The global Polyester Polyol Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Aliphatic Polyester Polyols, Aromatic Polyester Polyols), By Application (CASE (Coating, Adhesives, Sealants, Elastomers), Flexible Foam, Rigid Foam, Others).

Polyester polyol, a key component in the production of polyurethane, s to see robust demand in 2024. As a versatile raw material, polyester polyol finds applications across various industries, including automotive, construction, and furniture. Its favorable properties such as high tensile strength, flexibility, and chemical resistance make it a preferred choice for manufacturing polyurethane foams, coatings, adhesives, and sealants. The market's growth is further fueled by the increasing adoption of eco-friendly and sustainable polyols, aligning with the global shift towards greener technologies.

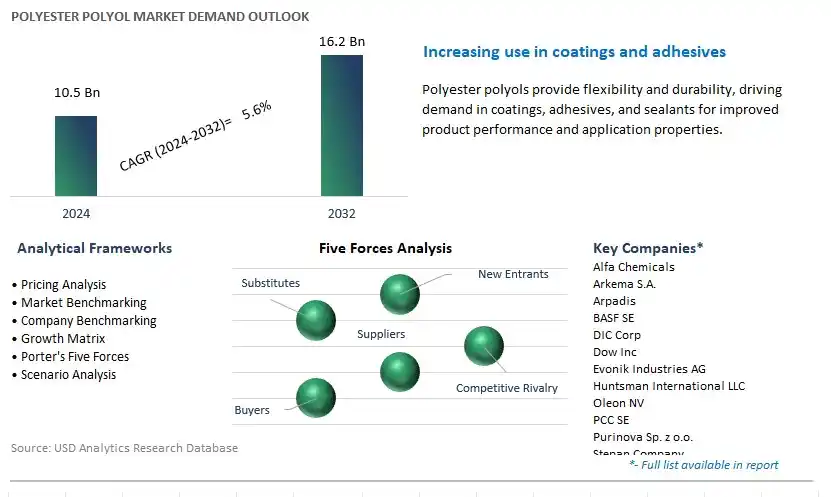

The market report analyses the leading companies in the industry including Alfa Chemicals, Arkema S.A., Arpadis, BASF SE, DIC Corp, Dow Inc, Evonik Industries AG, Huntsman International LLC, Oleon NV, PCC SE, Purinova Sp. z o.o., Stepan Company, TER HELL & Co. GmbH, Townsend Chemicals P/L, TRiiSO LLC, and others.

One prominent market trend in the polyester polyol industry is the growing demand for sustainable and high-performance polyurethane materials, driven by trends in construction, automotive, furniture, and insulation sectors. Polyester polyols, essential raw materials for producing polyurethane foams, coatings, adhesives, and elastomers, are witnessing heightened demand as manufacturers seek materials with improved environmental profiles, durability, and versatility. This trend is fueled by the increasing focus on sustainability, energy efficiency, and regulatory compliance, prompting the adoption of polyester polyols derived from renewable feedstocks, recycled materials, or bio-based sources. Additionally, the versatility of polyester polyols allows for the formulation of polyurethane products with tailored properties such as thermal insulation, fire resistance, and mechanical strength, driving their adoption in diverse applications worldwide.

A key market driver for polyester polyols is the growth of construction and automotive industries, which drive the demand for polyurethane-based materials for insulation, sealants, coatings, and interior components. As urbanization accelerates, infrastructure investments increase, and automotive production expands globally, there is a corresponding need for advanced materials that offer durability, energy efficiency, and design flexibility. Polyester polyols play a vital role in meeting these requirements by serving as building blocks for polyurethane products used in construction projects, such as rigid foam insulation, spray foam insulation, and roofing materials, as well as in automotive applications such as seating, interiors, underbody coatings, and structural adhesives. Furthermore, the growing demand for lightweight materials, energy-efficient buildings, and electric vehicles further amplifies the market demand for polyester polyols, sustaining their growth and innovation in the industry.

An opportunity for market growth lies in the development of bio-based and recycled polyester polyols that offer enhanced sustainability and reduced environmental impact compared to traditional petroleum-based materials. Companies specializing in polyester polyol production can capitalize on this opportunity by investing in research and development to engineer polyester polyols derived from renewable feedstocks such as plant-based oils, agricultural residues, or waste streams. Additionally, developing polyester polyols from recycled sources such as post-consumer PET bottles, industrial waste, or end-of-life polyurethane products presents opportunities to create closed-loop recycling systems and promote circular economy principles in the polyurethane industry. By offering bio-based and recycled polyester polyols with comparable performance and cost-effectiveness to conventional materials, manufacturers can meet the sustainability goals of customers, differentiate their products, and capture opportunities in the evolving market landscape.

Aromatic Polyester Polyols emerge as the largest segment in the Polyester Polyol market. Aromatic polyester polyols are widely used in various industries, including automotive, construction, furniture, and coatings, due to their excellent properties such as high durability, chemical resistance, and thermal stability. These polyols are particularly valued for their ability to provide strength and flexibility in polyurethane formulations, making them essential components in the production of flexible and rigid polyurethane foams, coatings, adhesives, and sealants. Moreover, aromatic polyester polyols offer cost-effective solutions for manufacturers without compromising on performance, making them preferred choices in applications where cost efficiency is critical. Additionally, the robust demand from end-user industries such as automotive and construction, coupled with the versatility and reliability of aromatic polyester polyols, solidifies their position as the largest segment in the Polyester Polyol market. As industries continue to innovate and develop new applications for polyurethane-based products, the demand for aromatic polyester polyols is expected to remain strong, sustaining its dominance in the market.

The CASE (Coating, Adhesives, Sealants, Elastomers) segment is the fastest-growing segment in the Polyester Polyol. CASE applications encompass a wide range of industries, including construction, automotive, packaging, and electronics, where polyester polyols play a crucial role in formulating coatings, adhesives, sealants, and elastomers. The demand for CASE products is driven by various factors such as urbanization, infrastructure development, automotive production, and consumer goods manufacturing. Polyester polyols are preferred in CASE applications due to their versatility, durability, and excellent adhesion properties, making them suitable for a diverse range of substrates and environments. Additionally, the growing emphasis on sustainability and environmental regulations in the coatings and adhesives industry further boosts the demand for polyester polyols, as they can be formulated with renewable raw materials and offer low volatile organic compound (VOC) emissions. Moreover, the increasing consumer demand for high-performance and eco-friendly products drives innovation and investment in CASE formulations, fuelling the growth of the polyester polyol market in this segment. As industries continue to prioritize performance, sustainability, and regulatory compliance in their products, the demand for polyester polyols in CASE applications is expected to experience rapid growth, making it the fastest-growing segment in the Polyester Polyol market.

By Type

Aliphatic Polyester Polyols

Aromatic Polyester Polyols

By Application

CASE (Coating, Adhesives, Sealants, Elastomers)

Flexible Foam

Rigid Foam

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alfa Chemicals

Arkema S.A.

Arpadis

BASF SE

DIC Corp

Dow Inc

Evonik Industries AG

Huntsman International LLC

Oleon NV

PCC SE

Purinova Sp. z o.o.

Stepan Company

TER HELL & Co. GmbH

Townsend Chemicals P/L

TRiiSO LLC

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Polyester Polyol Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Polyester Polyol Market Size Outlook, $ Million, 2021 to 2032

3.2 Polyester Polyol Market Outlook by Type, $ Million, 2021 to 2032

3.3 Polyester Polyol Market Outlook by Product, $ Million, 2021 to 2032

3.4 Polyester Polyol Market Outlook by Application, $ Million, 2021 to 2032

3.5 Polyester Polyol Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Polyester Polyol Industry

4.2 Key Market Trends in Polyester Polyol Industry

4.3 Potential Opportunities in Polyester Polyol Industry

4.4 Key Challenges in Polyester Polyol Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Polyester Polyol Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Polyester Polyol Market Outlook by Segments

7.1 Polyester Polyol Market Outlook by Segments, $ Million, 2021- 2032

By Type

Aliphatic Polyester Polyols

Aromatic Polyester Polyols

By Application

CASE (Coating, Adhesives, Sealants, Elastomers)

Flexible Foam

Rigid Foam

Others

8 North America Polyester Polyol Market Analysis and Outlook To 2032

8.1 Introduction to North America Polyester Polyol Markets in 2024

8.2 North America Polyester Polyol Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Polyester Polyol Market size Outlook by Segments, 2021-2032

By Type

Aliphatic Polyester Polyols

Aromatic Polyester Polyols

By Application

CASE (Coating, Adhesives, Sealants, Elastomers)

Flexible Foam

Rigid Foam

Others

9 Europe Polyester Polyol Market Analysis and Outlook To 2032

9.1 Introduction to Europe Polyester Polyol Markets in 2024

9.2 Europe Polyester Polyol Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Polyester Polyol Market Size Outlook by Segments, 2021-2032

By Type

Aliphatic Polyester Polyols

Aromatic Polyester Polyols

By Application

CASE (Coating, Adhesives, Sealants, Elastomers)

Flexible Foam

Rigid Foam

Others

10 Asia Pacific Polyester Polyol Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Polyester Polyol Markets in 2024

10.2 Asia Pacific Polyester Polyol Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Polyester Polyol Market size Outlook by Segments, 2021-2032

By Type

Aliphatic Polyester Polyols

Aromatic Polyester Polyols

By Application

CASE (Coating, Adhesives, Sealants, Elastomers)

Flexible Foam

Rigid Foam

Others

11 South America Polyester Polyol Market Analysis and Outlook To 2032

11.1 Introduction to South America Polyester Polyol Markets in 2024

11.2 South America Polyester Polyol Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Polyester Polyol Market size Outlook by Segments, 2021-2032

By Type

Aliphatic Polyester Polyols

Aromatic Polyester Polyols

By Application

CASE (Coating, Adhesives, Sealants, Elastomers)

Flexible Foam

Rigid Foam

Others

12 Middle East and Africa Polyester Polyol Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Polyester Polyol Markets in 2024

12.2 Middle East and Africa Polyester Polyol Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Polyester Polyol Market size Outlook by Segments, 2021-2032

By Type

Aliphatic Polyester Polyols

Aromatic Polyester Polyols

By Application

CASE (Coating, Adhesives, Sealants, Elastomers)

Flexible Foam

Rigid Foam

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Alfa Chemicals

Arkema S.A.

Arpadis

BASF SE

DIC Corp

Dow Inc

Evonik Industries AG

Huntsman International LLC

Oleon NV

PCC SE

Purinova Sp. z o.o.

Stepan Company

TER HELL & Co. GmbH

Townsend Chemicals P/L

TRiiSO LLC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Aliphatic Polyester Polyols

Aromatic Polyester Polyols

By Application

CASE (Coating, Adhesives, Sealants, Elastomers)

Flexible Foam

Rigid Foam

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Polyester Polyol Market Size is valued at $10.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.6% to reach $16.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alfa Chemicals, Arkema S.A., Arpadis, BASF SE, DIC Corp, Dow Inc, Evonik Industries AG, Huntsman International LLC, Oleon NV, PCC SE, Purinova Sp. z o.o., Stepan Company, TER HELL & Co. GmbH, Townsend Chemicals P/L, TRiiSO LLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume