The global Polyolefins Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Polyethylene (PE), Polypropylene (PP), Ethylene-Vinyl Acetate (EVA), Thermoplastic Polyolefins (TPO), Polyoxymethylene (POM), Polycarbonate (PC), Polymethyl Methacrylate (PMMA), Others), By Application (Film & Sheet, Injection Molding, Blow Molding, Profile Extrusion, Others).

Polyolefins are a class of thermoplastic polymers derived from olefin monomers such as ethylene and propylene, including polyethylene (PE) and polypropylene (PP), widely used in various packaging, automotive, construction, and consumer goods applications for their versatility, durability, and cost-effectiveness. In 2024, the market for polyolefins s to expand as industries seek lightweight, recyclable, and sustainable materials for diverse end-use requirements in a growing global economy. Polyolefins offer advantages such as high strength-to-weight ratio, chemical resistance, moisture resistance, and ease of processing, making them essential components in a wide range of products and applications. These polymers are used in packaging applications such as films, bottles, and containers for food, beverages, and personal care products, as well as in automotive components such as bumpers, interior trim, and fuel tanks for their impact resistance and chemical stability. In construction materials, polyolefins are used in pipes, fittings, and insulation for their corrosion resistance, thermal insulation, and longevity. The demand for polyolefins is driven by factors such as the growth of e-commerce and packaged goods industries, increasing demand for lightweight and fuel-efficient vehicles, and the expansion of infrastructure and urbanization projects. Market trends include the development of bio-based and recycled polyolefin formulations, the optimization of polymerization processes for improved efficiency and cost-effectiveness, and the integration of advanced additive and compounding technologies for enhanced performance and functionality.

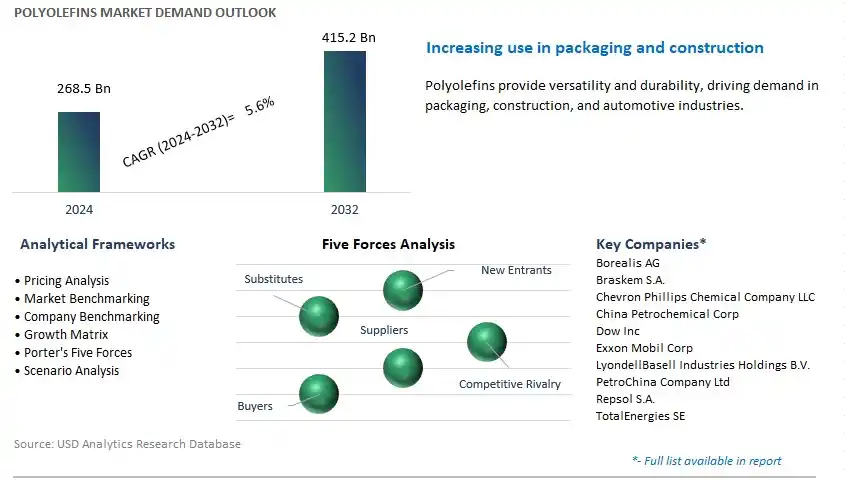

The market report analyses the leading companies in the industry including Borealis AG, Braskem S.A., Chevron Phillips Chemical Company LLC, China Petrochemical Corp, Dow Inc, Exxon Mobil Corp, LyondellBasell Industries Holdings B.V., PetroChina Company Ltd, Repsol S.A., TotalEnergies SE, and others.

A notable trend in the polyolefins market is the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious and regulations on single-use plastics tighten, there is a shift towards eco-friendly packaging materials. Polyolefins, including polyethylene (PE) and polypropylene (PP), are versatile polymers widely used in packaging due to their lightweight nature, durability, and recyclability. This trend is driving innovation in the development of bio-based and recycled polyolefins, as well as the adoption of advanced processing technologies to enhance the sustainability profile of polyolefin-based packaging solutions. With a focus on reducing environmental impact and promoting circular economy principles, the demand for sustainable polyolefin packaging is expected to continue growing across industries such as food and beverage, cosmetics, and healthcare.

A key driver fueling the polyolefins market is the expansion of infrastructure and construction projects worldwide. Polyolefins play a crucial role in various construction applications, including pipes, fittings, insulation, roofing, and geomembranes, due to their excellent mechanical properties, chemical resistance, and durability. As urbanization accelerates and governments invest in infrastructure development to support economic growth and urban expansion, there is a robust demand for polyolefin-based materials for building and construction purposes. Moreover, the recovery in the housing market, coupled with investments in sustainable building practices, is driving the adoption of polyolefin materials in energy-efficient construction and green building initiatives. As infrastructure projects continue to proliferate globally, the demand for polyolefins is expected to remain strong, supported by their versatility and performance in construction applications.

An opportunity for growth in the polyolefins market lies in innovation in automotive lightweighting. With increasing regulatory pressures to reduce vehicle emissions and improve fuel efficiency, automakers are turning to lightweight materials to optimize vehicle design and performance. Polyolefins, particularly high-performance grades such as polypropylene (PP) compounds and thermoplastic olefins (TPOs), offer significant weight savings compared to traditional materials like metals and glass, without compromising on strength or safety. By developing innovative polyolefin-based materials tailored for automotive applications, such as interior trim components, exterior body panels, and under-the-hood parts, manufacturers can capitalize on the growing demand for lightweighting solutions in the automotive industry. Additionally, advancements in material technology, including reinforcement techniques and additive formulations, present opportunities to further enhance the mechanical properties and design flexibility of polyolefin-based automotive materials, driving adoption and market expansion in this lucrative segment.

The Polyethylene (PE) segment is the largest segment in the Polyolefins Market due to its extensive use and wide-ranging applications across various industries. Polyethylene is one of the most widely produced and consumed polymers globally, accounting for a significant share of the total polymer market. It is a versatile thermoplastic polymer with properties such as high chemical resistance, excellent electrical insulation, low moisture absorption, and good mechanical strength. These properties make polyethylene suitable for a wide range of applications, including packaging, construction, automotive, consumer goods, agriculture, and healthcare. In the packaging industry, polyethylene is used to manufacture films, bags, bottles, and containers due to its flexibility, durability, and barrier properties. In the construction sector, polyethylene is utilized for pipes, sheets, and insulation materials due to its resistance to corrosion, weathering, and chemicals. Moreover, polyethylene finds applications in automotive components, household products, agricultural films, medical devices, and toys. With the continuous growth of these industries and increasing demand for lightweight, durable, and cost-effective materials, the demand for polyethylene remains robust. Furthermore, advancements in polyethylene production technologies, development of new grades and formulations, and the shift towards sustainable and recyclable materials further drive the growth of the Polyethylene segment in the Polyolefins Market. Therefore, the Polyethylene (PE) segment is the largest in the Polyolefins Market due to its significant contribution to various industries and the essential role of polyethylene in meeting diverse application requirements for packaging, construction, automotive, and consumer goods.

The Film & Sheet segment is the fastest-growing segment in the Polyolefins Market due to the increasing demand for flexible packaging solutions and lightweight materials across various industries. Polyolefins, particularly polyethylene and polypropylene, are extensively used in the production of films and sheets due to their excellent properties such as flexibility, transparency, moisture resistance, and sealability. These films and sheets find wide applications in packaging for food and beverages, pharmaceuticals, personal care products, industrial goods, and agricultural products. With the rising population, urbanization, and changing consumer preferences, there is a growing demand for convenient, hygienic, and sustainable packaging solutions. Polyolefin films and sheets offer advantages such as cost-effectiveness, versatility, and recyclability, making them preferred materials for packaging applications. Additionally, the growth of e-commerce and online retailing further fuels the demand for polyolefin films for shipping and protective packaging. Moreover, advancements in film extrusion technologies, such as multi-layer co-extrusion and Nano-composite films, enable the development of high-performance films with enhanced barrier properties, mechanical strength, and printability, driving their adoption in various packaging applications. Furthermore, initiatives towards sustainability and circular economy practices encourage the use of polyolefin films and sheets as eco-friendly alternatives to traditional packaging materials. Therefore, the Film & Sheet segment is the fastest-growing in the Polyolefins Market due to the increasing demand for flexible packaging solutions, advancements in film extrusion technologies, and sustainability considerations driving the adoption of polyolefin films and sheets across diverse industries.

By Product

Polyethylene (PE)

Polypropylene (PP)

Ethylene-Vinyl Acetate (EVA)

Thermoplastic Polyolefins (TPO)

Polyoxymethylene (POM)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Others

By Application

Film & Sheet

Injection Molding

Blow Molding

Profile Extrusion

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Borealis AG

Braskem S.A.

Chevron Phillips Chemical Company LLC

China Petrochemical Corp

Dow Inc

Exxon Mobil Corp

LyondellBasell Industries Holdings B.V.

PetroChina Company Ltd

Repsol S.A.

TotalEnergies SE

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Polyolefins Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Polyolefins Market Size Outlook, $ Million, 2021 to 2032

3.2 Polyolefins Market Outlook by Type, $ Million, 2021 to 2032

3.3 Polyolefins Market Outlook by Product, $ Million, 2021 to 2032

3.4 Polyolefins Market Outlook by Application, $ Million, 2021 to 2032

3.5 Polyolefins Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Polyolefins Industry

4.2 Key Market Trends in Polyolefins Industry

4.3 Potential Opportunities in Polyolefins Industry

4.4 Key Challenges in Polyolefins Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Polyolefins Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Polyolefins Market Outlook by Segments

7.1 Polyolefins Market Outlook by Segments, $ Million, 2021- 2032

By Product

Polyethylene (PE)

Polypropylene (PP)

Ethylene-Vinyl Acetate (EVA)

Thermoplastic Polyolefins (TPO)

Polyoxymethylene (POM)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Others

By Application

Film & Sheet

Injection Molding

Blow Molding

Profile Extrusion

Others

8 North America Polyolefins Market Analysis and Outlook To 2032

8.1 Introduction to North America Polyolefins Markets in 2024

8.2 North America Polyolefins Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Polyolefins Market size Outlook by Segments, 2021-2032

By Product

Polyethylene (PE)

Polypropylene (PP)

Ethylene-Vinyl Acetate (EVA)

Thermoplastic Polyolefins (TPO)

Polyoxymethylene (POM)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Others

By Application

Film & Sheet

Injection Molding

Blow Molding

Profile Extrusion

Others

9 Europe Polyolefins Market Analysis and Outlook To 2032

9.1 Introduction to Europe Polyolefins Markets in 2024

9.2 Europe Polyolefins Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Polyolefins Market Size Outlook by Segments, 2021-2032

By Product

Polyethylene (PE)

Polypropylene (PP)

Ethylene-Vinyl Acetate (EVA)

Thermoplastic Polyolefins (TPO)

Polyoxymethylene (POM)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Others

By Application

Film & Sheet

Injection Molding

Blow Molding

Profile Extrusion

Others

10 Asia Pacific Polyolefins Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Polyolefins Markets in 2024

10.2 Asia Pacific Polyolefins Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Polyolefins Market size Outlook by Segments, 2021-2032

By Product

Polyethylene (PE)

Polypropylene (PP)

Ethylene-Vinyl Acetate (EVA)

Thermoplastic Polyolefins (TPO)

Polyoxymethylene (POM)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Others

By Application

Film & Sheet

Injection Molding

Blow Molding

Profile Extrusion

Others

11 South America Polyolefins Market Analysis and Outlook To 2032

11.1 Introduction to South America Polyolefins Markets in 2024

11.2 South America Polyolefins Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Polyolefins Market size Outlook by Segments, 2021-2032

By Product

Polyethylene (PE)

Polypropylene (PP)

Ethylene-Vinyl Acetate (EVA)

Thermoplastic Polyolefins (TPO)

Polyoxymethylene (POM)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Others

By Application

Film & Sheet

Injection Molding

Blow Molding

Profile Extrusion

Others

12 Middle East and Africa Polyolefins Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Polyolefins Markets in 2024

12.2 Middle East and Africa Polyolefins Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Polyolefins Market size Outlook by Segments, 2021-2032

By Product

Polyethylene (PE)

Polypropylene (PP)

Ethylene-Vinyl Acetate (EVA)

Thermoplastic Polyolefins (TPO)

Polyoxymethylene (POM)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Others

By Application

Film & Sheet

Injection Molding

Blow Molding

Profile Extrusion

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Borealis AG

Braskem S.A.

Chevron Phillips Chemical Company LLC

China Petrochemical Corp

Dow Inc

Exxon Mobil Corp

LyondellBasell Industries Holdings B.V.

PetroChina Company Ltd

Repsol S.A.

TotalEnergies SE

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Polyethylene (PE)

Polypropylene (PP)

Ethylene-Vinyl Acetate (EVA)

Thermoplastic Polyolefins (TPO)

Polyoxymethylene (POM)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Others

By Application

Film & Sheet

Injection Molding

Blow Molding

Profile Extrusion

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Polyolefins Market Size is valued at $268.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.6% to reach $415.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Borealis AG, Braskem S.A., Chevron Phillips Chemical Company LLC, China Petrochemical Corp, Dow Inc, Exxon Mobil Corp, LyondellBasell Industries Holdings B.V., PetroChina Company Ltd, Repsol S.A., TotalEnergies SE

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume