Strong demand for protection of both Electric Resistance Welded (ERW) and Seamless pipes from exposure to weather, corrosion, and chemicals across end-user industries is driving the market outlook. Potential advantages including increased durability, smooth surface for flow control, energy savings, protection from such as hydrogen sulfides, CO2 and water, and reduced inhibitors are marketed by manufacturers. Pipeline manufacturers are deploying coatings during the manufacturing stage to ensure consistent application, detect any disbondments, and ease of repair. The pipeline coatings industry plays a critical role in ensuring the longevity, safety, and efficiency of pipelines used in various sectors, including oil and gas, water supply, and industrial transportation.

In addition to corrosion resistance, the pipeline coatings industry is witnessing advancements in coatings that offer enhanced mechanical properties, such as abrasion and impact resistance. The internal coating segment is also expanding, particularly in water and wastewater pipelines, where maintaining the quality of transported fluids is crucial. Epoxy-based linings, which are applied to the interior surfaces of pipes, are designed to prevent corrosion and biofouling while ensuring the purity of the water.

Recent advancements in FBE technology including the development of dual-layer FBE coatings that offer superior adhesion, impact resistance, and enhanced protection in harsh environments, polyurea coatings with formulations that focus on improving flexibility and adhesion to diverse substrates, Multi-layer coating systems like Three-Layer Polyethylene (3LPE) and Three-Layer Polypropylene (3LPP) Coatings with the use of nano-additives in the adhesive layer, epoxy coatings with antimicrobial properties, incorporation of polymeric additives in Cement Mortar Linings, use of aerogel and ceramic microsphere technologies to achieve high thermal resistance in Thermal Insulating Coatings, Self-Healing Epoxy Coatings, improved properties of waterborne epoxy and polyurethane coatings.

UV-curable coatings for both internal and external pipe applications, deployment of robotic systems for the application of coatings, and others aimed at improving the durability, efficiency, and environmental sustainability of coatings drive the market outlook.

Advancements in coating application technologies including the use of robotics and automation in applying pipe coatings, deployment of 3D printing technology for complex or irregularly shaped pipes is driving the market outlook. ABB’s Robotics for Coating Applications, KUKA Robotics including automated systems for applying protective coatings to pipes, which enhance efficiency and reduce manual labor. Vertico specializes in 3D printing technologies for constructing complex shapes, including pipe coatings and linings. Further, Cold Jet offers solutions for additive manufacturing, including 3D printing of coating materials.

In addition, demand for customized coating solutions tailored to specific applications and environmental conditions for diverse types of fluids, pressures, and temperatures, strong demand for modular coating systems that can be adapted or upgraded based on changing needs, and other customized and tailor-made solutions is increasing. Huntsman’s AVITERA® SE dyes illustrate the trend of customization, Jotun provides customized coating solutions for industrial flooring, AkzoNobel offers modular coating systems like Interline® 9001, which can be adapted for different industrial applications, Sherwin-Williams’ PIPELINE® coatings designed with modular features.

Further, the development of advanced barrier materials including graphene-based coatings with enhanced mechanical properties, superior corrosion resistance, and increased thermal stability, Hybrid coatings such as polymers with inorganic compounds that combine multiple types of materials for desired properties are set to drive the market outlook. GrapheneCA’s Coatings offer superior corrosion resistance, mechanical strength, and thermal stability, Versarien produces coatings incorporating graphene, Hempel offers hybrid coatings like Hempadur® 15500, International Paint’s Intercure® 2000 provides hybrid coatings that use a blend of polymers and inorganic compounds.

Shell's oil sands operations in Alberta demonstrates that the use of advanced thermal barrier coatings reduced heat loss by 25% in high-temperature pipelines. According to the U.S. Department of Energy, advanced thermal barrier coatings can improve thermal insulation by up to 40%, presenting strong growth prospects over the forecast period.

Pipe Coating Technologies- Integration of Circular Economy Principles in Coating Design and advancements in self-healing coating technologies

The integration of circular economy principles into the design and application of pipe coatings is a growing driver in the industry. By incorporating circular economy principles, manufacturers are developing coatings that reduce the environmental footprint, optimizing the use of resources, reducing the need for raw materials, and minimizing waste, lower costs and improved overall efficiency, compliance with emerging regulations such as ISO 12944 for corrosion protection.

In addition, Self-healing coatings represent a significant advancement in the pipeline coatings industry, driven by the need for enhanced durability and reduced maintenance costs. Self-healing coatings address common issues such as corrosion and mechanical damage by providing a proactive repair mechanism. By autonomously repairing minor damages, these coatings minimize the need for manual repairs and maintenance. Self-healing technologies also enhance the reliability of pipeline systems by ensuring continuous protection against environmental and operational stresses.

According to the U.S. Department of Energy, the adoption of self-healing technologies in pipeline coatings can lead to a reduction in maintenance costs by up to 30%. Further, BP Plc identified that self-healing coatings in offshore pipeline projects demonstrated a 25% improvement in maintenance intervals compared to conventional coatings.

AkzoNobel continues to market Interline® 9001, a self-healing epoxy coating designed for industrial pipelines that incorporates microcapsules that release a healing agent when the coating is damaged, providing enhanced protection and durability. Similarly, BASF’s MasterProtect® H 4000 features self-healing properties through embedded microcapsules that repair minor damage.

Pipe Coating Market Share Insights

Thermoplastic Polymer Coatings, Fusion Bonded Epoxy Coating, Bituminous, Concrete, and Others are the key segments in the pipe coating industry. Of these, the Thermoplastic Polymer Coatings held a dominant market share of 31.9% in 2024, followed by Fusion Bonded Epoxy Coating with 22.8% market share, driven by exceptional flexibility and durability. Increasing role in providing robust protection against corrosion, abrasion, and chemical exposure presents strong prospects across oil and gas, water utilities, and industrial processes. Thermoplastic Polymer Coatings including polyolefins, polyvinyl chlorides (PVC), and polyurethanes, offer superior resistance to harsh environmental conditions and mechanical wear.

Innovations in polymer chemistry lead to the development of advanced formulations with improved performance characteristics with companies like 3M and BASF are investing in enhancing the properties of thermoplastic coatings. 3M’s Scotchkote™ series includes thermoplastic polymer coatings known for their exceptional abrasion resistance and chemical stability, making them ideal for harsh environments. BASF’s Elastocool™ coatings also exemplify advanced thermoplastic technology with superior flexibility and thermal resistance, enhancing their performance in high-temperature applications. Dow Chemical’s DOWSIL™ thermoplastic elastomer coatings offer enhanced performance characteristics for pipelines exposed to extreme weather conditions while Axalta Coating Systems’ Fusion Bonded Epoxy (FBE) coatings opt for advanced thermoplastic technology, providing excellent corrosion protection and thermal stability.

Adherence to ISO 21809-1 and ASTM D3276 is driving the innovations in the industry. In the oil and gas sector, these coatings are crucial for protecting pipelines from corrosive substances and extreme environmental conditions. Nippon Paint’s Expanse™ coating system provides exceptional protection against corrosive substances and extreme temperatures. Similarly, in water and wastewater management, their resistance to chemicals and abrasion makes them ideal for ensuring the longevity and reliability of pipeline systems. PPG Industries’ Xylar™ coatings are used in water and wastewater management due to their chemical resistance and durability. The ongoing expansion of infrastructure projects globally continues to drive the demand for thermoplastic polymer coatings, solidifying their position as a market leader.

Among Pipe Coating forms, Powder form is projected to be the largest revenue generator

The powder form coatings dominate the market with a commanding 77.4% share, driven by superior performance, application, and cost-effectiveness compared to their liquid counterparts. Powder coatings provide a thicker and more uniform coating compared to liquid coatings. For instance, AkzoNobel’s Interpon™ powder coatings are renowned for their durability and resistance to harsh conditions. In addition, powder coatings are more environmentally friendly than liquid coatings with companies such as Sherwin-Williams’ Powdura series marketing environmental advantage with low VOC emissions. Further, the application of powder coatings is generally more cost-effective due to lower material wastage and reduced need for multiple coats.

PPG Industries’ Duranar coatings are used in demanding environments such as oil and gas pipelines. The coating’s ability to withstand harsh conditions while maintaining its integrity makes it a preferred choice in high-performance applications. The powder coating process is also more efficient and less labor-intensive than liquid coatings and is advantageous in large-scale industrial applications. On the other hand, Liquid coatings, like BASF’s Clysar™, are often used where application flexibility is crucial, but they typically require solvents and may have higher associated environmental and operational costs.

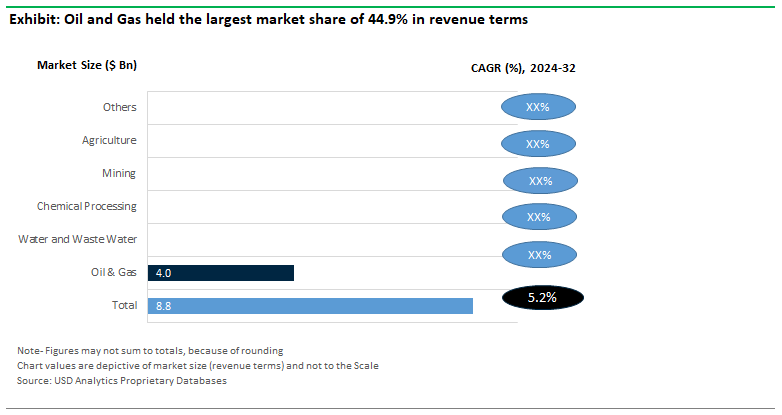

The oil and gas sector is the largest end-user segment in the pipe coating market, generating a revenue share of 64.9% in 2024, driven by demanding operational conditions and rigorous performance requirements in the industry. The segment is followed by water and wastewater treatment pipelines with 18.6%. The overall market growth is driven by increasing energy demand, infrastructure development, and technological advancements in coating materials. The development of new coatings with enhanced properties, such as graphene-based coatings and hybrid formulations, presents opportunities for further market expansion.

Large-scale upcoming pipeline projects including Xinjiang–Guangdong–Zhejiang SNG Pipeline (8,972 Km), West African Gas Extension Pipeline (5,600 Km), Canadian Prosperity Project Pipeline (4,500 Km), Trans Saharan Gas pipeline (4,128 Km), West–East IV Pipeline (3,340 Km), and others present strong prospects for oil and gas pipe coatings. According to the IEA, global investments in oil and gas pipelines were projected to reach $110 billion annually by 2025 with $50 billion in the US. Similarly, the EIA estimated that total capital expenditures in U.S. oil and gas infrastructure, which includes pipelines, would increase by 5% annually through 2025. This represents a rise from $150 billion in 2022 to an estimated $170 billion by 2025.

Pipelines in the oil and gas industry are exposed to harsh environments, including corrosive substances, high pressures, and extreme temperatures. Carboline’s Carbozinc, Nippon Paint’s Expanse, and others are widely marketed as advanced coatings specifically formulated to provide superior corrosion resistance. Further, oil and gas pipelines often transport fluids at elevated temperatures with Thermal insulation coatings, such as PPG Industries' PPG HI-TEMP marketed for pipeline protection from thermal stress and heat loss. Similarly, Hempel’s Hempathane and others provides robust mechanical protection, making it suitable for the rigors of the oil and gas sector.

North America is poised to be the largest market for pipe coating vendors with 41.8% market share. North America is a hub for technological innovation in pipe coatings with companies like 3M, Sherwin-Williams, and PPG Industries investing significantly in developing advanced coating technologies. The introduction of new products such as Axalta’s AquaTech™, which features advanced corrosion-resistant properties presents long-term outlook. 3M Scotchkote™, Sherwin-Williams Powdura™, PPG Industries Duranar™, Axalta AquaTech™ and others are set to gain significantly from the robust market outlook.

The North American pipe coatings market size forecast is largely driven by substantial capital expenditures, technological advancements, and adherence to stringent regulatory standards.According to the U.S. Energy Information Administration (EIA), North American capital expenditures for pipeline infrastructure are projected to reach approximately $50 billion annually by 2025. Mountain Valley gas Pipeline (MVP) from the Marcellus and Utica shale regions in West Virginia to southern Virginia.

Line 3 Replacement Project transporting crude oil from Alberta, Canada, through Minnesota to Superior, Wisconsin, Dakota Access Pipeline (DAPL) Expansion to approximately 570,000 bpd, Permian Highway gas Pipeline from the Permian Basin in West Texas to the Gulf Coast, Trans Mountain Expansion Project (TMEP) from Alberta to British Columbia to expand capacity to 890,000 bpd, Gulf Coast Express Pipelinefrom the Permian Basin to the Gulf Coast, Rover Pipeline to transport natural gas from the Marcellus and Utica shales to Midwest and Gulf Coast regions, Keystone XL oil Pipeline from Alberta, Canada, to the U.S. Gulf Coast, and other planned projects present strong growth prospects.

The global pipe coating market is characterized by a dynamic and competitive landscape, featuring a mix of established multinational corporations and specialized companies. The competitive environment is shaped by factors such as technological innovation, product differentiation, strategic partnerships, and geographic expansion. Key companies in the industry include 3M, AkzoNobel NV, A.W. Chesterton Co, Arabian Pipe Coating Co (APCO), Aegion Coating Services, Al Qahtani Pipe Coating Industries, BASF SE, Bauhuis BV, Borusan Mannesmann, Bredero Shaw Ltd, Celanese Corporation, Allan Edwards Inc, BSR Coatings, Corinth Pipeworks (Cenergy Holdings SA), Hempel Coatings, Dura-Bond (DBB Acquisition LLC), Mutares AG, GBA Products Co Ltd, Jotun, DuPont, Wasco Energy Group of Companies, Perma-Pipe Inc, Shaic International Co, Shawcor Ltd, The Sherwin-Williams Company (Valspar), Tenaris SA, PPG Industries Inc, Hempel Coatings, Lyondellbasell Industries Holdings BV, and others.

The market ecosystem for pipe coatings involves a series of interconnected steps that transform raw materials into high-performance coatings used to protect pipelines in various industries.

|

Parameter |

Details |

|

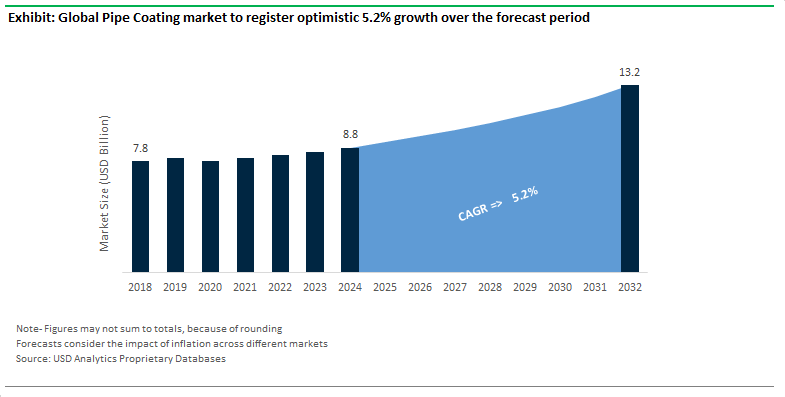

Market Size (2024) |

$8.8 Billion |

|

Market Size (2032) |

$13.2 Billion |

|

Market Growth Rate |

5.2% |

|

Largest Segment- Product |

Thermoplastic Polymer Coatings (31.9% Market Share) |

|

Largest Segment- Form |

Powder Form (77.4% Revenue Share) |

|

Fastest Growing Market- Region |

North America (41.8% Market Share) |

|

Largest End-User Industry |

Oil and Gas (64.9% Market Share) |

|

Segments |

Products, Technologies, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

3M, AkzoNobel NV, A.W. Chesterton Co, Arabian Pipe Coating Co (APCO), Aegion Coating Services, Al Qahtani Pipe Coating Industries, BASF SE, Bauhuis BV, Borusan Mannesmann, Bredero Shaw Ltd, Celanese Corporation, Allan Edwards Inc, BSR Coatings, Corinth Pipeworks (Cenergy Holdings SA), Hempel Coatings, Dura-Bond (DBB Acquisition LLC), Mutares AG, GBA Products Co Ltd, Jotun, DuPont, Wasco Energy Group of Companies, Perma-Pipe Inc, Shaic International Co, Shawcor Ltd, The Sherwin-Williams Company (Valspar), Tenaris SA, PPG Industries Inc, Hempel Coatings, Lyondellbasell Industries Holdings BV |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Types

Forms

End Use Industries

Countries Analyzed

*List not exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Pipe Coatings Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Pipe Coatings Market Size by Segments, 2018- 2023

Key Statistics, 2024

Pipe Coatings Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Pipe Coatings Types, 2018-2023

Pipe Coatings Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Pipe Coatings Applications, 2018-2023

8. Pipe Coatings Market Size Outlook by Segments, 2024- 2032

Pipe Coatings Market Size Outlook by Resin, USD Million, 2024-2032

Growth Comparison (y-o-y) across Pipe Coatings Resins, 2024-2032

Pipe Coatings Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Pipe Coatings Types, 2024-2032

Pipe Coatings Market Size Outlook by End-Users, USD Million, 2024-2032

Growth Comparison (y-o-y) across Pipe Coatings End-Users, 2024-2032

9. Pipe Coatings Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Pipe Coatings Market Size Outlook by Type, 2021- 2032

United States Pipe Coatings Market Size Outlook by Application, 2021- 2032

United States Pipe Coatings Market Size Outlook by End-User, 2021- 2032

11. Canada Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Pipe Coatings Market Size Outlook by Type, 2021- 2032

Canada Pipe Coatings Market Size Outlook by Application, 2021- 2032

Canada Pipe Coatings Market Size Outlook by End-User, 2021- 2032

12. Mexico Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Pipe Coatings Market Size Outlook by Type, 2021- 2032

Mexico Pipe Coatings Market Size Outlook by Application, 2021- 2032

Mexico Pipe Coatings Market Size Outlook by End-User, 2021- 2032

13. Germany Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Pipe Coatings Market Size Outlook by Type, 2021- 2032

Germany Pipe Coatings Market Size Outlook by Application, 2021- 2032

Germany Pipe Coatings Market Size Outlook by End-User, 2021- 2032

14. France Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

France Pipe Coatings Market Size Outlook by Type, 2021- 2032

France Pipe Coatings Market Size Outlook by Application, 2021- 2032

France Pipe Coatings Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Pipe Coatings Market Size Outlook by Type, 2021- 2032

United Kingdom Pipe Coatings Market Size Outlook by Application, 2021- 2032

United Kingdom Pipe Coatings Market Size Outlook by End-User, 2021- 2032

10. Spain Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Pipe Coatings Market Size Outlook by Type, 2021- 2032

Spain Pipe Coatings Market Size Outlook by Application, 2021- 2032

Spain Pipe Coatings Market Size Outlook by End-User, 2021- 2032

16. Italy Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Pipe Coatings Market Size Outlook by Type, 2021- 2032

Italy Pipe Coatings Market Size Outlook by Application, 2021- 2032

Italy Pipe Coatings Market Size Outlook by End-User, 2021- 2032

17. Benelux Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Pipe Coatings Market Size Outlook by Type, 2021- 2032

Benelux Pipe Coatings Market Size Outlook by Application, 2021- 2032

Benelux Pipe Coatings Market Size Outlook by End-User, 2021- 2032

18. Nordic Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Pipe Coatings Market Size Outlook by Type, 2021- 2032

Nordic Pipe Coatings Market Size Outlook by Application, 2021- 2032

Nordic Pipe Coatings Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Pipe Coatings Market Size Outlook by Type, 2021- 2032

Rest of Europe Pipe Coatings Market Size Outlook by Application, 2021- 2032

Rest of Europe Pipe Coatings Market Size Outlook by End-User, 2021- 2032

20. China Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

China Pipe Coatings Market Size Outlook by Type, 2021- 2032

China Pipe Coatings Market Size Outlook by Application, 2021- 2032

China Pipe Coatings Market Size Outlook by End-User, 2021- 2032

21. India Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

India Pipe Coatings Market Size Outlook by Type, 2021- 2032

India Pipe Coatings Market Size Outlook by Application, 2021- 2032

India Pipe Coatings Market Size Outlook by End-User, 2021- 2032

22. Japan Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Pipe Coatings Market Size Outlook by Type, 2021- 2032

Japan Pipe Coatings Market Size Outlook by Application, 2021- 2032

Japan Pipe Coatings Market Size Outlook by End-User, 2021- 2032

23. South Korea Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Pipe Coatings Market Size Outlook by Type, 2021- 2032

South Korea Pipe Coatings Market Size Outlook by Application, 2021- 2032

South Korea Pipe Coatings Market Size Outlook by End-User, 2021- 2032

24. Australia Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Pipe Coatings Market Size Outlook by Type, 2021- 2032

Australia Pipe Coatings Market Size Outlook by Application, 2021- 2032

Australia Pipe Coatings Market Size Outlook by End-User, 2021- 2032

25. South East Asia Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Pipe Coatings Market Size Outlook by Type, 2021- 2032

South East Asia Pipe Coatings Market Size Outlook by Application, 2021- 2032

South East Asia Pipe Coatings Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Pipe Coatings Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Pipe Coatings Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Pipe Coatings Market Size Outlook by End-User, 2021- 2032

27. Brazil Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Pipe Coatings Market Size Outlook by Type, 2021- 2032

Brazil Pipe Coatings Market Size Outlook by Application, 2021- 2032

Brazil Pipe Coatings Market Size Outlook by End-User, 2021- 2032

28. Argentina Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Pipe Coatings Market Size Outlook by Type, 2021- 2032

Argentina Pipe Coatings Market Size Outlook by Application, 2021- 2032

Argentina Pipe Coatings Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Pipe Coatings Market Size Outlook by Type, 2021- 2032

Rest of South America Pipe Coatings Market Size Outlook by Application, 2021- 2032

Rest of South America Pipe Coatings Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Pipe Coatings Market Size Outlook by Type, 2021- 2032

United Arab Emirates Pipe Coatings Market Size Outlook by Application, 2021- 2032

United Arab Emirates Pipe Coatings Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Pipe Coatings Market Size Outlook by Type, 2021- 2032

Saudi Arabia Pipe Coatings Market Size Outlook by Application, 2021- 2032

Saudi Arabia Pipe Coatings Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Pipe Coatings Market Size Outlook by Type, 2021- 2032

Rest of Middle East Pipe Coatings Market Size Outlook by Application, 2021- 2032

Rest of Middle East Pipe Coatings Market Size Outlook by End-User, 2021- 2032

33. South Africa Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Pipe Coatings Market Size Outlook by Type, 2021- 2032

South Africa Pipe Coatings Market Size Outlook by Application, 2021- 2032

South Africa Pipe Coatings Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Pipe Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Pipe Coatings Market Size Outlook by Type, 2021- 2032

Rest of Africa Pipe Coatings Market Size Outlook by Application, 2021- 2032

Rest of Africa Pipe Coatings Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Types

Forms

End Use Industries

Countries Analyzed

Pipe Coating Market Size is estimated to increase at a 5.2% CAGR over the forecast period from $8.8 Billion 2024 to $13.2 Billion in 2032

Thermoplastic Polymer Coatings (31.9% Market Share), Powder Form (77.4% Revenue Share), Oil and Gas (64.9% Market Share)

3M, AkzoNobel NV, A.W. Chesterton Co, Arabian Pipe Coating Co (APCO), Aegion Coating Services, Al Qahtani Pipe Coating Industries, BASF SE, Bauhuis BV, Borusan Mannesmann, Bredero Shaw Ltd, Celanese Corporation, Allan Edwards Inc, BSR Coatings, Corinth Pipeworks (Cenergy Holdings SA), Hempel Coatings, Dura-Bond (DBB Acquisition LLC), Mutares AG, GBA Products Co Ltd, Jotun, DuPont, Wasco Energy Group of Companies, Perma-Pipe Inc, Shaic International Co, Shawcor Ltd, The Sherwin-Williams Company (Valspar), Tenaris SA, PPG Industries Inc, Hempel Coatings, Lyondellbasell Industries Holdings BV

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume

North America (41.8% Market Share)