The global Polyolefin Catalyst Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Classification (Polypropylene, Polyethylene), By Catalyst (Zeigler-Natta Catalyst, Single-site Catalyst, Chromium), By Application (Injection Molding, Blow Molding, Films, Fibers, Others).

Polyolefin catalysts to drive innovation and efficiency in the production of polyethylene and polypropylene resins in 2024. These catalysts play a critical role in controlling the molecular structure and properties of polyolefin polymers, influencing their mechanical strength, thermal stability, and processing behavior. With the growing demand for lightweight and durable materials in packaging, automotive, and construction sectors, the market for polyolefin catalysts experiences steady growth. Manufacturers focus on developing advanced catalyst technologies that enable higher yields, improved product quality, and reduced environmental impact, thereby enhancing the competitiveness of polyolefin-based products in the global market.

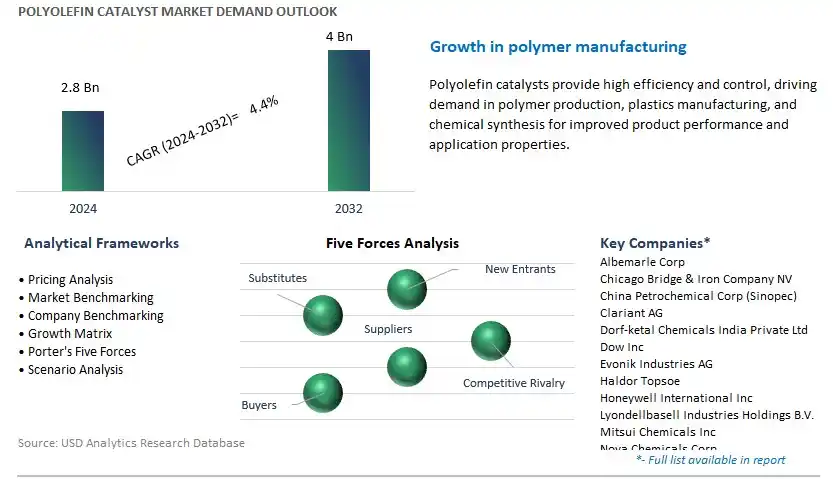

The market report analyses the leading companies in the industry including Albemarle Corp, Chicago Bridge & Iron Company NV, China Petrochemical Corp (Sinopec), Clariant AG, Dorf-ketal Chemicals India Private Ltd, Dow Inc, Evonik Industries AG, Haldor Topsoe, Honeywell International Inc, Lyondellbasell Industries Holdings B.V., Mitsui Chemicals Inc, Nova Chemicals Corp, W. R. Grace & Co., Zeochem, Zeolyst International, and others.

A prominent trend in the Polyolefin Catalyst Market is the increasing demand for polypropylene and polyethylene. These polyolefins are extensively used in packaging, automotive, and consumer goods industries due to their lightweight, durability, and versatility. As these sectors expand, the need for efficient catalysts to enhance polyolefin production continues to rise, driving advancements in catalyst technology.

The primary driver for the Polyolefin Catalyst Market is the expansion of the polymer manufacturing industry. With rapid industrialization and urbanization, there is a significant increase in the production of polyolefins to meet the growing demand for plastic products. This expansion necessitates advanced catalysts to improve production efficiency and polymer properties, thereby boosting the market.

A significant opportunity in the Polyolefin Catalyst Market lies in the development of sustainable and eco-friendly catalysts. As environmental concerns and regulations intensify, there is a pressing need for catalysts that reduce the environmental footprint of polyolefin production. Innovating in green catalyst technologies can help manufacturers meet regulatory requirements and cater to the increasing consumer preference for sustainable products, opening new growth avenues.

Polyethylene is the largest segment in the Polyolefin Catalyst Market. Polyethylene is one of the most widely used plastics globally, finding extensive applications in packaging, construction, automotive, and various consumer goods. As a versatile and cost-effective material, polyethylene is favored for its lightweight nature, excellent chemical resistance, and durability. Polyolefin catalysts play a crucial role in the production of polyethylene by facilitating the polymerization process and controlling key properties such as molecular weight, density, and branching. With the increasing demand for flexible and rigid packaging solutions, pipes, films, and other polyethylene-based products, the market for polyethylene continues to expand rapidly. Additionally, advancements in catalyst technologies have led to the development of highly efficient and selective catalyst systems, enabling manufacturers to optimize production processes, reduce costs, and enhance product quality. As industries continue to innovate and develop new applications for polyethylene, the demand for polyolefin catalysts tailored for polyethylene production is expected to remain strong, solidifying polyethylene as the largest segment in the Polyolefin Catalyst Market.

Single-site catalysts emerge as the fastest-growing segment in the Polyolefin Catalyst Market. Single-site catalysts offer precise control over the polymerization process, resulting in the production of polyolefins with tailored properties such as molecular weight, structure, and stereochemistry. This level of control enables manufacturers to produce polymers with enhanced performance characteristics, including improved strength, flexibility, and thermal stability. Single-site catalysts exhibit high selectivity and activity, allowing for efficient polymerization reactions with minimal waste and by-products. Additionally, single-site catalysts enable the production of a wide range of polyolefin products, including polyethylene and polypropylene, for various applications across industries such as packaging, automotive, and construction. As industries continue to demand advanced materials with superior properties and performance, the adoption of single-site catalysts is expected to increase rapidly, driving the growth of this segment in the Polyolefin Catalyst Market. Moreover, ongoing research and development efforts aimed at optimizing single-site catalyst formulations and processes are to further accelerate their growth and market penetration in the coming years.

Injection molding is the largest segment in the Polyolefin Catalyst Market. Injection molding is a widely used manufacturing process for producing plastic parts and components with intricate shapes and precise dimensions. Polyolefin catalysts play a crucial role in injection molding applications by facilitating the polymerization process and controlling key properties such as melt flow rate, molecular weight distribution, and thermal stability. Polyolefin materials produced through injection molding find extensive applications across industries such as automotive, packaging, consumer goods, and electronics. The versatility, durability, and cost-effectiveness of injection-molded polyolefin products contribute to their widespread adoption in various end-use applications. Additionally, advancements in catalyst technologies have led to the development of highly efficient and versatile catalyst systems optimized for injection molding processes, enabling manufacturers to achieve enhanced production efficiencies and product performance. As the demand for injection-molded polyolefin products continues to grow across diverse industries, driven by factors such as urbanization, infrastructure development, and consumer preferences, the market for polyolefin catalysts tailored for injection molding applications is expected to remain robust, solidifying injection molding as the largest segment in the Polyolefin Catalyst Market.

By Classification

Polypropylene

Polyethylene

By Catalyst

Zeigler-Natta Catalyst

Single-site Catalyst

Chromium

By Application

Injection Molding

Blow Molding

Films

Fibers

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Albemarle Corp

Chicago Bridge & Iron Company NV

China Petrochemical Corp (Sinopec)

Clariant AG

Dorf-ketal Chemicals India Private Ltd

Dow Inc

Evonik Industries AG

Haldor Topsoe

Honeywell International Inc

Lyondellbasell Industries Holdings B.V.

Mitsui Chemicals Inc

Nova Chemicals Corp

W. R. Grace & Co.

Zeochem

Zeolyst International

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Polyolefin Catalyst Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Polyolefin Catalyst Market Size Outlook, $ Million, 2021 to 2032

3.2 Polyolefin Catalyst Market Outlook by Type, $ Million, 2021 to 2032

3.3 Polyolefin Catalyst Market Outlook by Product, $ Million, 2021 to 2032

3.4 Polyolefin Catalyst Market Outlook by Application, $ Million, 2021 to 2032

3.5 Polyolefin Catalyst Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Polyolefin Catalyst Industry

4.2 Key Market Trends in Polyolefin Catalyst Industry

4.3 Potential Opportunities in Polyolefin Catalyst Industry

4.4 Key Challenges in Polyolefin Catalyst Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Polyolefin Catalyst Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Polyolefin Catalyst Market Outlook by Segments

7.1 Polyolefin Catalyst Market Outlook by Segments, $ Million, 2021- 2032

By Classification

Polypropylene

Polyethylene

By Catalyst

Zeigler-Natta Catalyst

Single-site Catalyst

Chromium

By Application

Injection Molding

Blow Molding

Films

Fibers

Others

8 North America Polyolefin Catalyst Market Analysis and Outlook To 2032

8.1 Introduction to North America Polyolefin Catalyst Markets in 2024

8.2 North America Polyolefin Catalyst Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Polyolefin Catalyst Market size Outlook by Segments, 2021-2032

By Classification

Polypropylene

Polyethylene

By Catalyst

Zeigler-Natta Catalyst

Single-site Catalyst

Chromium

By Application

Injection Molding

Blow Molding

Films

Fibers

Others

9 Europe Polyolefin Catalyst Market Analysis and Outlook To 2032

9.1 Introduction to Europe Polyolefin Catalyst Markets in 2024

9.2 Europe Polyolefin Catalyst Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Polyolefin Catalyst Market Size Outlook by Segments, 2021-2032

By Classification

Polypropylene

Polyethylene

By Catalyst

Zeigler-Natta Catalyst

Single-site Catalyst

Chromium

By Application

Injection Molding

Blow Molding

Films

Fibers

Others

10 Asia Pacific Polyolefin Catalyst Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Polyolefin Catalyst Markets in 2024

10.2 Asia Pacific Polyolefin Catalyst Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Polyolefin Catalyst Market size Outlook by Segments, 2021-2032

By Classification

Polypropylene

Polyethylene

By Catalyst

Zeigler-Natta Catalyst

Single-site Catalyst

Chromium

By Application

Injection Molding

Blow Molding

Films

Fibers

Others

11 South America Polyolefin Catalyst Market Analysis and Outlook To 2032

11.1 Introduction to South America Polyolefin Catalyst Markets in 2024

11.2 South America Polyolefin Catalyst Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Polyolefin Catalyst Market size Outlook by Segments, 2021-2032

By Classification

Polypropylene

Polyethylene

By Catalyst

Zeigler-Natta Catalyst

Single-site Catalyst

Chromium

By Application

Injection Molding

Blow Molding

Films

Fibers

Others

12 Middle East and Africa Polyolefin Catalyst Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Polyolefin Catalyst Markets in 2024

12.2 Middle East and Africa Polyolefin Catalyst Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Polyolefin Catalyst Market size Outlook by Segments, 2021-2032

By Classification

Polypropylene

Polyethylene

By Catalyst

Zeigler-Natta Catalyst

Single-site Catalyst

Chromium

By Application

Injection Molding

Blow Molding

Films

Fibers

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Albemarle Corp

Chicago Bridge & Iron Company NV

China Petrochemical Corp (Sinopec)

Clariant AG

Dorf-ketal Chemicals India Private Ltd

Dow Inc

Evonik Industries AG

Haldor Topsoe

Honeywell International Inc

Lyondellbasell Industries Holdings B.V.

Mitsui Chemicals Inc

Nova Chemicals Corp

W. R. Grace & Co.

Zeochem

Zeolyst International

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Classification

Polypropylene

Polyethylene

By Catalyst

Zeigler-Natta Catalyst

Single-site Catalyst

Chromium

By Application

Injection Molding

Blow Molding

Films

Fibers

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Polyolefin Catalyst Market Size is valued at $2.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.4% to reach $4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Albemarle Corp, Chicago Bridge & Iron Company NV, China Petrochemical Corp (Sinopec), Clariant AG, Dorf-ketal Chemicals India Private Ltd, Dow Inc, Evonik Industries AG, Haldor Topsoe, Honeywell International Inc, Lyondellbasell Industries Holdings B.V., Mitsui Chemicals Inc, Nova Chemicals Corp, W. R. Grace & Co., Zeochem, Zeolyst International

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume