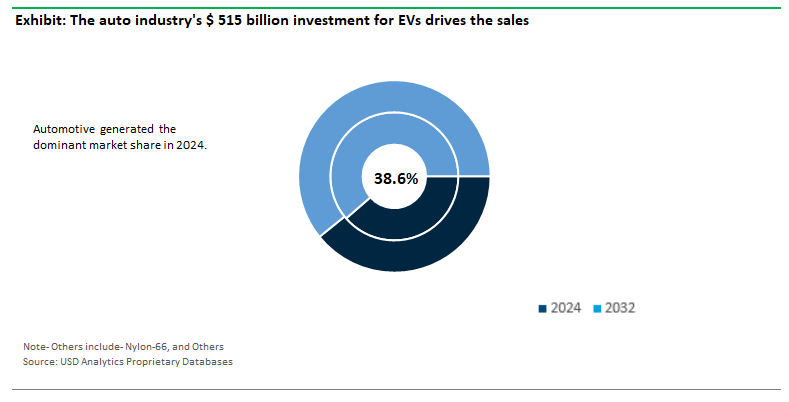

Among diverse polyurethane coating applications, automotive is projected to dominate, holding a 38.6% revenue share in 2024. This growth is driven by the industry's increased focus on lightweight materials, enhanced durability, and the growing use of electric vehicles (EVs). The auto industry's $ 515 billion investment by 2030 for EVs (BEV-Battery Electric Vehicles, Plug-In Hybrid, Fuel Cell) drives the market outlook. PU coatings offer protection for lighter substrates like plastics and composite materials used in vehicle interiors, exteriors, and underbody components.

The expansion of the EV sector is pushing demand for advanced PU coatings that can withstand the thermal management systems of batteries and motors. In particular, polyurethane coatings are preferred for scratch resistance, gloss retention, and chemical resistance for both interior trims and exterior paint protection. In addition, aesthetic coatings that offer unique color choices and finishes, such as matte, gloss, and metallic, are driving demand for polyurethane coatings.

Rapid industrialization coupled with robust automotive and furniture demand in Asia Pacific countries drives the regional PU Coating market size outlook. China, Japan, India, and South Korea are among the largest automotive manufacturing hubs globally, and the demand for PU coatings is surging to meet the sector’s needs. Accordingly, leading manufacturers are expanding their production bases in the region. For instance, BASF has expanded its production facilities in Shanghai, China, to produce more high-performance PU coatings for local automotive manufacturers such as BYD Auto and Geely.

Similarly, Nippon Paint introduced new PU coating lines tailored for electric vehicles produced in Japan and South Korea, emphasizing thermal stability and lightweight applications for battery enclosures and body panels. In addition, the growing demand for smartphones, 5G technology, and electronic devices drives the sales of specialized polyurethane coatings. In addition, APAC countries are increasingly investing in solar and wind energy projects, encouraging new product launches. Polycoat Products is boosting PU coatings production for wind turbines and solar panel mounts across China.

The Polyurethane Coatings market is fragmented with local players posing stiff competition to global majors. Companies are investing in sustainable coatings, particularly water-based and bio-based polyurethanes, to meet growing environmental regulations and market demand for eco-friendly products. Additionally, they are targeting high-performance coatings for automotive, renewable energy, and marine, where durability and specialized functionalities. Expansion through acquisitions, especially in emerging regions like Asia-Pacific, is another core strategy to enhance their global reach and capture fast-growing markets. Leading companies included in the study are Akzo Nobel NV, Asian Paints, Axalta Coating Systems, BASF SE, IVM Chemicals SRL, Jotun, Polycoat Products, PPG Industries Inc., RPM International Inc, The Sherwin-Williams Company, and others.

|

Parameter |

Details |

|

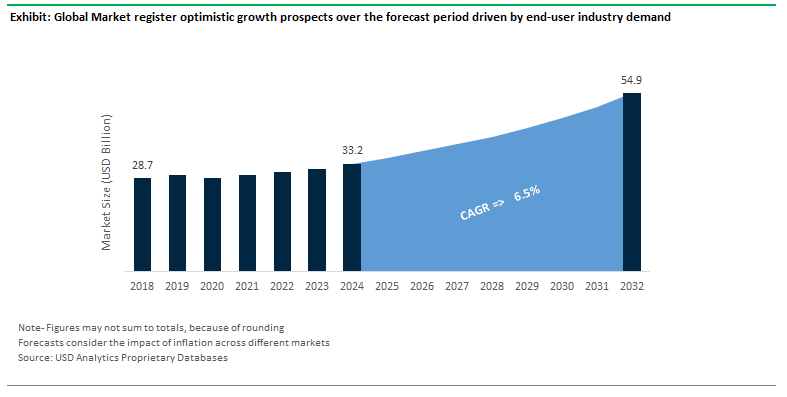

Market Size (2024) |

$33.2 Billion |

|

Market Size (2032) |

$54.9 Billion |

|

Market Growth Rate |

6.5% |

|

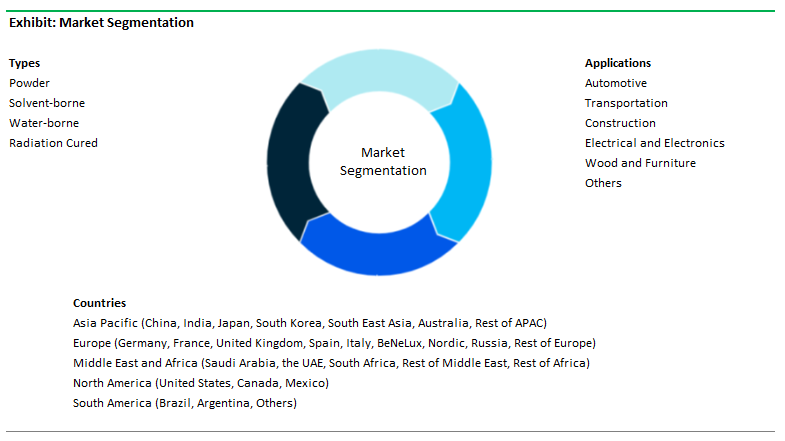

Largest Segment- Product |

Solvent-borne |

|

Fastest Growing Market- Region |

Asia Pacific (8.6% CAGR) |

|

Largest End-User Industry |

Automotive (38.6% Market Share) |

|

Segments |

Types, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Akzo Nobel NV, Asian Paints, Axalta Coating Systems, BASF SE, IVM Chemicals SRL, Jotun, Polycoat Products, PPG Industries Inc, RPM International Inc, The Sherwin-Williams Company |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Type

Application

Geography

Companies

*- List not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Polyurethane Coatings Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Polyurethane Coatings Market Size by Segments, 2018- 2023

Key Statistics, 2024

Polyurethane Coatings Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Polyurethane Coatings Types, 2018-2023

Polyurethane Coatings Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Polyurethane Coatings Applications, 2018-2023

8. Polyurethane Coatings Market Size Outlook by Segments, 2024- 2032

Polyurethane Coatings Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Polyurethane Coatings Types, 2024-2032

Polyurethane Coatings Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Polyurethane Coatings Applications, 2024-2032

9. Polyurethane Coatings Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

United States Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

United States Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

11. Canada Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Canada Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Canada Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

12. Mexico Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Mexico Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Mexico Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

13. Germany Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Germany Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Germany Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

14. France Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

France Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

France Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

France Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

United Kingdom Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

United Kingdom Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

10. Spain Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Spain Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Spain Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

16. Italy Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Italy Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Italy Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

17. Benelux Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Benelux Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Benelux Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

18. Nordic Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Nordic Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Nordic Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Rest of Europe Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Rest of Europe Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

20. China Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

China Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

China Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

China Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

21. India Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

India Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

India Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

India Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

22. Japan Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Japan Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Japan Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

23. South Korea Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

South Korea Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

South Korea Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

24. Australia Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Australia Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Australia Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

25. South East Asia Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

South East Asia Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

South East Asia Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

27. Brazil Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Brazil Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Brazil Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

28. Argentina Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Argentina Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Argentina Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Rest of South America Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Rest of South America Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

United Arab Emirates Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

United Arab Emirates Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Saudi Arabia Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Saudi Arabia Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Rest of Middle East Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Rest of Middle East Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

33. South Africa Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

South Africa Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

South Africa Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Polyurethane Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Polyurethane Coatings Market Size Outlook by Type, 2021- 2032

Rest of Africa Polyurethane Coatings Market Size Outlook by Application, 2021- 2032

Rest of Africa Polyurethane Coatings Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Application

Geography

Polyurethane Coatings Market Size is estimated to increase at a 6.5% CAGR over the forecast period from $33.2 Billion in 2024 to $54.9 Billion in 2032

High-Performance PU Coatings for Renewable Energy present strong growth opportunities for new entrants and industry leaders, PU Coatings for Smart and Self-Healing Surfaces witnessing rapid market penetration,

Akzo Nobel NV, Asian Paints, Axalta Coating Systems, BASF SE, IVM Chemicals SRL, Jotun, Polycoat Products, PPG Industries Inc, RPM International Inc, The Sherwin-Williams Company

Automotive (38.6% Market Share), Solvent-borne Polyurethane Coatings

Asia Pacific (8.6% CAGR)