The global Polytrimethylene Terephthalate Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Bio Based, Petroleum Based), By Application (Film Materials, Fiber), By End-User (Automotive, Building & Construction, Packaging, Medical, Consumer Goods, Textiles).

The Polytrimethylene Terephthalate (PTT) market is experiencing steady growth, driven by its unique combination of properties including high elasticity, resilience, and chemical resistance. Key trends shaping this industry include the increasing demand for PTT in textile applications such as apparel, carpets, and upholstery, where its soft touch and excellent dyeability offer advantages over traditional materials like polyester. Additionally, advancements in polymer processing techniques and fiber spinning technologies are expanding the range of PTT-based products, enabling the development of innovative textiles with enhanced performance characteristics. Moreover, the growing emphasis on sustainability and eco-friendliness is driving the adoption of bio-based PTT derived from renewable resources, further bolstering market growth. With ongoing research and development focusing on improving production efficiency and exploring new applications, the PTT market is poised for continued expansion in the coming years.

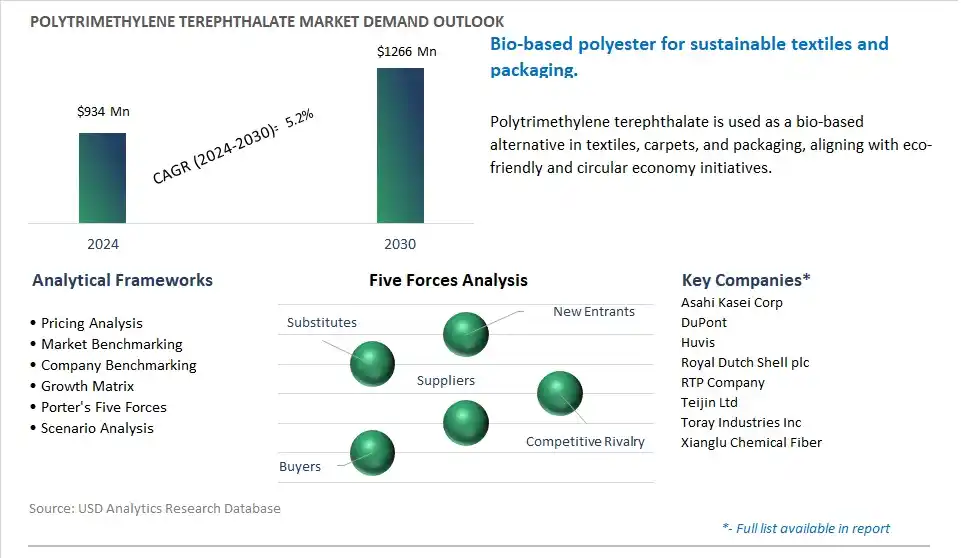

The market report analyses the leading companies in the industry including Asahi Kasei Corp, DuPont, Huvis, Royal Dutch Shell plc, RTP Company, Teijin Ltd, Toray Industries Inc, Xianglu Chemical Fiber.

A prominent trend in the polytrimethylene terephthalate (PTT) market is the increased demand for sustainable textile fibers. PTT, a polyester polymer, offers unique properties such as elasticity, softness, and resilience, making it an attractive alternative to traditional textile materials like cotton and nylon. With growing environmental concerns and consumer preferences for eco-friendly products, there is a rising demand for textile fibers derived from renewable resources and produced using sustainable processes. PTT, which can be manufactured from bio-based feedstocks such as plant sugars, presents an environmentally friendly option for textile applications. This is driving the commitment to sustainability and the adoption of eco-friendly materials in the textile sector, driving market growth for PTT fibers.

The market for polytrimethylene terephthalate (PTT) is driven by advancements in textile technology and applications, which expand the potential uses of PTT fibers in various industries. PTT fibers offer excellent characteristics such as moisture management, wrinkle resistance, and dyeability, making them suitable for a wide range of textile applications including apparel, home furnishings, automotive interiors, and industrial textiles. As textile manufacturers seek innovative materials to meet evolving consumer needs and market trends, there is a growing interest in PTT fibers for their performance attributes and versatility. Additionally, technological advancements in fiber spinning, processing, and finishing techniques enhance the properties and functionality of PTT fibers, driving market demand and adoption in diverse applications.

A potential opportunity in the polytrimethylene terephthalate (PTT) market lies in penetrating the sustainable fashion and apparel segment. With increasing awareness of environmental issues and ethical concerns in the fashion industry, there is a growing demand for sustainable and eco-friendly clothing options. PTT fibers, derived from renewable feedstocks and offering biodegradability and recyclability, align with the sustainability goals of fashion brands and consumers. By promoting PTT fibers as a sustainable alternative to conventional textile materials, manufacturers can capitalize on the growing demand for eco-friendly fashion and apparel products. Additionally, collaborations with fashion designers, brand partnerships, and marketing initiatives highlighting the sustainability benefits of PTT fibers can help drive adoption and market penetration in the sustainable fashion segment. Expanding into sustainable fashion presents an opportunity for differentiation, brand positioning, and market growth in the polytrimethylene terephthalate market.

The largest segment in the Polytrimethylene Terephthalate (PTT) Market is Petroleum Based. Petroleum-based PTT is derived from fossil fuel sources and has been traditionally used in various applications such as textiles, packaging, automotive, and electronics. It offers excellent properties such as high tensile strength, chemical resistance, and dimensional stability, making it suitable for a wide range of end-use applications. Additionally, petroleum-based PTT has a well-established supply chain and manufacturing infrastructure, which ensures consistent availability and competitive pricing compared to bio-based alternatives. Further, the versatility and performance characteristics of petroleum-based PTT have led to its widespread adoption by manufacturers across different industries, consolidating its position as the largest segment in the Polytrimethylene Terephthalate Market.

The fastest-growing segment in the Polytrimethylene Terephthalate (PTT) Market is Fiber. PTT fibers offer a unique combination of properties such as high elasticity, softness, resilience, and resistance to wrinkles and abrasion, making them ideal for various textile applications. The growing demand for PTT fibers in sectors such as apparel, home textiles, and industrial textiles is being driven by factors such as increasing consumer preference for comfortable and functional clothing, as well as the rising trend towards sustainable and eco-friendly materials. PTT fibers also exhibit excellent dyeability and color fastness, making them suitable for vibrant and long-lasting textile products. Additionally, advancements in PTT fiber production technology, including spinning processes and fiber modifications, have further improved their performance characteristics, driving their adoption in diverse applications. Furthermore, the versatility and versatility of PTT fibers make them well-suited for blending with other fibers, such as polyester or natural fibers, to enhance their properties and expand their application potential, contributing to the segment's rapid growth in the Polytrimethylene Terephthalate Market.

The fastest-growing segment in the Polytrimethylene Terephthalate (PTT) Market is Packaging. PTT offers excellent properties for packaging applications, including high strength, dimensional stability, clarity, and barrier properties against moisture, gases, and odors. These characteristics make PTT an ideal material for various packaging formats such as bottles, containers, films, and trays used in food, beverage, personal care, and pharmaceutical industries. The growing demand for sustainable and recyclable packaging materials, coupled with increasing regulatory pressure to reduce plastic waste and carbon footprint, is driving the adoption of PTT-based packaging solutions. Additionally, advancements in PTT processing technology, such as injection molding, blow molding, and thermoforming, have expanded the application scope and versatility of PTT in packaging, enabling the production of innovative and functional packaging designs. Furthermore, the rising consumer awareness and preference for eco-friendly and environmentally responsible packaging options further fuel the demand for PTT-based packaging solutions, contributing to the segment's rapid growth in the Polytrimethylene Terephthalate Market.

By Type

Bio Based

Petroleum Based

By Application

Film Materials

Fiber

-Carpet Fabric

-Automotive Fabric

-Apparels

-Engineering Plastics

By End-User

Automotive

Building & Construction

Packaging

Medical

Consumer Goods

Textiles

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Asahi Kasei Corp

DuPont

Huvis

Royal Dutch Shell plc

RTP Company

Teijin Ltd

Toray Industries Inc

Xianglu Chemical Fiber

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Polytrimethylene Terephthalate Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Polytrimethylene Terephthalate Market Size Outlook, $ Million, 2021 to 2030

3.2 Polytrimethylene Terephthalate Market Outlook by Type, $ Million, 2021 to 2030

3.3 Polytrimethylene Terephthalate Market Outlook by Product, $ Million, 2021 to 2030

3.4 Polytrimethylene Terephthalate Market Outlook by Application, $ Million, 2021 to 2030

3.5 Polytrimethylene Terephthalate Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Polytrimethylene Terephthalate Industry

4.2 Key Market Trends in Polytrimethylene Terephthalate Industry

4.3 Potential Opportunities in Polytrimethylene Terephthalate Industry

4.4 Key Challenges in Polytrimethylene Terephthalate Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Polytrimethylene Terephthalate Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Polytrimethylene Terephthalate Market Outlook by Segments

7.1 Polytrimethylene Terephthalate Market Outlook by Segments, $ Million, 2021- 2030

By Type

Bio Based

Petroleum Based

By Application

Film Materials

Fiber

-Carpet Fabric

-Automotive Fabric

-Apparels

-Engineering Plastics

By End-User

Automotive

Building & Construction

Packaging

Medical

Consumer Goods

Textiles

8 North America Polytrimethylene Terephthalate Market Analysis and Outlook To 2030

8.1 Introduction to North America Polytrimethylene Terephthalate Markets in 2024

8.2 North America Polytrimethylene Terephthalate Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Polytrimethylene Terephthalate Market size Outlook by Segments, 2021-2030

By Type

Bio Based

Petroleum Based

By Application

Film Materials

Fiber

-Carpet Fabric

-Automotive Fabric

-Apparels

-Engineering Plastics

By End-User

Automotive

Building & Construction

Packaging

Medical

Consumer Goods

Textiles

9 Europe Polytrimethylene Terephthalate Market Analysis and Outlook To 2030

9.1 Introduction to Europe Polytrimethylene Terephthalate Markets in 2024

9.2 Europe Polytrimethylene Terephthalate Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Polytrimethylene Terephthalate Market Size Outlook by Segments, 2021-2030

By Type

Bio Based

Petroleum Based

By Application

Film Materials

Fiber

-Carpet Fabric

-Automotive Fabric

-Apparels

-Engineering Plastics

By End-User

Automotive

Building & Construction

Packaging

Medical

Consumer Goods

Textiles

10 Asia Pacific Polytrimethylene Terephthalate Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Polytrimethylene Terephthalate Markets in 2024

10.2 Asia Pacific Polytrimethylene Terephthalate Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Polytrimethylene Terephthalate Market size Outlook by Segments, 2021-2030

By Type

Bio Based

Petroleum Based

By Application

Film Materials

Fiber

-Carpet Fabric

-Automotive Fabric

-Apparels

-Engineering Plastics

By End-User

Automotive

Building & Construction

Packaging

Medical

Consumer Goods

Textiles

11 South America Polytrimethylene Terephthalate Market Analysis and Outlook To 2030

11.1 Introduction to South America Polytrimethylene Terephthalate Markets in 2024

11.2 South America Polytrimethylene Terephthalate Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Polytrimethylene Terephthalate Market size Outlook by Segments, 2021-2030

By Type

Bio Based

Petroleum Based

By Application

Film Materials

Fiber

-Carpet Fabric

-Automotive Fabric

-Apparels

-Engineering Plastics

By End-User

Automotive

Building & Construction

Packaging

Medical

Consumer Goods

Textiles

12 Middle East and Africa Polytrimethylene Terephthalate Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Polytrimethylene Terephthalate Markets in 2024

12.2 Middle East and Africa Polytrimethylene Terephthalate Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Polytrimethylene Terephthalate Market size Outlook by Segments, 2021-2030

By Type

Bio Based

Petroleum Based

By Application

Film Materials

Fiber

-Carpet Fabric

-Automotive Fabric

-Apparels

-Engineering Plastics

By End-User

Automotive

Building & Construction

Packaging

Medical

Consumer Goods

Textiles

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Asahi Kasei Corp

DuPont

Huvis

Royal Dutch Shell plc

RTP Company

Teijin Ltd

Toray Industries Inc

Xianglu Chemical Fiber

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Bio Based

Petroleum Based

By Application

Film Materials

Fiber

-Carpet Fabric

-Automotive Fabric

-Apparels

-Engineering Plastics

By End-User

Automotive

Building & Construction

Packaging

Medical

Consumer Goods

Textiles

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Polytrimethylene Terephthalate is forecast to reach $1266 Million in 2030 from $934 Million in 2024, registering a CAGR of 5.2%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Asahi Kasei Corp, DuPont, Huvis, Royal Dutch Shell plc, RTP Company, Teijin Ltd, Toray Industries Inc, Xianglu Chemical Fiber

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume