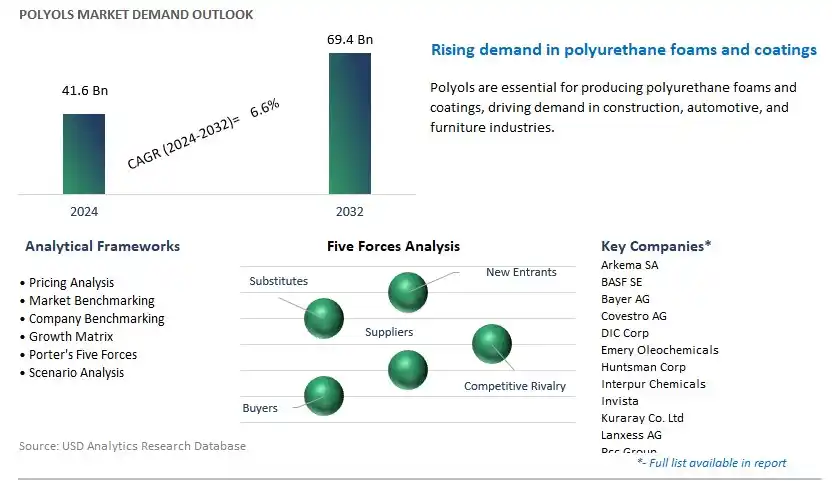

New product launches to cater to niche application segments shape the Polyols market size outlook. Widening applications of polyols across rigid and flexible foams, surface and fabric coatings, and CASE (Coatings, Adhesives, Sealants and Elastomer) support the long-term growth prospects. Demand for rigid foams from insulation, refrigeration, packaging and construction industries coupled with widening applications of flexible foams in upholstery, mattresses and automotive seats drive the market outlook.

In particular, rapid urbanization and increasing construction across emerging countries present the demand for polyols. Further, the use of polyols in the manufacture of seats, headrests, and armrests, as well as other automotive components encouraging investments in capacity additions. The growing demand for bio-based polyols is also encouraging investments in new capacity additions through greenfield projects and expansion projects.

Amidst oversupply conditions in Asia Pacific, companies are opting for consolidation trends. The market is characterized by oligopoly in nature and is witnessing backward integration among major players. Further, growth prospects remain significant in Middle Eastern markets with manufacturers focusing specialty grade polyols.

Polyols constitute the main feedstock for manufacturing polyurethane across industrial products and consumer basics. The linear polymer is manufactured using ethylene oxide, epoxypropane, epoxybutane, and others. Key technologies include Ring-opening homopolymerization and copolymerization using catalyst are marketed. In addition, manufacturers are focusing launch of new technologies such as Ingevity plans to launch Capa® HS polycaprolactone polyols for enhanced hydrolytic resistance in polyurethanes.

Polyether polyols are manufactured by the catalysed addition of PO or ethylene oxide (EO) to an initiator with active hydrogen atoms. In addition to Polyurethane Polyols, Polyester Polyols combined with isocyanates like MDI and/or TDI to make polyurethane. Polyester polyols are mainly used to produce insulation and elastomers. Further, Polyester polyols are used in combinations with melamines, acrylates, epoxy, and others.

Bio-based polyols for sustainable consumer goods, expansion of polyurethane-based 3d printing materials, polyols for energy-efficient insulation in construction, polyols for carbon capture materials, automotive lightweighting through polyol-based polyurethanes, advanced polyols for medical applications, polyols for recyclable polyurethane foams, flame-retardant polyols for electronics and aerospace, customized polyol blends for electric vehicle (EV) battery casings, polyols for high-performance sporting goods, and others present strong growth prospects.

The development of polyurethane materials with enhanced CO₂-capturing capabilities in industrial sectors focused on reducing greenhouse gas emissions presents significant growth prospects. Following the Paris Agreement, chemicals, energy, and manufacturing companies are opting for polyether and polyester polyols to produce polyurethane foams that not only capture CO₂ but also store it in their molecular structure. For instance, Bayer AG’s CO₂ntainer project uses a polyol system to produce foams capable of absorbing carbon dioxide. Covestro’s polyols are also being integrated into materials used in carbon capture technologies for the petrochemical industry while Mitsui Chemicals is researching how to incorporate CO₂ into polyols used in the production of polyurethane elastomers. Dow Chemical’s VORACOR™ systems also incorporate polyols that enable construction foams to store CO₂.

Customized polyol blends for polyurethane-based battery casings is encouraging companies to invest in new product development to address thermal management, lightweighting, fire resistance, and impact protection. EV battery systems generate significant heat during operation, which can negatively impact performance and safety. Polyol-based polyurethane materials are being customized to have superior thermal insulating properties, ensuring that the battery remains at optimal operating temperatures while preventing overheating. Further, customized polyols are formulated to produce lightweight yet structurally robust polyurethane foams for battery casings. Further, as the automotive industry shifts toward sustainability, the demand for bio-based polyols for EV battery casings is rising. Bio-based polyols derived from renewable resources like plant oils or recycled plastics provide a sustainable alternative to traditional petroleum-based polyols.

The average price of polyether polyols was around $2,200 to $2,400 per ton in early 2023. However, prices varied depending on the region, with higher costs in Europe due to energy crises and supply chain constraints. In regions like North America and Europe, bio-based polyols are gaining traction as sustainability becomes a key purchasing criterion for industries like construction and automotive. The price of bio-based polyols tends to be higher than conventional petrochemical-derived polyols, with costs hovering around $3,000 to $3,500 per ton depending on the source and production process. Over the forecast period, robust demand from key industries like construction, automotive, and consumer goods will help sustain overall market growth.

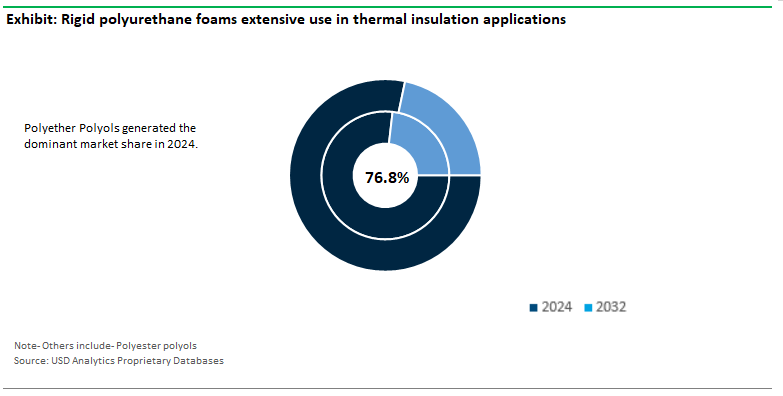

Polyols Market Share Insights

In 2024, polyether polyols emerged as the dominant segment, accounting for 76.8% of the total polyols market share. Rigid polyurethane foams are widely used extensively in thermal insulation applications in buildings, appliances, and refrigeration systems while Flexible polyurethane foams are widely used in furniture, bedding, and automotive seat cushioning. The dominant market share of Polyether polyols is driven by superior properties including low viscosity, easy processing, and high reactivity with isocyanates, for producing high-quality polyurethanes. Over the forecast period, increased demand for energy-efficient materials, the adoption of green technologies, and the growing focus on sustainable materials in manufacturing support the market outlook.

In 2024, PU flexible foam is projected to be the largest revenue generator among polyol applications, capturing a 36.3% share of the total market. The increasing consumer demand for high-quality, ergonomic mattresses and furniture significantly drives the use of PU flexible foam. In addition, automotive manufacturers prioritize lightweight, durable, and comfortable materials, driving flexible PU foam sales across vehicle interiors. Advances such as open-cell foam technology and high-resilience foam formulations further enhance the material's ability to conform to body shapes, maintain elasticity, and improve air circulation.

Asia Pacific is the largest end-user of ABS with 44.7% market share and is poised to register a robust 6.9% CAGR over the forecast period to 2032. Rapid growth in construction industry in China, India, and Southeast Asia present strong growth prospects. The FOB price for polyols in the region averaged around $1300 per Metric Ton.

Polyols used in rigid polyurethane (PU) foams are widely employed in building insulation to improve energy efficiency and reduce heat loss. Wanhua Chemical Group Co. Ltd. (China), KPX Chemical Co., Ltd. (South Korea), and others continue to market products for niche applications. Further, automotive, furniture and bedding industries also present strong prospects in the region.

The global Polyols market is oligopolistic with the presence of both local and global players. Leading companies included in the study are Arkema SA, BASF SE, Bayer AG, Covestro AG, DIC Corp, Emery Oleochemicals, Huntsman Corp, Interpur Chemicals, Invista, Kuraray Co. Ltd, Lanxess AG, Pcc Group, Perstorp Polyols Inc, Polygreen Chemicals, Polyols and Polymers Pvt. Ltd, Repsol SA, Royal Dutch Shell plc, Saudi Aramco, Shakun Industries, Shandong Longhua New Material Co. Ltd, Sinopec Corp, Solvay SA, Stepan Company, Sumitomo Bakelite High Performance Plastics (SBHPP), The Dow Chemical Company, Vintek Chemical Products Pvt. Ltd, Wanhua Chemical Group, Zibo Dexin Lianbang Chemical Industry Co. Ltd, and others.

|

Parameter |

Details |

|

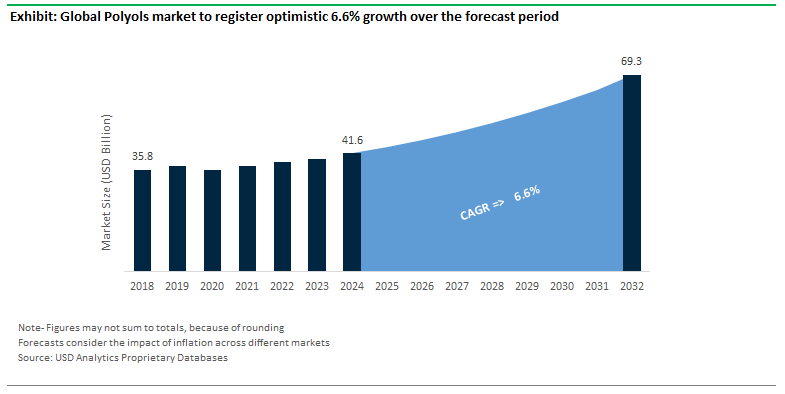

Market Size (2024) |

$41.6 Billion |

|

Market Size (2032) |

$69.4 Billion |

|

Market Growth Rate |

6.6% |

|

Largest Segment- Type |

Polyether Polyols (76.8% market share) |

|

Fastest Growing Market- Region |

Asia Pacific (6.9% CAGR) |

|

Largest Segment- Application |

Flexible Foam (36.3% Revenue Share) |

|

Largest Segment- End-User |

Building & Construction |

|

Segments |

Types, Applications, End-Users |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Arkema SA, BASF SE, Bayer AG, Covestro AG, DIC Corp, Emery Oleochemicals, Huntsman Corp, Interpur Chemicals, Invista, Kuraray Co. Ltd, Lanxess AG, Pcc Group, Perstorp Polyols Inc, Polygreen Chemicals, Polyols and Polymers Pvt. Ltd, Repsol SA, Royal Dutch Shell plc, Saudi Aramco, Shakun Industries, Shandong Longhua New Material Co. Ltd, Sinopec Corp, Solvay SA, Stepan Company, Sumitomo Bakelite High Performance Plastics (SBHPP), The Dow Chemical Company, Vintek Chemical Products Pvt. Ltd, Wanhua Chemical Group, Zibo Dexin Lianbang Chemical Industry Co. Ltd |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Type

Applications

End-Users

Countries Analyzed

Polyols Companies Profiled in the Study

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Polyols Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Polyols Market Size by Segments, 2018- 2023

Key Statistics, 2024

Polyols Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Polyols Types, 2018-2023

Polyols Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Polyols Applications, 2018-2023

8. Polyols Market Size Outlook by Segments, 2024- 2032

Polyols Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Polyols Types, 2024-2032

Polyols Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Polyols Applications, 2024-2032

Polyols Market Size Outlook by End-Users, USD Million, 2024-2032

Growth Comparison (y-o-y) across Polyols End-Users, 2024-2032

9. Polyols Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Polyols Market Size Outlook by Type, 2021- 2032

United States Polyols Market Size Outlook by Application, 2021- 2032

United States Polyols Market Size Outlook by End-User, 2021- 2032

11. Canada Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Polyols Market Size Outlook by Type, 2021- 2032

Canada Polyols Market Size Outlook by Application, 2021- 2032

Canada Polyols Market Size Outlook by End-User, 2021- 2032

12. Mexico Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Polyols Market Size Outlook by Type, 2021- 2032

Mexico Polyols Market Size Outlook by Application, 2021- 2032

Mexico Polyols Market Size Outlook by End-User, 2021- 2032

13. Germany Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Polyols Market Size Outlook by Type, 2021- 2032

Germany Polyols Market Size Outlook by Application, 2021- 2032

Germany Polyols Market Size Outlook by End-User, 2021- 2032

14. France Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

France Polyols Market Size Outlook by Type, 2021- 2032

France Polyols Market Size Outlook by Application, 2021- 2032

France Polyols Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Polyols Market Size Outlook by Type, 2021- 2032

United Kingdom Polyols Market Size Outlook by Application, 2021- 2032

United Kingdom Polyols Market Size Outlook by End-User, 2021- 2032

10. Spain Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Polyols Market Size Outlook by Type, 2021- 2032

Spain Polyols Market Size Outlook by Application, 2021- 2032

Spain Polyols Market Size Outlook by End-User, 2021- 2032

16. Italy Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Polyols Market Size Outlook by Type, 2021- 2032

Italy Polyols Market Size Outlook by Application, 2021- 2032

Italy Polyols Market Size Outlook by End-User, 2021- 2032

17. Benelux Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Polyols Market Size Outlook by Type, 2021- 2032

Benelux Polyols Market Size Outlook by Application, 2021- 2032

Benelux Polyols Market Size Outlook by End-User, 2021- 2032

18. Nordic Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Polyols Market Size Outlook by Type, 2021- 2032

Nordic Polyols Market Size Outlook by Application, 2021- 2032

Nordic Polyols Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Polyols Market Size Outlook by Type, 2021- 2032

Rest of Europe Polyols Market Size Outlook by Application, 2021- 2032

Rest of Europe Polyols Market Size Outlook by End-User, 2021- 2032

20. China Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

China Polyols Market Size Outlook by Type, 2021- 2032

China Polyols Market Size Outlook by Application, 2021- 2032

China Polyols Market Size Outlook by End-User, 2021- 2032

21. India Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

India Polyols Market Size Outlook by Type, 2021- 2032

India Polyols Market Size Outlook by Application, 2021- 2032

India Polyols Market Size Outlook by End-User, 2021- 2032

22. Japan Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Polyols Market Size Outlook by Type, 2021- 2032

Japan Polyols Market Size Outlook by Application, 2021- 2032

Japan Polyols Market Size Outlook by End-User, 2021- 2032

23. South Korea Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Polyols Market Size Outlook by Type, 2021- 2032

South Korea Polyols Market Size Outlook by Application, 2021- 2032

South Korea Polyols Market Size Outlook by End-User, 2021- 2032

24. Australia Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Polyols Market Size Outlook by Type, 2021- 2032

Australia Polyols Market Size Outlook by Application, 2021- 2032

Australia Polyols Market Size Outlook by End-User, 2021- 2032

25. South East Asia Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Polyols Market Size Outlook by Type, 2021- 2032

South East Asia Polyols Market Size Outlook by Application, 2021- 2032

South East Asia Polyols Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Polyols Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Polyols Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Polyols Market Size Outlook by End-User, 2021- 2032

27. Brazil Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Polyols Market Size Outlook by Type, 2021- 2032

Brazil Polyols Market Size Outlook by Application, 2021- 2032

Brazil Polyols Market Size Outlook by End-User, 2021- 2032

28. Argentina Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Polyols Market Size Outlook by Type, 2021- 2032

Argentina Polyols Market Size Outlook by Application, 2021- 2032

Argentina Polyols Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Polyols Market Size Outlook by Type, 2021- 2032

Rest of South America Polyols Market Size Outlook by Application, 2021- 2032

Rest of South America Polyols Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Polyols Market Size Outlook by Type, 2021- 2032

United Arab Emirates Polyols Market Size Outlook by Application, 2021- 2032

United Arab Emirates Polyols Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Polyols Market Size Outlook by Type, 2021- 2032

Saudi Arabia Polyols Market Size Outlook by Application, 2021- 2032

Saudi Arabia Polyols Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Polyols Market Size Outlook by Type, 2021- 2032

Rest of Middle East Polyols Market Size Outlook by Application, 2021- 2032

Rest of Middle East Polyols Market Size Outlook by End-User, 2021- 2032

33. South Africa Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Polyols Market Size Outlook by Type, 2021- 2032

South Africa Polyols Market Size Outlook by Application, 2021- 2032

South Africa Polyols Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Polyols Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Polyols Market Size Outlook by Type, 2021- 2032

Rest of Africa Polyols Market Size Outlook by Application, 2021- 2032

Rest of Africa Polyols Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Applications

End-Users

Countries Analyzed

USD Analytics forecasts the global Polyols market size to increase from $41.6 Billion in 2024 to $69.4 Billion in 2032, registering a CAGR of 6.6% during the forecast period

Polyether Polyols (76.8% market share), Flexible Foam (36.3% Revenue Share), Building & Construction

Arkema SA, BASF SE, Bayer AG, Covestro AG, DIC Corp, Emery Oleochemicals, Huntsman Corp, Interpur Chemicals, Invista, Kuraray Co. Ltd, Lanxess AG, Pcc Group, Perstorp Polyols Inc, Polygreen Chemicals, Polyols and Polymers Pvt. Ltd, Repsol SA, Royal Dutch Shell plc, Saudi Aramco, Shakun Industries, Shandong Longhua New Material Co. Ltd, Sinopec Corp, Solvay SA, Stepan Company, Sumitomo Bakelite High Performance Plastics (SBHPP), The Dow Chemical Company, Vintek Chemical Products Pvt. Ltd, Wanhua Chemical Group, Zibo Dexin Lianbang Chemical Industry Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume

Asia Pacific (6.9% CAGR)